Most major US equity indices closed higher, Europe was mixed, and most APAC markets were lower. US and benchmark European government bonds closed lower. European iTraxx and CDX-NA were close to unchanged on the day. The US dollar and natural gas closed higher, while oil, gold, silver, and copper were lower.

Americas

- Most US equity indices closed higher except for Russell 2000 closing flat; DJIA +0.9%, S&P 500 +0.8%, and Nasdaq +0.5%.

- 10yr US govt bonds closed +3bps/1.66% yield and 30yr bonds +3bps/2.34% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY +2bp/293bps, which is flat and -6bps week-over-week, respectively.

- DXY US dollar index closed +0.1%/92.16.

- Gold closed -0.8%/$1,745 per troy oz, silver -1.0%/$25.33 per troy oz, and copper -1.3%/$4.04 per pound.

- Crude oil closed -0.5%/$59.32 per barrel and natural gas closed +0.2%/$2.53 per mmbtu.

- US commonwealth Puerto Rico is striving for a fossil fuel-free power sector by 2050, with an interim goal of sourcing 40% of its electricity from renewables in 2025. The goal may prove to be insurmountable unless the island is able to make major upgrades to its power grid and rapidly install new capacity, given that renewables provided just 2.5% of its power in 2020, according to the US Energy Information Administration (EIA). Clean energy advocates say Puerto Rico can achieve this goal if the island is wise when spending the $20-billion-plus that the US Congress has approved for the island's recovery from two hurricanes in 2017. However, standing in the way of this transformation are technological challenges, entrenched interests, political instability, a bankrupt utility company, a financial oversight board, and more, according to experts interviewed by IHS Markit. (IHS Markit Climate and Sustainability News' Kevin Adler)

- Fugro's M/V Fugro Explorer has begun conducting geotechnical work to advance the New England Aqua Ventus I project, a floating wind pilot project offshore Maine. In December 2019, Central Maine Power Company and Maine Aqua Ventus signed a 20-year power purchase agreement for the Aqua Ventus demonstration project. The demo project will involve a single, semisubmersible concrete-hull platform that will support a 10-12 megawatt wind turbine. Design work is to be finalized by the end of 2021, with construction and project completion scheduled in 2023 or 2024. (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

- The total US producer price index (PPI) for final demand rose 1.0% in March after a 0.5% jump in February. The 12-month change was 4.2%, but prices were starting to plunge a year earlier. (IHS Markit Economist Michael Montgomery)

- Total goods prices rose 1.7% after two consecutive 1.4% gains to start the year. The PPI for food rose 0.5% while the PPI for energy jumped 5.9%. Growth of goods prices (final demand) excluding these two components was 0.9%.

- Alas, the 0.9% jump in goods excluding food and energy is partly an artifact of final demand for goods including sales to government and exports. The old-style stage of processing concept does not include the latter two and rose only 0.3%. Why does that matter? Chemicals are heavily exported, as is steel scrap, and the former climbed 9.1% and the latter 10.8%, so these items are more highly weighted than what they mean for the domestically produced goods that use them.

- Oil-based products, especially gasoline and diesel fuel, continued to climb apace. This was mostly due to the disruptive effects of Winter Storm Uri in February, which severely dented inventories as it ravaged refining operations. Lean stocks amplified the climb in crude prices but is only temporary and should reverse in April and May data.

- Total services prices climbed 0.7% in March. Transportation and warehousing services grew 1.5% on a rise in air fares and truck and air freight rates. Excluding trade, transportation, and warehousing, services prices firmed a moderate 0.4%. Connecting the dots, the freight rates reflect climbing fuel prices and reviving activity.

- Excluding food and energy, producer prices were up 2.5% in February and 3.1% in March y/y, the fastest growth pace since before the pandemic.

