All major US and European equity indices closed lower, while APAC was mixed. US government bonds closed higher and benchmark European government bonds closed mixed. European iTraxx closed almost unchanged on the day across IG and high yield, CDX-NA was flat, and CDX-NAHY was tighter on the day. The US dollar, oil, and natural gas closed higher, while gold, silver and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; S&P 500 -0.1%, DJIA -0.2%, Nasdaq -0.6%, and Russell 2000 -1.1%.

- 10yr US govt bonds closed -3bps/1.34% yield and 30yr bonds -3bps/1.96% yield.

- CDX-NAIG closed flat/47bps and CDX-NAHY -3bp/275bps.

- DXY US dollar index closed +0.2%/92.65.

- Gold closed -0.3%/$1,794 per troy oz, silver -1.3%/$24.06 per troy oz, and copper -1.1%/$4.23 per pound.

- Crude oil closed +1.4%/$69.30 per barrel and natural gas closed +7.6%/$4.91 per mmbtu.

- Municipal bond primary activity will remain subdued following the Labor Day Holiday, with last week's calendar registering $6.1 billion of new issue activity after several large issuers entered the primary arena to finance new issue bonds. The New York City Transitional Finance Authority led last week's calendar, successfully pricing $950 million of future tax secured subordinate bonds with spread tightening noted throughout the scale, with the greatest bumps (3bps) concentrated in the intermediate range of the curve (+50bps to MAC). The State of Wisconsin also tapped into the primary market to take advantage of current borrowing levels, financing $326 million of general obligation bonds, with noteworthy bumps across the scale ranging from 18-20bps, as accounts swarmed investment grade paper driving a significant reduction in true interest cost to the issuer. This week's holiday-shortened calendar is slated to fall in line with last week's volume offering $6.3 billion across 172 new issues, alongside a greater presence of various ESG offerings amounting to $.65 billion, with the greatest concentration noted in the housing sector. The Hamptons Roads Transportation Accountability Commission (Aa2/A+/-) will lead this week's negotiated calendar, supplying $818 million of senior lien notes within a sole 07/2026 tranche, senior managed by Citi with an EPD of tomorrow 09/09. The City of Grand Forks, North Dakota will also come to market, offering $383 million for the Altru Health System (Baa2/-/BBB-) across one series, senior managed by Bank of America. This week's competitive calendar will span 105 issues for a total of $2.3 billion or ~37% of the total weekly calendar, led by the State of Minnesota auctioning three separate tranches for an aggregated total of $879 million on Thursday 09/09. (IHS Markit Global Market Group's Matthew Gerstenfeld)

- US job openings rose to a new series high of 10.9 million on the last business day of July. Healthcare and social assistance (up 294,000) and finance and insurance (up 116,000) saw the largest gains. (IHS Markit Economist Akshat Goel)

- The number and rate of hires were about unchanged at 6.7 million and 4.5%. Hires increased in state and local government education (up 33,000) and in federal government (up 21,000) and fell in retail trade (down 277,000), durable goods manufacturing (down 41,000), and educational services (down 23,000).

- Job separations was little changed at 5.8 million, while the layoffs and discharges were little changed at a near-record-low 1.5 million. All four regions saw little change in layoffs and discharges.

- About 4.0 million workers quit their jobs, tying the record set in April; the quits rate was unchanged at 2.7%, a whisker below April's 2.8% record low. Generally, a high quits rate is good—it indicates that workers are able to improve their lot by pursuing opportunities elsewhere.

- Over the 12 months ending in June, there was a net employment gain of 7.0 million, nearly matching the July 12-month payroll gain of 7.4 million.

- There was a record-low 0.8 unemployed worker for every job opening at the end of July, as the number of job openings exceeded the number of unemployed.

- Outstanding US nonmortgage consumer credit rose $17 billion to $4.33 trillion in July, only 45% of the pace of expansion in June. (US Regional Economics)

- The 12-month change in outstanding consumer credit was 4.2%, about the same as in June.

- Revolving credit rose $5.6 billion, a far smaller rise than June's $18.2 billion.

- The level of revolving credit turned positive compared with a year earlier as the gains from 2021 exceeded declines in 2020.

- The ratio of nonmortgage consumer credit to disposable personal income sagged to 24.0% from 24.2%, but erratic stimulus measures make single-month ratios of little use.

- Consumers used stimulus payments to pay down (or off) debt last year and in January 2021. Revolving debt gains surged in May and June to very high levels, but caution seems to have reemerged in the Delta-wave era. Vehicle debt gains would also have cooled as both July and August sales suffered from weak vehicle sales owing to lean inventories on dealers' lots—an issue that should plague the balance of 2021.

- The administration of US President Joe Biden has unveiled a plan entitled "American Pandemic Preparedness: Transforming our Capabilities", which lays out a set of urgent needs and opportunities in five key areas that are deemed necessary to protect the United States against biological threats. These five key areas include transforming medical defenses, ensuring situational awareness about infectious-disease threats, strengthening public health systems, building core capabilities, and managing the mission with seriousness of purpose, commitment, and accountability. The total cost of the plan has been budgeted at USD65.3 billion, to be invested over a period of 7-10 years. Within this overall expenditure figure, USD24.2 billion has been set aside for vaccines, including their design, testing, and authorization, as well as for the enabling of rapid, large-scale manufacturing capacity and for simplifying distribution. Other key areas of expenditure include an allocation of USD11.8 billion for therapeutics, such as the development of antivirals that inhibit key proteins for viral families, and USD5.0 billion to enhance diagnostic capabilities. The full plan is available here. (IHS Markit Life Sciences' Milena Izmirlieva)

- According to a Twitter post by Tesla CEO Elon Musk, the Roadster has been delayed until 2023. Musk stated that "2021 has been the year of super crazy supply chain shortages, so it wouldn't matter if we had 17 new products, as none would ship. Assuming 2022 is not mega drama, new Roadster should ship in 2023. The post suggests that a semiconductor shortage is behind the Roadster's delay. Tesla has also delayed the upcoming Cybertruck; during the most recent earnings call, the company indicated that getting production of a new battery cell up to scale was taking longer than expected. Tesla, like most automakers, is looking to allocate capital properly. Therefore, it means that the focus is now on getting the new German and US plants up and running with Model 3 and Model Y production as quickly as possible. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Solid-state battery startup Solid Power will expand its US factory to build test cells for Ford and BMW in 2022, according to media reports. Automotive News reports that the company is building a new site to increase production of sulphide-based solid electrolytes as well as a new pilot line to produce 100 ampere battery cells, reported to have the capacity for automotive use. Solid Power reportedly has an agreement to provide Ford and BMW with test cells in 2022, aiming for full battery production in 2025 and vehicle manufacturing in 2026, Automotive News quotes CEO Douglas Campbell as saying. For full production, Solid Power will aim to partner with an automaker or existing battery manufacturer. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Vistra Energy's 300-MW Moss Landing lithium-ion battery facility in California remains offline while the company investigates why several modules overheated enough 4 September to trigger sprinkler systems, preventing a fire and any offsite impacts. (IHS Markit Net-Zero Business Daily's George Lobsenz)

- The company said 7 September the facility might be out of service for "some time" as it conducts an investigation into the incident in partnership with LG Energy Solution and Fluence, its engineering contractor, and makes any needed repairs.

- The Moss Landing facility, which is on track to become the world's largest battery storage facility, in August announced the completion of a 100-MW expansion of the facility, bringing its total storage capacity to about 400 MW.

- The company said the 100-MW battery system remained available for operation because it is located in a separate building at the Moss Landing site and was unaffected by the incident.

- The merchant generator did not say what caused the overheating, but the battery components involved were made by LG, which earlier this year announced a worldwide recall of batteries produced in 2017 and 2018 due to manufacturing defects implicated in fires at other lithium-ion battery facilities in the US and South Korea.

- Researchers with DNV GL, a global engineering standards company, told IHS Markit's The Energy Daily last year that an independent investigation into LG battery fires in South Korea found that heavy cycling of batteries to shift solar power from low midday demand periods to high-demand evening periods could accelerate battery degradation and contribute to increased fire risk.

- The Canadian Ivey Purchasing Managers' Index (PMI) jumped 9.6 points to 66.0 following the 15.5-point plunge in the previous month. (IHS Markit Economist Chul-Woo Hong)

- The employment index improved while the inventories index remained virtually unchanged.

- Despite the modest increase, the supplier deliveries index continued to show severe supply-chain disruptions.

- The price index fell for two consecutive months to 69.7, indicating a slight moderation of upward inflation pressure.

- Although downside risk to the real GDP forecast rose with the continued pandemic impact, Canada's economic recovery in the second half of 2021 will be robust, led by strong domestic demand.

- Despite the increasing uncertainty about the fourth pandemic wave, purchasing managers' spending activity showed a firm improvement in August, partly reflecting solid domestic demand. After the decline in the previous month, the employment index jumped back to a historically elevated level at 66.9, despite labor shortages persisting for some industries.

- Together with worsening suppliers' delivery time, purchasing managers continued to strongly build inventories likely to prevent a further supply shortage. Meanwhile, the prices index declined 7.4 points to the lowest level since December 2020, indicating milder inflation pressure compared with the previous month.

- The September policy announcement was as expected, with the Bank of Canada keeping interest rates unchanged, maintaining extraordinary guidance, and not making any downward adjustment to quantitative easing, which is currently targeted at a $2-billion/week pace. (IHS Markit Economist Arlene Kish)

- The domestic outlook was dented with supply-chain bottlenecks affecting Canada's exports and the drop from record-high residential investment, resulting in the decline in second-quarter real GDP. Given that production and trade headwinds are temporary, recovery is anticipated with a decent consumer sector.

