All major European and most US equity indices closed higher, while most APAC markets were lower. US government bonds and most benchmark European bonds closed higher. CDX-NA was close to flat on the day. The US dollar closed lower, while oil, natural gas, gold, silver, and copper closed higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher except Nasdaq -0.5%.; DJIA +0.7%, Russell 2000 +0.5%, and S&P 500 +0.3%;

- 10yr US govt bonds closed -2bps/1.61% yield and 30yr bonds -1bp/2.28% yield.

- CDX-NAIG closed flat/50bps and CDX-NAHY -1bp/285bps.

- DXY US dollar index closed -0.4%/90.95.

- Copper closed +1.4%/$4.53 per pound, which is its highest close since 15 February 2011 and only 10 cents shy of the all-time high close of $4.63 per pound on 14 February 2011.

- Gold closed +1.4%/$1,792 per troy oz and silver +4.2%/$26.96 per troy oz.

- Crude oil closed +1.4%/$64.49 per barrel and natural gas closed +1.2%/$2.97 per mmbtu.

- The seasonally adjusted IHS Markit U.S. Manufacturing Purchasing Managers' Index™ (PMI™) posted 60.5 in April, up from 59.1 in March and broadly in line with the earlier 'flash' estimate of 60.6. The PMI figure was the highest since data collection for the series began in May 2007 and signaled a marked expansion. (IHS Markit Economist Chris Williamson)

- Contributing to the greater headline figure was a sharp and faster upturn in production across the manufacturing sector.

- Output growth was commonly linked to a stronger rise in new orders, although some companies continued to highlight pressure on capacity following raw material shortages.

- Firms sought to pass on higher costs to clients through a further rise in output charges in April. The rate of charge inflation eased slightly from March, but was the second-fastest on record.

- US total construction spending rose 0.2% in March, only partially reversing a larger decline in February. The increase in March was considerably weaker than both the Bloomberg expectation and the IHS Markit assumption. (IHS Markit Economist Ben Herzon and Lawrence Nelson)

- Core construction spending slipped 0.1% in March. February was revised higher. Relative to the assumptions implicit in the advance estimate of the National Accounts, core construction spending was about as expected, so we did not revise our estimate of 6.4% GDP growth in the first quarter.

- However, we had assumed that much of the weakness in February core construction spending was due to unseasonably harsh winter weather, so we had assumed a robust rebound in March.

- That construction activity did not rebound to what had been a firming trend suggests something else besides weather may have been restraining construction activity in February. News reports suggest anecdotally that spot labor and materials shortages as well as permitting delays may be a headwind for construction activity in coming months.

- Private residential construction rose 1.7% in March. Since reaching a trough last May, private residential construction has risen a stunning 34.4%. The residential sector has benefitted from low mortgage rates, a migration to less densely populated suburban areas, limited inventories of homes for sale, and some pent-up demand.

- Private nonresidential construction spending declined 0.9% in March and has been trending lower for about one year. State-and-local construction spending declined 1.4% in March (following a 1.4% decline in February) and had weak momentum heading into the second quarter. About three-quarters of the two-month decline was in education and in highway and streets.

- Pfizer (US) has announced that it has acquired the privately held Amplyx Pharmaceuticals, which specialises in developing therapies for debilitating and life-threatening diseases that affect people with compromised immune systems. Amplyx's lead compound is fosmanogepix (APX001), which is at the Phase II stage for treating patients with life-threatening invasive fungal infections caused by yeasts and molds. The financial terms of the acquisition were not disclosed. Pfizer's full acquisition comes after it was previously one of several companies that contributed a total of USD140 million to a Series C funding round for Amplyx. (IHS Markit Life Sciences's Milena Izmirlieva)

- Florida citrus growers are urging a federal court to uphold EPA's registration of aldicarb for use on oranges and grapefruit, calling the insecticide "the most promising tool" to combat citrus greening. First found in Florida in 2005, the bacterial disease is spread by the non-native Asian Citrus Psyllid and has no known cure. It causes the discoloration of citrus fruit and leaves, eventually killing the infected tree. Production in Florida is down 70% from 20 years ago and researchers estimate citrus greening has cost citrus growers some $3 billion in lost revenue. (IHS Markit Food and Agricultural Policy's JR Pegg)

