Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 23 Jun, 2020

By S&P Global

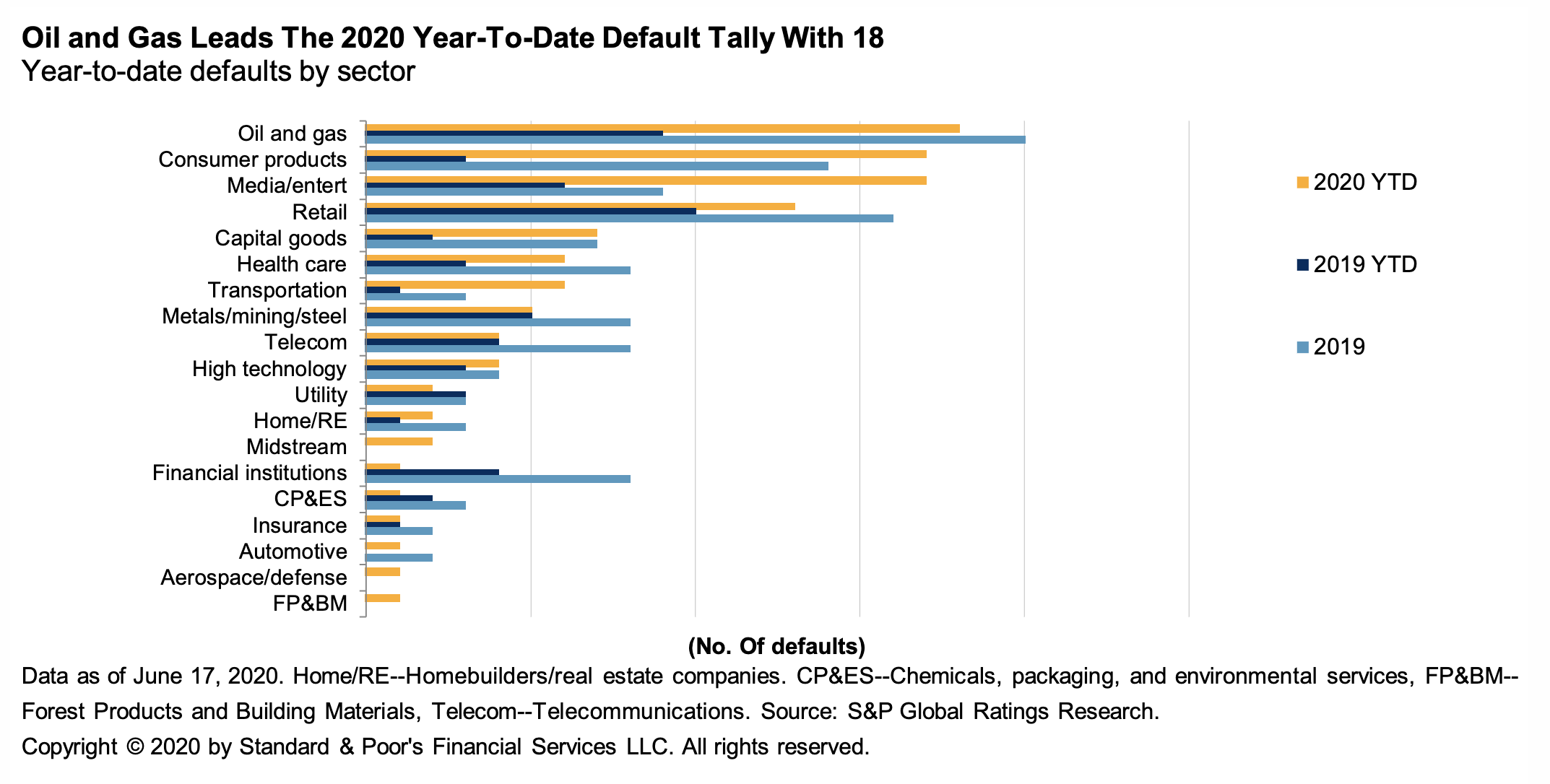

With the global year-to-date corporate default tally reaching 109 last week, the oil and gas sector is caught in the crossfire of uncertainty and volatility—accounting for 18 of the defaults, the most of any sector suffering in the pandemic-caused downturn, and at a record pace compared to the 20 oil and gas defaults in all of 2019, according to S&P Global Ratings.

