Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 Oct, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Increased Demand for Data in Private Equity Markets

Last week, the managers of Harvard University’s $51 billion endowment warned that they anticipated significant markdowns in the endowment’s private equity and venture capital portfolio. Only, they couldn’t say precisely how much they thought they had lost. The endowment requires private equity fund managers to mark their positions annually, which means that many of their private equity investments don’t reflect market conditions for the entirety of 2022, which has been a tough year for investments.

“As a public investor, you get more transparency. You know exactly how you're going to be communicated to — what structure, your financials, the returns, the multiples, even the data,” Andrew Eisen, head of software solutions for S&P Global Market Intelligence, said in a recent interview. “But if you only get an update on the revenue on a quarterly basis, how do you decide what the changes are in the value of a transaction on a private company today?”

The lack of data and transparency in private equity is a challenge for both investors, known as limited partners, and fund managers, known as general partners. In a recent survey of U.S. private equity executives conducted for S&P Global Market Intelligence, 83% said the topic of “big data” is becoming more important at their firms. The executives were particularly excited about the use of data in their search for new investments, also known as deal origination or deal sourcing, with 43% saying they anticipate a positive impact. The survey also revealed that 27% of respondents believed data to be useful for due diligence, while 30% believed data to be useful for long-term value creation and performance analysis. However, organizational inertia keeps most private equity firms from using data as effectively as they could. 87% of respondents said problems with stakeholder buy-in was the greatest impediment to making better use of data.

While a lack of data is a frustration for the general partners in a private equity firm, it is a bigger concern for the firms’ limited partners. This year, as some limited partners tried to sell their stakes on the secondary market — either to realize paper profits or gain additional liquidity — many found that the market didn’t support anticipated valuations. Some limited partners have chosen to hold onto their investments in private equity, rather than sell and realize a loss.

Because many private equity managers and investors are choosing to hold onto portfolio companies for longer, the pace of fundraising has slowed. According to alternative assets data provider Preqin, private equity fundraising will decline 21.5% year over year in 2022. While global macroeconomic conditions are the primary reason private markets have slowed, the lack of transparency that served private markets in the long bull market may be biting them in today’s bear market.

Private equity firms have an advantage in that their limited partners are composed of institutional investors and high net worth individuals who have greater capacity to ride out market downturns. With some private equity firms looking to blockchain technology to widen their investor base, the demands for data and transparency are likely to increase.

Today is Monday, October 17, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

Listen: The Essential Podcast, Episode 69: Slouching Toward Utopia — Brad Delong And The Long Twentieth Century

Brad DeLong, professor of economics at the University of California, Berkeley joins the Essential Podcast to discuss his ambitious and controversial new book Slouching Towards Utopia: An Economic History of the Twentieth Century. The Essential Podcast from S&P Global is dedicated to sharing essential intelligence with those working in and affected by financial markets. Host Nathan Hunt focuses on those issues of immediate importance to global financial markets — macroeconomic trends, the credit cycle, climate risk, ESG, global trade, and more — in interviews with subject matter experts from around the world.

—Listen and subscribe to the Essential Podcast from S&P Global

Access more insights on the global economy >

Yield Curve Inverts Further As Rate Hike Speculation Stokes Recession Fears

The U.S. government bond market is flashing strong signals of an imminent recession. Key portions of the Treasury yield curve are nearing inversion or inverting to degrees not seen since the early 1980s. As inflation continues to soar to four-decade highs and the domestic labor market remains stubbornly tight, shorter-duration bond yields are expected to climb further and faster than longer-dated yields, creating further inversion and increasing the likelihood of a deep recession.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

