Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Nov, 2022

By Hassan Javed

U.S. states employ a variety of rate regulation mechanisms, including prior approval, modified prior approval, file and use, and use and file. Some states do not require explicit regulatory approval prior to insurers using new rates. This analysis is based on when rate filings are "disposed" by state regulators and does not take into account when those new rates became effective for new and renewal business. In some instances, a new rate may have been in effect prior to the month the regulator approved the filing.

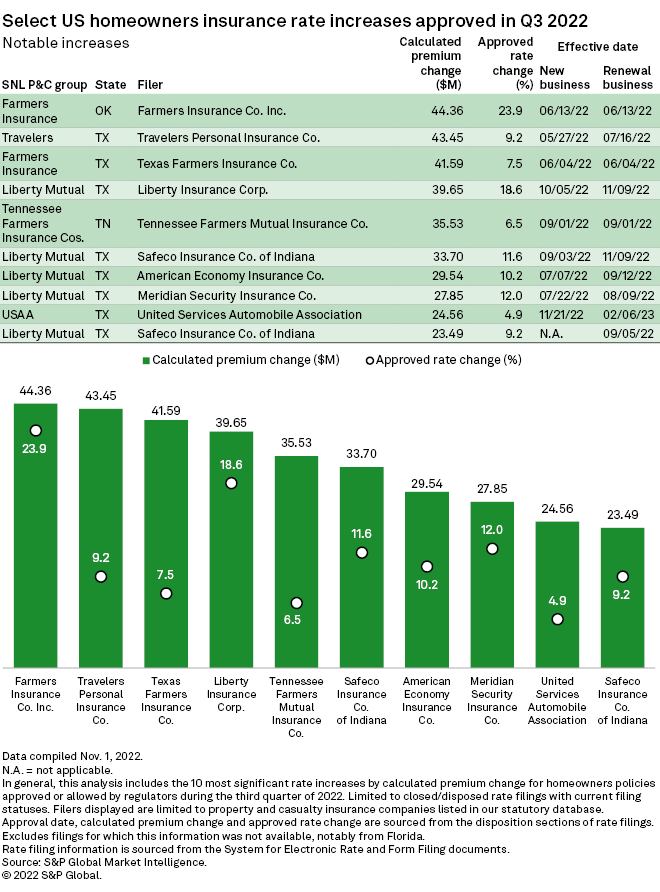

Homeowners insurance rates in Texas continued to increase in the third quarter, according to an S&P Global Market Intelligence analysis.

Regulators in the Lone Star State approved 53 rate hikes during the quarter, which are expected to increase overall premiums by $455.5 million.

Liberty Mutual, Farmers increase rates

Liberty Mutual Holding Co. Inc. received approval for 122 rate hikes across the U.S., which are expected to increase the group's cumulative premiums by $411.0 million, the largest increase of any group. About 45%, or $186 million, of this overall change can be attributed to 13 rate increases approved by the regulators of Texas.

Farmers Insurance Group of Cos. is expected to see the second-largest increase in its overall premiums from rate hikes in the homeowners insurance sector. Subsidiaries of the group received approval for 95 rate hikes during the quarter, which are expected to increase overall premiums by $300.0 million. The group managed to acquire three approvals in Texas that could increase the overall premiums by $57.6 million.

|

* Learn more about the Hurricane Ian catastrophe losses * Read more about the homeowners rate hikes in H1. |

State Farm tops rate decrease chart

On the other end of the spectrum, State Farm Mutual Automobile Insurance Co. saw the most rate decreases during the quarter. The group received approval for 11 rate cuts, which are expected to decrease overall premiums by $15.8 million, the most of any group.

The most impactful rate decrease was approved in Mississippi. The 1.9% decrease is expected to cut overall premiums by $4.9 million and affect nearly 178,000 policyholders.