“The pace of [overall] defaults has risen considerably as many firms, particularly at the low end of the ratings spectrum, struggle to refinance debt given substantive weakness in revenues due to COVID-19 and the subsequent weak economic environment,” S&P Global Ratings said in a June 19 report. “With the collapse of oil and gas prices in the beginning of 2020, the majority of speculative-grade issuers in the riskier 'B' or lower rating categories have had difficulty issuing unsecured debt or equity due to limited investor appetite. As these issuers wrestle with refinancing risks from a lack of market access, we can expect more defaults.”

“Ever since the [Federal Reserve] released its tsunami of credit, credit markets have rallied the most since the depth of the Global Financial Crisis,” S&P Dow Jones Indices’ Director of Fixed Income Indices, Kevin Horan, said in a June 19 article. “Continued central bank actions have driven the already existing trend toward demand for higher-yielding assets, helping companies issue debt with fewer lender safeguards and covenants. With the Fed willing to support the markets and be the buyer of last resort, credit spreads have tightened since March.”

“In the U.S. and Canada, where low oil prices and demand weakness from the COVID-19 pandemic are hitting drillers particularly hard, international law firm Haynes and Boone LLP reported the number of oil and gas producers filing for bankruptcy increased to 14 in the second quarter of 2020, up from five during the first quarter. The 19 bankruptcies announced so far this year involved a combined debt of approximately $13.1 billion,” according to S&P Global Market Intelligence.

An S&P Global Market Intelligence analysis found that at least 11 U.S. interstate natural gas pipelines are exposed to producer shippers that have either filed for Chapter 11 bankruptcy protection or are expected to in the near future, and some of the pipeline operators have either lost their investment-grade credit ratings or are at high risk of doing so.

Governments’ stay-at-home and coronavirus-containment measures impacted oil demand in April and May. After Saudi Arabia and Russia fought a weeks-long oil price war, OPEC agreed in a historic decision on April 12 to cut the organization’s production by 9.7 million barrels a day in May and June, and steadily increase production until the agreement’s expiration in 2022. Shortly after, on April 20, the front-month NYMEX WTI crude benchmark oil price settled in negative territory for the first time ever.

Oil demand has since recovered from those lows, but as the global economy starts its recovery from the crisis, many nations are integrating green principles into their energy plans—and many corporates in the oil and gas sector may never recover.

“Governments have a once-in-a-lifetime opportunity to reboot their economies and bring a wave of new employment opportunities while accelerating the shift to a more resilient and cleaner energy future,” International Energy Agency Executive Director Dr. Fatih Birol said in a June 18 statement announcing the organization’s Sustainable Recovery Plan in partnership with the International Monetary Fund, which “lays out the data and analysis showing that a cleaner, fairer and more secure energy future is within our reach.”

Today is Tuesday, June 23, 2020, and here is today’s essential intelligence.

Online grocery growth softens as COVID-19 restrictions ease

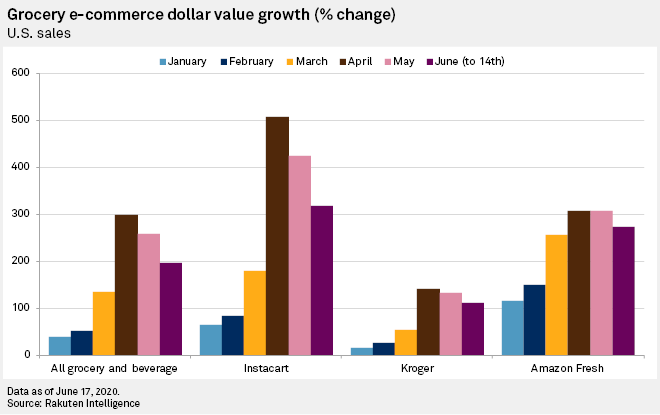

Coronavirus was a boon for online grocery sales in March and April. But that momentum is starting to wane as stay-at-home orders ease and stores return to normalcy. For the first half of June, the growth of U.S. online grocery orders in dollar terms slowed to 200% from 300% expansion in April, according to data compiled by Rakuten Intelligence that is based on sales at 34 companies, including grocery delivery service Instacart, The Kroger Co. and Amazon.com Inc.'s Amazon Fresh operations. All three of those companies are digesting slowdowns in online order growth.

