Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 6 Oct, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The 800-year old Cambridge University announced on Oct. 1, after five years of pressure from students and academics, that will divest its £3.5 billion ($4.45 billion) endowment from fossil fuel investments by 2030 and make “significant” investments in renewable energy in the next five years. A dozen major metropolises around the world accounting for more than 26 million residents, including Cape Town, London, Milan, and New York, pledged on Sept. 22 to remove their cities’ assets from fossil fuel companies and reinvest them into climate solutions. The megabank Morgan Stanley said on Sept. 21 that it will align its lending portfolio with the climate goals of the Paris Agreement to achieve net-zero emissions status by 2050.

"It's always good to be on the winning side," C.B. Bhattacharya, a professor of sustainability and ethics at the University of Pittsburgh, said of Morgan Stanley's motivations in an S&P Global Market Intelligence interview. "Fossil fuels do not have a future. Even banks, which are perennially slow to adapt to these things, they have woken up and have realized that it's now or never."

By dramatically disrupting countries’ macroeconomics, behaviors, and policies, the coronavirus pandemic will lower global energy-sector carbon emissions by 27.5 gigatons in the three decades from this year through 2050—but more than 10 times those reductions would be needed to keep the climate from warming more than 2 degrees Celsius above industrial levels by that time, according to recent research by S&P Global’s Energy Transition Research Lab. In order to successfully decarbonize the interconnected global energy system, the research determined that “a mosaic of solutions beyond just renewables and fossil fuel demand destruction” is needed, and “recent announcements from policymakers, leading energy companies, and end users illustrate the many kinds of climate solutions.”

Investors managing approximately $15 trillion in assets have committed to divesting from fossil fuel companies as of this year, according to the nonprofit organization Fossil Free. However, divesting assets from fossil-fuel-generating companies, as the U.K. university and major cities presently plan to do, may highlight a principled, rather than practical approach, according to Mona Navqi, S&P Dow Jones Indices’ senior director and head of ESG product strategy for North America.

As many institutional investors divest from fossil fuels, “some [are] citing motives such as the avoidance of stranded-asset risk. Many banks and insurers have also committed to neither finance nor underwrite fossil fuel projects, inevitably slowing the industry’s expansion. However, divestment will not likely move a company’s stock price so long as there continue to be many investors who do not share the same moral virtues,” Ms. Naqvi said in an article last year. She advocated an engagement approach, in which investors “retain a seat at the table to influence company behavior, drive industry change, or advance a particular cause,” as having greater potential to yield benevolent results in the transition to a low-carbon economy.

That said, S&P Dow Jones Indices removed thermal-coal companies from the S&P 500 ESG Index, which aims to offer a sustainable version of the S&P 500 benchmark equities index with similar risk and returns, in response to market demand.

“When the S&P 500 ESG Index was launched in January 2019 as an accessible starting point for ESG investors around this world, it did so by excluding the types of business activities deemed unacceptable by the broadest possible majority of sustainability-minded investors,” Ms. Naqvi said in a Sept. 23 article. “The landscape has evolved to a point at which thermal coal companies may now be counted among this lowest common denominator of ‘unsustainable’ investments.”

Fossil-fuel companies may be unwilling to be engaged by their investors to adopt climate-friendly practices. As oil and energy companies, including BP and Royal Dutch Shell, make carbon-reduction commitments, the energy multinational Exxon Mobil has been planning production that will ramp its carbon dioxide output up 17% by 2025, to an additional 21 million metric tons per year, according to Bloomberg News.

Today is Tuesday, October 6, 2020, and here is today’s essential intelligence.

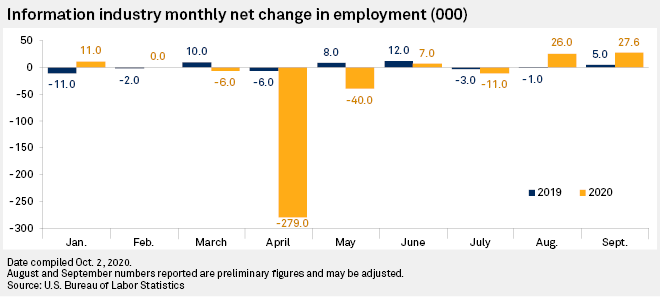

U.S. Information Industries Saw Job Gains Jump as Theaters Reopened in September

U.S. information industries in September recorded the largest job gains since the pandemic began hitting the country, driven largely by a rush of movie theaters reopening for the first major box office release in months. The sector's recovery could prove temporary, however, as studios continue to push back major film releases, and one of the top U.S. theater chains said Oct. 5 that it would soon close all of its domestic locations again due to the limited box office schedule this fall.

