Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 Oct, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

As the global economy continues to grapple with the COVID-19 pandemic, another virus poses a significant threat.

From February-April, cyberattacks against the global financial sector swelled 238%, and ransom attacks inreased ninefold, according to data from Carbon Black Inc., a unit of VMware, which provides cybersecurity technology to financial institutions.

"There's a perfect storm," Tom Kellermann, head of security strategy at VMware's security business unit, told S&P Global Market Intelligence in an interview. "Frankly, in my 22 years in cybersecurity, I've never seen it get this bad."

In the first half of this year, attacks on the Internet of Things—the world of devices featuring technology that allows them to connect with other devices and systems—jumped nearly 35% from the preceding six months, according to Microsoft. The company said in its Digital Defense Report this week that its analysts have observed “16 different nation-state actors either targeting customers involved in the global COVID-19 response efforts or using the crisis in themed lures to expand their credential theft and malware delivery tactics” that targeted global health organizations and academic and commercial organizations developing vaccine research “in efforts to perform reconnaissance on their networks or people.”

The pandemic has seen ransomware attacks increase 150%, phishing approximately 600%, and cyberattacks on banks 150%, according to Munich-based Munich Re, one of the world’s largest reinsurers.

“This crisis has provided malicious cyber actors with opportunities to take advantage of cyber vulnerabilities on a new scale,” the U.S. Chamber of Commerce said this week in a report on cybersecure remote working during the pandemic.

As the COVID crisis continues to accelerate digital innovation and transformation, S&P Global Ratings expects the cyberinsurance market to enjoy its biggest period of growth in the next decade—when commercial and private cyberinsurance permiums are anticipated to increase 20%-30% on average every year from the current global total of approximately $5 billion, with small and medium-sized enterprises holding the majority of untapped demand.

“We believe there will be a tipping point within the next decade, likely accelerated by the COVID-19 pandemic, when the frequency of successful attacks increases. If this is accompanied by a simultaneous increase in the severity of an attack, there may be a more significant effect on entities' credit profiles, especially if handled poorly,” S&P Global Ratings said in a report last week.

Global insurance firms have issued similarly stark warnings about the pandemic’s implications for cyber risk.

The crisis is “the best reminder for us all" regarding “the potentially huge consequences of a cyberattack causing widespread business interruption, even without causing a high or any level of physical damage," Munich Re’s chief underwriter, Stefan Golling, told journalists earlier this month, according to S&P Global Market Intelligence. Likewise, Swiss Re head of cyber product management Anthony Cordonnier said during a news conference earlier this summer that the pandemic could be a “watershed moment” for the cyber insurance market.

Today is Friday, October 2, 2020, and here is today’s essential intelligence.

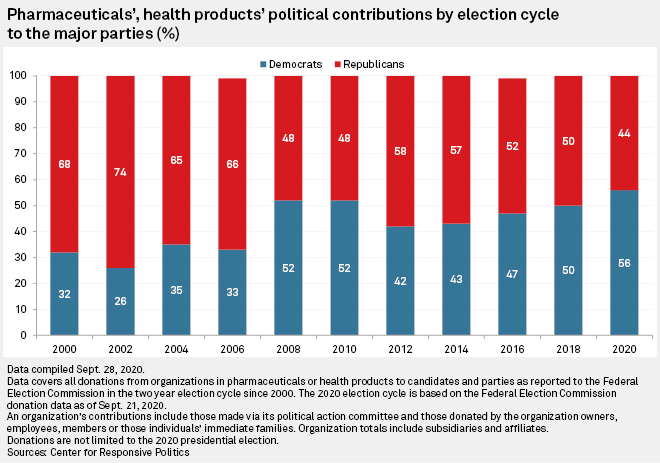

Pharma, Medtech Contributions to U.S. Democrats Reach Highest Level in 20 Years

Political contributions to Democrats from the pharmaceutical and health products industries rose to the highest level in at least two decades in the 2019-2020 U.S. election cycle, according to an analysis of data from the Center for Responsive Politics. More than half of all political contributions from the two healthcare subsectors has gone to Democrats, continuing a trend of rising contributions to the party from these companies since 2012, the data shows.

—Read the full article from S&P Global Market Intelligence

FERC's Chatterjee says Agency must Confront CO2 Pricing Regardless of Election

The complex issue of how to accommodate state-determined carbon pricing in U.S. wholesale power markets will persist no matter who wins the nation's presidential election, Federal Energy Regulatory Commission Chairman Neil Chatterjee said Oct. 1. "Regardless of what happens in the election, I think this commission is going to have to confront these issues as states are going to continue to take it upon themselves to push for these policies," Chatterjee said on a call with reporters following a Sept. 30 technical conference on carbon pricing.

