Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 10 Oct, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Tech Disruption in Retail Banking: Adapt or Die

For retail banks, adapting to tech disruption is a necessity, not a choice.

Most banks, particularly large institutions, are allocating a significant portion of their capital expenditure to upgrading technology infrastructure. Banks are digitalizing their business models because they simply cannot afford not to, as well as to navigate a changing environment that currently includes elevated inflation, a war in Ukraine, energy price instability and the aftershocks of a pandemic. How well they leverage investments in technologies such as cloud computing, cybersecurity and generative AI to enhance competitiveness could mean the difference between growth and extinction.

Among the factors driving banks' increased investment in technology are their customers' growing preference for remote banking and the pressure from nonbank institutions offering online services. Tech adoption has become an operational necessity as well, with many institutions using technology to streamline operations, diversify product selections and create new revenue streams. In light of increasingly sophisticated cyberattacks, banks are also exploring the use of AI and machine learning for simple and repetitive tasks so their staff can upskill and focus on higher-level issues.

Tech adoption rates across countries and between banks vary, however, depending largely on technology infrastructure, regulation, local preference and competitive pressure. An S&P Global Ratings analysis indicated that these technology gaps "will have implications for bank customers and could weigh on the health of banks, national banking sectors, and economies."

In Ireland, which has a relatively strong mix of technological infrastructure and talent, banks have been able to implement tech improvements through internal development and collaborations with tech providers. Over the past decade, however, Irish banks have focused on resolving legacy issues such as asset quality weaknesses and poor efficiency, slowing down the adoption of technologies needed to offer innovative products and enable internal digital transformations, despite the country's technology infrastructure and ecosystem being among the best in Europe. Customer stickiness and basic product and service expectations have also limited the adoption of digital solutions.

With legacy issues now largely solved and higher interest rates boosting revenue, Irish banks should have more room to invest in tech improvements and digital transformations. The growing popularity of noncash payment methods such as cards and mobile is also encouraging the adoption of new technologies.

In Mexico's banking sector, the adoption of new technologies has primarily been the purview of large institutions, which typically have the funds for such an undertaking. Large foreign-owned banks also benefit from their parent companies' knowledge and experience in digitalizing subsidiaries in other countries and regions.

Among smaller players, the pace of tech adoption is sluggish. Besides the small scale of their operations, their high business concentration, relative to that of larger players, and thin profit margins leave little room for investments in technology.

Regarding disruption from financial technology companies, S&P Global Ratings analysts believe that such organizations do not represent an immediate risk to Irish and Mexican banks.

Irish fintechs tend to be niche players and are unlikely to replace the position of traditional banks as a one-stop shop. However, in the medium term, fintechs could become relevant competitors in certain services, enabled by newer technology and the better targeting of younger generations, according to analysts.

In Mexico, S&P Global Ratings analysts see little overlap between the target customers of banks and fintechs, as fintechs focus mainly on those who are unbanked. Bank-fintech collaboration in the country is expected to persist in the coming years.

Today is Tuesday, October 10, 2023, and here is today’s essential intelligence.

Written by Jasmine Castroverde.