—Read the full article from S&P Global Market Intelligence

Macao's Recovery Odds Remain Dim as Casino Revenue Falls 90% in September

Revenue generated by Macao's casino industry plunged 90% year over year in September as the gradual resumption in tourism dampens hopes for a quick recovery. Macao's gross gaming revenue during the month fell to 2.21 billion patacas from 22.08 billion patacas in September 2019, according to the Gaming Inspection and Coordination Bureau. However, the figure represents a 66% increase from the 1.33 billion patacas generated in August.

—Read the full article from S&P Global Market Intelligence

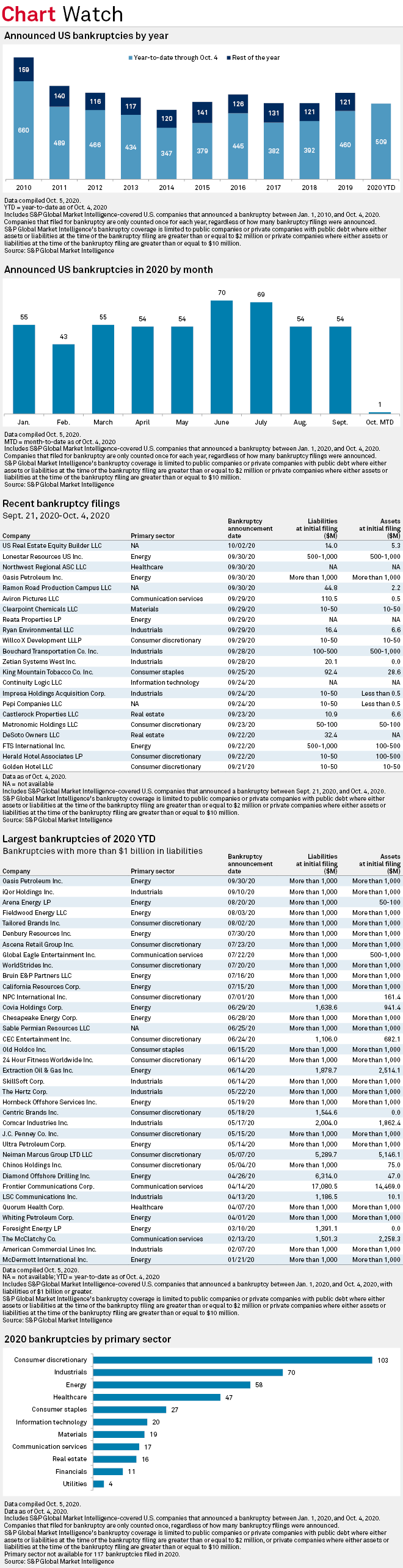

U.S. Bankruptcies Surpass 500 Mark as Coronavirus Takes Toll

Corporate bankruptcies in the U.S. continue to grow amid the coronavirus pandemic as 22 new companies added their names to a growing list of bankruptcies in 2020 in the last two weeks, an S&P Global Market Intelligence analysis shows. A total of 509 companies have gone bankrupt this year as of Oct. 4, exceeding the number of filings during any comparable period since 2010.