- Americas Styrenics (AmSty; The Woodlands, Texas) and Agilyx (Tigard, Oregon) say they are exploring the development of a second jointly owned facility for the chemical recycling of polystyrene (PS) to styrene monomer. To be located at AmSty's styrene production site in St. James, Louisiana, the facility would have an initial capacity of 50-100 metric tons/day (18,000-36,000 metric tons/year). A feasibility study is under way. (IHS Markit Chemical Advisory)

- The US president's recently announced new package to improve infrastructure and create jobs in the country includes USD100 billion in consumer rebates for new electric vehicles (EVs), media reports state. According to a Reuters report, USD174 billion is included in the plan to boost EV sales. That figure reportedly includes USD100 billion in rebates, as well as USD15 billion for 500,000 new EV charging stations. The Reuters report cites a US Department of Transportation email as a source for the more detailed information on the president's plan. The plan also reportedly includes USD20 billion for electric school buses, USD25 billion for zero-emission transit, and USD14 billion in other EV tax incentives. The Reuters report quotes a Treasury report stating that the proposed incentives are "to encourage people to switch to electric vehicles and efficient electric appliances". (IHS Markit AutoIntelligence's Stephanie Brinley)

- According to media reports, customers are indicating delays in the delivery of new Model S and Model X vehicles; Tesla has not yet issued a comment. Electrek is reporting that customers with original delivery dates scheduled for March and April are now being pushed to a May to July timeframe. The publication also notes that the Tesla website indicates a 10-14-week lead time for the Model S Long Range or Plaid models in the US and a May to June timeframe for deliveries on new orders for the Model X at this time (confirmed by IHS Markit at the time of writing, although Tesla could change this information). (IHS Markit AutoIntelligence's Stephanie Brinley)

- Ford has announced that it plans skip the traditional mid-year shutdowns at many North American plants in the wake of the semiconductor shortage. Meanwhile, General Motors (GM) plans to restart production at one plant and pause or limit production at six other plants in North America amid the microchip shortage. Traditionally, most US and Canadian auto plants are shut down for two weeks in July, which is called the summer shutdown period, but Automotive News reports that Ford is cancelling those shutdowns at several plants to help make up for production lost due to the semiconductor shortage. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Canada's net employment skyrocketed by 303,100 positions in March. This is the second consecutive month in which job creation exceeded market expectations. (IHS Markit Economist Arlene Kish)

- Labor-market gains were broad-based with another month of solid private-sector increases, which experienced advances in full-time positions surpassing the increase in part-time jobs.

- The addition to youth net employment was the biggest among the age cohorts during the month at 115,000, but employment for workers 55 years and over is the only age cohort where employment is at pre-pandemic levels.

- The labor force participation rate jumped 0.5 percentage point to 65.2% and the unemployment rate shrank 0.7 percentage point to 7.5%, the lowest rate since the start of the pandemic. Increased optimism towards the end of the second wave brought more workers back to the labor force, as it expanded to February 2020 levels.

- The super-charged jump in employment and the large upswing in monthly total hours worked (up 2.0% from February) support our forecast of a robust increase in first-quarter real GDP. Expanding provincial and regional emergency brake measures enacted to slow the spread of the virus will reverse some, if not all, of these gains in April.