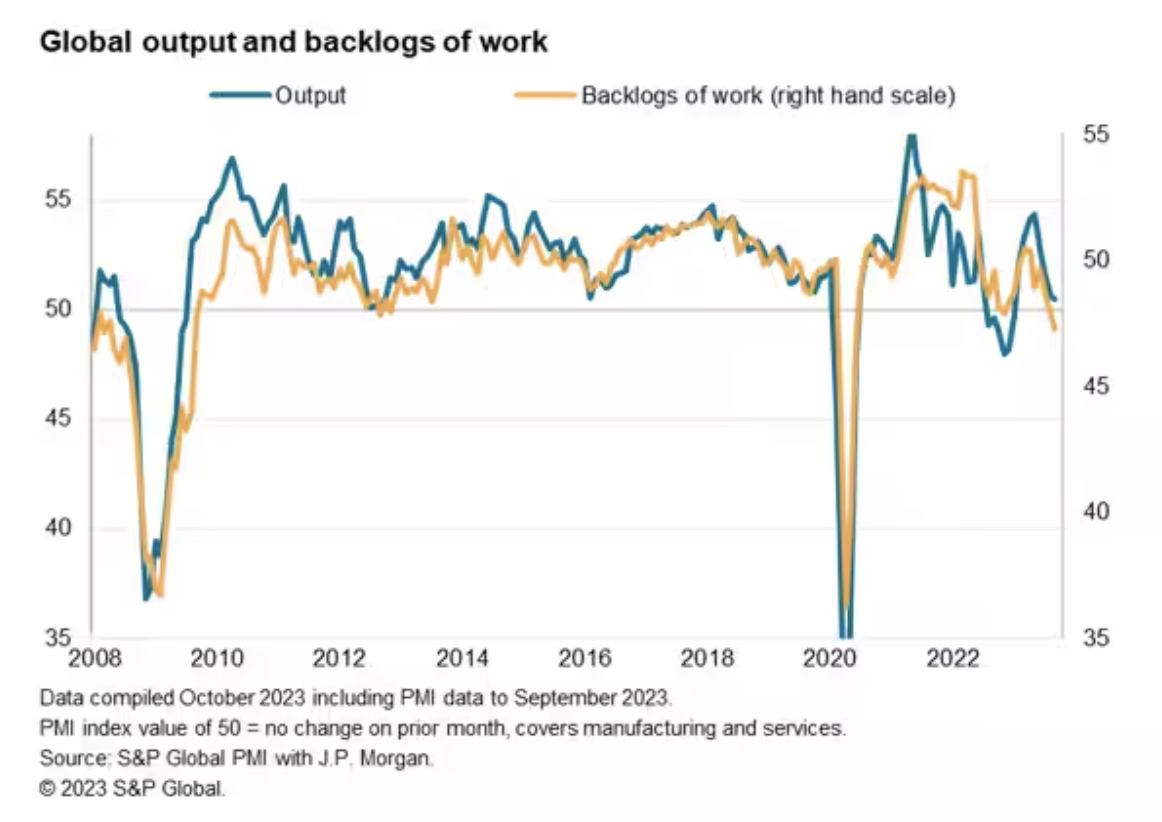

Global PMI Signals Near-Term Downturn Risks Amid Falling Backlogs Of Work

Global economic growth remained largely stalled for a second consecutive month in September, according to the S&P Global PMI surveys, based on data provided by over 27,000 companies. The data point to a significant loss of global growth momentum after the resurgence of demand seen earlier in the year, which had been fueled in particular by a post-pandemic revival of service sector activity.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

This Week In Credit: Data Examination Ahead

Credit trends last week were largely positive across sectors and regions. This week will be data heavy. In the US, given recent stronger-than-expected labor market data, the focus is on Wednesday's PPI announcement and Thursday's CPI release. The Federal government's September budget statement will be important given the continuing debates in Congress. Additional economic data releases include credit data for China (Wednesday) and the UK's August GDP (Friday).

