Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 Oct, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

All Eyes on China’s Banking Sector

Banks are usually considered safe havens for investment, but as the pace of global economic growth slows, they are under increasing scrutiny from investors and analysts. This includes Chinese banks, which merit particular attention due to the scale of China’s banking sector.

Relatively sluggish gross domestic product growth year-to-date has given rise to expectations of financial stress for companies and households — stress that will have a knock-on effect for banks’ loan books. In May, S&P Global Ratings revised its economic risk trend on Chinese banks from positive to stable.

“Economic growth prospects are weaker. Inflation is rising. Corporate and household leverage is high, and stress in the property sector is intensifying. We expect this combination to challenge the generally stable rating trends across the global and Asia-Pacific banking sector,” said S&P Global Ratings in its “Asia-Pacific Financial Institutions Monitor” report for the third quarter.

S&P Global Ratings forecasts Asia-Pacific banks will experience credit losses of about $425 billion in 2022 and about $440 billion in 2023. These numbers, which largely reflect the Chinese banking sector, are about 23% higher than those forecast in February.

Any credit issues won’t be helped by the country’s recent mortgage boycott, in which customers of unfinished residential building projects stopped servicing their mortgages in protest at construction delays. However, analysts say the boycott is unlikely to pose a systemic threat to the banking sector from the residential mortgage-backed securities market given its small scale relative to Chinese banks’ total loan books.

Worsening economic conditions have created another headwind for banks. While earnings at the four largest Chinese banks continue to grow — helping them put aside more reserves against potential bad loans — poor demand for credit has slowed the pace of earnings growth. Companies and households have been put off borrowing by economic uncertainty, the COVID-19 pandemic and issues in the domestic property market, analysts said.

In the first half of 2022, profit growth at Bank of China Ltd., Industrial and Commercial Bank of China Ltd., Agricultural Bank of China Ltd. and China Construction Bank Corp. was down compared with the same period in 2021. That puts pressure on the banks to grow their loan books in the second half, according to S&P Global Market Intelligence.

One piece of good news is that large mainland Chinese banks are doing relatively well compared with regional rivals when it comes to meeting key requirements under Basel III, the regulatory capital regime imposed on banks in the aftermath of the 2008 global financial crisis. Most mainland Chinese banks showed year-over-year improvements to their closely watched common equity Tier 1 ratios for the quarter ended June, according to research by S&P Global Market Intelligence. Chinese banks also performed better than their Asia-Pacific peers when it came to Basel III leverage and liquidity ratios.

Meanwhile, Chinese banks still managed to outperform Asian peers in terms of growing loans and deposits in the second quarter. While this doesn’t make an economic rout less likely, it puts the sector in a better position to weather any turbulence.

Today is Tuesday, October 18, 2022, and here is today’s essential intelligence.

Written by Mark Pengelly.

Australian Economy Under Pressure Amid Strong Inflation, But Signs Of Price Peak Appear

