Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 30 Jun, 2021

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Temperatures are soaring to unprecedented highs in a heat dome across western North America. The 116 degrees Fahrenheit temperatures are so extreme they’ve melted power cables and buckled roads in places like Portland, Ore., and Western Canada has sweltered in a never-before-seen 117.5 degrees—indications of the more frequent and debilitating physical effects of climate change.

“As climate change induces extreme weather events more and more frequently, we need to make investments to build a more resilient [power] grid,” President Joe Biden said June 29 during a speech in Wisconsin about the impending bipartisan infrastructure deal that aims, among other provisions, to modernize the country’s energy grid. “Anybody ever believe you’d turn on the news and see it’s 116 degrees in Portland, Oregon?”

Last year tied with 2016 as the hottest on record, according to data from the Copernicus Climate Change Service, and recent extreme weather events signal that this is becoming the new normal. After devastating wildfires raged across California last summer and a polar vortex froze Texas this winter, market participants across the U.S. are taking action to become more resilient in the face of increasing climate risk. California regulators and the statewide power grid manager, the California Independent System Operator (Cal-ISO), have implemented myriad reforms to bolster reserves of precious power supplies to avoid a repeat of last summer’s events, and Texas lawmakers have signed bills addressing the extreme weather.

But changes may not be materializing soon enough. Rolling blackouts similar to those that left millions without power in California last year are in effect across Oregon now. Cal-ISO and utilities in Oregon and elsewhere in the Pacific Northwest are urging consumers to conserve energy to reduce stress on the power grid as prices and demand rise, according to S&P Global Platts. In the Northeastern U.S., which is also suffering from a heat wave, with temperatures exceeding 90 degrees Fahrenheit, regional gas and power prices are rising alongside climbing temperatures. In addition, spot natural gas prices in Southern California climbed above $7 per 1 million British thermal units on June 29, and NYMEX Henry Hub natural gas futures and forwards prices have gained 40 -45 cents, according to S&P Global Platts Analytics data.

High heat brings the heightened risk of wildfires. The U.S. now faces concerns over the quality and harvest prospects of crops due to the heatwave, particularly for the spring wheat that accounts for 25% of the country’s total wheat production. In Canada, the world’s largest producer of spring wheat, production is also threatened, according to a recent report by the agriculture market research firm Gro Intelligence cited by S&P Global Platts.

"The spring planted wheat has had so little moisture that some farmers may not have any harvest," a recent report by the export market development organization for the U.S. wheat industry, U.S. Wheat Associates, said, according to S&P Global Platts.

Today is Wednesday, June 30, 2021, and here is today’s essential intelligence.

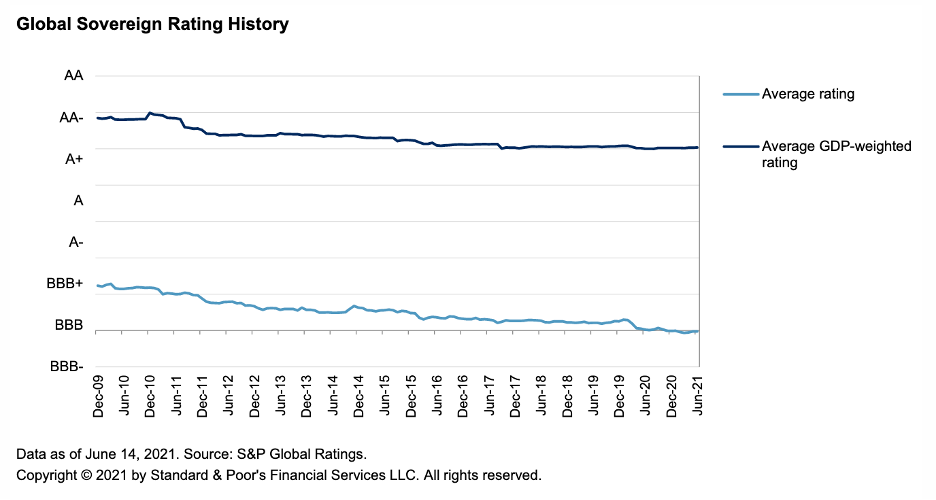

Global Sovereign Rating Trends Midyear 2021: Recovery Will be Uneven as Pandemic Risks Linger

S&P Global Ratings sovereign ratings are showing signs of stabilizing after a wave of negative rating actions last year. S&P Global Ratings expects uneven recovery among regions as pandemic-related risks linger. These risks include slow vaccination rollouts, new virus strains, stimulus considerations, inflation, and social tensions.

—Read the full report from S&P Global Ratings

Credit Conditions Emerging Markets Q3 2021: Slow Vaccination Prevents A Robust Recovery

Credit conditions in emerging markets (EMs) continue improving, supported by sustained economic recovery in developed countries and in many cases improving domestic demand as EM economies are able to resume activities. Notably, the economic fallout from intermittent lockdowns resulting from ongoing pandemic waves hasn't been as severe as that from the initial social distancing measures in early 2020.

—Read the full report from S&P Global Ratings

Credit Conditions North America Q3 2021: Looking Ahead, It’s Looking Up

Credit conditions in North America are extremely favorable entering the third quarter. Economic activity has rebounded sharply as COVID-19 case counts decline and social restrictions ease. This has boosted revenues for borrowers we rate in a number of corporate sectors, improving their prospects for a return to pre-pandemic levels sooner than S&P Global Ratings expected.

—Read the full report from S&P Global Ratings

Credit Conditions Europe Q3 2021: Late-Cycle Redux

High vaccine efficacy, falling COVID-19 case numbers (notably among older vaccinated persons including in the U.K.), and extensive policy support have boosted confidence and reflated the regional economy. When and how to rebalance policy settings are two big questions.

—Read the full report from S&P Global Ratings

Credit Conditions Asia-Pacific Q3 2021: One Region, Two Recoveries

Export growth is rising in East Asia while new waves of COVID-19 infections are hobbling the economic recoveries of countries in South and Southeast Asia. This means that ratings trends will remain disparate.

—Read the full report from S&P Global Ratings

Sector Roundup Asia-Pacific Q3 2021: Some Pain, Some Gain

While the Asia-Pacific recovery is gaining traction in a growing number of sectors, downside rating risk persists heading into the second half of 2021.

—Read the full report from S&P Global Ratings

Appalachia Autumn 2021 Gas Forwards Push Record Levels as Regional Balance Tightens

Autumn-season forwards prices at Appalachia's benchmark upstream hub, Eastern Gas South, are pushing historic highs in late June as record power burn and flat production continue to strain the region's supply balance, leaving storage inventories trailing five-year average levels.

—Read the full article from S&P Global Platts

As Singapore, Hong Kong Weigh SPAC Rules, Listings Flow to U.S., South Korea

The Singapore and Hong Kong exchanges are considering loosening their listing rules to attract special purpose acquisition companies, but most of these blank-check companies will likely still opt for exchanges in the U.S. or South Korea, according to market experts.

—Read the full article from S&P Global Market Intelligence

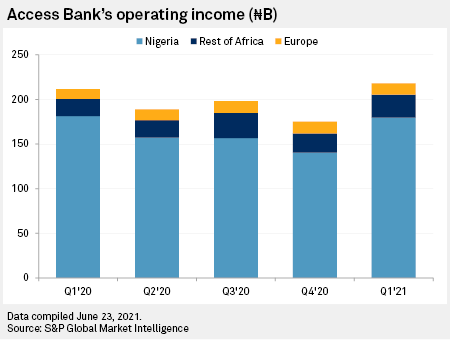

Nigeria's Access Bank Faces Tough Competition In South Africa Venture

Nigeria's Access Bank PLC faces tough competition from incumbents as it ramps up operations in South Africa, but it could find success in niche markets.

—Read the full article from S&P Global Market Intelligence

Citizens Still on the Hunt for Deals Post HSBC Branch Deal

While Citizens Financial Group Inc. sees stronger organic growth opportunities than peers, the company remains on the pursuit for acquisitions after announcing plans to acquire the East Coast branches and national online deposit business of HSBC Bank USA NA.