—Read the full article from S&P Global Market Intelligence

Customer Willingness to Pay Remains Key Unknown in Hydrogen Market Development: Panel

Customer willingness to pay for green or renewable hydrogen remains the unknown factor shaping both government policy and investment in the nascent industry, panelists said at an S&P Global Platts virtual hydrogen conference Oct. 1. During a Q&A session, key hydrogen leaders were asked whether they envisioned their customers would be willing to pay a premium for green hydrogen produced from renewables over time.

—Read the full article from S&P Global Platts

Policy, Investment Coordination Needed for Hydrogen Implementation to Bear Fruit: Conference

Renewable hydrogen implementation and carbon neutrality remain within reach, but policy and investment will need to go hand in hand to reach decarbonization goals, speakers said at an S&P Global Platts virtual hydrogen conference Oct. 1. Hydrogen will play a key role in hard-to-abate sectors and mobility where electrification cannot be the solution, but challenges remain, CEO of Engie's hydrogen business unit, Michele Azalbert, told the first annual Platts Hydrogen Markets Europe conference.

—Read the full article from S&P Global Platts

Listen: Take Notes: The Swedish Covered Bond Market

We continue with our look at local covered bond markets, this time in Sweden. Covered bonds analyst Casper Andersen returns with host Tom Schopflocher to provide insights into this relatively young but large market, including how the recently approved European Covered Bond Framework could affect liquidity risk and the impact of the COVID-19 pandemic.

—Listen and subscribe to Take Notes, a podcast from S&P Global Ratings

Credit FAQ: Dubai's Already High Debt Burden Set To Worsen Amid A Deep Pandemic-Related Macroeconomic Shock

While it does not rate Dubai, S&P Global Ratings expects Dubai's economy will contract sharply by around 11% in 2020, owing in part to its concentration in travel and tourism, two of the industries most affected by COVID-19. We estimate, based on publicly available information, that Dubai's gross general government debt will reach about 77% of GDP in 2020; however, a broader assessment of the public sector, including government-related entity (GRE) debt, indicates a debt burden closer to 148% of GDP.