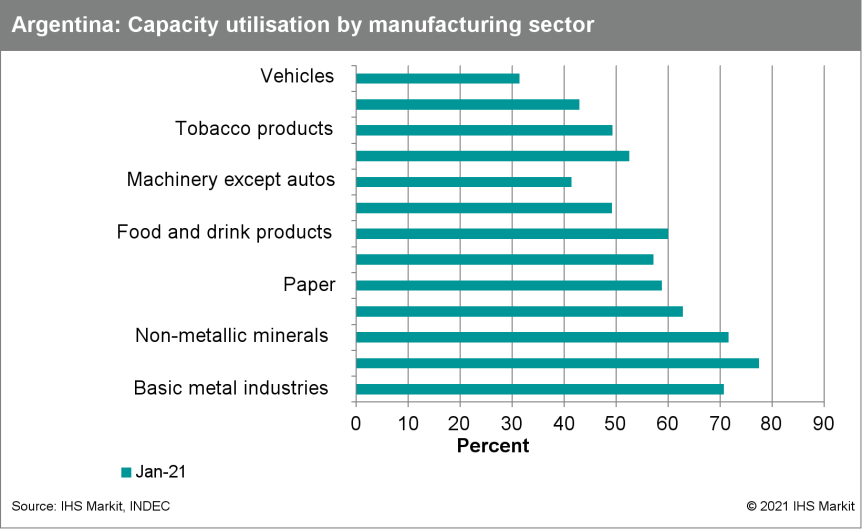

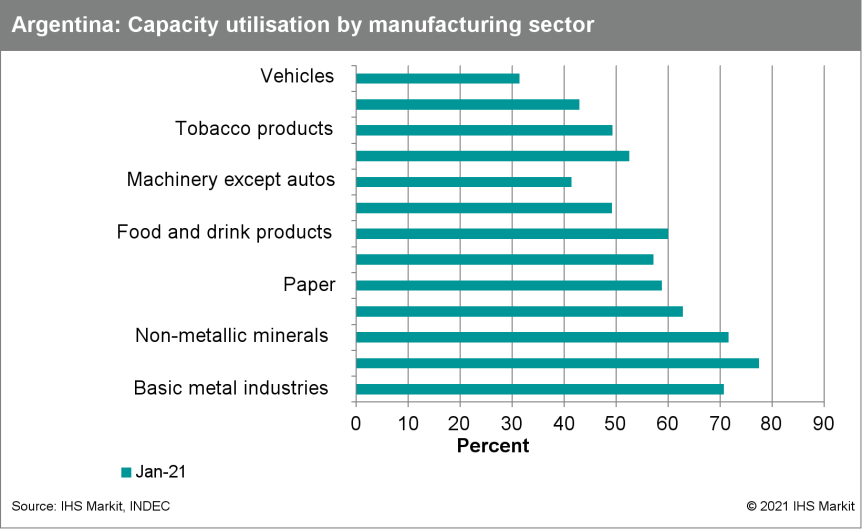

- According to Argentina's National Institute of Statistics and Census (Instituto Nacional de Estadística y Censos: INDEC), the country's industrial production increased by 1.6% year on year (y/y) in February. Seasonally adjusted data show a 1.6% month-on-month (m/m) decrease in February, compared with a 1.7% m/m increase in January (revised figure). (IHS Markit Economist Paula Diosquez-Rice)

- The largest annual decreases in February were in oil refining, rubber and plastics, tobacco products, vehicle assembly, other transport equipment, and clothing and apparel, among others. However, a few sectors posted a strong y/y expansion in February: machinery and equipment; non-metal minerals; textiles; basic metals; and general equipment.

- A qualitative industrial poll of companies conducted by INDEC shows that 41% of respondents estimate that demand will expand in March to May, compared with the same period in 2020 (up from 36% in the previous month's survey). The percentage of respondents that expect demand to remain relatively the same increased to 38%, while 48% of respondents expect exports to remain at a similar level during the period.

- Argentina is to phase out the production, import, sale and use of the insecticide chlorpyrifos, according to national media. The Argentine national plant and animal health inspection service, the Senasa, is working on a phase out of the active ingredient. Several reports claim that the phase out will commence with an import ban, followed by a production ban and ultimately, a prohibition on all commercialization of the insecticide. The course is reportedly expected to last a little over a year. Chlorpyrifos-based insecticides are applied on grains, fruits, vegetables as well as covering garden use. (IHS Markit Food and Agricultural Policy's Robert Birkett)

Europe/Middle East/Africa

- Major European equity indices closed mixed; Germany +0.2%, France +0.1%, UK -0.4%, Italy -0.6%, and Spain -0.8%.

- 10yr European govt bonds closed lower; Italy +7bps, Spain +5bps, France +4bps, and Germany/UK +3bps.

