S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Aug, 2025

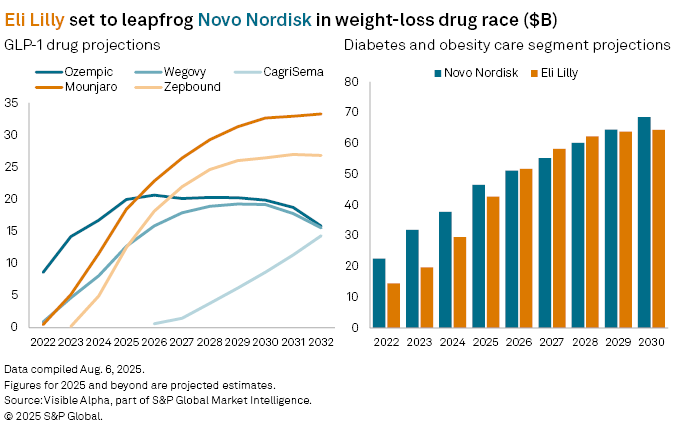

Eli Lilly and Co. (NYSE: LLY) is expected to overtake Novo Nordisk A/S (NYSE: NVO) in the fast-expanding GLP-1 drug market in 2025, as booming demand for its dual-action therapies, Mounjaro and Zepbound, reshapes the landscape of diabetes and obesity treatment, according to Visible Alpha consensus estimates.

While the Danish drugmaker pioneered the sector with blockbusters Ozempic and Wegovy, it now finds itself on the defensive. Novo has cut its 2025 guidance twice, citing slower-than-expected uptake of GLP-1 drugs. Supply bottlenecks for Wegovy, a rise in the use of compounded semaglutide amid ongoing shortages, and intensifying competition have weighed on sales expectations. Meanwhile, patients are increasingly switching from Ozempic to rival therapies.

Novo Nordisk shares have dropped 50% year-to-date as investor concerns mount over pricing pressure, moderating growth, and a weakening innovation pipeline. Disappointing trial data in March for its next-generation obesity drug, CagriSema, have further dented confidence.

Analysts forecast Ozempic sales to rise just +7% in 2025 to $20 billion, down sharply from +26% growth last year, and slow further to +3% in 2026. Wegovy sales are expected to increase +40% to $13 billion in 2025, with growth easing to +25% in 2026. Novo’s diabetes and obesity portfolio — which accounts for the bulk of its business — is projected to grow +10% in 2025 to $46.5 billion, compared to a +26% growth last year.

By contrast, Eli Lilly’s star is rising. Mounjaro sales are forecast to surge +60% year-over-year to $18.4 billion in 2025, reaching $22.8 billion by 2026. Zepbound, its weight-loss treatment, is expected to more than double sales from $4.9 billion in 2024 to $12.5 billion in 2025, and grow further to $18.1 billion in 2026.

– Learn about Visible Alpha | S&P Global.

– Explore Visible Alpha Add-On for CapIQ Pro.

– Learn about Visible Alpha BioPharma.

– Access Visible Alpha estimates on Eli Lilly and Novo Nordisk.