—Read the full article from S&P Global Market Intelligence

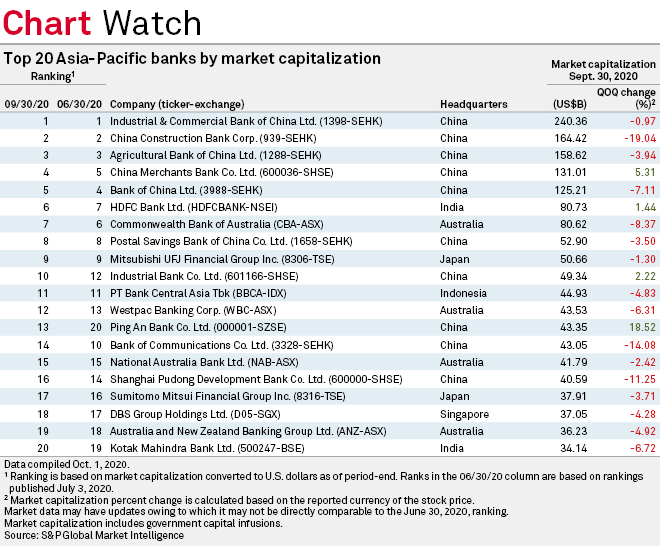

Major Asia-Pacific Banks See Market Cap Declines in Q3 as COVID-19 Woes Continue

Sixteen of the 20 largest Asia-Pacific banks saw declines in their market capitalization in the three months ended Sept. 30, according to S&P Global Market Intelligence data, as uncertainties created by the COVID-19 pandemic continued to drag on investor sentiment in the region.

—Read the full article from S&P Global Market Intelligence

Court Case Looms as Potential New Drag on Indian Banks' Earnings

India's highest court will resume hearing Oct. 5 on whether banks can levy interest on loans during a moratorium, a ruling that could put billions of dollars of lenders' interest income at stake and plunge them deeper into a financial crunch. The moratorium, first announced by the Reserve Bank of India in March and later extended to Aug. 31, was aimed at providing temporary relief to borrowers affected by the coronavirus pandemic, but they are still required to pay the principal amount, interest and interest on the deferred amounts for the period of the moratorium, referred to as interest-on-interest.

—Read the full article from S&P Global Market Intelligence

All-in-one Merger of German Federal State Banks Not Likely to Happen Soon

Mergers between Germany's federal state banks, which are seen as crucial to boosting their profits, are unlikely to happen in the near term, but more consolidation of functions may be seen soon. The idea of combining the remaining landesbanken into one central institution for the public savings banks sector in Germany has been pushed by the federal savings banks association DSGV. Such consolidation would be similar to the merger of DZ BANK AG and WGZ Bank in 2016, which created one central institution for Germany's cooperative banks.

—Read the full article from S&P Global Market Intelligence

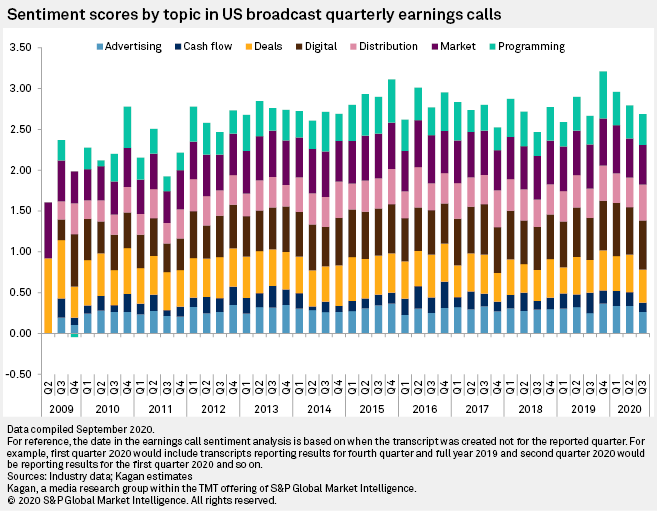

Sentiment Analysis of U.S. Broadcast Earnings Call Transcripts

Natural language processing, or NLP, is a powerful tool for financial analysis, and this new report creates sentiment scores for broadcast quarterly earnings calls by topic over the last 10 years using Python and machine-readable transcripts from S&P Global Inc. As an example, based on this NLP analysis of textual data in broadcast earnings calls transcripts, compound sentiment scores on the topic of advertising have fluctuated from a low of 0.15 in 2009 to a high of 0.32 in 2015 and back down to 0.27 in second-quarter 2020 from the impact from COVID-19.

