Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 26 Jun, 2020

By S&P Global

The collapse of the German digital payments company Wirecard seemingly illustrates Warren Buffett’s famous aphorism: “You never know who's swimming naked until the tide goes out.”

Wirecard, long the darling of the German fintech market, filed for insolvency this week due to what it described as “excessive indebtedness.” Reports indicate that the approximately €1.9 billion ($2.1 billion) the company claimed to have on their books has either gone missing or never existed. Longtime Wirecard auditor EY indicated in a statement that there were “clear indications that this was an elaborate and sophisticated fraud, involving multiple parties around the world in different institutions, with a deliberate aim of deception.” Reports dating back years, in the Financial Times and other new outlets, have suggested that Wirecard’s challenges may be unique to a company that has struggled with balance-sheet irregularities for more than a decade.

The coronavirus pandemic and the associated lockdowns have strained all aspects of the global economy. While digital payments appear to be an area of potential growth, as consumers and retailers avoid the high-touch cash alternative, the market faces significant headwinds.

"In the next few years, I'd expect to see a lot of unicorns that have come out of this pandemic," Ritesh Jain, HSBC Holdings’ chief operating officer and global head of Digital Technology Delivery, said in May, suggesting that the pandemic could be the catalyst for the creation of new financial technology players to enter the market.

While time will tell if Mr. Jain’s prediction of billion-dollar valuations will become a reality, the early months of the pandemic have seen a fintech funding slump in affected markets. The amount of venture capital raised by financial technology companies in the Asia-Pacific region dropped 58.5%, to $1.3 billion, in the first quarter, according to S&P Global Market Intelligence. Investments have fallen in India and China, two markets that were seen as growth areas for fintech and digital payments.

The market in China has also suffered from Softbank’s ongoing effort to pare back portfolio losses. Softbank had provided Wirecard a €900 million ($1 billion) injection of cash in the form of a convertible bond as recently as April of last year. However, by September, Softbank had sold this bond to other investors through Credit Suisse.

"There is a chance or a risk that this crisis could result in a lot of creative destruction in the smaller fintech section. [If] this were to happen, it could make 'big tech' even bigger and stronger,” French economist Benoît Cœuré, who heads the Bank for International Settlements’ innovation hub, said at a June 24 press conference. “In that case, industry structure and competition will become even more important for regulators. The jury is still out, but it's a very tangible risk.”

Because Germany has long been considered a high-growth market for cashless payments, Wirecard’s insolvency may seem surprising.

"Germany is in the middle of a cash-to-electronic payments transition and there is limited time for banks to react,” Reinhard Höll, a partner at the consultancy firm McKinsey & Co., said in an interview with S&P Global Market Intelligence in February.

There are signs showing that the digital payments ecosystem remains viable as an alternative to a cash-based economy.

"Even during the height of the stress, we didn't see any real episodes of freezing up of the payments system itself, both in developing and developed economies,” Mr. Cœuré said.

Today is Friday, June 26, 2020, and here is today’s essential intelligence.

