Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Feb, 2022

|

Federal Reserve Board chairperson Jerome Powell is expected to announce multiple rate hikes throughout 2022 to tackle runaway inflation. |

Corporate borrowing costs are rising ahead of the Federal Reserve's highly anticipated interest rate hikes, a potential sign of pain for companies looking to raise cash in 2022. Healthy corporate balance sheets and projected earnings growth, however, will minimize any credit risk to companies from more expensive debt.

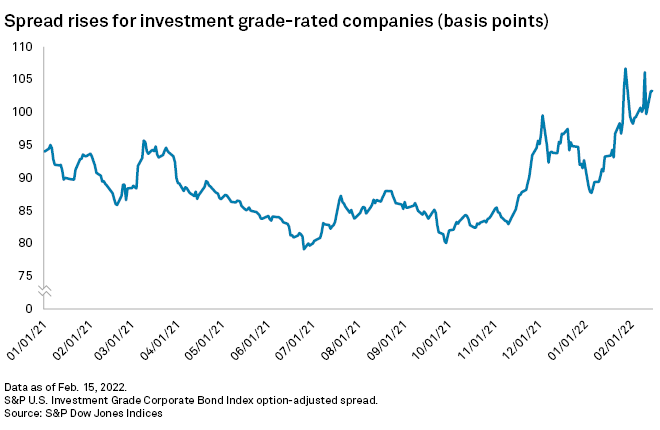

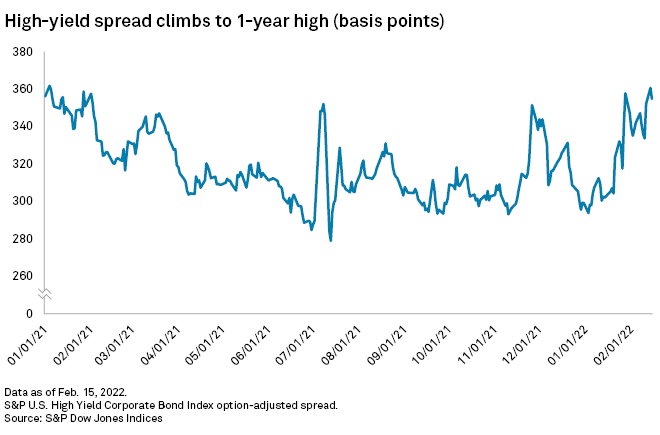

Corporate bond spreads — the premium investors earn for buying corporate debt instead of government bonds — have widened amid a broader rise in yields. Bond yields rise as prices fall, meaning companies get less bang for their buck when they issue debt. This effectively increases borrowing costs, making it more expensive to refinance or raise capital to invest in M&A or capital expenditure.

Demand for risk assets has weakened as the Federal Reserve looks to tighten pandemic-era monetary policy by raising interest rates and reducing the size of its $9 trillion balance sheet, removing a lynchpin of demand for government bonds that has forced private investors into other assets such as corporate bonds and stocks.

The S&P U.S. Investment Grade Corporate Bond Index option-adjusted spread has widened to 112 basis points as of Feb. 22, up from 93 bps at the start of the year and the highest level since November 2020. The lower-rated high-yield bond spread has widened to a one-year high, reaching 368 bps on Feb. 18, up from 299 bps at the start of the year. The high-yield spread settled at 365 bps on Feb. 22.

The moves have the potential to spell trouble for companies that racked up debt during the pandemic, especially those in the riskier high-yield category, where spreads have climbed even higher. Still, U.S. companies largely carry healthy balance sheets and forecasts for further growth in earnings have reduced investors' worries.

"We see fundamentals as still quite strong," Greg Staples, head of fixed income in North America at DWS, said in an email. "Corporations have bolstered cash holdings and extended maturities. We do not see a material pick-up in downgrades, let alone bankruptcies."

Institutions will step in with demand

The Fed suppressed corporate bond yields to historically low levels during the pandemic as it pumped liquidity into markets to ensure companies had access to finance. The Fed bought trillions of dollars of government bonds and mortgage-backed securities through that quantitative easing program, crowding out investors into riskier assets such as corporate bonds, and reducing yields as the prices of the bonds rose.

With the Fed tapering its bond-buying and officials planning to begin selling off some of the assets on the central bank's $9 trillion balance sheet, a major source of demand for bonds is exiting the fray.

"There's going to be less demand [for corporate bonds], not no demand," Hjort said. "There will still be decent demand from pension funds who have very high funding ratios and a strong incentive to reallocate into fixed income, and from life insurance funds for whom the higher long-end yields allow them to reach their yield targets."

Asset managers will likely scale back their purchases of corporate bonds in line with the reduction of the Fed's balance sheet, but others will be incentivized to step in as prices fall. Meanwhile, institutional investors — who are less price-sensitive and need to hold high-quality government and corporate bonds for regulatory reasons — will be attracted to cheaper bonds.

"The more aggressive market pricing for rate rises gets, the more excited we get about the potential opportunity," Nick Hayes, manager of AXA Investment Managers Global Strategic Bond strategy, said in an email.

Improved fundamentals

While spreads have risen, they remain at historically low levels. That will likely keep companies in the bond market, even if demand drops, to fund M&A and share buybacks as they did in 2021 at record levels.

Just 13% of U.S. corporations have negative outlooks or are at risk of downgrades, according to S&P Global Ratings. That is the lowest number at the start of any year since 2015 and just two percentage points above the all-time low.

"They're going to face higher funding costs but not enough so that it changes fundamental metrics any time this year, and I don't think it changes their outlook for spending," Hjort said.

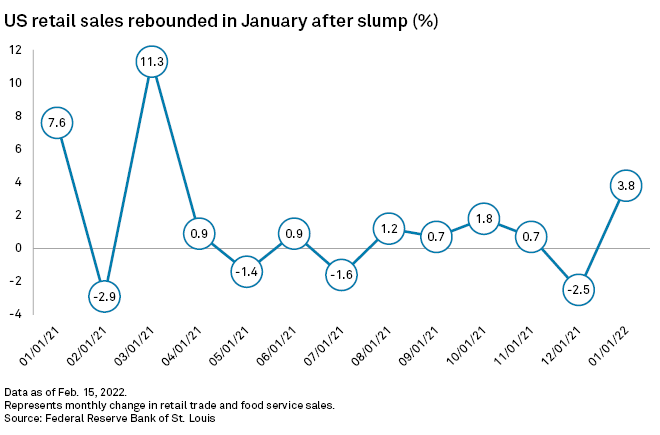

Robust earnings growth buoyed companies in 2021 as the economy rebounded. Recent data has been patchy, with U.S. retail sales slumping 2.5% in December before growing by 3.8% in January and the University of Michigan Consumer Sentiment index falling to a 10-year low in February.

Some believe the Fed will exhibit a lot of flexibility in the way it tightens policy to ensure borrowing costs do not rise too sharply.

"We think [there is] an expectation that central banks' corporate bond programs might be re-implemented if the economic situation were to worsen sharply," Nicholas Farr, assistant economist at Capital Economics, said in an email, noting such a move "should keep spreads from rising much further."