- Global growth, particularly that in the United States, is on a relatively more solid footing, but rising COVID-19 cases and associated restrictions, along with supply-chain disruptions, increase uncertainty regarding the timing of the recovery.

- Against this backdrop, inflation concerns linger temporarily, continuing upward pressure on goods.

- The current forecast of monetary policy is unchanged as the Bank of Canada maintains the overnight rate of 0.25% until the inflation rate hits 2.0% on a sustainable basis, which is expected in the second half of 2022. The reduction in quantitative easing depends on the strength of the recovery, aided by the rebound in the third quarter.

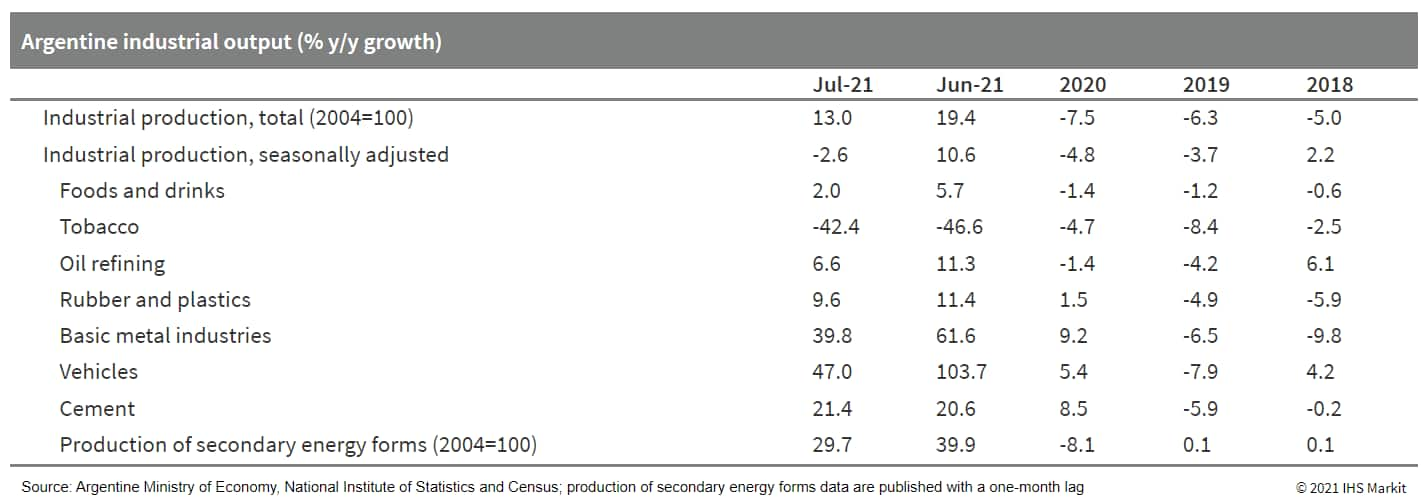

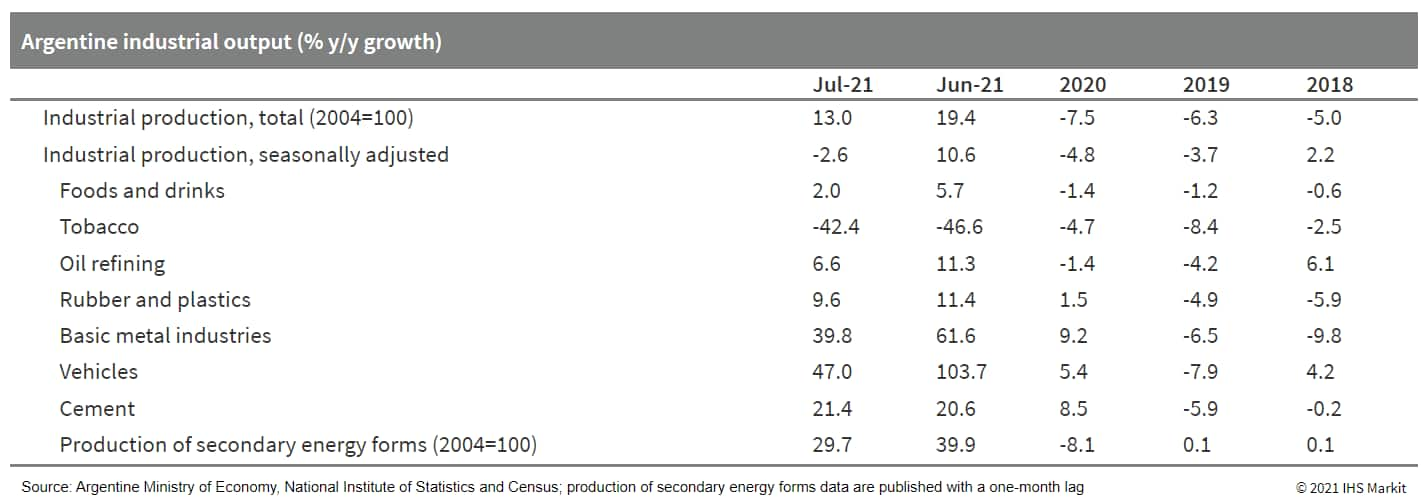

- According to Argentina's National Institute of Statistics and Censuses (Instituto Nacional de Estadística y Censos: INDEC), the country's industrial production increased by 13% year on year (y/y) in July. Seasonally adjusted data show a 2.6% month-on-month (m/m) decrease in July, compared with a 10.6% m/m increase in June and the decline during the extensive lockdown in May 2021. (IHS Markit Economist Paula Diosquez-Rice)