—Read the full article from S&P Global Market Intelligence

US automakers accelerate online selling options during COVID-19 pandemic

Major U.S. automakers are expanding online sales options during the coronavirus pandemic, a trend that experts say is likely to accelerate even as the largest companies remain reliant on dealerships. Automakers began expanding their online presence to encourage vehicle sales as government orders that closed businesses, including dealerships, and kept consumers at home caused a drop in demand for new vehicles in the first quarter of 2020 and prompted experts to shave their full-year sales forecasts.

—Read the full article from S&P Global Market Intelligence

Default, Transition, and Recovery: Energy-Sector Stress Boosts The 2020 Corporate Default Tally To 109

The 2020 global corporate default tally has reached 109 after eight issuers defaulted since S&P Global Ratings’ last report. With three defaults this week, the oil and gas sector now leads the default tally with 18, compared with the 2019 year-end total of 20. Of these, the U.S. leads with 12, followed by Europe and the emerging markets, with three each. "The pace of defaults has risen considerably as many firms, particularly at the low end of the ratings spectrum, struggle to refinance debt given substantive weakness in revenues due to COVID-19 and the subsequent weak economic environment," said Sudeep Kesh, head of S&P Global Credit Market Services.

—Read the full report from S&P Global Ratings

Like the Virus, Credit Spreads Could Be at Risk of a Possible Second Wave

Ever since the Fed released its tsunami of credit, credit markets have rallied the most since the depth of the Global Financial Crisis. Continued central bank actions have driven the already existing trend toward demand for higher-yielding assets, helping companies issue debt with fewer lender safeguards and covenants. With the Fed willing to support the markets and be the buyer of last resort, credit spreads have tightened since March 2020. The option-adjusted spread (OAS) of the S&P U.S. Investment Grade Corporate Bond Index and the S&P U.S. High Yield Corporate Bond Index reached a YTD peak on March 23, 2020, while returns hit a low on March 19. Leveraged loans’ spread to Libor, as measured by the S&P/LSTA Leveraged Loan Index, topped out at L+980 on March 20.

—Read the full article from S&P Dow Jones Indices

Insurers' Debt Remains Attractive To Investors During COVID-19 Uncertainty

Investors are particularly sensitive to credit quality when the economic environment is uncertain, which should advantage insurers' issuances. This is due to the relatively strong credit quality of insurers, which shines when compared with nonfinancial corporate sectors. S&P Global Ratings expects the sector to tap the debt market and refinance, as needed, its upcoming redemptions in line with investor expectations. In the hybrid space, we see the risk of non-call as very remote, particularly given that the potential financial savings from a non-call (even on a pretax basis) are relatively modest. Despite higher credit spreads triggered by the pandemic-induced recession and market jitters, insurers are still accessing the debt capital markets at favorable coupon rates. We estimate that about $140 billion (or 20% of total outstanding debt) of debt is coming for call or maturity by Dec. 31, 2021.

—Read the full report from S&P Global Ratings

Construction loan delinquencies at US banks climbed 23.8% in Q1

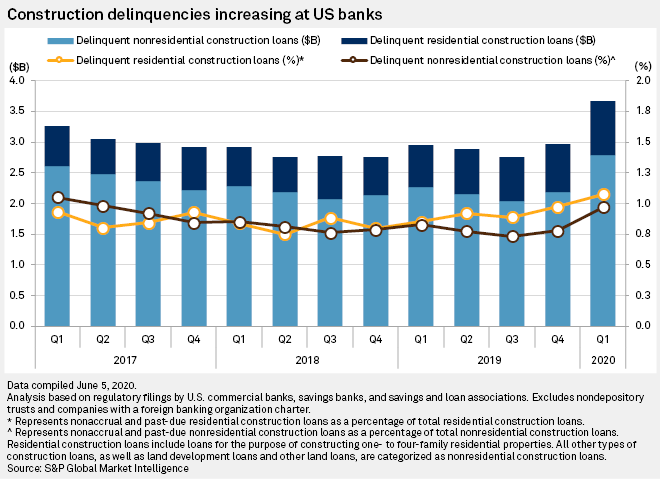

Construction loan delinquencies at U.S. banks rose in the first quarter in both absolute and relative terms while banks' outstanding construction loans as a share of total loans fell for the fourth straight quarter. The COVID-19 pandemic, which struck much of the U.S. near the end of the quarter, forced many developers to shut down or delay their projects, in some cases amid government-mandated work stoppages. While the months in which the virus' impact was most severe are not included in the data, many individual lenders said in earnings calls that their construction books were well-structured to withstand a downturn.