Smooth Sailing for Facebook While Twitter, Snap and Pinterest Trail in Profits

Facebook Inc. generated a massive $18.69 billion in revenue for the second quarter of 2020 while Twitter Inc., Snap Inc. and Pinterest Inc. were each well below the $1 billion mark. Second-quarter 2020 proved to be more difficult because of economic challenges presented by the COVID-19 pandemic. Despite these challenges, Twitter, Snap and Pinterest all had boosts in daily active users, or DAUs.

—Read the full article from S&P Global Market Intelligence

Biden Would Offer Stable, Tech-focused Future for Auto Industry – Experts

A Joe Biden presidency would give the auto industry a more stable future focused on forward-looking technology like electrification and autonomous driving, while a continuation of the Donald Trump presidency would push for more traditional car manufacturing in the U.S., experts say.

—Read the full article from S&P Global Market Intelligence

Surge in Telehealth Usage Raises New Cyber Risk, Fraud Concerns – Experts

As telehealth usage has skyrocketed during the COVID-19 pandemic, cyberattacks, fraud and abuse have emerged as threats to its future growth. The U.S. Department of Health and Human Services temporarily relaxed regulations in March so that providers could reach out to patients more easily through services such as Apple Inc.'s FaceTime or Skype Inc.'s video conferencing platform.

—Read the full article from S&P Global Market Intelligence

Listen: Broader Threat Forces U.S. Energy Sector to Look Harder at Cyber Defenses

The coronavirus pandemic has rapidly accelerated the digitization of US energy companies, moving operational technology and corporate networks into workers' homes. Leo Simonovich, vice president and global head of industrial cyber and digital security at Siemens Energy, says this has heightened the need for oil, gas and power companies to increase their cyber defenses. With more point-to-point connections as a result of remote working, energy companies face the potential for more cyberattacks. Capitol Crude asks Simonovich about the cybersecurity implications of actions at the Federal Energy Regulatory Commission and how the energy transition and use of new technologies could compound cyber risks across the energy system. Stick around for the Market Minute, a look at near-term oil market drivers with Platts editor Chris van Moessner.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

Watch: Market Movers Europe, Oct 5-9: EU to set new emissions target as oil sector meets for Africa Oil Week

In this week's highlights: The downstream sector gathers online for Africa Oil Week; oil and gas strike looms in Norway; key votes are expected on the EU's emissions target; the winter winds will be blowing through the power market; and the European petrochemical sector will be discussing the outlook for next year virtually.

—Watch and share this Market Movers video from S&P Global Platts

US ELECTIONS: Biden Win Could Fray US-Saudi Ties, Bring New Oil Market Rifts

If Democrats win the White House and US Senate in the November elections, US-Saudi relations would likely fray, creating reverberations across the global oil market, Washington-based energy analysts predict. The Democratic Party's priorities of climate action, ending US support for the war in Yemen and holding Saudi Arabia accountable for the killing of journalist Jamal Kashoggi will make it difficult for a Biden administration to appear anything but tough with Riyadh, despite longstanding ties between the two top oil producers, analysts said.

—Read the full article from S&P Global Platts

Permian Basin Supply Fundamentals Signal Possible Rebound for Winter Gas Prices

Permian forwards markets could retrace a recent, precipitous drop in winter gas prices as transitory, shoulder-season pressures on the cash market ease and longer-term fundamentals come back into focus. On Oct. 2, calendar-month prices for December, January and February settled at $2.04, $2.70 and $2.78/MMBtu, respectively, S&P Global Platts' most recently published M2MS forwards data shows.

—Read the full article from S&P Global Platts

Mexico Announces Set of Infrastructure Projects, Including Energy, to Reactivate Economy

Mexico announced on Oct. 5 a set of infrastructure projects worth almost $14 billion to reactivate the economy, including a new coker for one of its six refineries as well as a liquefaction plant to export natural gas. The federal government and private industry will begin working on the set of 147 infrastructure projects, including five energy projects, jointly beginning in 2021, requiring total investments of $13.895 billion. "The public sector alone could not reactivate the economy as needed," President Andres Manuel Lopez Obrador said during his daily press conference.

—Read the full article from S&P Global Platts

OIL QUARTERLY: Transportation Fuels See Bearish Q3 on Low Demand

Demand for transportation fuels remained muted in the third quarter amid continued coronavirus pandemic concerns and economic pressures, while refinery run cuts have provided some balance to the markets.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language