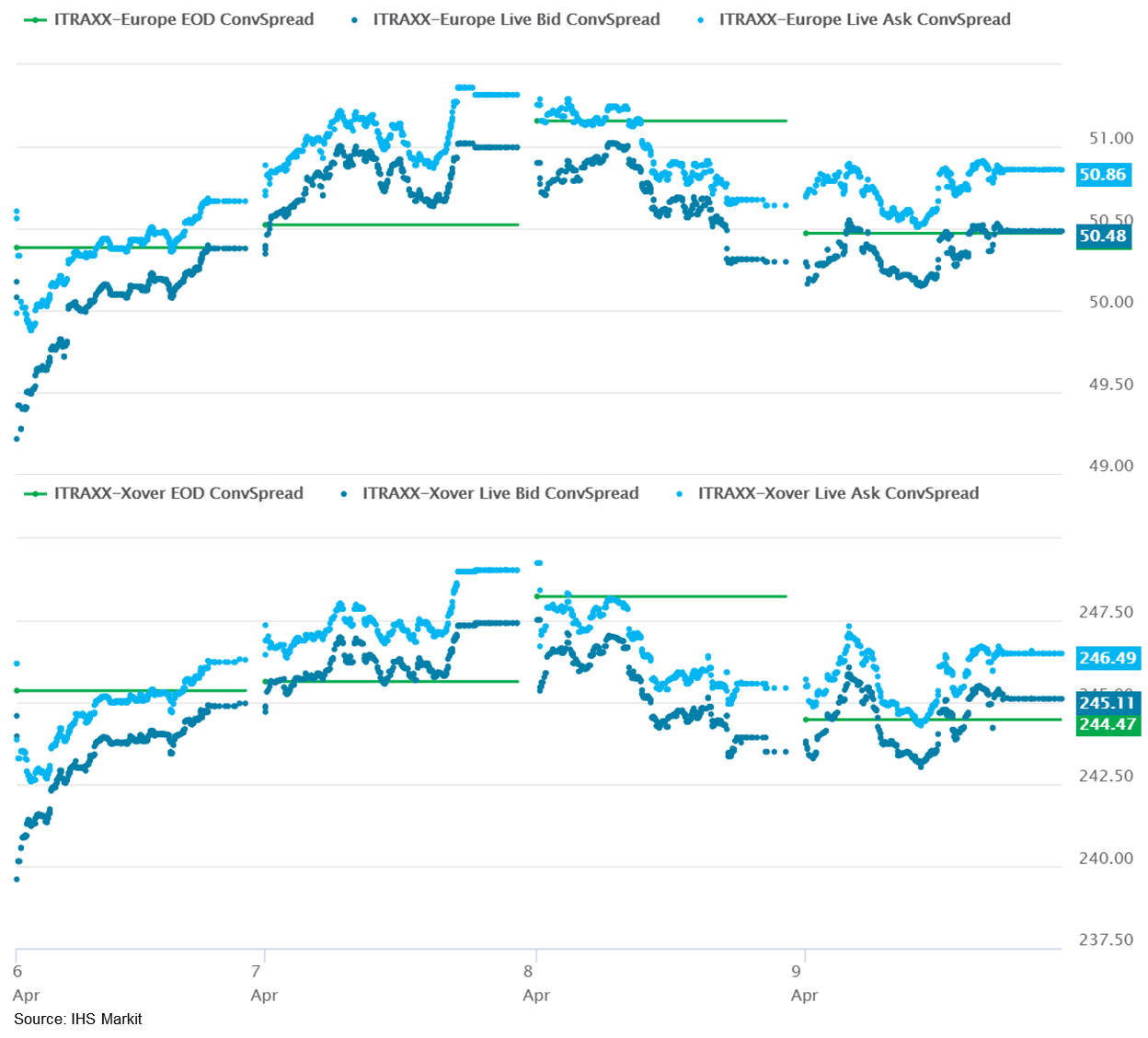

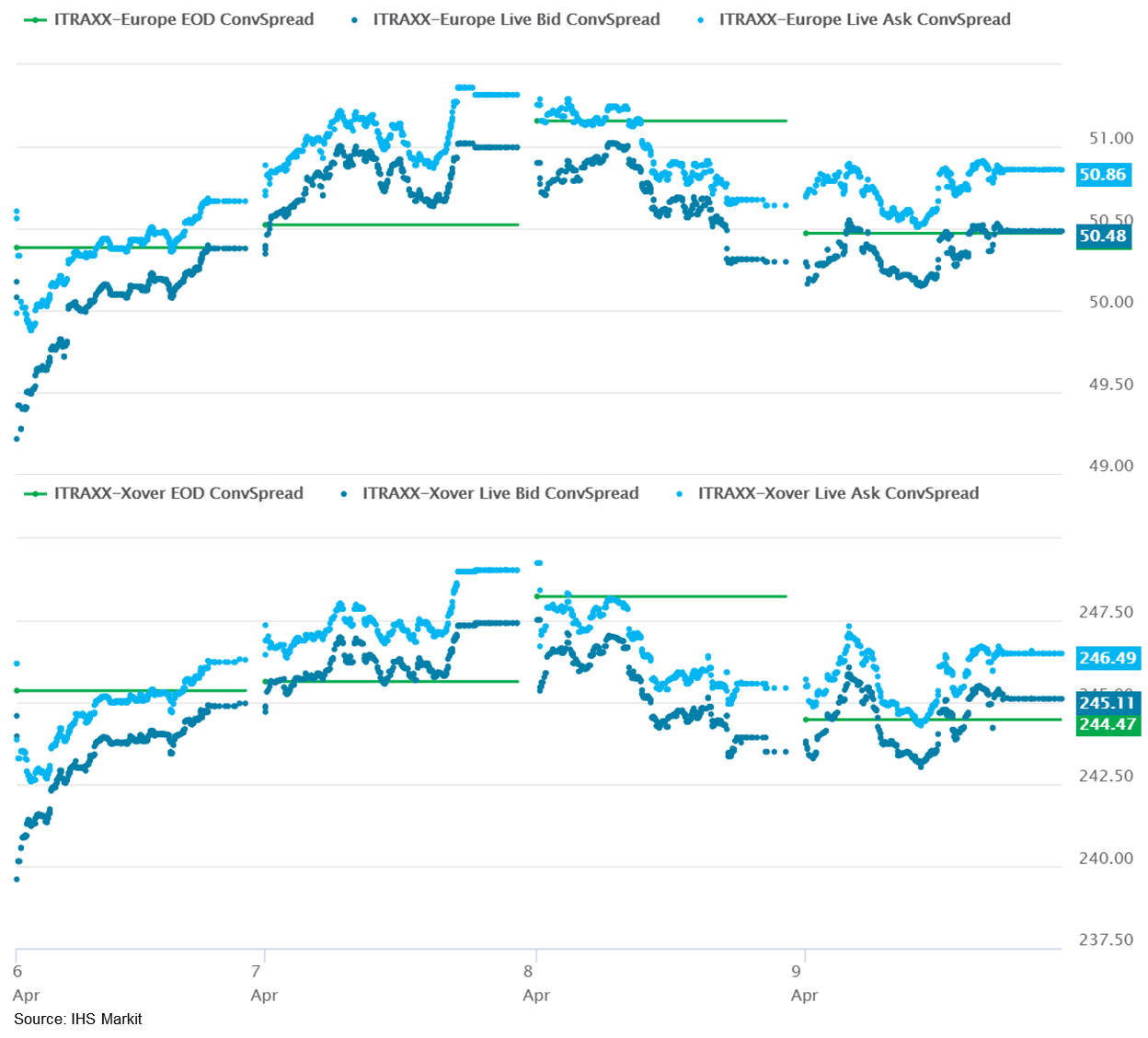

- iTraxx-Europe closed flat/51bps and iTraxx-Europe +1bp/246bps, which is +1bp week-over-week across both indices.

- Brent crude closed -0.4%/$62.95 per barrel.

- Saudi Arabia's energy giant Aramco has agreed to sell a 49% stake in its oil pipelines to an international consortium led by U.S. investment firm EIG Global Energy Partners and Abu Dhabi sovereign-wealth fund Mubadala Investment Co. for over $12 billion, according to people familiar with the matter. (WSJ)

- Seasonally and calendar-adjusted German industrial production excluding construction declined by 1.8% month on month (m/m) in February, extending January's small dip by 0.2% m/m. If construction is included, total production declined by 1.6% m/m in February, following a larger dip by 2.0% m/m in January that had been caused by a weather-induced slump in construction activity. (IHS Markit Economist Timo Klein)

- February's production decline owed mainly to a setback in investment goods output, although intermediate goods were also affected.

- A different split according to industrial branches reveals that the largest downward impulse came from another plunge of automobile production (-7.0% m/m, although January's drop was revised from -12.1% to -6.5% m/m), followed by machinery/equipment (-2.7% m/m). These declines are mostly related to a shortage of computer chips, i.e. supply chain problems, rather than a shortage of demand.

- Other sectors like computers and electrical equipment (1.1% m/m), metals (-0.2%), and chemicals/pharmaceuticals (-1.1%) posted a fairly steady output performance.