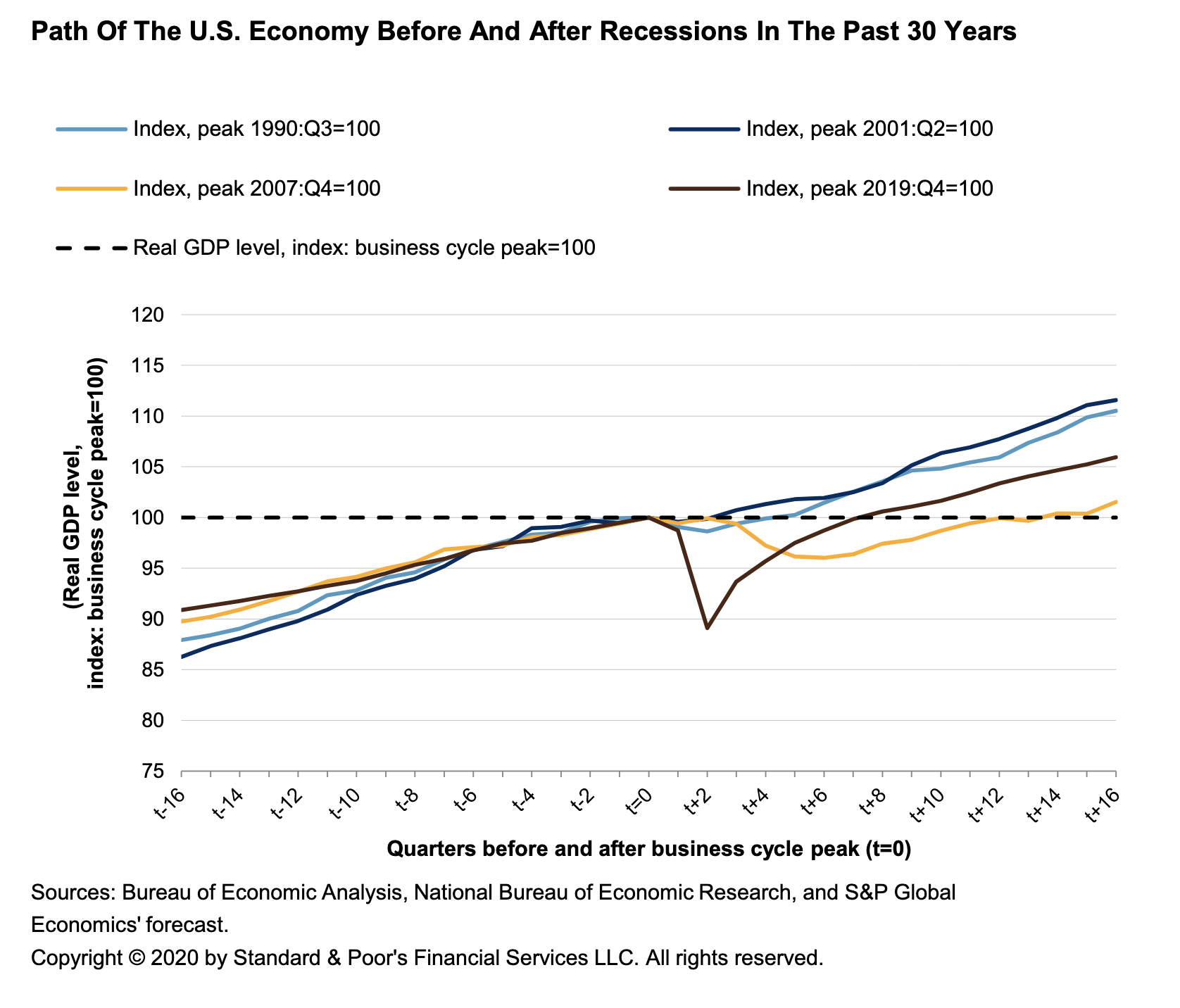

Economic Research: The U.S. Faces A Longer And Slower Climb From The Bottom

Just as fast as the U.S. economy entered recession, it may have already reached a bottom, in May. S&P Global Ratings now sees full-year GDP contracting 5.0% (was down 5.2% in our April forecast). However, the recovery will be slow, as the lingering effects of COVID-19 severely limit growth. We expect a modest rebound of 5.2% in 2021, a full percentage point weaker than our previous estimate of 6.2%. We expect a slower drift down for the unemployment rate later this year, to 8.9% in the fourth quarter, almost one percentage point higher than in our April baseline forecast. The unemployment rate won't reach pre-crisis levels until fourth-quarter 2023. The recovery remains fragile--in particular because of uncertainty about when an effective vaccine will be readily available, fears of another wave of COVID-19, and businesses that survive being reluctant to quickly rehire workers.

—Read the full report from S&P Global Ratings

VIX stays elevated as investors weigh rising COVID-19 cases against Fed support

Investors face a dilemma in their reading of capital markets. Should they be guided by the rising cases of coronavirus in the U.S. and minimize risk, or do they take on risk in the expectation that the Federal Reserve will be there to support markets once more. The resultant uncertainty can be seen in the VIX, which measures investor expectations for volatility on the S&P 500 index. The so-called Fear Index remains at historically elevated levels even after falling significantly from the record highs it reached at the beginning of the pandemic's arrival on U.S. shores in March.

—Read the full article from S&P Global Market Intelligence

Pandemic spotlights vulnerability of US reliance on foreign drug manufacturing

The COVID-19 pandemic has highlighted the urgency for the U.S. to have a stronger domestic manufacturing base for drugs, vaccines and other medical supplies after many healthcare providers found themselves unable to obtain certain medicines. Before COVID-19 struck the U.S., the Food and Drug Administration was already grappling with shortages of about 200 medicines, many of them considered essential for patient care.