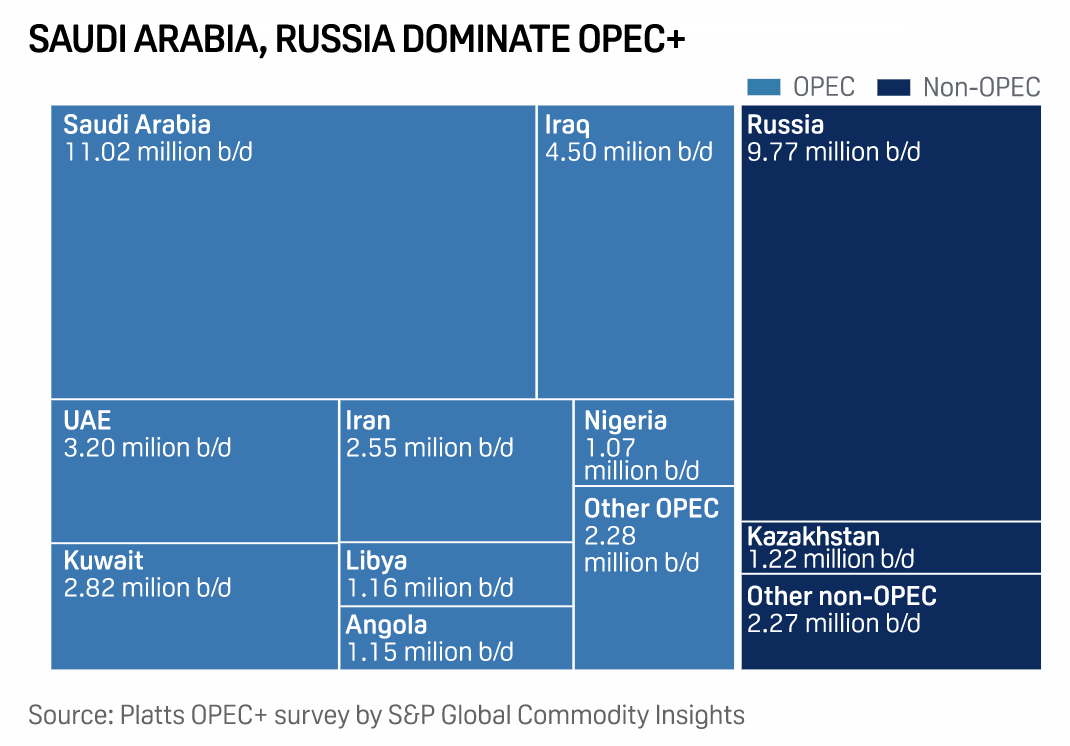

U.S.-Saudi Rift Deepens Over OPEC+ Oil Cut Logic

The blame game over the recent OPEC+ decision to cut crude oil production has escalated, with the U.S. again accusing Saudi Arabia of siding with Russia, after the kingdom rejected any suggestion that politics played a role in its shepherding of the deal. In a sharply worded statement Oct. 13, White House spokesman John Kirby said Saudi officials were keenly aware that cutting production to prop up prices would increase Russia's ability to finance its war in Ukraine and blunt the effectiveness of western sanctions on Moscow.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