- Manufacturing orders came in at 1.2% m/m in February, following January's 0.8% m/m, are already indicating an imminent recovery in production. This holds even more for the index excluding big-ticket items (1.5% m/m in February after January's 1.7%), signaling that the upswing in demand is broad-based.

- Volta Trucks has confirmed that it is interested in building its battery electric vehicles (BEVs) at Nissan's Barcelona (Spain) facility after it ends production. The company said in a statement that "it is investigating the manufacture of the Volta Zero in Spain, having formally expressed an interest in the Decarbonisation Hub project within the former Nissan manufacturing facilities in Barcelona." (IHS Markit AutoIntelligence's Ian Fletcher)

- Volvo Group has announced that it is to collaborate with SSAB on the research, development, serial production and commercial use of fossil-free steel in vehicle manufacture. According to a statement, the companies have signed a deal for Volvo Group to use steel made using hydrogen in concept vehicles and machines before the end of 2021. (IHS Markit AutoIntelligence's Ian Fletcher)

- South Africa's real seasonally adjusted manufacturing production fell by 1.2% m/m and 1.0% year on year (y/y) during February, latest statistics from the South African statistical service, StatsSA, show. During January-February, real seasonally adjusted manufacturing production decreased 1.2% y/y. (IHS Markit Economist Thea Fourie)

- Sectors recording y/y decreases in production in February included petroleum, chemical products, rubber and plastic products (falling by 8.4% y/y and contributing minus 1.8 percentage point to overall manufacturing output).

- Other sectors recording decreases were basic iron and steel, non-ferrous metal products, metal products and machinery (down by 4.8% y/y and contributing minus 0.9 percentage point); and furniture and 'other' manufacturing (down 17.0% y/y and contributing minus 0.6 percentage point).

- Production in the motor vehicles, parts and accessories and other transport equipment sector remained resilient, increasing by 13.2% y/y and contributing 1.2 percentage points to overall manufacturing production during February.

Asia-Pacific

- Most APAC equity markets were closed lower except for Japan +0.2%; Australia -0.1%, India -0.3%, South Korea -0.4%, Mainland China -0.9%, and Hong Kong -1.1%.