—Read the full article from S&P Global Ratings

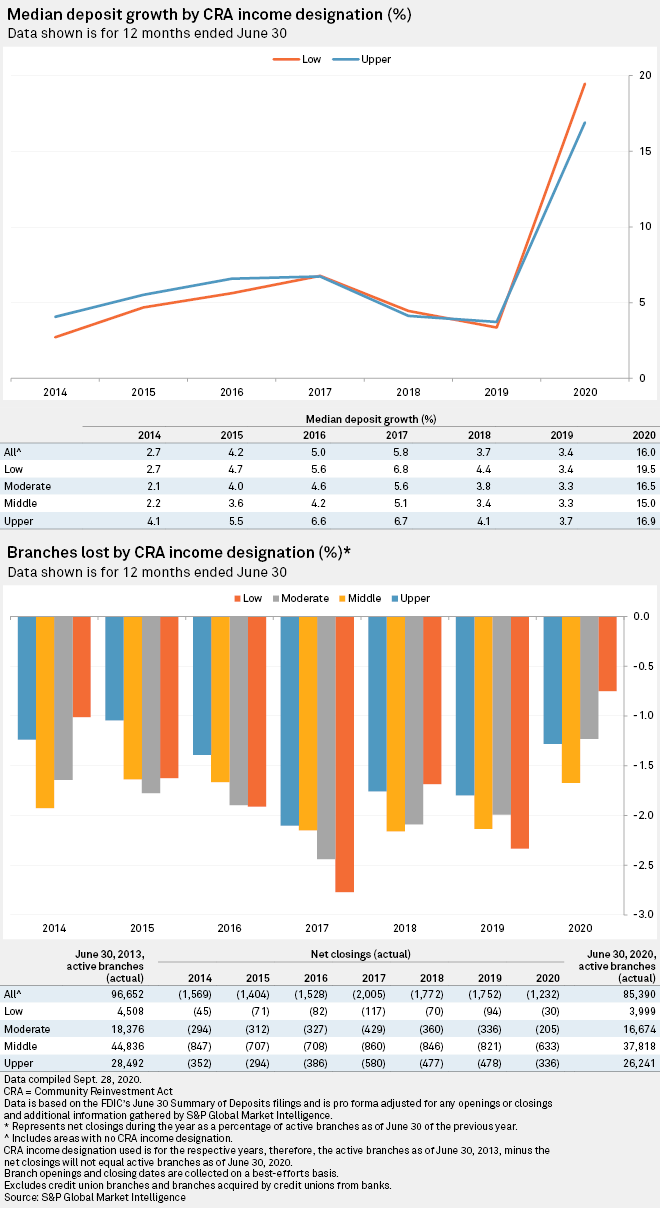

YOY Deposit Growth Highest in Low-Income Neighborhoods

Bank branches in low-income neighborhoods posted the strongest deposit growth of any income segment through the second quarter, a period when expanded unemployment benefits and government stimulus checks arrived for many consumers. Meanwhile, national banks continued to shutter branches in low-income areas, and the bank that opened the most collects abnormally high overdraft and service charges.

—Read the full article from S&P Global Market Intelligence

NatWest CEO Warns Test of Asset Quality to Come as Jobs Scheme Ends

Alison Rose, CEO of NatWest Group PLC, warned that it would not be until the final quarter that a clear picture on asset quality would emerge as the U.K. government's job furloughing scheme comes to an end. Rose, speaking at S&P Global's Banking Horizons Europe 2020 virtual conference, said there would be further impairments for the group in the second half. This would be driven by a combination of the economic outlook and how effective government support schemes proved.

—Read the full article from S&P Global Market Intelligence

Outlook Bleak for Berman Federal State Banks, but COVID-19 No Repeat of 2008

Germany's federal state banks, or landesbanken, are better prepared to weather the coronavirus crisis than they were to withstand the global financial crisis of 2008, but their commercial real estate and air finance portfolios could come under particular pressure, according to analysts.

—Read the full article from S&P Global Market Intelligence

Loan Growth Outpaces Deposits at Large Asian Banks on COVID-19 Liquidity Support

Loan growth outpaced deposits at most of Asia-Pacific's 20 largest banks in the quarter ended June 30 as authorities' expanded liquidity support to banks to help cushion the impact of the COVID-19 pandemic and economies, especially China, started to open up in the period. China's Ping An Bank Co. Ltd. led the pack with an 11.2% rise in its loan-to-deposit ratio, followed by China Minsheng Banking Corp. Ltd. and Bank of Communications Co. Ltd. with 4.2% and 3.7% increases, respectively.

—Read the full article from S&P Global Market Intelligence

State of the Video Game Industry Amid COVID-19–S&P Podcast

As companies and businesses around the globe continue to grapple with financial losses amid the COVID-19 pandemic, the video game sector has remained an outlier. People sheltering at home due to the pandemic increasingly turned to video games, resulting in revenue spikes for gaming firms and record sales for consoles, speakers said on the latest episode of "MediaTalk," an S&P Global Market Intelligence podcast.

—Listen and subscribe to Media Talk, a podcast from S&P Global Market Intelligence

TikTok Privacy Probes in Europe Raise Stakes for Local Data Handling

Facing a complicated transaction in the U.S., video-sharing platform TikTok Inc. may be hoping to find a simpler solution to regulatory scrutiny in Europe. TikTok was granted an injunction Sept. 27 against the Trump administration's move to ban the app. Meanwhile, the company is negotiating a sale to Oracle Corp. and Walmart Inc. to resolve U.S. national security concerns. In Europe, the Beijing Byte Dance Telecommunications Co. Ltd.-owned company is facing investigations of a different nature. Data watchdogs in France, Italy, Holland, Denmark and the U.K. are investigating the social media app's compliance with the bloc's stringent data protection rules, known as the General Data Protection Regulation, or GDPR.

—Read the full article from S&P Global Market Intelligence

Latin America 2020 Box Office Revenues Down 80% YOY as Releases Pick Up

Box office revenue in Latin America fell 79.5% year over year in the first eight months of 2020, data from S&P Global Market Intelligence and OPUSData shows. August film releases offer a reason to be cautiously optimistic. The month saw eight new films in theaters across the tracked markets of Mexico, Argentina and Brazil — the highest number since March. The number of releases in August fell 87.1% year over year, compared to 97.5% in July, and 100% in May.

—Read the full article from S&P Global Market Intelligence

European Box Office Revenues Down 69% YOY Through August

Europe's film box office is experiencing a slow recovery from coronavirus lockdowns, data from OPUSData and collated by S&P Global Market Intelligence shows. Box office revenue in the region totaled $1.43 billion in the first eight months of 2020, down 69.0% year over year, according to the data. The Netherlands recorded the smallest year-over-year decline at 45.4%, owing largely to the re-release of the Harry Potter films in mid-July. The eight-part series is owned and distributed by Warner Bros. Pictures Inc.