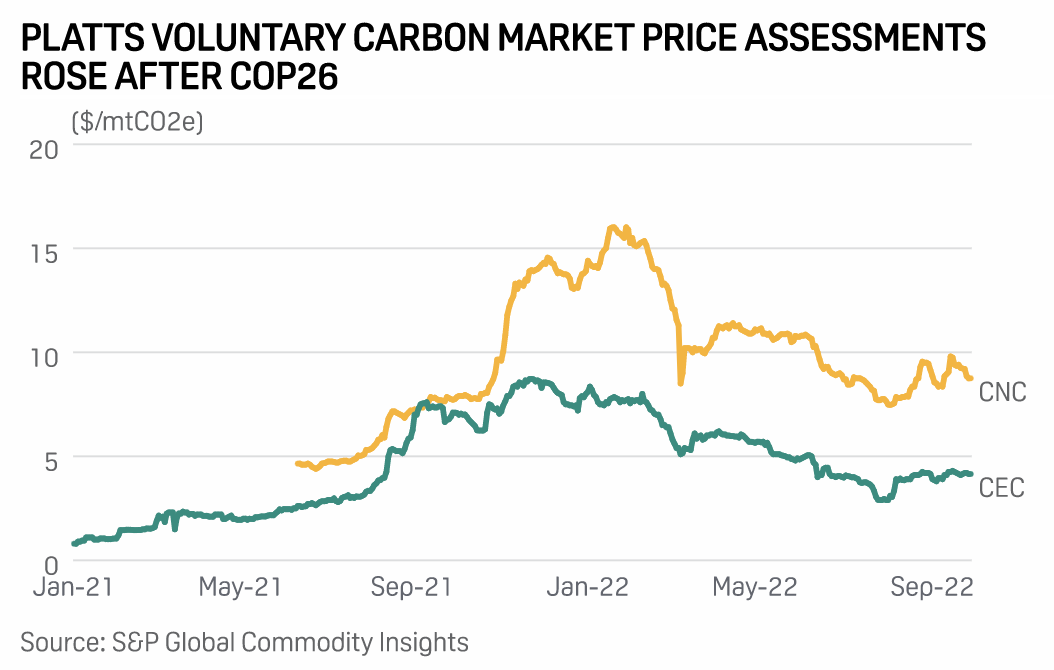

Voluntary Carbon Market Players Seek Clarity, Concrete Guidelines At COP27

While the 2021 UN Climate Change Conference, or COP26, laid out landmark decisions on Article 6 of the Paris Agreement, market participants remain fraught with confusion on the intricacies around Articles 6.2 and 6.4, the application of corresponding adjustment and the future of the voluntary carbon market as it stands today. S&P Global Commodity Insights spoke to key players in the VCM on their expectations ahead of COP27, which will be held at Sharm El Sheikh in Egypt on Nov. 6-18.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: French Strikes Cause Europe's Gasoline, Diesel Prices To Rise As Markets Tighten

The gasoline and diesel markets in Northwest Europe have tightened as France seeks alternative sources of supply due to strike at five of the country's six refineries. Though negotiations are ongoing at ExxonMobil and TotalEnergies, and strike action might stop soon, supply disruptions are expected to continue at least for a few weeks. In this episode of the Platts Oil Markets Podcast, S&P Global Commodity Insights senior editors Virginie Malicier and Elza Turner discuss with Francesco Di Salvo why these social movements had such an impact on road fuel prices.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

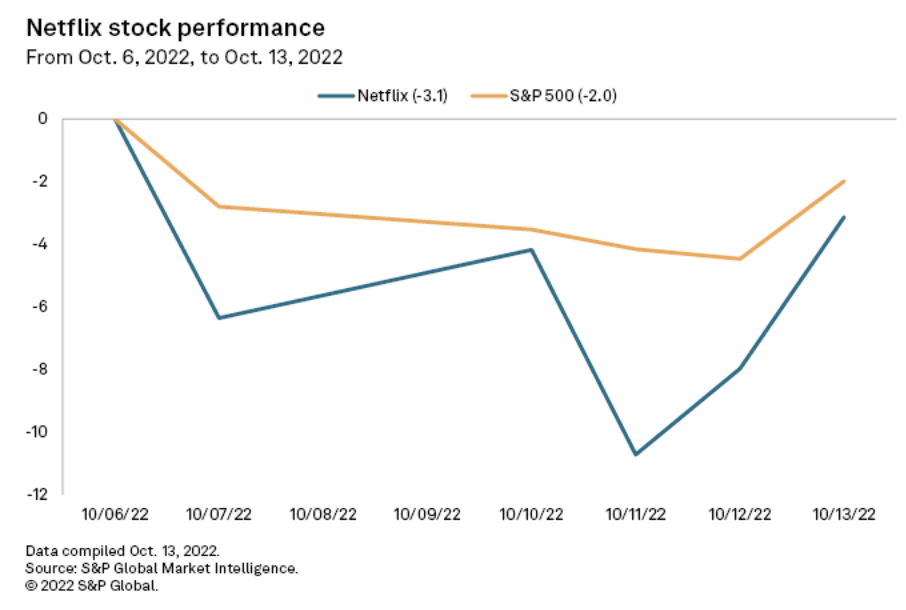

Netflix Ad-Tier Update Rattles Streaming Sector Ahead Of Q3 Earnings

Netflix Inc. is set to kick off the September-quarter earnings season for the country's biggest subscription video platforms Oct. 18, and the company's advertising strategy is center stage. Netflix is combatting a variety of headwinds in 2022, including flattening membership trends, increased competition and macroeconomic uncertainty, all of which have weighed on the company's stock value this year.

—Read the article from S&P Global Market Intelligence