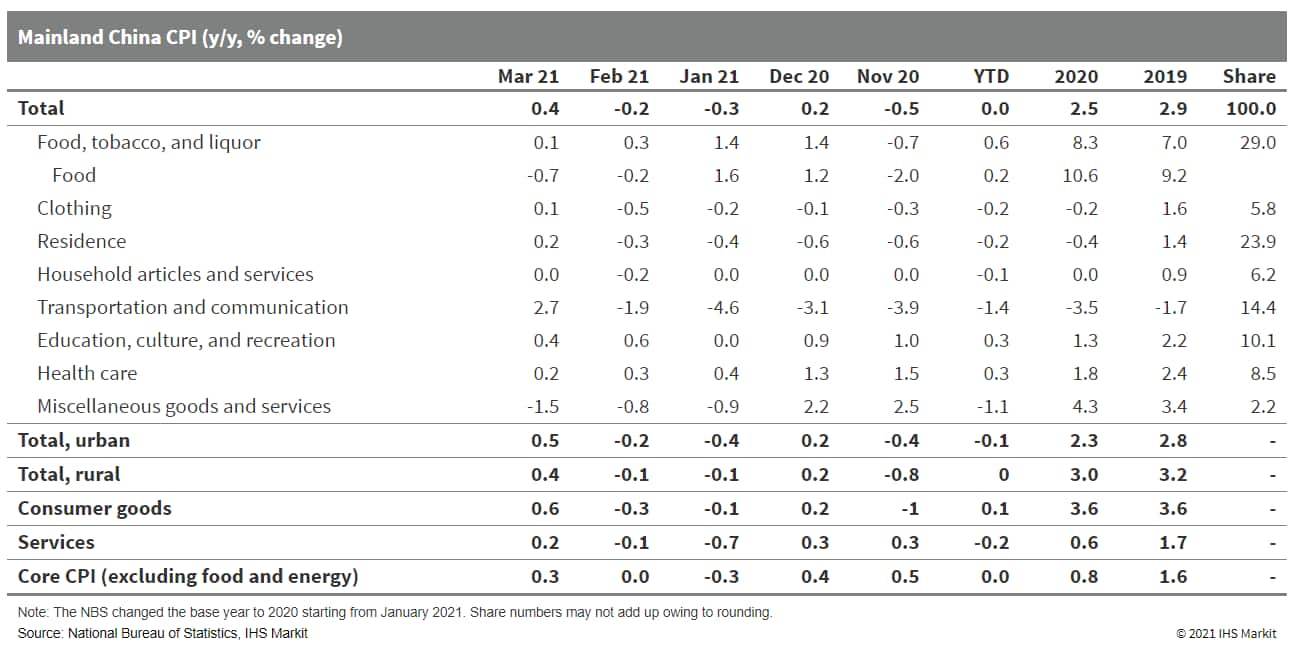

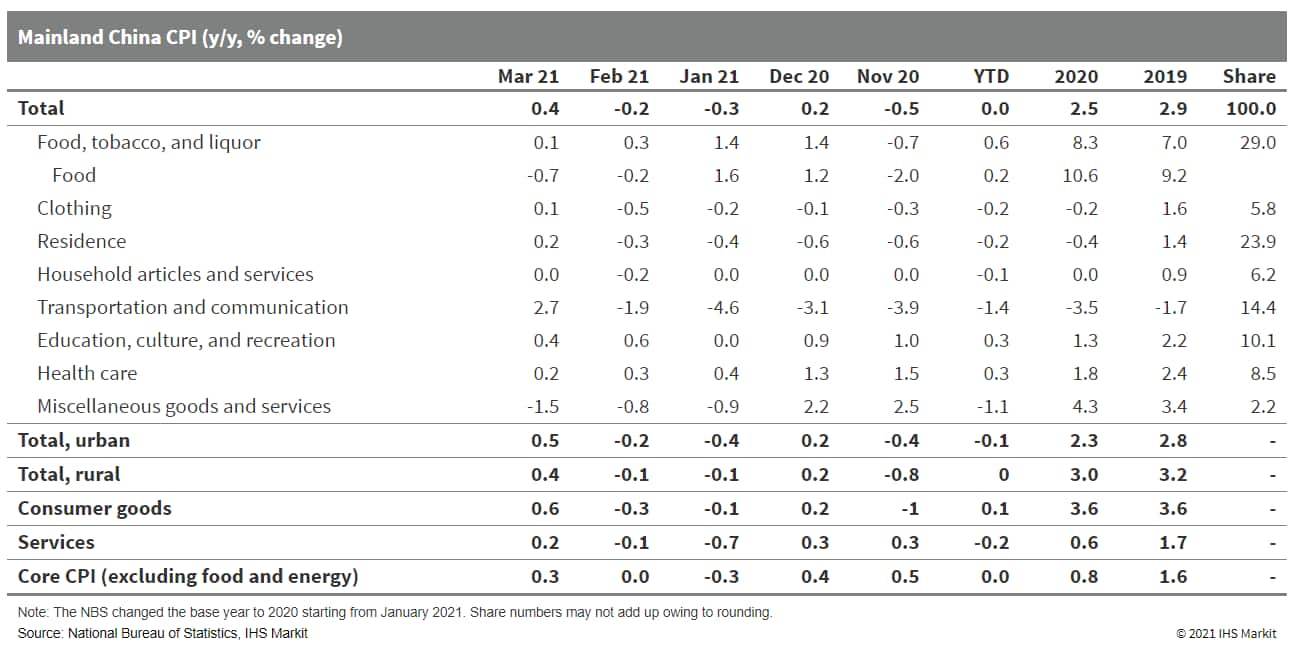

- Mainland China's Consumer Price Index (CPI) increased by 0.4% year on year (y/y) in March, up by 0.6 percentage point from February and returning into inflation territory, according to the National Bureau of Statistics (NBS). In month-on-month (m/m) terms, the CPI deflated 0.5% in March, down by 1.1 percentage points from February as effect of the disruptions from the Lunar New Year holiday fade. (IHS Markit Economist Lei Yi)

- A diminishing high-base effect, together with sustained economic recovery, supported the increase in the March headline CPI. While food prices deflation widened to 0.7% y/y in March, non-food prices rose by 0.7% y/y, compared with a 0.2% y/y deflation in February.