- Stellantis' Free2Move is adding its monthly Car on Demand service to Los Angeles and six other US states by the end of 2021. The service provides access to vehicles on a monthly basis, including insurance, roadside assistance, vehicle maintenance, free delivery and up to 1,000 miles per month. Free2Move says it will be a fully digital experience and a flexible contract without commitment on duration. The contract will start at USD699 per month. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous truck startup Plus is in talks to go public through a reverse merger agreement with special purpose acquisition company (SPAC), Hennessy Capital Investment Corp. V, reports Automotive News. The company plans to raise USD500-USD600 million in funding through the deal, which will value it at more than USD3 billion. The company will receive proceeds from the SPAC as well through private investment in public equity (PIPE) with participants including BlackRock Inc., which is already a Hennessy investor. According to the report, negotiations are ongoing and subject to change and the parties could reach an agreement as soon as next week. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The first quarter of 2021 marked the fourth consecutive quarter in which Barbados's economy recorded a year-on-year (y/y) decline near or above 20%. Tourism remains battered by the COVID-19-virus pandemic and its effects on travel demand, mobility restrictions, and the labor market. (IHS Markit Economist Jeremy Smith)

- Output fell by 19.8% y/y in the first quarter, a slight improvement from the previous result but worse when considering the 5% y/y decline in the first quarter of 2020.

- Barbados's struggles offer an early indication of the impact of new travel restrictions imposed by key source markets such as the United States, the United Kingdom, and Canada on the Caribbean region. In addition, Barbados experienced its first major domestic COVID-19-virus outbreak in early 2021, prompting an island-wide lockdown in February.

- These developments stunted an already tenuous economic recovery, especially in the vital tourism sector, whose output plunged by an estimated 96% y/y. The modest increase in visitors registered in the fourth quarter of 2020 reversed course and first-quarter arrivals were under 50% of those in December alone.

- Hotel occupancy rates were reported at 22.3% with many closed completely and many hotels that managed to attracted visitors did so at heavily discounted prices.

Europe/Middle East/Africa

- All major European equity indices closed higher; Italy +1.2%, Spain +0.9%, Germany +0.7%, and France +0.6%.

- Most 10yr European govt bonds closed higher except for Germany flat; Spain -4bps, Italy -2bps, and France -1bp.

- VW's CEO Herbert Diess is quoted as saying the company plans to design and develop its own high-powered chip for autonomous vehicles (AVs), reported by Automotive News Europe. The CEO reportedly does not plan to build semiconductors but wants to own patents. The company's Cariad software unit would develop the expertise and expand. According to the report, the effort would be driven by remaining competitive against Tesla and a possible Apple AV, long rumored and possibly arriving in the second half of this decade. Although the industry is reeling from a semiconductor shortage that is expected to have its most severe impact in the second quarter of 2021 but also to linger into 2022, Diess's comments do not appear to be focused on addressing that issue. Instead, the remarks are about ensuring VW has the necessary internal expertise to compete in a drastically different automotive future. (IHS Markit AutoIntelligence's Stephanie Brinley)