- The largest annual increases in July were in vehicle assembly, clothing and apparel, basic metals, general equipment, other transportation equipment, and non-metallic minerals, among others. A few sectors posted a slower year-on-year expansion in July: food and beverages; oil refining; chemicals; and wood, paper, and printing. Tobacco products and household furniture and mattresses posted an annual decline.

- A qualitative industrial poll of companies conducted by INDEC shows that 30% of respondents estimate that demand will expand in August-October 2021, compared with the same period in 2020 (down from 32% in the previous month's survey). The percentage of respondents that expect demand to remain relatively the same increased to 50%, while 51% of respondents expect exports to remain at a similar level during the period.

Europe/Middle East/Africa

- All major European equity indices closed lower; Spain -0.6%, UK/Italy -0.8%, France -0.9%, and Germany -1.5%.

- 10yr European govt bonds closed mixed; Italy -2bps, France -1bp, Germany/Spain flat, and UK +1bp.

- iTraxx-Europe closed flat/45bps and iTraxx-Xover flat/229bps.

- Brent crude closed +1.3%/$72.60 per barrel.

- UK-based autonomous vehicle (AV) software company Oxbotica has partnered with Applied EV to develop a fully autonomous multi-purpose electric vehicle (EV), according to a company statement. Under this partnership, Oxbotica will integrate its AV software with Applied EV's Blanc Robot EV platform to develop a driverless vehicle, which will be deployed in a wide range of environments for a variety of commercial applications. The first industries targeted for deployment will be industrial logistics and goods delivery. Paul Newman, founder and chief technology officer of Oxbotica, said, "Working in collaboration with AppliedEV to provide the market with an autonomy solution comprising both hardware and software with the highest safety standards is a singular and unifying goal. We have an ambitious deployment goal over the coming years, driven by an extraordinary market appetite for a world-class product." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Members of the European Parliament (MEPs) are expected to back national taxes on unsustainable food when they finalize their position on the Farm to Fork (F2F) strategy this week. (IHS Markit Food and Agricultural Policy's Steve Gillman)

- On 9 September, the Parliament's Environment and Agriculture Committees (ENVI/AGRI) will vote on their position to the Farm to Fork strategy and it is expected that all political groups will support a compromise that could change the way food is taxed.

- Compromise amendment 27 reads: "True food prices, reflecting the true cost of production for farmers and also for the environment and society, are the most efficient way to achieve sustainable and equitable food systems in the long term."

- The text comes from ENVI and AGRI's joint report on the F2F strategy from December 2020, which saw over 2,200 amendments tabled from MEPs. Subsequent discussions among the policymakers saw compromise amendment 27 emerge in its current state, which increases the chances that it will receive a positive vote.

- The text also urges member states to differentiate VAT rates on food with different health and environmental impacts, and choose a zero VAT tax for healthy and sustainable food products, such as fruits and vegetables.

- Siemens Gamesa has launched the world's first recyclable wind turbine blade ready for commercial use. The company produced the 81-meter long RecyclableBlade blade at its factory in Aalborg, Denmark, and will be looking to install and monitor a first set of blades at RWE's Kaskasi offshore wind farm in Germany. RecyclableBlade is made from a combination of materials bound together with a proprietary resin mix to form a strong and flexible lightweight structure. Overcoming one of the major hurdles to blade recycling, the new resin developed by Siemens Gamesa makes it possible to separate the resin from the other blade components using a mild process that does not alter the properties of the other materials in the blade, unlike existing methods of blade recycling. The process will allow blade materials to be reused in new applications after separation. The company is planning for RecyclableBlade to start producing energy from 2022 onwards, and is also planning to install them at some of EDF Renewables' offshore wind farms. (IHS Markit Upstream Costs and Technology's Melvin Leong)