- Services prices registered inflation of 0.2% y/y in March after staying in deflation territory for two consecutive months. Excluding the volatile food and energy components, the core CPI stood at 0.3% y/y in March, up 0.3 percentage point from the February reading.

- Mainland China's Producer Price Index (PPI) jumped by 4.4% y/y in March, the fastest rate of increase since mid-2018, up by 2.7 percentage points from February. On a month-on-month basis, the PPI inched up by 0.8 percentage point to 1.6% y/y, with 30 out of 40 surveyed industrial sectors reporting month-on-month price gains compared with 25 in February.

- China is trying to limit new high-speed railway construction along underused routes, according to guidelines jointly released by the National Development and Reform Commission (NDRC) and transport authorities at the end of March. (IHS Markit Economist Yating Xu)

- Under the guidelines, if a high-speed rail route is operating at less than 80% of its designed capacity, then a second line covering the same route should not be built.

- The guidelines also stipulate that new high-speed rail links should only be built to reach cities that already see more than 15 million total inbound and outbound trips per year, and call for tightening scrutiny over traffic volume and punishing those who fabricate data.

- The guidelines emphasize financing system reform for railway investment and strict control of new increased debt via means such as direct financing, renting, and a floating ticket price system, particularly in heavily indebted regions.

- Prices of pork and live pigs continue to fall in China as farmers offload their animals amid ongoing uncertainty over the threat posed by new variants of African Swine Fever (ASF). Wholesale prices for pork fell for the tenth straight week to stand at CNY34 per kg (USD5.18/kg) in the first week of April. Prices have now decreased by 25% since the start of this year and stand at their lowest point since August 2019. The declines are partly seasonal, as demand tends to weaken after the Lunar New Year holiday in February. But supply side factors are also playing a role, as farmers in some regions rush to sell their animals - either because they fear a new wave of ASF or because they think markets may weaken even further. (IHS Markit Food and Agricultural Commodities' Max Green)

- T Map Mobility has raised KRW400 billion (USD395 million) in funding from two private equity funds, Affirma Capital and EastBridge Partners. T Map Mobility signed an agreement to issue 4.57 million new common shares to allot them to the two private equity funds. In return, Affirma Capital and EastBridge Partners will have a 14% stake each in T Map Mobility, reports Yonhap News Agency. In 2020, T Map Mobility, SK Telecom's mobility spin-off, announced its intention to form a joint venture (JV) with Uber that will invest USD100 million for a 51% stake. The JV - named UT - aims to launch a new taxi-hailing service based on existing services offered by Uber and T Map Mobility. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Five South Korean conglomerates and other companies have committed a combined $38 billion to boosting the country's hydrogen economy by 2030, following the enactment of a hydrogen law in February, said the Ministry of Trade, Industry and Energy (MOTIE). In a statement in Korean released in March, MOTIE named five South Korean conglomerates - Hanwha, Hyosung, Hyundai, SK Group, and POSCO - and a number of small- and medium-size enterprises (SMEs) as the key players who would commit the funds for building the country's hydrogen economy in the next decade. (IHS Markit Climate and Sustainability News' Bernadette Lee)

- Ashok Leyland plans to create two subsidiaries to focus on the e-mobility market in India, according to a company filing with the Bombay Stock Exchange (BSE) yesterday (8 April). The first subsidiary, Switch Mobility Automotive Limited, is being formed to carry on the company's electric vehicle (EV) strategy in India, while the second, OHM Global Mobility Private Limited, is to focus on providing Mobility-as-a-Service (MaaS). (IHS Markit AutoIntelligence's Isha Sharma)

- Ride-hailing firm Grab is launching a fund with an initial capital of USD275 million to support programs aimed at improving the lives of its drivers, delivery riders, and merchants in Southeast Asia, reports The Business Times. The GrabForGood fund includes USD50 million in cash and USD200 million in anticipated value of Grab shares. Chief executive and co-founder Anthony Tan, co-founder Tan Hooi Ling, and president Ming Maa have pledged to donate an estimated combined USD25 million of Grab shares. The company also announced that it would allocate up to USD20 million from the fund to subsidize the cost of COVID-19 vaccines and vaccine administration of driver and delivery partners. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Posted 09 April 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.