—Read the report from S&P Global Ratings

Access more insights on capital markets >

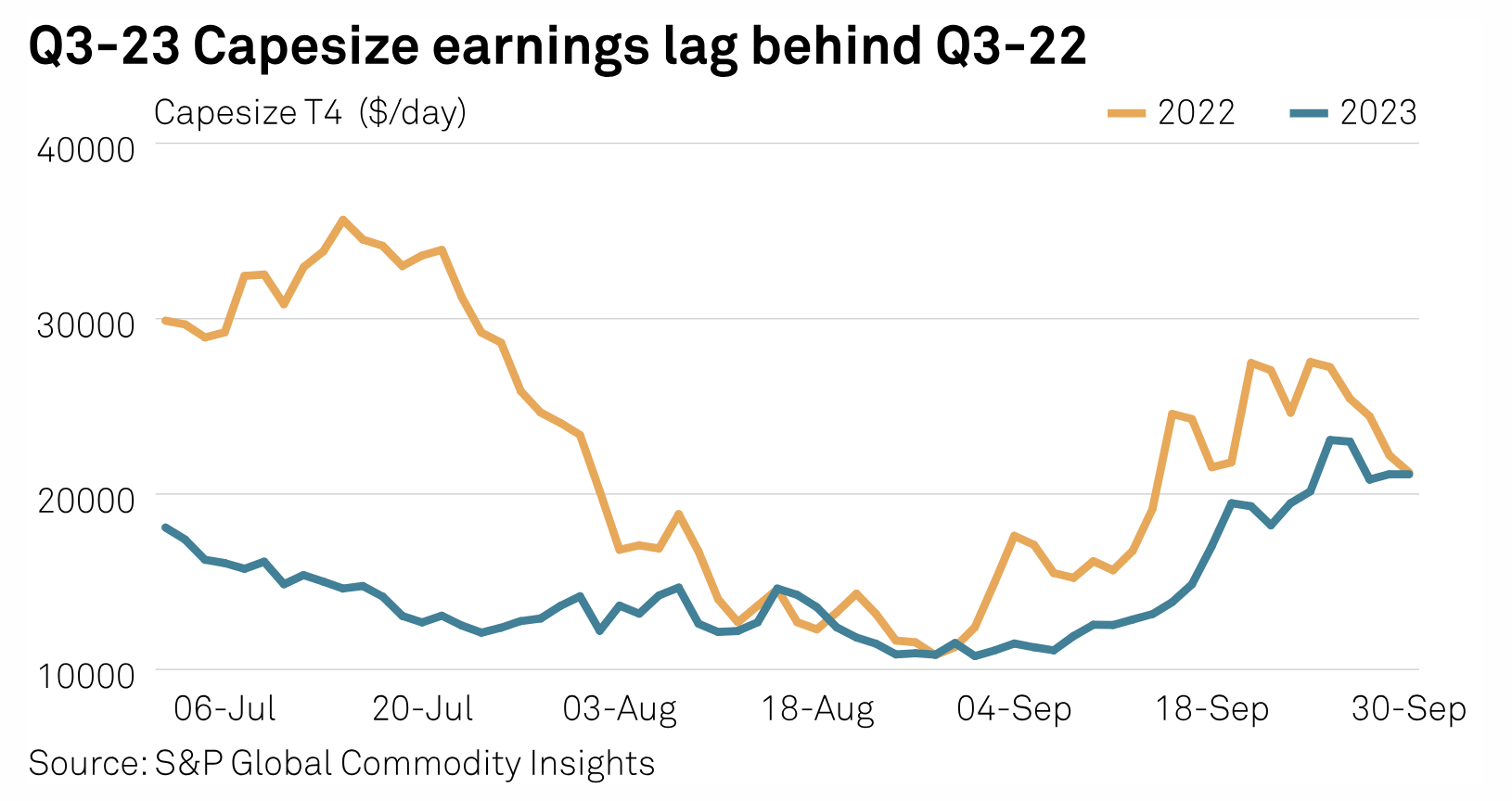

Coal Restocking Lifts Q4 Dry Bulk Shipping Hopes

While lackluster macroeconomic conditions posed significant obstacles in the recovery of dry bulk shipping market during third quarter, with poorer average returns across all vessel segments compared with Q3 last year, many market participants were expecting freight gains in Q4. The Platts Capesize T4 Index, a global ton-mile weighted average index of four Capesize routes, stood at an average of $14,493/d in Q3, below the $22,257/d seen in Q3 2022, S&P Global Commodity Insights data showed.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: How NOAA Is Working To Turn Climate Science Into Action

In this episode of the ESG Insider podcast, hear from Dr. Sarah Kapnick, chief scientist for National Oceanic and Atmospheric Administration (NOAA). NOAA is an agency in the US Department of Commerce focused on science, service and stewardship. Its mission is to understand and predict changes in climate, weather, ocean and coasts; share that knowledge and information; and conserve and manage coastal and marine ecosystems and resources.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

Listen: Fed Up With New US Offshore Drilling Plan, Will Oil Sector Say Bye, Bye, Bye To Gulf Of Mexico?

