S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Sep, 2025

By Nick Lazzaro

US Trade Representative Jamieson Greer and US Treasury Secretary Scott Bessent hold a news conference in Geneva on May 12, 2025. The US revoked a tariff waiver for low-value imports from China in May before expanding the policy in August to imports from all other countries. Source: Fabrice Coffrini /AFP via Getty Images. |

Businesses selling imported retail products in the US are reconfiguring their shipping strategies following the end of a longstanding tariff exemption for individual packages of low-value imports.

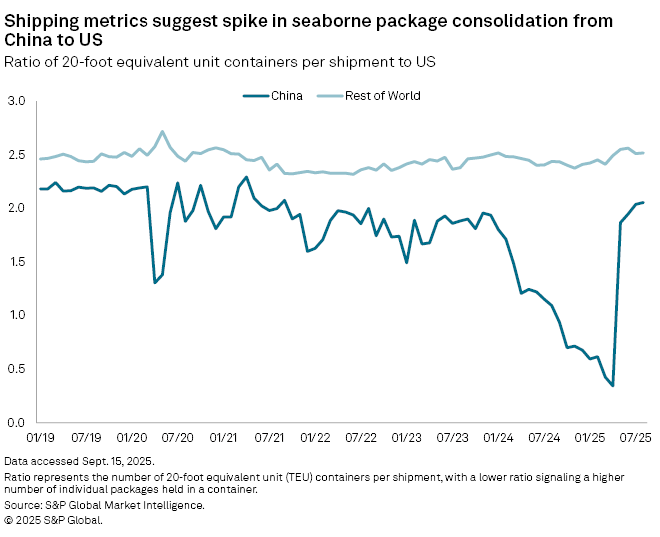

The US first revoked the exemption for imports from China in May before cancelling the tariff carve-out for the rest of the world at the end of August. S&P Global Market Intelligence data shows that the number of twenty-foot equivalent unit (TEU) containers per shipment from China to the US increased to 2.04 in July, a near four-year high, from 0.34 in April. The shipment data indicates that many businesses pivoted away from individual packages in favor of bulk shipments over the summer, according to Eric Oak, senior supply chain analyst at Market Intelligence.

"Imagine a container filled with individual packages like one would order from an e-commerce site, all individually addressed — each package is a 'shipment' but many fit in a container, meaning the average TEU per shipment falls," Oak said in an email. "After the de minimis exemption was removed, we saw seaborne imports move back [up] ... suggesting more business-to-business transactions."

Rethinking just-in-time inventory

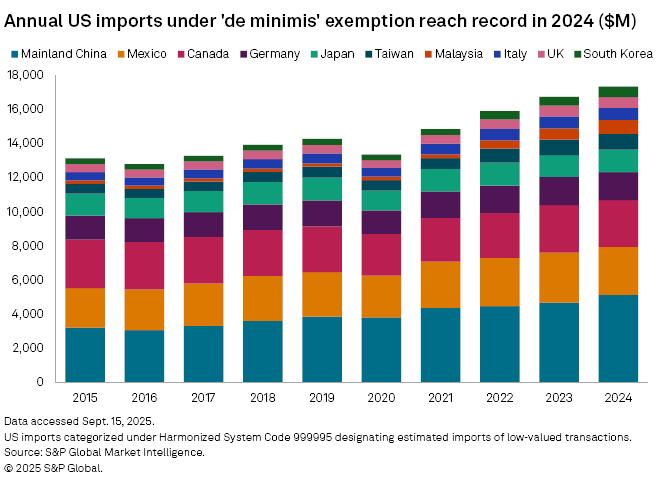

The US had allowed the tariff waiver for imports under a designated value, known as the de minimis exemption, for decades. The value threshold was raised to $800 from $200 in 2016, a hike that encouraged businesses to ship low-value products duty-free as individual packages on an order-to-order basis. Small business and e-commerce activity to surged over the last decade with the higher de minimis threshold.

Low-value import packages were often shipped via air freight directly to customers with a minimal customs inspection process. E-commerce businesses leveraged these benefits to gain market share by offering fast order fulfillment at low costs. With the removal of the de minimis waiver, however, the cost structure of this sales model has changed.

