Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 Jun, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Market Participants See Rare Earth Metals As Key to Energy Security

As the war in Ukraine continues and energy prices stay at historic highs, many industrialized countries are looking to the energy transition to provide their energy security. But market participants’ concerns over the centralization of mining and the processing of rare earth elements in countries like China and Russia are prompting investments to develop elsewhere.

While the world’s dependence on China for the rare earth elements that are crucial to the energy transition has recently begun easing, China’s exports of these elements are expected to grow by 30% this year, even as prices have moved steeply higher, according to S&P Global Market Intelligence. According to the U.S. Geological Survey, China accounted for 60% of global rare earths production last year—down from 97.7% in 2010.

Despite China’s declining global market share, some market participants are still concerned about the concentration of rare earths production and are responding with their own production plans.

“Our dependence on foreign countries for lithium-ion batteries has the potential to become the next OPEC,” Aaron Bent, CEO of the U.S. lithium battery company 6K Inc., said in a recent S&P Global Market Intelligence interview. Encouraging a more domestic battery supply chain “really comes back to a national security issue, and we're seeing more and more heightened awareness around the war in Ukraine and concerns about China and Taiwan,” he added.

The U.S. Department of the Interior announced plans on June 21 to invest $74.6 million across 30 states in order to fund new research and mapping in critical minerals and strengthen key domestic supply chains. The effort will be focused primarily on rare earth elements used in wind power, electric vehicle drive trains, consumer electronics, and other industrial sectors, according to S&P Global Commodity Insights.

Canadian Minister of Natural Resources Jonathan Wilkinson on June 13 announced plans to accelerate mine development, signaling a new willingness on the part of the left-leaning Liberal government to simplify the approvals for mining companies on rare earth and other critical elements, according to S&P Global Market Intelligence.

European governments are also looking to increase production of elements critical to the energy transition. A European Commission official told S&P Global Commodity Insights on June 20 that the bloc will prepare a legislative proposal to strengthen its industrial value chains.

However, slowing economic momentum and the potential for a global credit crunch may make it more challenging to finance new mining projects. Market participants at the Global Mining Finance Conference on June 7 said that rising interest rates may make it more difficult for riskier projects such as mine exploration to find funding—and rising insurance costs and concerns about ESG regulations may delay the development of new mining production, according to S&P Global Commodity Insights. This could risk delaying the energy transition and further destabilizing regional energy security.

“While the buildout of green energy production has and will continue to increase metals consumption, more stringent environmental policy has also led to upward pressure on production costs as miners clean up their operations,” Terence Kooyker, CEO of the commodities hedge fund Valent Asset Management, told the Daily Update. “This, coupled with the recent, significant tightening of credit conditions and uncertain macroeconomic outlook, has led miners to be more conservative with expansion plans compared to previous periods when metals were at these prices.”

