Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Jul, 2025

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

When consultancy Bain & Co. Inc. dug into private equity's multitrillion-dollar pile of dry powder a year ago, it excavated an uncomfortable truth for the industry: an estimated 24% of the capital was committed by investors at least four years earlier but has yet to be called.

Private equity fund managers cannot produce returns for investors without putting that money to work. Four years into the typical 10-year life span of a private equity fund, you would expect to see much of the dry powder deployed into buyouts and other investments.

Signs of a dealmaking turnaround emerged in 2024 when private equity-backed deal value increased globally, reversing two years of declines. Private equity fundraising, meanwhile, extended its skid into a third year. Those factors combined to chip away at the mountain of dry powder, which stood at $2.52 trillion as of June 30, down 7.7% from a record $2.73 trillion in 2023, according to S&P Global Market Intelligence data.

Private equity fund managers are still under pressure to strike deals and deliver for investors. But a macroeconomic outlook unsteadied by wars and US tariff policy has dashed expectations that dealmaking would return full force in 2025, and some are now pinning their hopes for 2026.

Read more about the decline in global private equity dry powder.

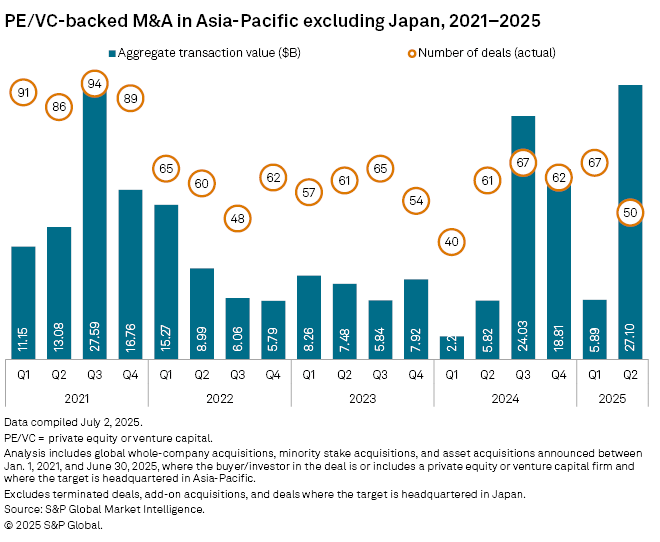

CHART OF THE WEEK: Increasing deal value in Asia-Pacific sans Japan

⮞ Investment by global private equity and venture capital firms in Asia-Pacific, excluding Japan, totaled $32.99 billion in the first half of 2025, more than four times the $8.10 billion total recorded during the same six-month period a year ago, according to Market Intelligence data.

⮞ Deal value in the second quarter alone totaled $27.10 billion, the highest quarterly total since the third quarter of 2021.

⮞ Private equity's share of overall deal value in the region was 24% in the second quarter, also the highest since the third quarter of 2021.

TOP DEALS

– Apollo Global Management Inc. completed the acquisition of the gaming and digital business of International Game Technology — which has begun trading on the NYSE under the Brightstar Lottery PLC business name — and the purchase of gaming operator Everi Holdings Inc. The all-cash transactions were valued at about $6.3 billion.

– KKR & Co. Inc. agreed to sell a controlling stake in India-based JB Chemicals & Pharmaceuticals Ltd. to Torrent Pharmaceuticals Ltd. in a deal with an equity valuation of 256.89 billion rupees.

– Bain Capital LP partnered with Warner Music Group Corp. to buy up to $1.2 billion of music catalogs.

TOP FUNDRAISING

– Recognize Partners LP raised $1.7 billion for Recognize Partners Fund II/II-A LP, its second fund, at final close. The fund will invest in digital service companies with an enterprise value between $50 million and $500 million.

– Shore Capital Partners LLC raised over $450 million at the close of Shore Capital Food & Beverage Partners Fund III. The fund will invest in lower-middle-market companies in the food and beverage sector.

– Catalio Capital Management LP secured more than $400 million in commitments for its fourth venture fund and related coinvestment vehicles. Catalio Nexus Fund IV LP aims to invest in biomedical technology companies.

– Tokyo-based venture capital firm AN Venture Partners secured $200 million at the final close of its AN Venture Partners I LP vehicle. The fund invests in biotechnology companies primarily in Japan.

MIDDLE-MARKET HIGHLIGHTS

– Northlane Capital Partners LLC sold healthcare benefit company The Difference Card in a deal with buyer Stone Point Capital LLC.

– Mill Point Capital LLC acquired location monitoring company SS8 Networks Inc. Union Square Advisors LLC was SS8's financial adviser on the deal, while Latham & Watkins was its legal counsel. Morrison Foerster was legal adviser to Mill Point.

– Truelink Capital Management LLC purchased Zep Inc., a cleaning products company. The seller was New Mountain Capital LLC.

FOCUS ON: KKR's INVESTMENTS IN AUSTRALIA

KKR & Co. Inc., through KKR Asia-Pacific Infrastructure Investors II SCSp, agreed to buy poultry supply chain company ProTen Ltd. from Aware Super Pty. Ltd.

The deal highlights KKR's growing interest in Australia. The private equity firm's total investments in the country stood at $6.48 billion, according to Market Intelligence data. This figure accounts for about 20% of KKR's total investment in Asia-Pacific, which exceeds $32 billion.

Of the 191 current direct investments by KKR in Asia-Pacific, 17 are in Australia.

KKR's recent transactions in the country include the planned acquisition of employment software company Employment Hero Pty. Ltd. and the pending purchase of a roughly 74.3% stake in airport operator Queensland Airports Ltd., alongside Skip Capital Pty. Ltd.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter