Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global Platts — 29 Apr, 2020

As China’s energy imports rise, so energy security climbs up the political agenda.

In 2014 Xi Jinping, General Secretary of the Communist Party of China, outlined a long-term energy strategy that included strengthening the domestic and overseas supply of oil and gas.

More recently, external pressures, notably a more bellicose United States, China’s key strategic competitor, have only heightened China’s vulnerability as energy imports continue to climb.

It is against this backdrop that in July 2018, Xi Jinping called on China’s major oil and gas companies to take measures to boost domestic output and improve national energy security. They duly complied.

Sinopec’s E&P spend increased 46% in 2019 over the previous year. The major’s efforts had little impact on production at China’s aging oil fields, which are structurally in decline. But natural gas production grew by a record 16 Bcm, reaching 176 Bcm last year. Shale and tight gas accounted for just over 30% of the total.

Shale gas revolutionized US natural gas production. With China having even larger shale gas resources than the US according to some estimates, the question is whether shale gas holds the key to securing China’s energy security.

China is no stranger to tight gas, which is has been producing since the 1990s. Like shale gas, tight gas uses horizontal drilling and fracking to release gas from reservoirs inaccessible using conventional techniques.

Most is found in the Ordos Basin, in north central China, which accounts for over 80% of China’s proven tight gas resources according to a paper published by researchers at the PetroChina Research Institute of Petroleum Exploration & Development.

Tight gas from Ordos began to seriously start flowing in the mid-2000s with the development of CNPC’s Sulige field, now the largest gas field in China. But large-scale development faces challenges. Production from individual wells is low, which means drilling thousands of wells, and heavy investment in surface gathering pipelines and infrastructure.

By 2018 CNOC had drilled 10,000 wells at Sulige. Further drilling in 2019 raised Sulige output to an all-time high of 25.45 Bcm. But despite the increase in wells, improvements in horizontal drilling and other technologies to improve well flow rates, production at Sulige in 2019 was still only up 4 Bcm on 2014.

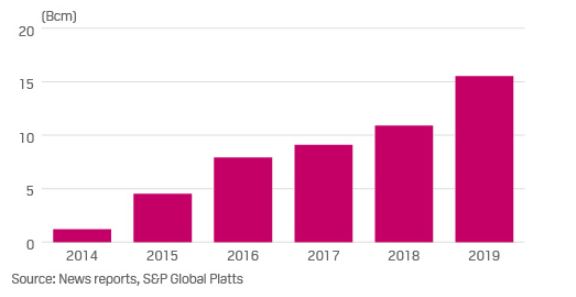

Shale gas output, on the other hand, grew by 14.3 bcm over the same period, with output reaching 15.5 bcm in 2019. Virtually all of this came from the Sichuan basin in Southwest China, which holds around 80% of China’s technically recoverable shale gas resources.

Output has been rising as Sinopec and CNPC’s own oilfield service companies gain more experience drilling and extracting gas from the complex geology of the mountainous Sichuan Basin.

Recent growth in output has been supported by a number of policy changes. In 2018 the government cut the resource tax for shale gas by 30%.

In June last year the government also changed the subsidy regime for unconventional gas from one where producers received a fixed subsidy per cubic meter of shale and coal bed methane gas produced, to one where funding is dependent on the amount a producer can grow unconventional output over the previous year.

The policy, which runs from 2019-2023, also rewards producers who increase production over the winter, when gas demand rises. And it includes tight gas, which was excluded from the previous regime.

PetroChina’s tight gas output rose 15% in the first half of 2019, with shale gas production nearly doubling last year to just over 8 bcm, up from 4.26 bcm in 2018. This was helped by the policy tweak, which PetroChina said would deliver an expected Yuan 4 billion ($580 million) in subsidies in 2019, up from Yuan 1.5 billion in 2018.

International oil companies have been involved in tight gas projects for over a decade, with both Shell and Total successfully partnering with CNPC through production sharing contracts in the Ordos basin. But they have had less success with shale.

Despite companies including ExxonMobil, Shell, and BP evaluating and drilling for shale gas none of their efforts led to viable commercial production.

In an effort to encourage investment into exploration and production, starting this year foreign and private companies have been allowed to explore and develop oil and gas resources without having to partner with one of the national oil companies.

But until there is greater sharing of geological data, more transparency around the competitive bidding and transfer of exploration rights, and laws to ensure equal treatment of private and foreign companies, there’s likely to be very little real competition for the state owned oil majors in the upstream sector.

Shale economics are improving. In 2015 Sinopec said that the cost per well at its Fuling field had fallen from Yuan 100 million to Yuan 80 million ($13 million). Three years later CNPC claimed that the costs per well at their blocks in Sichuan were as low as Yuan 50 million.

Despite this, costs are still high compared to the US. In 2016 researchers at the PetroChina Research Institute of Exploration and Development said that like-for-like exploration and development costs of shale gas in China were two to three times those in the US.

Much of China’s shale reserves and resources are locked away more than 3500 m underground, deep in the Sichuan basin.

The potential to significantly expand Chinese shale output depends on being able to economically extract gas from this deep shale. The success last year of Sinopec in achieving high flow rates from an exploration well over 4200 m deep in the Sichuan basin is encouraging, but drilling deeper means more time and cost.

Breakthroughs to reduce well development costs and boost production from fracked wells will be required for this gas to be commercially viable.

Despite the recent collapse in oil and gas prices, both CNPC and Sinopec have stated they intend to grow natural gas production in 2020.

Between them they are targeting shale gas output of 22 bcm in 2020. This may well be achievable, but it will still be well below the target of 30 bcm for this year in the government’s Shale Gas Development Plan (2016-2020).

Further out, questions remain around whether the economics are favorable enough to sustain large-scale development of unconventional resources.

The Shale Gas Development Plan is targeting 80- 100 bcm by 2030. Few think China can achieve this, but it might come close. Last year the CNPC Research Institute published its Energy Outlook, forecasting Chinese gas output to grow to around 280 bcm by 2030.

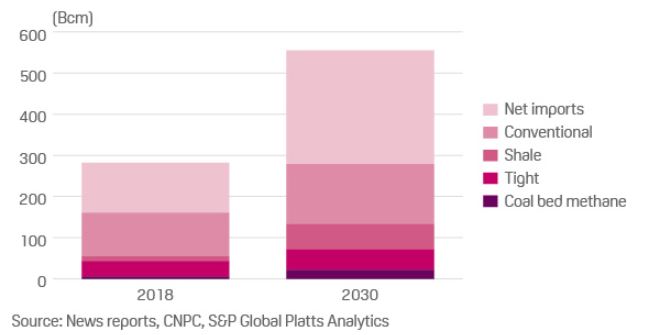

But without a change in the structure and trajectory of China’s energy consumption, gas demand is likely to rise faster than production. The S&P Global Platts Analytics World Energy Demand Model base case is that Chinese gas demand will rise to 555 bcm by 2030. This would see China’s import dependency – net imports as a percentage of consumption – rising from 43% in 2018 to 50% by 2030.

Even if (and it’s a big if) shale gas production can reach 100 bcm by 2030, unless China can find alternative fuels to natural gas, shale production looks unlikely to halt the trend of ever rising imports.