Today is Monday, June 27, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

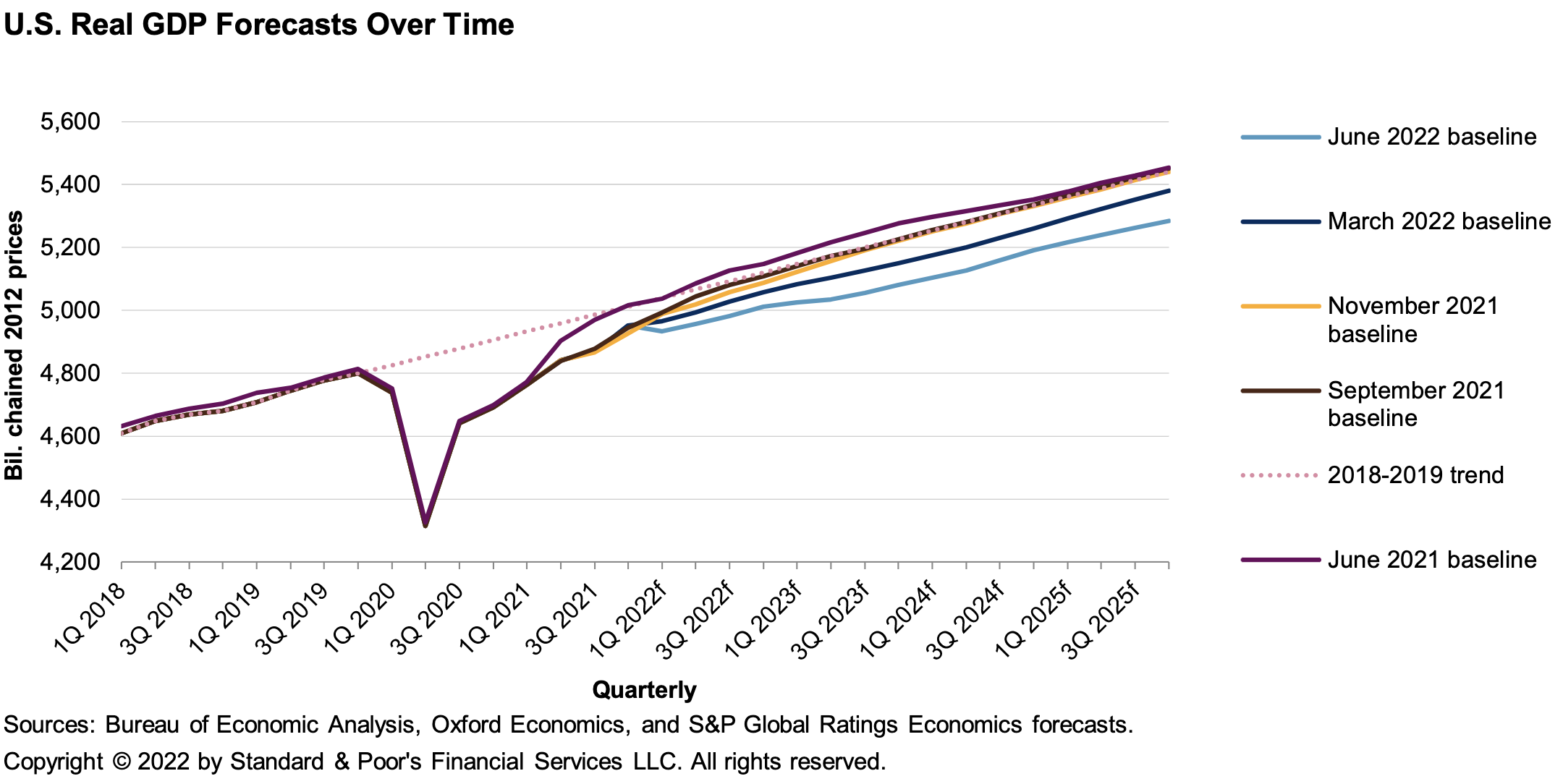

Economic Outlook U.S. Q3 2022: The Summer of Our Discontent

As we inch toward potential recession, S&P Global Ratings expects the Fed's stronger action to slow hiring and raise unemployment. Under such a scenario, the "cure" for the U.S. economy and jobs market may feel worse than the disease.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Competition Heats Up as Banks Try to Cash in on UAE's IPO Boom

A raft of privatizations in the United Arab Emirates is driving an initial public offering boom that is heightening competition among local and international banks for advisory mandates and putting pressure on the fees these institutions can charge.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