—Read the full article from S&P Global Market Intelligence

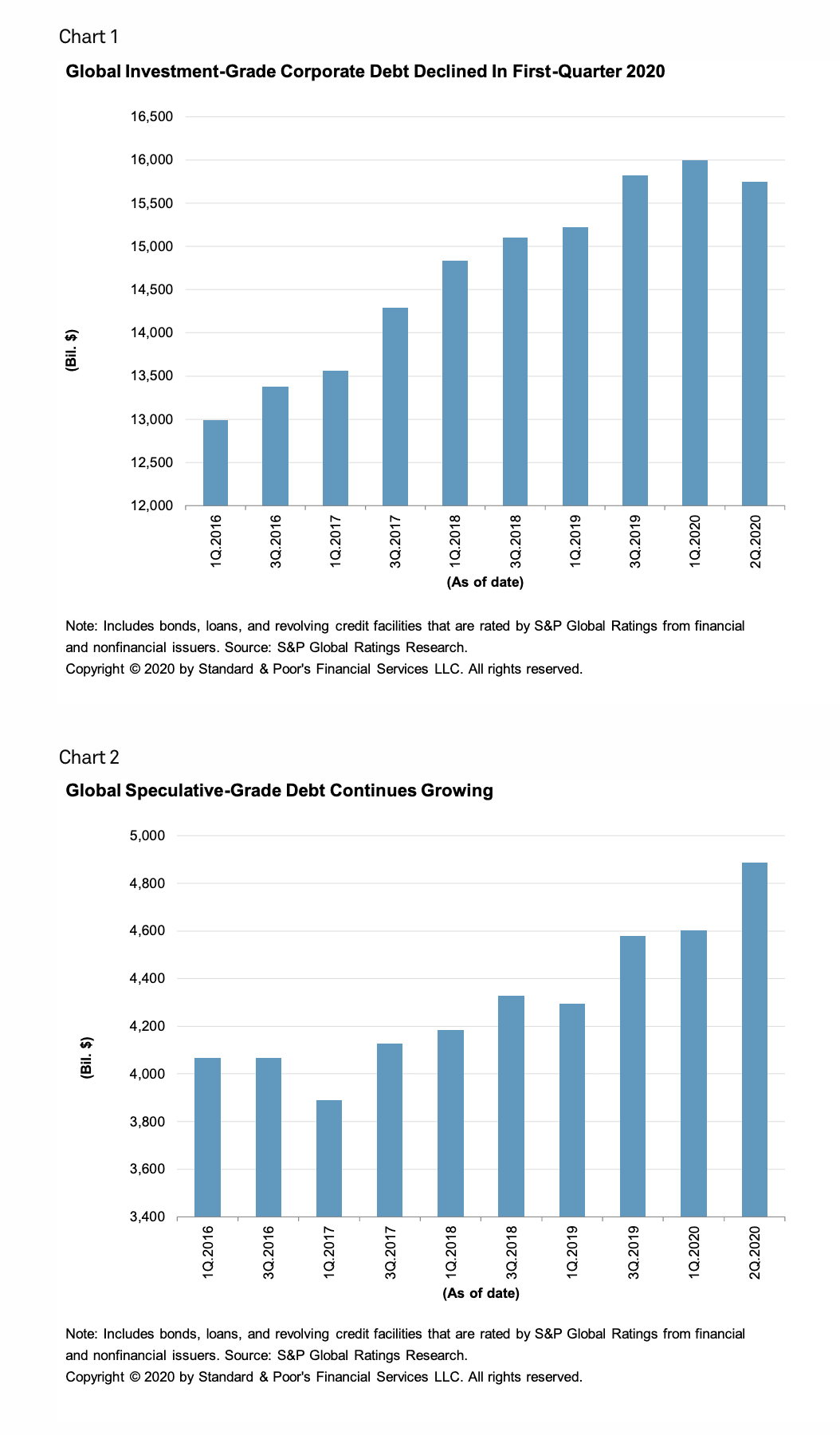

Credit Trends: Global Corporate Debt Market: State Of Play In 2020

The amount of global debt from financial and nonfinancial corporates rated by S&P Global Ratings grew by 6% from Jan. 1, 2019, to $20.6 trillion as of April 1, 2020. Following several fallen angel downgrades in first-quarter 2020, speculative-grade debt in the U.S. (including loans and revolving credit facilities in addition to bonds and notes) is now approaching $3 trillion. Since the beginning of 2019, the amount of U.S. corporate debt has grown by 10%, outpacing the 2% growth of European corporate debt.

—Read the full report from S&P Global Ratings

Despite COVID-19 Disruption, European Utilities Are Set For Growth

European utilities are showing solid credit resilience in the COVID-19 crisis: we have downgraded only 3% of our rated portfolio since March, while in total 21% have a negative outlook or CreditWatch negative. Regulated networks and long-term contracted renewables, which represent a growing proportion of utilities' core businesses, continue to offer solid growth prospects. S&P Global Ratings anticipates ongoing strong new investment by utilities over the next two to three years, while past investments will yield additional cash flows over 2021-2023 as projects are commissioned. We also expect the European Green Deal, signed in December 2019 by the European Commission, will be a key enabler of the European economic recovery, supporting investments in the energy sector. However, we believe support will be spread over the next decade rather than provide short-term help. Downside risks for the sector beyond our base case are rising bad debt and a weak power price recovery.