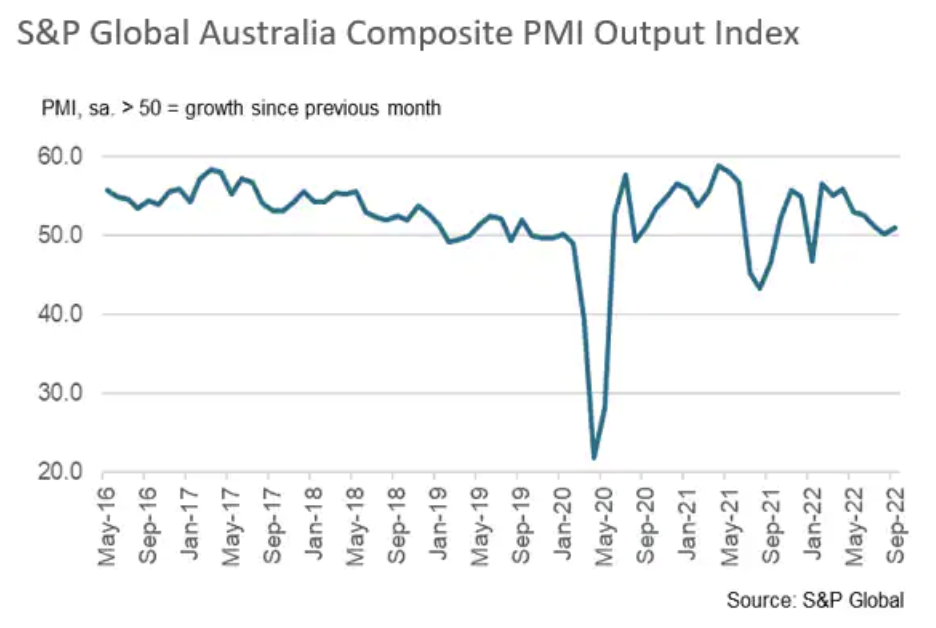

The release of the Australia flash PMI on Oct. 24 will be eagerly awaited after recent PMI survey data, compiled by S&P Global, signaled that inflationary pressures remained a major risk to the health of Australia's private sector economy. September saw steep price rises and subsequent interest rate hikes acting to subdue demand and business activity. Business confidence meanwhile slumped to the lowest since the outbreak of the COVID-19 pandemic.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Hurricane Ian Unlikely To Pose Serious Credit Risk To Florida Banks

Hurricane Ian devastated Southern Florida communities, but banks in the area are unlikely to suffer long-term negative effects, according to equity analysts. While banks in the impacted areas could see an uptick in loan loss reserves, insurance should shield them from meaningful credit losses. Further, storms such as Hurricane Ian often lead to longer-term positives, such as a resurgence of local economic activity as communities rebuild and insurance funds flow through, equity analysts said.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

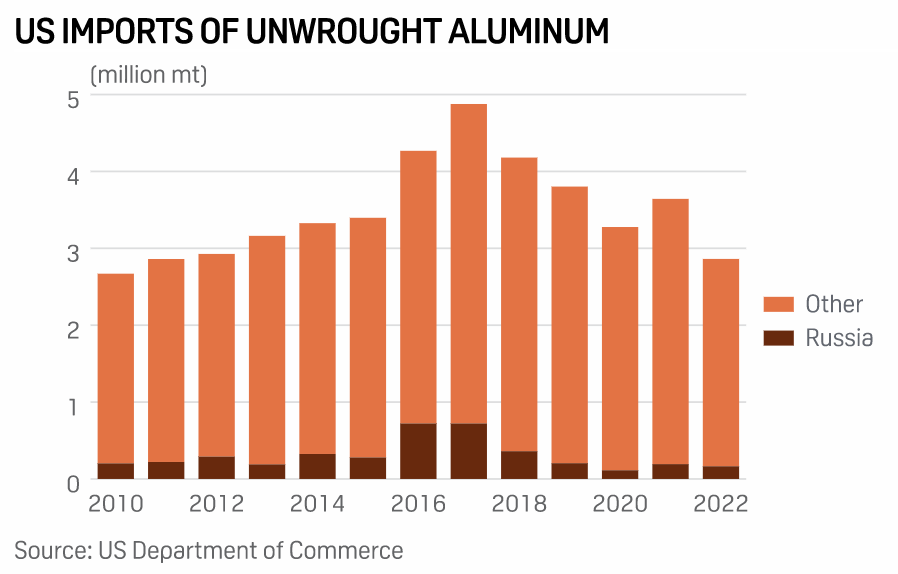

Speculation On U.S. Ban Of Russian Aluminum Imports Could Hurt Market: En+

En+ issued a warning Oct. 14 noting the harmful consequences that could ensue from recent speculation that the US government is considering actions to block aluminum imports from Russia. "Irresponsible market speculation of this sort only benefits our competitors who have publicly advocated for restricting our market access but hurts the American consumer and the U.S. economy, risking more than 164,000 direct and 470,000 indirect jobs in potentially affected downstream industries," En+ Chairman Christopher Burnham said in a statement.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: How Investment Firms Are Integrating Climate Risks In Their Portfolios

As extreme weather events such as Hurricane Ian intensify, the urgency of combatting climate change is increasing. The investment community is taking steps to make investment products low-carbon and reduce risk across portfolios. But what does that look like in practice? In this episode of the ESG Insider podcast, hosts Lindsey Hall and Esther Whieldon speak to two London-based investment managers on the sidelines of an S&P Global Sustainable1 event in London about what investors are doing to understand and manage climate risk in their investment portfolios.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