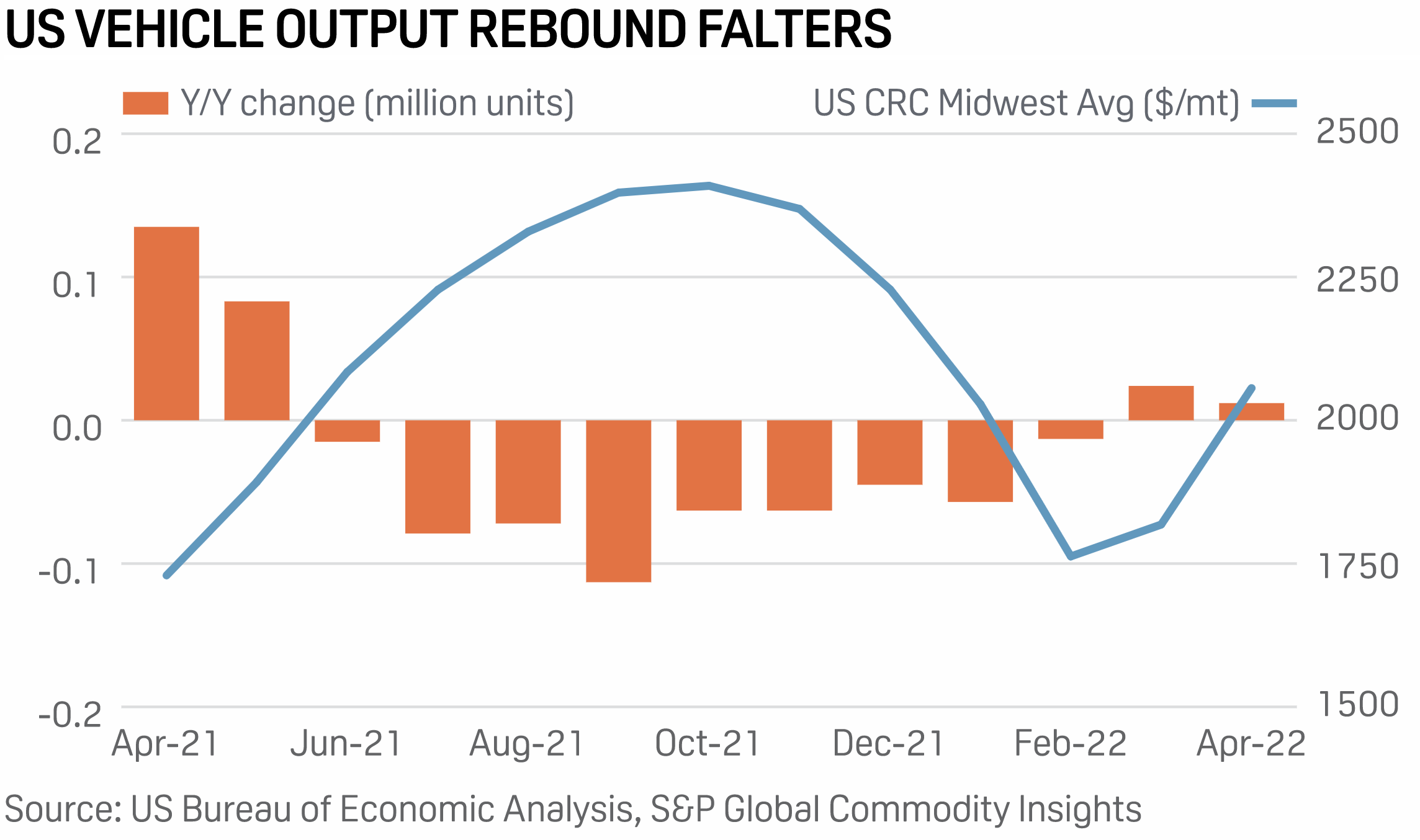

Around the Tracks: Vehicle Makers Stumble Over Geopolitics, Supply Chain Tangle

Lockdowns to limit the spread of COVID-19 in China, especially in Shanghai, disrupted the supply chains of vehicle makers, who were already dealing with a shortage of semiconductor chips.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