—Read the full report from S&P Global Ratings

Investor interest selectively returns to LatAm sovereign bond issuances

After a rapid and severe flight of capital from Latin American markets earlier in the year, some countries are seeing renewed interest by way of sovereign bond issuances, despite a worsening economic outlook for the region. Heading into 2020, sovereign issuances across Latin America were widely expected to grow over the course of the year amid stronger growth projections and easing central bank policies. S&P Global Ratings forecast a 3.8% rise in bond issuances for the region, and Ecuador started the year with a $400 million social bond, the first Latin American country to issue such an instrument. Those expectations flipped on their head, however, with the coronavirus pandemic. Investment capital fled emerging markets at a record pace, and credit default swaps — a key measurement of credit risk — skyrocketed.

—Read the full article from S&P Global Market Intelligence

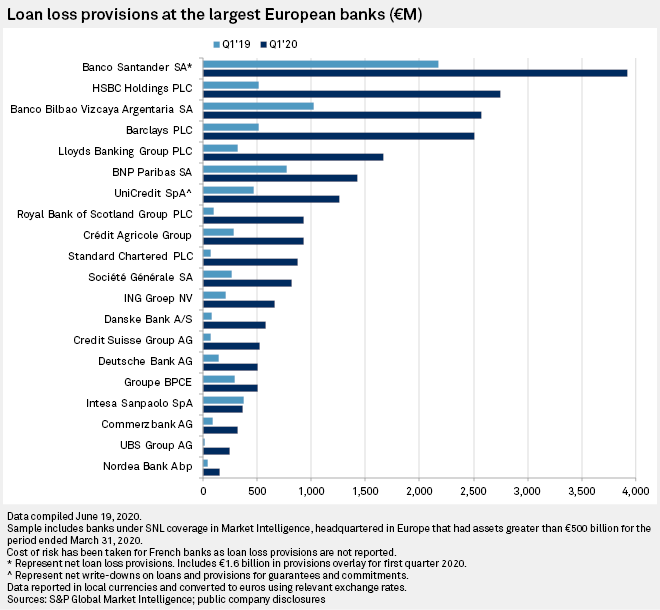

Market pushes for transparency around European banks' expected credit losses

As post-2008 accounting rules face their first real test amid the coronavirus pandemic, banks need to be transparent about their expected credit loss models to help the market understand how well they are faring, according to analysts. The crisis triggered a spike in first-quarter loan loss provisions across the board, but amounts diverged widely between European banks. Among a sample of the largest European banks by assets, Spain's Banco Santander SA recorded provisions of €3.93 billion, while Finland-based Nordea recorded just €154.0 million.

—Read the full article from S&P Global Market Intelligence

CLO exposure among US banks drops slightly in Q1

Collateralized loan obligation holdings at U.S. banks dipped slightly in the first quarter to just under $99 billion, compared to $99.5 billion as of the end of the fourth quarter of 2019, according to bank regulatory filings with the Federal Reserve System. JPMorgan Chase & Co. is again the largest holder of CLO securities as of March 31, growing its total holdings to just under $34 billion in the first quarter, compared to $29.8 billion at the end of 2019.