In about two months, Interior Secretary Deb Haaland is expected to formally approve a new National Outer Continental Shelf Oil and Gas Leasing Program, putting a five-year offshore leasing plan back on the books after the country’s previous program expired over a year ago. As one could imagine, the oil industry was not pleased to hear that only three lease sales for acres in the Gulf of Mexico would be conducted over the next five years. American Petroleum Institute President and CEO Mike Sommers joined the podcast to share the industry’s perspective on the new offshore leasing plan, its impact on broader supply and demand dynamics and next steps.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

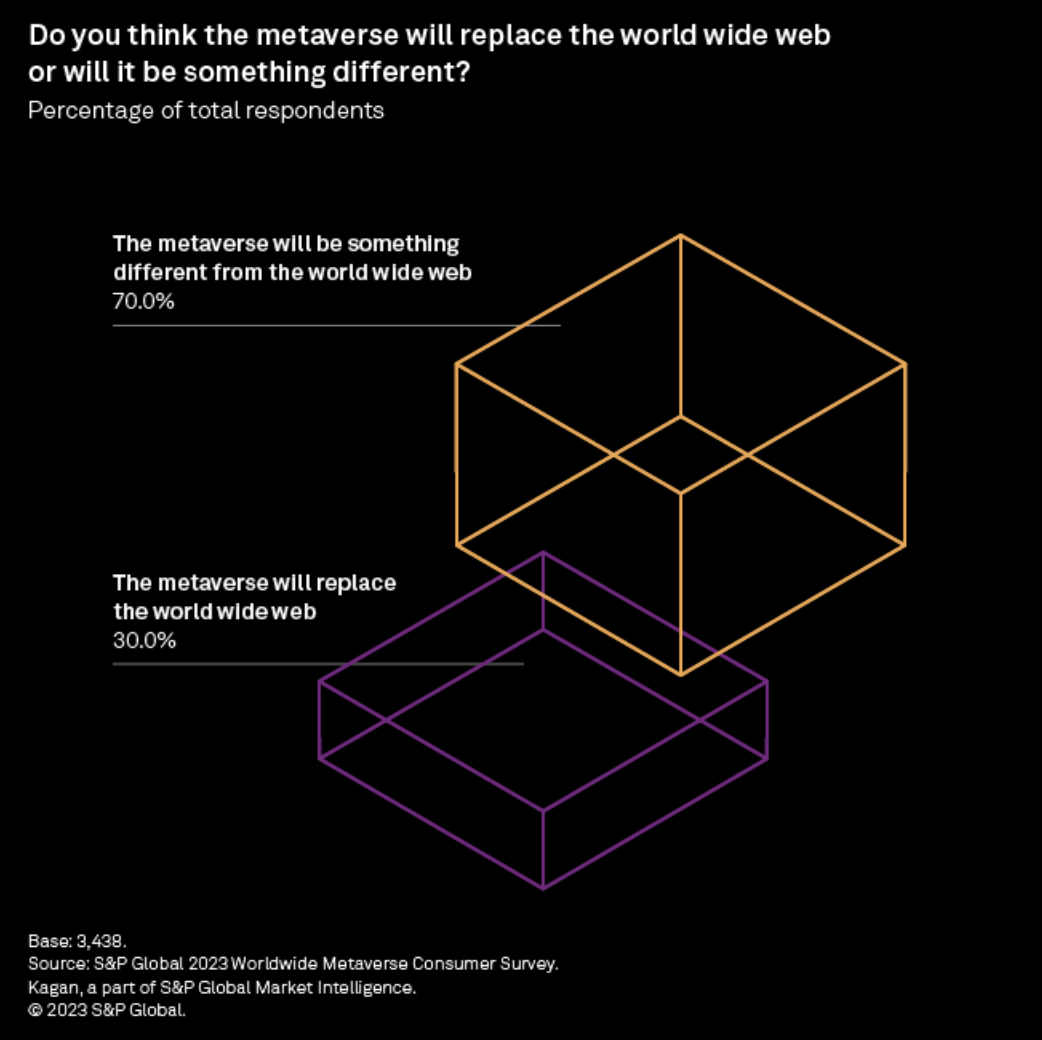

Survey: Metaverse Will Be Impactful, But Not A Web Replacement

S&P Global defines the metaverse as the long-term vision for the next phase of the internet, which will feature a single, shared, immersive and persistent 3D virtual space where humans and machines interact with one another and with data, enhancing the physical world as much as replacing it. In practice, the consumer-based metaverse is envisioned as a series of interconnected virtual spaces built for socializing, gaming and shopping. Over the long term, there is potential for these spaces to merge with the real world via augmented reality.

—Read the article from S&P Global Market Intelligence

Content Type

Location

Language