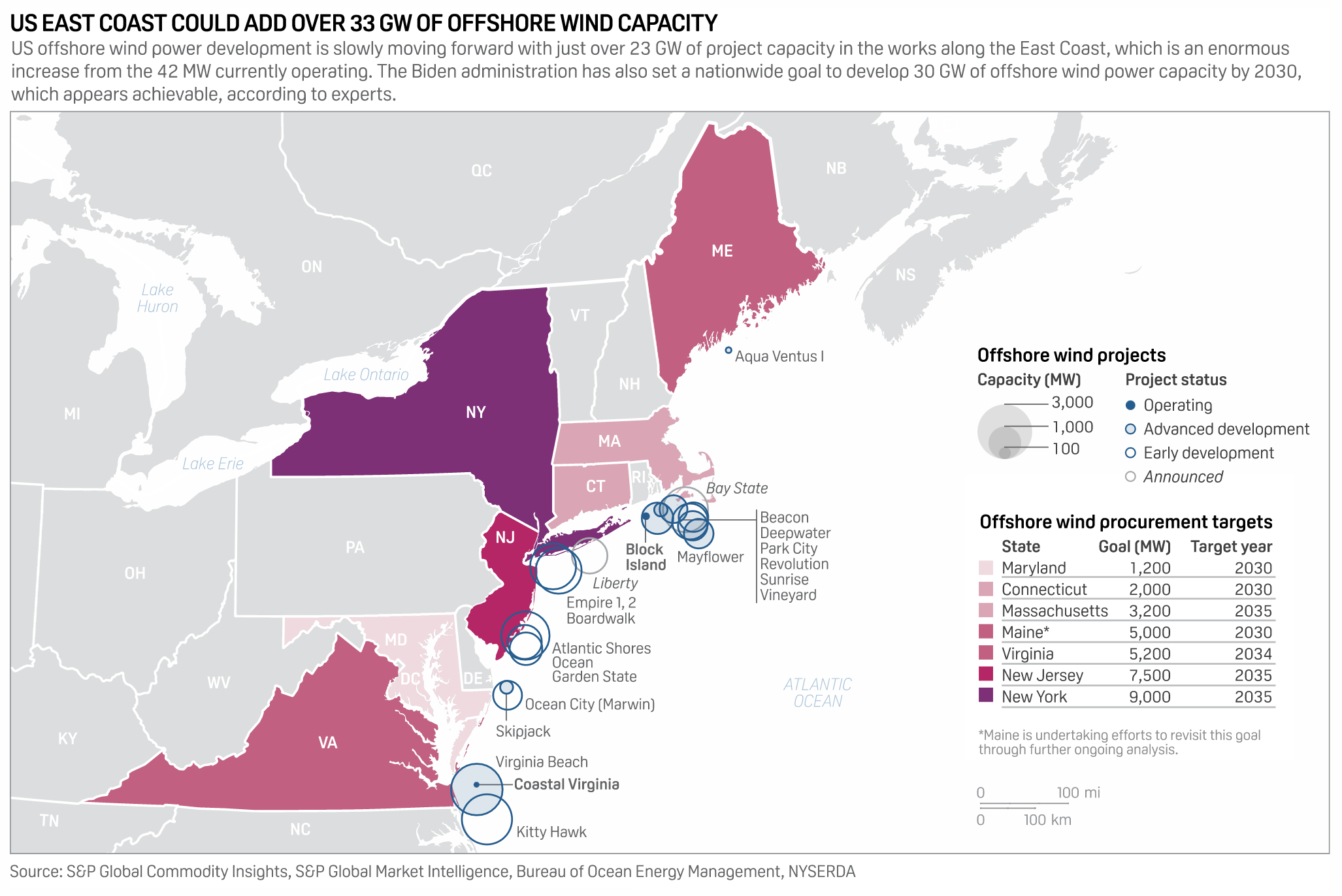

Biden Administration Creates Federal-State Offshore Wind Development Partnership

The U.S. Department of Energy said June 23 that it will lead the development of a comprehensive offshore wind supply chain roadmap to help meet the Biden administration's goal of 30 GW of offshore wind power capacity by 2030 and 100% clean electricity by 2035.