—Read the full article from S&P Global Market Intelligence

Japan's Banks Face Rising Climate Activism Despite Vetoed Motions

Shareholder activism in Japan has been growing in recent years, mostly directed at corporate governance issues in large companies. Although activist investors failed to push through climate motions at two megabanks in Japan over the past year, pressure is building on lenders to rein in financing for fossil fuel projects and support an international effort against global warming.

—Read the full article from S&P Global Market Intelligence

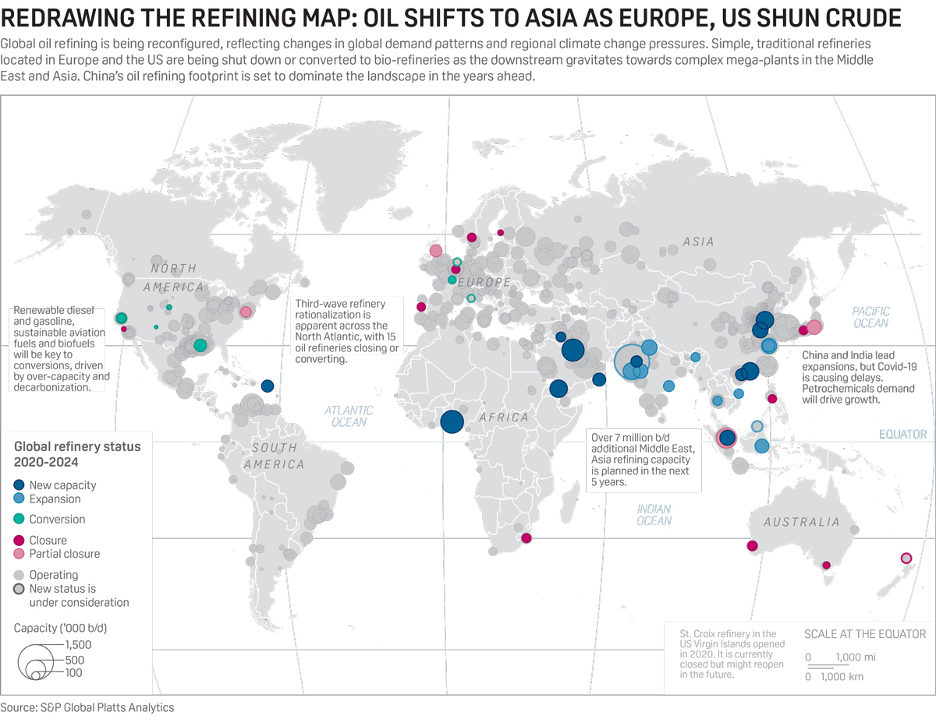

Fuel for Thought: Oil Demand Optimism Bittersweet for Global Refining Industry

The oil refining industry could struggle to return to full health in the next couple of years as analysts predict that the oil demand recovery enables new plants to start outpacing closures bringing extra capacity to the beleaguered sector.

—Read the full article from S&P Global Platts

Analysis: Australia's Gasoline Imports Likely to Trend Higher In H2 Despite New COVID Setback

Despite around half of Australia's population contending with the threat of entering July under lockdown, the country's gasoline imports are expected to increase in the second half of the year, industry sources told S&P Global Platts.

—Read the full article from S&P Global Platts

U.S. Must Rethink Sanctions After Creating Alliance Among Targets: Wilson Center Panel

The U.S. must rethink its use of oil and other sanctions after the economic pressure has pushed China, Iran, Russia and Venezuela into strong trading partnerships with each other rather than isolating the countries as Washington intended, a Wilson Center panel of international experts said June 29.

—Read the full article from S&P Global Platts

EU Steel Import Safeguards Extension Divides Market Opinions

The European Commission has formally published rules governing steel import safeguards into the European Union for the next three years: leaving safeguards in place for all 26 steel product categories, subject to annual review. The extended safeguard, which pits traders and consumers against mills, will officially run from July 1.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language