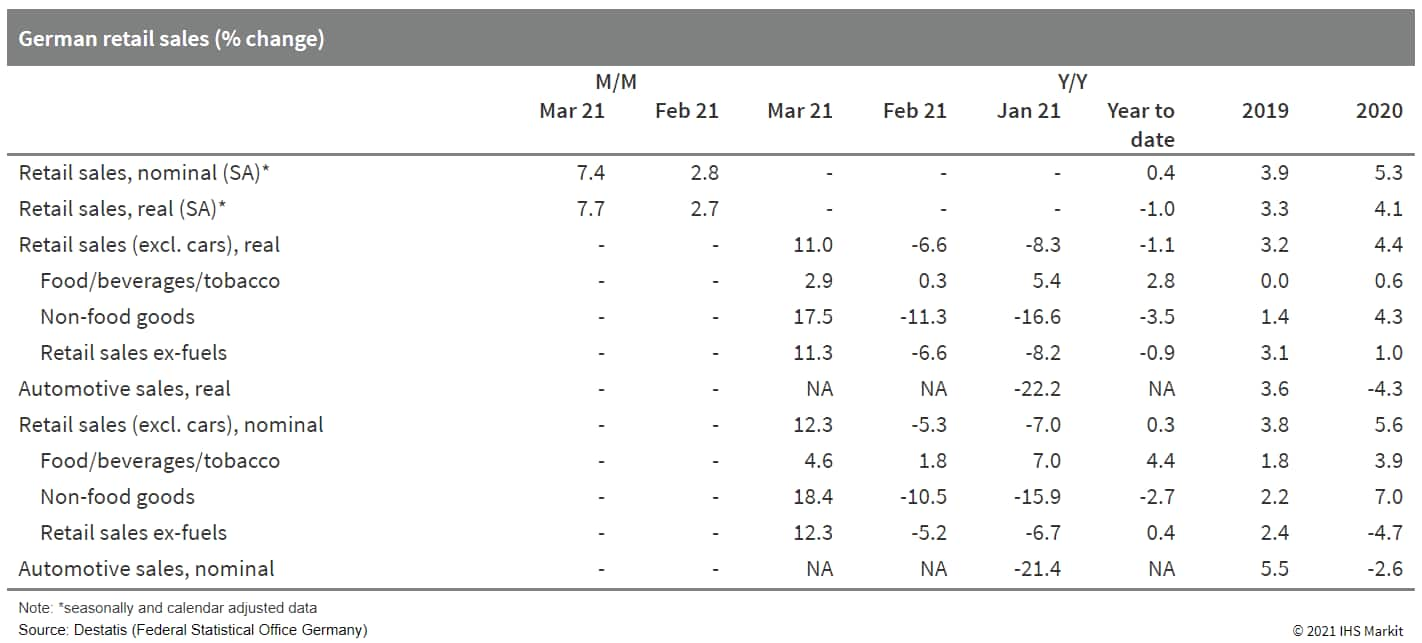

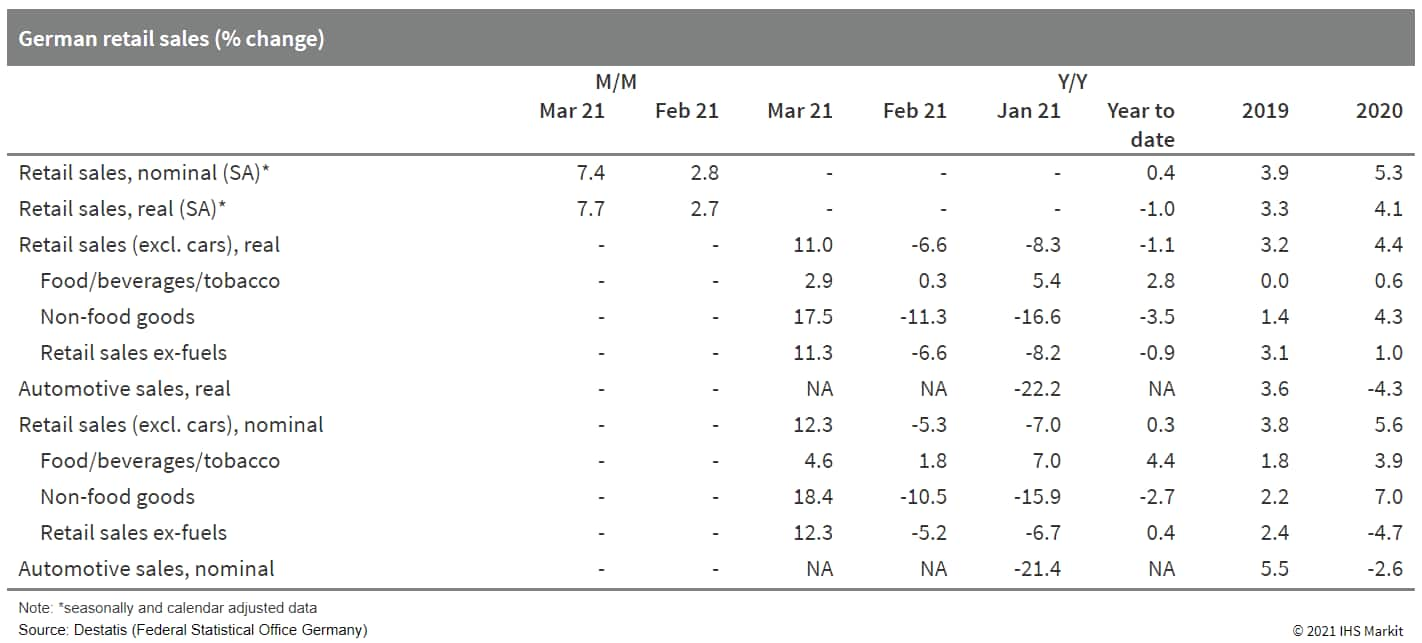

- According to Federal Statistical Office (FSO) data, real retail sales excluding cars rebounded by 7.7% month on month (m/m, seasonally and calendar adjusted) in March. Combined with February's 2.8% monthly increase, much (but not all) of the cumulative December-January plunge by 12.7% thus has been recouped lately. Furthermore, owing to the base effect of the shutdown in mid-March 2020, the real adjusted year-on-year (y/y) rate has recovered from February's -3.0% to 5.4% in March. As the unadjusted counterpart additionally benefited from an Easter-related calendar effect, it rebounded even more sharply from -6.6% to 11.0%. (IHS Markit Economist Timo Klein)