—Read the article from S&P Global Commodity Insights

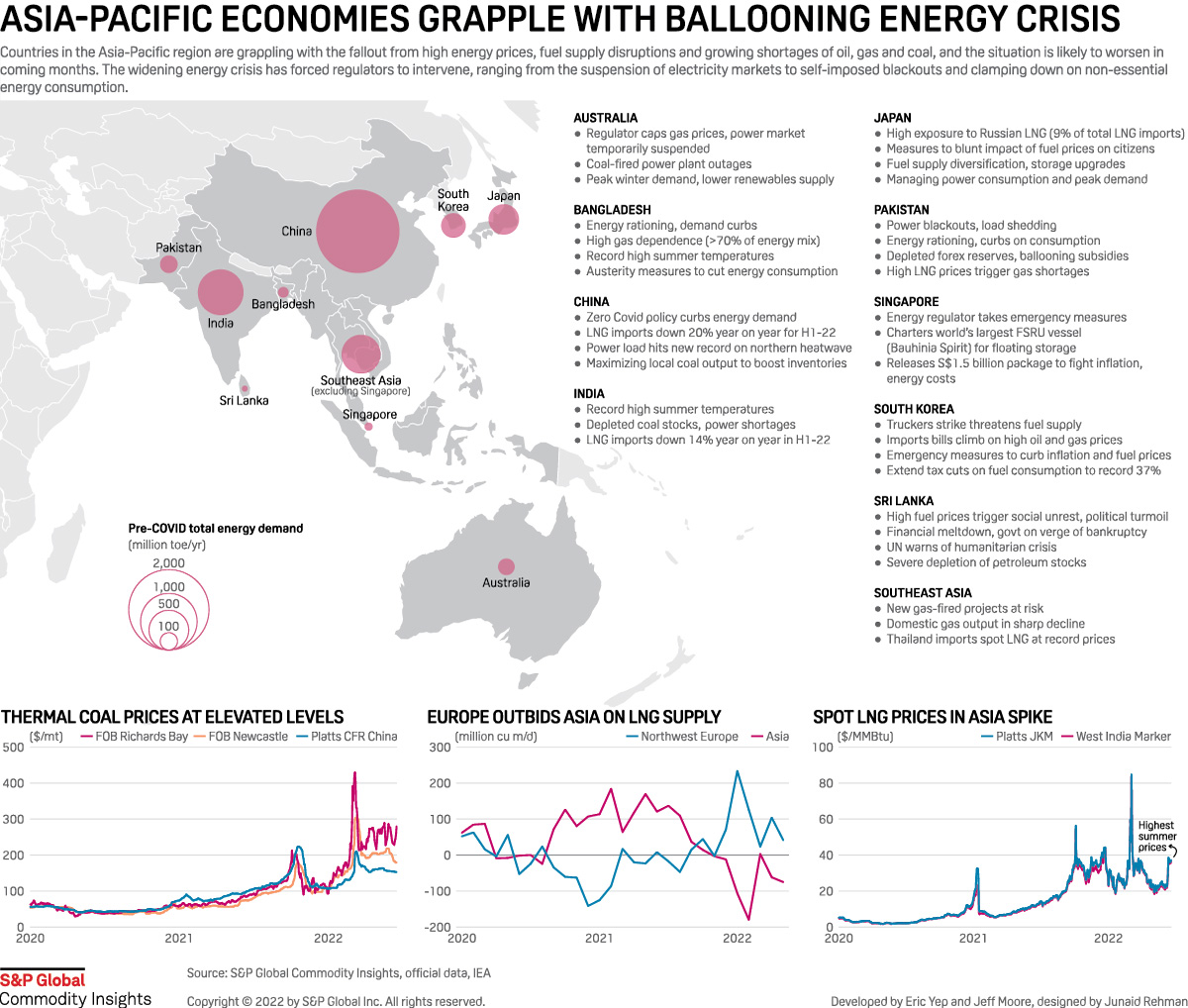

Asia-Pacific Economies Face Escalating Energy Crisis

Asia-Pacific economies are facing an energy crisis that threatens to worsen in coming months and reach historic proportions if the Russia-Ukraine war continues. The magnitude of the crisis varies in different countries but broader trends are identical – high fuel prices, supply disruptions, domestic energy shortages, blackouts, involuntary demand destruction, calculated energy rationing, depleting forex reserves and market volatility.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

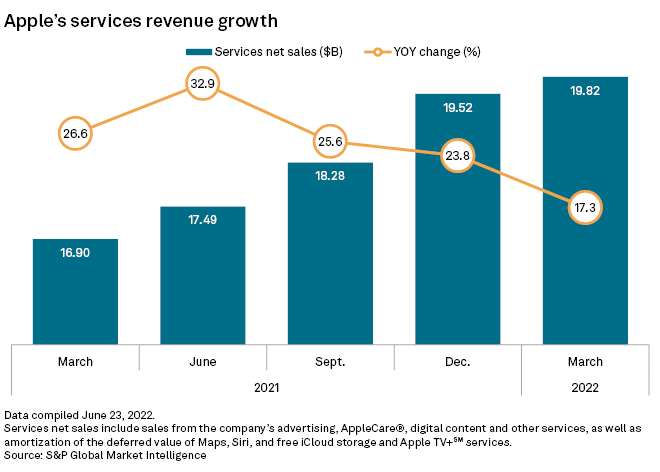

Apple Grows Gaming Market Share as App Store Dominates Mobile Space

Even though the iPhone maker does not produce any of its own gaming hardware or software, the cut it charges for every transaction within the App Store has turned the company into one of the biggest earners in the industry. Nevertheless, analysts think it is inevitable that Apple will deepen its involvement in gaming to stay abreast of evolving technology and regulatory matters.

—Read the article from S&P Global Market Intelligence

Content Type

Location

Language