"In the world of fast fulfillment, not being able to ship those small quantities takes away a whole segment of the business," said Paul Baris, principal for the North America division at supply chain and procurement consultancy Efficio, in an interview. "There's going to be a lot of very small business owners that all of a sudden, they've lost their businesses."

Air freight delivery to the US from China slowed over the summer alongside the change in seaborne shipment patterns, as noted in recent earnings calls by international air freight shippers FedEx Corp. and United Parcel Service Inc.

"From a year-over-year perspective, we will have pressure in the transpacific lane, and when we talked about the headwind on tariffs, the vast majority of that is impact from China to the US, and within that, the vast majority is the impact of de minimis," FedEx Executive Vice President and Chief Customer Officer Brie Carere said during an earnings call in June.

In a July earnings call, UPS CEO and Director Carol Tome said the elimination of the de minimis exemption resulted in a 34.8% year-over-year drop in the shipper's average daily volume between China and the US during May and June.

"Businesses can no longer rely on the relatively light-touch documentation for the smaller packages, so they'll have moved those into bulk shipments and stocked up where they could," Martin Balaam, CEO and co-founder of product information management platform Pimberly, said in an interview.

Bonded warehouses in the US provide one option where importers can store bulk shipments to maintain just-in-time inventories on which duties are delayed and paid only when products are withdrawn for sale, Balaam said.

Small businesses, consumers impacted most

The removal of the de minimis exemption is likely to have an outsize impact on smaller export-reliant businesses and US consumers.

"For smaller exporters who have invested heavily in the US market and don't want to lose it, but don't have sufficient volumes to shift their business model, they can continue shipping small packages and either eat the additional costs, pass them to the consumer, or, more likely, a combination of both," John Lash, group vice president of product strategy at supply chain platform e2open, said in an inerview.

Price increases would add pressure to inflation-weary consumers. Inflation, as measured by the consumer price index, remained elevated in August with a 2.9% gain year over year, according to government data released Sept. 11.

"Higher import costs on favorite goods are one more blow to an already fragile consumer confidence," Lash said. "While ending de minimis is unlikely to be the tipping point, it's a step closer to a larger and far more significant indirect economic effect from curtailed spending."

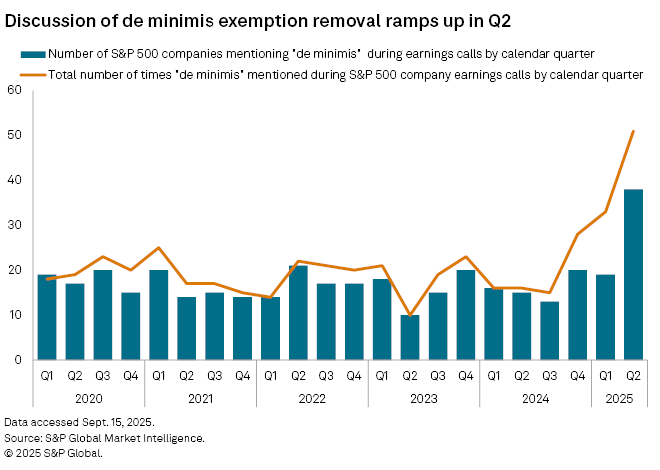

The removal of the de minimis exemption has also gained attention from large companies. During earnings calls held in the second quarter, the term "de minimis" was mentioned 51 times by 38 S&P 500 companies, up from 16 mentions by 15 companies during the same quarter in 2024, according to Market Intelligence data.

Many companies such as apparel retailer Lululemon Athletica Inc. noted that they were able to employ mitigation strategies to offset the impact of new US trade policies.

"We are navigating increased costs related to tariffs and the removal of the de minimis exemption," Lululemon Athletica CFO Meghan Frank said in an earnings call Sept. 4. "We are taking actions in both the near term and long term to mitigate the increased tariff costs, including strategic pricing actions, supply chain initiatives, including vendor negotiations and enterprise-wide expense savings initiatives."

Notably, smaller businesses may not be able to implement such strategies as effectively.

"Unlike large businesses, smaller organizations often lack the resources to manage more complex customs filing processes and are more apt to abandon the market altogether," e2open's Lash said. "As many of these goods are boutique items, this action could reduce consumer choice and further erode sentiment by losing access to a cherished product."