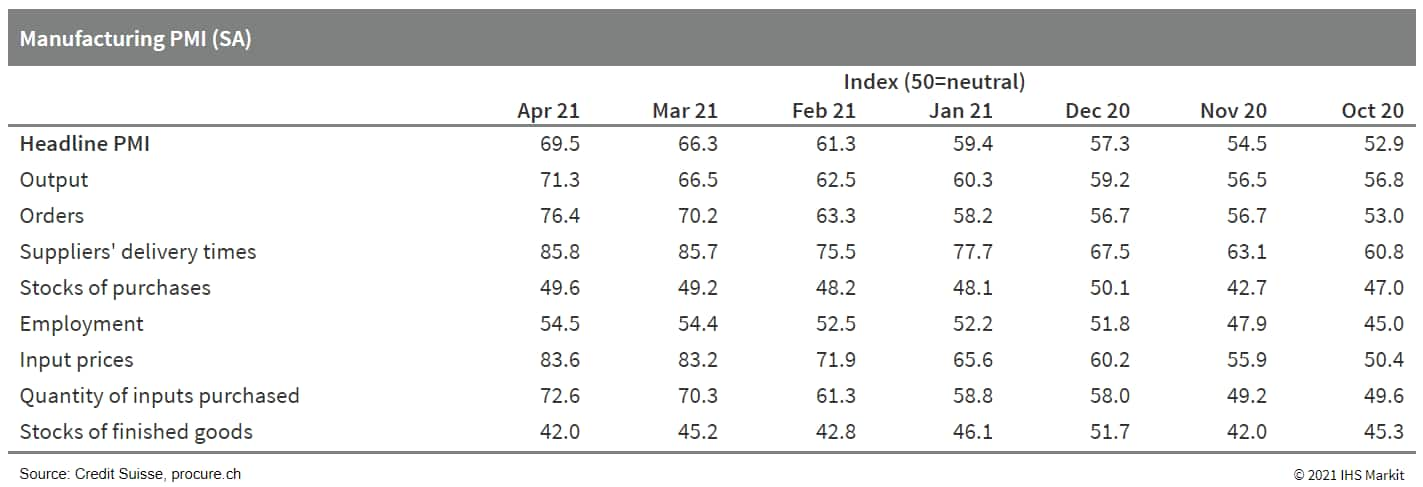

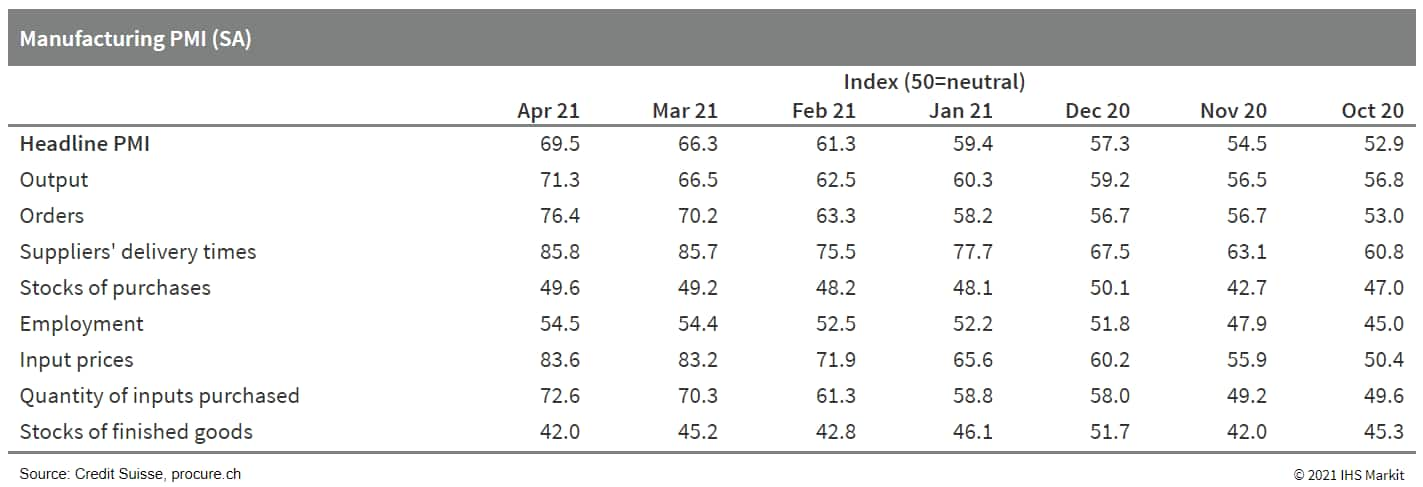

- In April, the Swiss purchasing managers' index (PMI) for the manufacturing sector (seasonally adjusted) - compiled by the Association for Procurement and Supply Management procure.ch and published by Credit Suisse - improved to a new all-time high of 69.5, which is more than three points above its previous series peak. This compares with a long-term average of 53.8. (IHS Markit Economist Timo Klein)

- Even the PMI counterpart for the services sector increased anew from 55.5 in March to 57.6 in April, having fluctuated for a long time (June 2020 to February 2021) close to the level of 50 that separates contraction from expansion territory. The driving factors for the latest improvement were business (up 6.0 to 62.9) and employment (up 3.8 to 50.0), but new orders (up 1.5 to 61.8) were also supportive.

- With respect to manufacturing PMI, orders and current output were the driving factors for April's further increase, but it should be noted that supplier delivery times remained steady at an all-time high.

- A resilient European production sector fueled Turkish export growth in the first quarter. Shipments to the EU jumped by 18.2% y/y in January-March 2021, buoying the country's headline exports by 17.2% y/y. While the export of gold did boost the overall shipment growth, even without the gold trade, exports would have grown by a robust, 15.8% y/y in the first quarter of 2021. (IHS Markit Economist Andrew Birch)

- Meanwhile, the tightening of monetary policy in the first two months of the year, combined with renewed lockdown measures to battle against another surge of COVID-19 infections, kept import growth more moderate. Import expansion was still strong overall, however, at just under 10% y/y in the first quarter. A nearly 23% y/y surge in capital good imports boosted the overall import bill.

- With exports growing faster than imports in the first quarter, the merchandise-trade deficit narrowed, by over USD2 billion y/y, to USD11.0 billion.

- The Danish government has announced a new sustainability target to reduce their farmers' greenhouse gas emissions by 7.1 million tons over the next decade. On 28 April, the country's agriculture ministry released its new sustainability strategy which outlined several actions to reach the 2030 greenhouse gas reduction goal. The government expects to reduce 1.6 million tons of CO2 (equivalent) through better soil and slurry management while a further 0.5 million tons of emission cutes are to be delivered through existing sustainable farming practices. There is also a focus on several new technologies, such as pyrolysis and grass biorefining, which are hoped to deliver most of the biggest decrease of 5 million tons of CO2. (IHS Markit Food and Agricultural Policy's Steve Gillman)