—Read the full article from S&P Global Market Intelligence

Bank credit performance in limbo as massive experiment in forbearance unspools

U.S. bank disclosures about loan payment deferrals have quickly turned from unequivocally frightening to somewhat comforting in that they are not as bad as they might have been. But as with recent employment figures, the end game remains unclear. The process of bringing back workers could be derailed by new surges in COVID-19 infections. Meanwhile, more borrowers may need to skip payments if federal cash infusions run out without another relief package. The extent of the damage will depend on how many borrowers are just temporarily out of work because of the pandemic, and how many face long-term unemployment.

—Read the full article from S&P Global Market Intelligence

ABA backs bill supporting brokered deposits; Main Street program up and running

The American Bankers Association published a letter June 16 supporting a bill introduced by Sen. Jerry Moran, R-Kan., that would lift restrictions on brokered deposits — a move sought for years by the banking industry, which has argued that the current rules no longer reflect modern times. Fed Chairman Jerome Powell shed some light on the U.S. economic outlook on the first day of his two-day testimony in Congress last week. More in the Washington Wrap, a weekly recap of financial regulation, news, and chatter from around the capital.

—Read the full article from S&P Global Market Intelligence

Watch: Market Movers Europe, Jun 22-26: Compliance and green credentials in the spotlight

In this week's Market Movers: the rise in emissions prices will be watched closely by a wide range of industries, the world's biggest steelmaker will unveil plans to go green, and storage injections are the focus of the gas market.

—Watch and share this video from S&P Global Platts

Oil demand faces new threat as 'green recovery' hopes take root

As the world emerges from the economic wastelands of the coronavirus pandemic, hopes are growing that climate-friendly policies and behavior changes will speed the transition away from fossil fuels. But there may be speed bumps along the way. Political parties, business leaders and environmental groups are calling for a 'green recovery' to transform the global economy in the wake of the pandemic. Many believe the push will accelerate the demise of the era of oil.

—Read the full article from S&P Global Platts

Japan green bond issuance in 2020 may fall from record high as COVID-19 rages

Japan's green bond issuance may drop this year for the first time in at least seven years, with many climate-responsible projects likely to take a back seat while companies focus on surviving the economic downturn due to prolonged coronavirus interruptions, experts say. The world's third-largest economy is likely to issue $4.5 billion to $5.0 billion worth of green bonds in 2020, according to an estimate by Climate Bonds Initiative, or CBI, a U.K. nonprofit organization that created the green bond standards. It will be down from $7.2 billion last year, the highest volume recorded since 2014, when aggregate data became available.

—Read the full article from S&P Global Market Intelligence

A Pandemic-Driven Surge In Social Bond Issuance Shows The Sustainable Debt Market Is Evolving

S&P Global Ratings expects social bonds to emerge as the fastest-growing segment of the sustainable debt market in 2020. This stands in sharp contrast to the rest of the global fixed income market, for which we expect issuance volumes to decline this year. We believe recent growth in social bond issuance indicates that the COVID-19 pandemic has not turned issuers' or investors' attention away from sustainable finance, but rather interest seems to be growing. Corporations and financial institutions will become more active in the social bond market as the pandemic accelerates private issuers' interest in social considerations. While significant steps have been made to standardize social bond disclosure and reporting, we believe issues persist and improvements have been slow to proliferate.

—Read the full report from S&P Global Ratings

Taking Up the Challenge of Turbulent Markets with ESG and Multi-Assets

After a long bull market, the COVID-19 pandemic has shaken the financial markets and put the question of how to earn a smooth return stream over a long period of time back on the table. This has given rise to a strengthening of conviction toward environmental, social, and governance (ESG) investing and risk management. S&P Dow Jones Indices recently launched the S&P ESG Global Macro Index, which is designed to deliver stable returns through various market conditions and to align investments with ESG values. The index exploits dynamic allocation between regional diversified bonds and ESG-themed equities based on economic and market trend signals and aims for a stable risk level by adjusting allocation between the portfolio and cash on a daily basis.

—Read the full article from S&P Dow Jones Indices

Written and compiled by Molly Mintz.

Content Type

Location

Language