—Read the full article from S&P Global Market Intelligence

China Leads APAC 2020 Box Office Thanks to August Blockbuster

China's 2020 box office revenue rose from $98.1 million at the end of July to $623.8 million at the end of August thanks to blockbuster "Ba Bai," according to data from S&P Global Market Intelligence and OPUSData. Despite the success of the historical drama, which is also known as "The Eight Hundred," China box office revenue for the first eight months of the year was down 91.5% year over year.

—Read the full article from S&P Global Market Intelligence

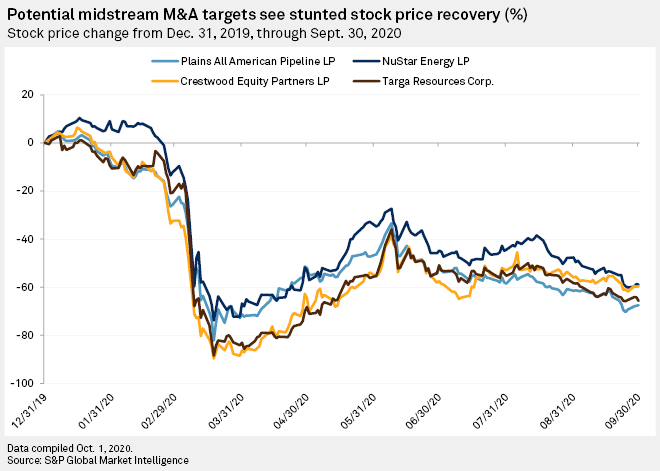

Oil, Gas Pipeline Merger Slump Expected to Persist Even as Producers Consolidate

Any oil and gas merger-and-acquisition momentum from Devon Energy Corp.'s recently announced acquisition of fellow Permian Basin driller WPX Energy Inc. will likely not trickle down to the midstream sector despite a consensus that consolidation is warranted, industry analysts said. The approximately $12 billion, all-stock deal is a merger of equals and garnered mostly positive reviews as fallout from the COVID-19 pandemic and historically low oil prices is shrinking the North American upstream universe.

—Read the full article from S&P Global Market Intelligence

U.S. Oil, Gas Rig Count Jumps 18 to 326 for Second Week of Double-Digit Gains: Enverus

The US oil and gas rig count jumped 18 to 326 in the week ended Sept. 30, rig data provider Enverus said, marking a second consecutive week of double-digit gains and a sign of a bold reversal for a fleet that has wobbled for months within a narrow range amid low oil prices and sluggish activity. Oil-weighted rig totals were up 17 to 234, while rigs chasing gas gained one for a total of 92, Enverus said. The nationwide increased followed a 15-unit gain the previous week.

—Read the full article from S&P Global Platts

U.S. Crude Exports Remain Relatively Resilient During Pandemic, Busy Hurricane Season

U.S. crude exports have weathered both a pandemic and a particularly busy hurricane season to rebound almost to the record highs of early 2020, but weaker US production volumes threaten export flows heading into next year. U.S. crude exports peaked at 3.71 million b/d in February and fell to a year-to-date low of 2.75 million b/d in June, according to the U.S. Energy Information Administration, but they've since rebounded to 3.51 million b/d for the week ending Sept. 25.

—Read the full article from S&P Global Platts

COVID-19 Delays Cambodia's LNG Ambitions After Initial Imports from China

Cambodia broke new ground in January with its first LNG imports in ISO tanks from China, but its plans to ramp up volumes, build a floating regasification terminal and establish a gas pipeline and trucking network have been temporarily delayed because of COVID-19. The tiny Southeast Asian country imported around 83 mt of ISO tank LNG from China's national oil company, CNOOC, making it the first new LNG importing country in Asia in 2020, even before Myanmar imported its first cargoes in June.

—Read the full article from S&P Global Platts

A Second Wave Sinks Commodities in September

The headline S&P GSCI fell 3.6% in September on the back of growing concern regarding the prolonged economic impact of a second wave of the COVID-19 pandemic. Across sectors, both industrial metals and energy contracted, while the agriculture and livestock sectors benefited from cursory signs of the return of demand from China.

—Read the full article from S&P Dow Jones Indices

Listen: Kerosene Powering Ships

The COVID-19 pandemic continues to create interesting opportunities; one of the more surprising is seeing kerosene finding its way into marine fuel. Platts reporters Sarah-Jane Flaws and Gary Clark discuss with Joel Hanley how a once-premium product has mingled with shipping fuel.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language