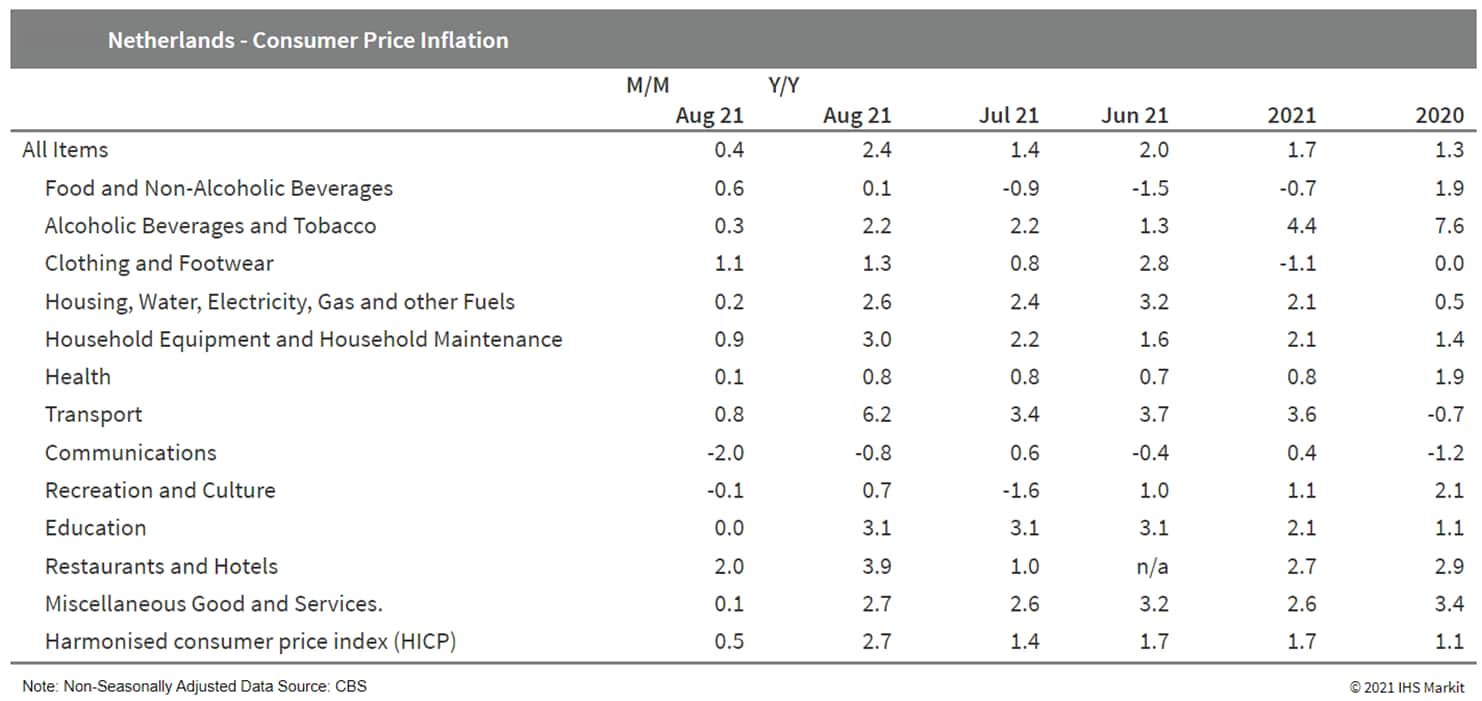

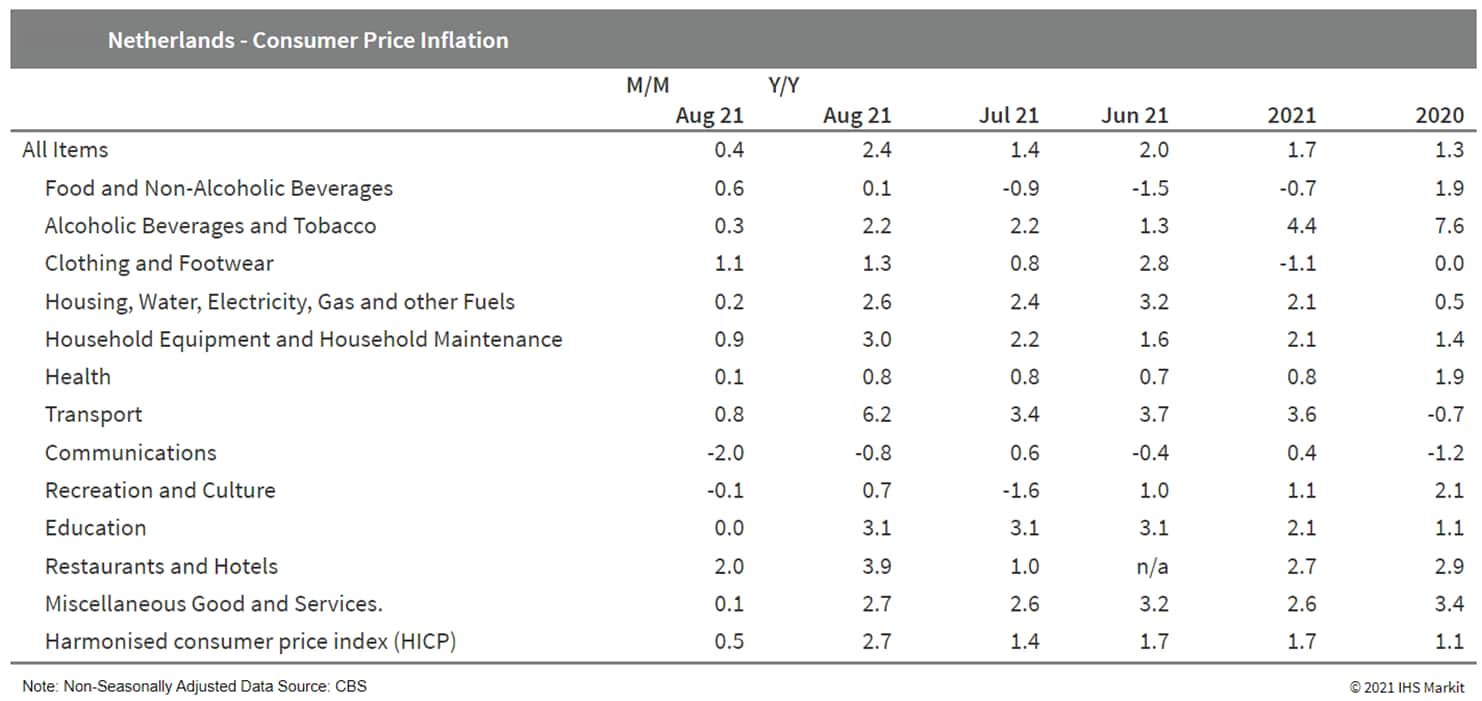

- Statistics Netherlands (Centraal Bureau voor de Statistiek: CBS) reports that consumer prices in the Netherlands in August increased by 2.4% year on year (y/y), after weakening from growth of 2.0% y/y in June to 1.4% y/y in July. This is the highest inflation rate since December 2019. (IHS Markit Economist Marie-Louise Deshaires)

- On a monthly basis, consumer prices rose by 0.4% month on month (m/m), according to the national consumer price index (CPI) measure. According to the European Harmonised Index of Consumer Prices (HICP), inflation rose by 2.7% y/y in August, up from 1.4% y/y in the previous month and just below eurozone inflation of 3.0% y/y in the same month.

- The rise in the inflation rate was mainly driven by higher holiday prices. The price of package deals for holidays abroad rose by 16.4% y/y, up from a 4.4% annual drop in July. This, however, was driven by a relatively low price level of package holidays in August 2020 rather than a higher level of prices in August 2021. Annual growth in holiday park accommodation prices also recovered from the 6.3% y/y drop in July, rising by 12.0% y/y. This rise was mainly driven by high price levels in August 2021.

9. Greece's GDP rose by 3.4% quarter on quarter (q/q) during the second quarter, according to seasonally adjusted figures. Its GDP is now estimated to have risen by 4.5% q/q during the first quarter (revised up from 4.4% q/q). (IHS Markit Economist Diego Iscaro)

- On a year-on-year (y/y) basis, Greece's economy grew by 16.2% during the second quarter. Real GDP is now 0.7% above its pre-pandemic level during the fourth quarter of 2019.

- The expenditure breakdown of the first-quarter figures shows growth being largely driven by strong increases in fixed investment and stocks (see chart).

- Construction investment (which represents 6% of total investment) rose by a strong 7.0% q/q, while investment on intellectual property products (18% of total investment) grew by 5.6% q/q. Investment in transport equipment increased by a further 1.6% q/q.

- Inventory changes contributed 4.4 percentage points to the total change in demand during the second quarter. This adds to a 5.0-percentage-point contribution during the first quarter.