- The head of the Association of Turkish Travel Agencies (TURSAB), Firuz Baglikaya, was quoted by local news outlets on 30 April as stating that tourism-sector borrowers are having difficulty renegotiating troubled loans with banks amid an ongoing slump in tourism arrivals and revenue. Noting the higher cost of securing new financing following the policy rate hikes under former Turkish central bank governor Naci Ağbal and a lack of access to Credit Guarantee Fund loans, Baglikaya accused banks of "not picking up their phones" and requested help for the industry from President Recep Tayyip Erdoğan, Ahval News reports. In the first quarter of 2021, tourism revenue fell by 40% year on year (y/y) to USD2.45 billion, with visitor numbers dropping by 54% y/y to 2.6 million. (IHS Markit Banking Risk's Alyssa Grzelak)

- Loans to tourism-sector borrowers were up by 41% y/y at the end of 2020, but account for just 3.7% of total lending. Non-performing loans (NPLs) on this component of banks' loan books were slightly higher than the overall NPL ratio of 4.1%, at 5.4% as of the end of 2020. One subcomponent of the tourism-sector loan book reported NPL ratios above 11%.

- The NPL ratio on tourism-sector loans declined last year from a peak of 8.6% at the end of 2019, an improvement that IHS Markit largely attributes to forbearance and restructuring given the clear economic strain the sector is under.

Asia-Pacific

- APAC equity markets closed mixed; Australia flat, India -0.1%, South Korea -0.7%, and Hong Kong -1.3%.

- Chinese tech company Huawei is in discussion to acquire the electric vehicle (EV) unit of a small domestic automaker, according to ET Auto citing two unnamed people with direct knowledge of the matter. According to the sources, Huawei is in talks with Chongqing Sokon to acquire a controlling stake in the latter's Chongqing Jinkang New Energy Automobile. Jinkang counts the EV brand Seres, formerly known as SF Motors, as its main asset. Seres is a new brand for China, and made an effort at the US market that has not come to fruition. As part of the deal, Huawei also plans to buy an undetermined stake in privately-owned Chongqing Sokon Holdings, the biggest shareholder of Shanghai-listed Sokon. The unnamed sources also indicated that Huawei is also looking to take a controlling stake in EV brand ArcFox of BAIC's BluePark New Energy Technology, however, BAIC wants Huawei as just a minority stake holder in Arcfox. (IHS Markit AutoIntelligence Stephanie Brinley and Nitin Budhiraja)

- Chinese automaker SAIC Motor Corporation (SAIC) has reported net profit attributable to equity holders of the company at CNY6.847 billion (USD1.06 billion) during the first quarter of 2021, compared to CNY1.120 billion in the same period last year, according to a company filing with the Shanghai Stock Exchange. Total operating income during the period stood at CNY189.09 billion, up 82.13% y/y. During the period, SAIC's financial expenses were reduced from CNY701.7 million in the first quarter of 2020 to CNY5.687 million in the first quarter of 2021 owing to the decrease in foreign exchange losses y/y, while research and development (R&D) expenditure stood at CNY3.417 billion, up 10.5% year on year (y/y). (IHS Markit AutoIntelligence's Nitin Budhiraja)

- JCB India, an earthmoving and construction equipment manufacturer, announced a 10-day stop of production across all its manufacturing facilities in India from 1 May, reports The Indian Express. JCB joins manufacturers like Maruti Suzuki, MG, and Toyota which had already announced their plant stoppage plans in April due to the surge of COVID-19 cases. In April, Maruti Suzuki announced plans to shut production operations at its manufacturing plants in Haryana and Gujarat from 1 to 9 May (by bringing forward its maintenance schedule) as well as to attempt to let its large vendor base divert oxygen for medical requirements amid the second wave of COVID-19 infections in the country. (IHS Markit AutoIntelligence's Tarun Thakur)

- Gojek has announced a target of 2030 for 100% of its ride-hailing fleet to be zero-emission vehicles, according to a company statement. To support drivers switching to electric vehicles (EVs), Gojek will form partnerships with manufacturers and explore favorable leasing arrangements. The company laid out a pledge to achieve "Three Zeros: Zero Emissions, Zero Waste and Zero Barriers" by 2030 in its first annual sustainability report. The plans will involve Gojek investing in a series of EV pilot programs across Southeast Asia, as well as launching a "world-first" in-app carbon offsetting feature. The announcement follows Gojek finalizing a proposed merger with Indonesia's e-commerce giant Tokopedia that would result in a new entity called GoTo. The combined entity will create a powerhouse dominating the Indonesian market, one of the world's fastest-growing internet economies. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Posted 03 May 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.