EU Gas Consumption Plunges In Q2 On Mild Weather, High Prices: EC

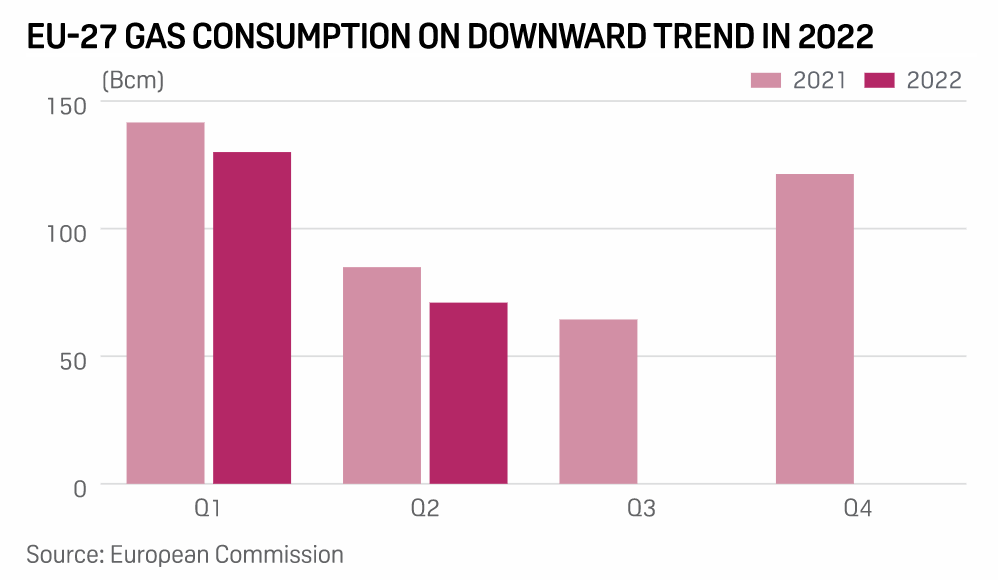

EU gas consumption in the second quarter fell 16.3% year on year to 71 Bcm due to mild weather and demand destruction caused by high prices, the European Commission said Oct. 17 in its quarterly market report. Gas use in power generation — which had been more resilient in the first quarter — also fell in Q2, by 7% year on year, the EC said. EU gas demand began to fall towards the end of 2021 as prices surged, primarily due to Russian supply curtailments.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Vehicle Retailing – Old Dog, New Tricks

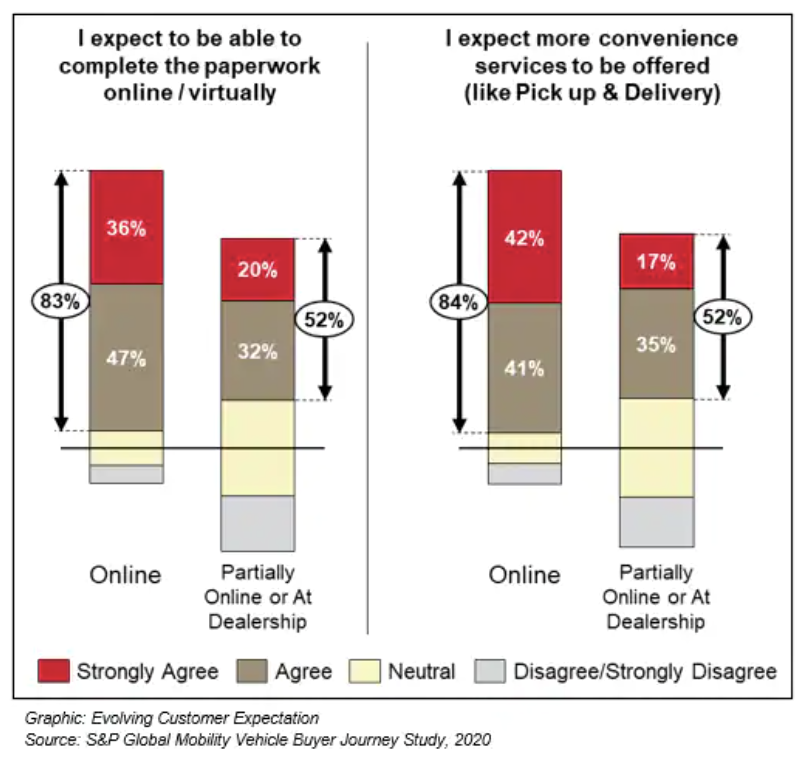

No-haggle pricing, direct-to-consumer, agency model — there are OEM announcements about new retail concepts almost every week, and often referenced in an EV context. But is selling EVs really all that different from selling ICE vehicles? Evolving customer expectations — as opposed to electrification — is the impetus for change. Electrification is merely the lever to disrupt an industry that hasn't changed its retail model in over 80 years and still remains slow to adjust.

—Read the article from S&P Global Mobility