- The surge in inventories is likely to be linked to changes in demand/production and supply-side disruptions caused by the pandemic. Moreover, a correction is likely as the economy reopens and demand and supply conditions normalize.

- Strong gross fixed investment helped to offset weakness in other expenditure components. For example, private and public consumption fell by 0.4% q/q and 0.7% q/q, respectively.

10. Russian car-sharing company Delimobil is reportedly considering raising USD350 million in its US-based IPO. The company is targeting an offering this year for a listing on the New York Stock Exchange and a dual listing in Moscow, reports Reuters. According to the report, Delimobil has hired Bank of America and Citi to arrange the offering. UBS, Russia's Sberbank CIB, VTB Capital, and Renaissance Capital are among the other banks participating in the IPO process. Delimobil was established in 2015 and currently has a fleet of more than 16,000 vehicles, with more than 1 million members. The company announced its IPO plans in 2019, saying that it would float a 40% stake. In 2020, it announced plans to sell up to a 10% stake to investors in a pre-placement ahead of its IPO on the New York Stock Exchange, planned in early 2022. (IHS Markit Automotive Mobility's Surabhi Rajpal)

11. South Africa's real GDP expanded by 1.2% quarter on quarter (q/q) during the second quarter of 2021, from 1.0% q/q in the previous quarter. This leaves South Africa's GDP up by an average of 8.4% year on year (y/y) during the first half of 2021, from a contraction of 8.3% y/y for the same period a year ago. (IHS Markit Economist Thea Fourie)

- Latest numbers produced by Statistics South Africa (StatsSA) show that exports of goods and services contributed the largest to second-quarter growth, adding 1.0 percentage points. This was followed by household consumption expenditure, contributing 0.3 percentage points, and gross fixed investment spending contributing 0.1 percentage points. A drawdown in inventory levels, particularly in the electricity and mining sectors, was a drag on overall economic activity during the second quarter.