—Read the full article from S&P Global Market Intelligence

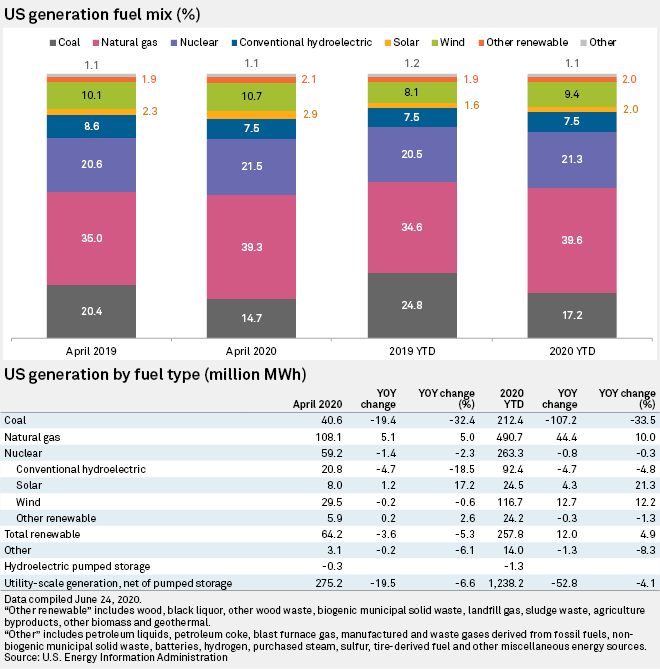

Renewable generation eclipses coal, nuclear for 2nd straight month in April

Although U.S. net generation in April fell 6.6% below the same month in 2019, renewable generation has continued to grow as a source of the nation's supply and surpassed nuclear and coal for the second month in a row. Renewables accounted for 23.3% of the total, expanding its lead on nuclear generation as the second-largest source of power supply. Nuclear generation made up 21.5% of the nation's electricity, while gas-fired generation remained the largest supplier of power with a 39.3% share.

—Read the full article from S&P Global Market Intelligence

Study quantifies carbon prices needed to meet New England climate targets

Considerable progress toward Northeast US decarbonization can be supported by a progressively increasing price for carbon dioxide emissions in a range of $25 to $35/short ton CO2 in 2025 and $55 to $70/st CO2 in 2030 and 2035, according to a study released this week. The New England Power Generators Association trade group commissioned a report that outlines a pathway to meet New England states' economy-wide decarbonization goals.

—Read the full article from S&P Global Platts

UK's Committee on Climate Change calls for sustainable recovery plan

The UK's official advisory body on climate change has urged the government to speed up planning for a post-pandemic economic recovery, setting out a range of recommendations to achieve a net-zero emissions target sooner while protecting the economy from future climate shocks. In its annual report on emissions reductions to parliament on June 25, the influential Committee on Climate Change said emphasizing green investments, including on energy networks and new technologies such as green hydrogen, could speed up progress on climate targets and position the UK as an international leader on climate action ahead of the COP26 climate summit in 2021.

—Read the full article from S&P Global Platts

'The worst is behind us': Analysts see continued recovery for global oil markets

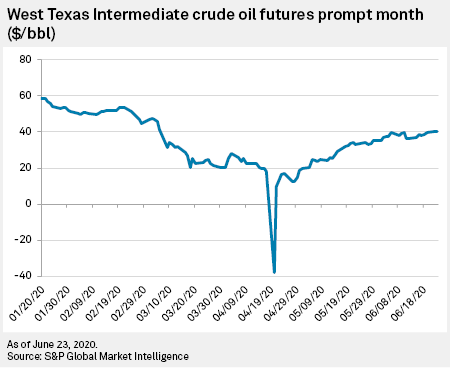

After reaching historic lows in April, global oil prices could continue to chop higher in the coming months as COVID-19 shelter-in-place restrictions begin to lift. Speaking at the Global Executive Petroleum Virtual Conference hosted by S&P Global Platts on June 24, analysts pointed to reduced global supply and the faster-than-expected return of demand keeping both Brent and West Texas Intermediate crude prices on an upward trajectory. Most analysts see prices stabilizing between $50 per barrel and $60/bbl by year's end, still shy of pre-pandemic levels. "We think the worst is behind us," Neil Atkinson, head of oil markets at the Paris-based International Energy Agency, said at the conference. "The market is gradually adjusting."

—Read the full article from S&P Global Market Intelligence

INTERVIEW: Gas crunch looms on project deferrals, but no worries for oil: EY's Brogan

Fears of a crude supply crunch in the coming years are overblown, as economically driven shut-ins, particularly in the US shale patch, could be reversed with relative ease, but that is not the case for gas as the spate of project deferrals could eventually lead to shortages, the head of oil and gas for consultancy EY, Andy Brogan, said in an interview with S&P Global Platts. While gas prices were currently depressed and looked likely to remain so for the next few years due to overcapacity, overall gas demand was expected to continue rising. Eventually, demand would outpace new supply additions, given that a number of new LNG projects had been canceled or deferred due to market conditions, Brogan said.

—Read the full article from S&P Global Platts

Analysis: China's steel market to remain balanced as 2020 output reaches 1 bil mt

The supply and demand dynamics in China's steel market look set to remain in balance over the second half of 2020 as its steel capacity expansion has slowed, while downstream infrastructure and construction demand is being aided by looser credit policies. As a result, S&P Global Platts maintains its 2020 forecast that China's pig iron and crude steel output will increase by around 1.7% and 2%, respectively, year on year. This will take crude steel output to 1,016 million mt for 2020, up from 996 million mt in 2019, and breaching the 1 billion mt mark for the first time, Platts estimates.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language