- A rebound in non-durable and durable spending supported overall household spending during the second quarter. Subcategories taking the lead included transport (up by 2.77% q/q, contributing 0.4 percentage point); healthcare (2.5% q/q, contributing 0.2 percentage point); food and non-alcoholic beverages (1.7% q/q, contributing 0.2 percentage point); restaurants (2.4% q/q, contributing 0.1 percentage point); telecommunications (1.6% q/q, contributing 0.1 percentage point); and clothing and footwear (1.1%, contributing 0.1 percentage point).

- Fixed investment spending found support from the acquisition of machinery and equipment (1.8% q/q, contributing 0.7 of a percentage point), 'other' assets (6.4% q/q, contributing 0.7 percentage point), and transport equipment (1.1%, contributing 0.1 percentage point).

- Sectors with the largest contributions to overall GDP growth during the second quarter were the transport (6.9% q/q), personal services (2.5% q/q), and the trade industries (22% q/q).

Asia-Pacific

- All major APAC equity markets closed lower except for Japan +0.9%; Mainland China flat, India/Hong Kong -0.1%, Australia -0.2%, and South Korea -0.8%.

- Chinese central authorities issued two development plans on 5 and 6 September, respectively, to further strengthen ties between Guangdong Province and Macao SAR and Hong Kong SAR. (IHS Markit Economist Lei Yi)

- For Macao SAR, an in-depth cooperation zone will be established at Hengqin Island, located in the city of Zhuhai (Guangdong Province), with special emphasis placed on facilitating diversification of Macao SAR's economy. Scientific research and high-tech manufacturing were highlighted as key industries to be developed, together with financial services provision with special focus on Portuguese-speaking countries. Authorities will also explore free capital flow within the zone and promote capital account convertibility.

- All enterprises in industries deemed beneficial for Macao SAR's diversified development path can enjoy a preferential corporate income tax rate of 15%, while skilled workers can have their personal income tax capped at 15% - these are similar to the tax arrangements implemented in the Hainan Free Trade Port. The tax burden of residents of Macao SAR working in the Hengqin cooperation zone will not be higher than those working in Macao SAR. Further, to improve infrastructural linkages, Macao SAR's light rail system is planned to be connected to the cooperation zone and therefore the mainland transportation network.

- For Hong Kong SAR, Shenzhen's Qianhai cooperation zone will be expanded to over 120 square kilometers, about eightfold the current size. The main objectives of the development of Qianhai zone differs from the Hengqin cooperation zone in that the Qianhai cooperation zone specifically focuses on modern services development, calling for further service trade liberalization and financial sector opening up, relying on Hong Kong SAR's comparative advantages.

- Geely Automobile Holdings Limited has invested USD50 million in autonomous vehicle (AV) technology startup ECARX, according to a company statement. In return, Geely will acquire a 1.51% stake in the startup. ECARX is a subsidiary of Chinese automaker Geely and focuses on the technology used in car chips, high-definition maps, and smart vehicles. The company is headquartered in Hangzhou (China) and has branches in Gothenburg (Sweden) and the Chinese cities of Wuhan, Shanghai, Beijing, and Dalian. In 2020, ECARX raised CNY1.3 billion (USD194.5 million) in a Series-A funding round led by Baidu and SIG China. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Japan's real GDP for the second quarter of 2021 has been revised upwards to growth of 0.5% quarter on quarter (q/q), or 1.9% q/q annualized, from a 0.3% q/q, or 1.3% q/q annualized, rise. The upward revision largely reflects an increase in government consumption and private capital expenditure (capex), offsetting the downward revisions to change in private inventories and public investment. (IHS Markit Economist Harumi Taguchi)

- The better-than-expected increases stemmed from an upward revision of government consumption to 1.3% q/q from 0.5% q/q. Extended COVID-19-virus-related containment measures and additional spending for emergency subsidies were probably behind the stronger increase. Capex has been revised upwards to 2.3% q/q from 1.7% q/q, in line with IHS Markit's expectations.

- Although investment in other buildings and structures (down by 0.6% q/q) and transport equipment (down by 6.1% q/q) continued to decline, investment in other machinery and equipment (up by 2.8% q/q) and intellectual property products (up by 5.0% q/q) rebounded. The continued decline in investment in transport equipment partially reflected weak production of autos caused by semiconductor shortages.

- Toyota chief technology officer Masahiko Maeda has presented an update to the company's carbon neutrality targets in the context of battery development and expectations for electrified vehicles. Toyota will invest JPY1.5 trillion into battery development and production through to 2030 and is considering development of capacity for 200 GWh by 2030 globally and developing three battery types to support battery electric vehicles (BEVs), fuel-cell electric vehicles (FCEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs). To expand options for achieving carbon neutrality at all stages of the vehicle lifecycle, from development to battery reuse, fueling, and disposal, Toyota sees two paths for immediate CO2 reduction. In areas in which renewable energy will be widely used going forward, the company sees its ability to provide HEVs at an affordable price point as an effective way for CO2 emission reduction. By the company's calculations, one HEV can reduce the same amount of CO2 emissions as three BEVs. Announcements along the same line have been coming from many automakers throughout 2020 and 2021, and Toyota has joined the club, in part likely an effort to contradict criticism that it is moving more slowly in this arena. With this presentation, Toyota maintains a previously announced target for sales of 8 million electrified vehicles globally in 2030, of which 2 million are planned to be BEVs. In comparison, the company sold about 10.5 million vehicles globally in 2019, prior to the pandemic, and is forecast to sell 11.2 million units globally in 2023. IHS Markit's August engine installation forecast projects Toyota's BEV production reaching 1.73 million units in 2030. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Japan has launched a new project, "Road to the L4", that aims to promote advanced mobility services involving Level 4 autonomous operations. Level 4 autonomous vehicles (AVs) require no human intervention, but their applications are limited to specific conditions. Under this project, the use of AVs will be expanded in more than 40 locations around the country by 2025. The government has allocated about JPY6 billion (USD55 million) for developing autonomous services this fiscal year, including for the L4 project. The project aims to ensure that AVs operate safely and effectively where there are other vehicles and humans, thereby promoting acceptance and understanding, reports the Japan Times. Japan is seeking to promote autonomous technology and aims to sell full AVs in 2025. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Honda, in partnership with General Motors (GM) and Cruise, will begin a testing program by deploying autonomous vehicles (AVs) in Japan this September, according to a company statement. Public road tests will be conducted in 2022 in Utsunomiya City and Haga Town, Tochigi Prefecture. Initially, a high-definition map of the area will be created using a specialized vehicle for mapping. Following this, the Cruise AV will be driven on public roads in Japan to develop and test AVs adapted to the traffic environment and the required rules and regulations. In 2018, Honda invested USD750 million in an immediate equity stake in Cruise, as well as making a commitment to invest USD2.0 billion over 12 years to develop AVs and technology with GM. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Despite the severe containment measures implemented by the government for most of the third quarter, Vietnam's daily new COVID-19 cases have persistently exceeded 12,000. Since the COVID-19-virus Delta variant began to spread in late April, Vietnam has recorded over 500,000 cases. The latest outbreak continues to be concentrated in the country's southern industrial hub, which accounts for one-third of Vietnam's GDP, but, more importantly, plays a key role in global supply chains for electrical and electronics components, machinery, textiles, apparel, and furniture. (IHS Markit Economist Jola Pasku)

- A growing number of factories in industrial zones report being forced to suspend operations because either workers test positive or because authorities lock down the entire area after detecting cases nearby. With vaccines scarce, manufacturers are undertaking extreme measures to isolate staff and maintain production, including renting hotels for workers or housing them in factories.

- The ongoing outbreak has hit Vietnam's economy hard, with industrial production (IP) activities moving into contraction territory in August (down 7.4% y/y), marking one of the steepest falls since the pandemic began last year. To date IP has averaged 6.8%.

- Data on exports remained strong until last month, although the strong y/y growth was skewed from the base effects of last year. August data showed exports mirroring the trend witnessed in IP, with exports falling by 1.1% y/y.

- Following its September meeting, the Reserve Bank of Australia (RBA) maintained the cash rate target and the yield target for three-year Australian Government Securities (AGS) at 0.10%, reiterating that the bond target is for the April 2024 bond. The central bank also maintained its commitment to modestly slow the bond buying program to AUD4 billion (USD2.97 billion) this month, down from the initial AUD5 billion. However, it will maintain the program at this level of purchases until "at least mid-February 2022", thus marking a delay from the initially announced date of November. (IHS Markit Economist Bree Neff)

- The post-decision statements continued to emphasize that the RBA's baseline scenario does not expect the central bank to raise the policy rate before 2024, or when the headline inflation rate is sustainably within the central bank's inflation target range of 2-3%. To achieve this goal, the RBA believes that Australia needs to achieve full employment and higher wage growth.

- This month, support for this base case arose from what the RBA termed the "disruption" but not "derailment" of the Australian economy by the ongoing Delta variant-driven outbreak of COVID-19 infections. The RBA's forecasts indicate a decline in September-quarter GDP and a rising unemployment rate from virus containment measures. The main issue is how quickly and sharply will the economy bounce back in the December quarter, which will depend on how quickly states meet their vaccination targets.

Posted 08 September 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.