Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 Jun, 2021

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.The Mexican government has recently issued a range of new regulations for the midstream and power sectors that have had broad implications for the country’s energy industry. The outcome of Mexico's June elections will be decisive for the future energy landscape as President Andres Manuel Lopez Obrador seeks to gain enough support to revise the country's constitution and end the country's energy liberalization. The counter-reform, which the government said is aimed at restoring order and reducing corruption, would reverse President Enrique Pena Nieto’s opening of the public energy sector to investment in 2013—through which the private sector had hoped to modernize the country's infrastructure and secure more market share. While his predecessor had believed opening up the energy sector to broader competition would bring billions of dollars of investments into the country, President Lopez Obrador has utilized the lack of results as a foundation for his actions to undo the original reforms. "The president has been very consistent in his discourse and has kept his promises. The president has said he wants to do this, and so nobody should feel surprised of what he has attempted in the energy sector," Rodrigo Montes de Oca, a research scholar at the Baker Institute Center for the United States and Mexico, told S&P Global Platts. President Lopez Obrador has argued that private companies’ participation in the country’s energy market isn’t a necessity. Over the last 18 months, he has limited the involvement of private players by preventing companies holding electricity generation permits from moving forward with their plans and increasing requirements for companies looking to obtain permits to import fuels. "The attack on the industry will go on. I do not see the president changing his discourse and allowing the participation of private companies in the sector," Paul Alejandro Sanchez Campos, a Mexico-based energy consultant, told S&P Global Platts, adding that President Lopez Obrador’s attack on energy liberalization won’t escalate much further if his party doesn’t win a majority, but the energy sector will likely remain stagnant for at least three more years. Official projections based on the early voting results out of Mexico’s June 6 midterm elections, published by the country’s National Electoral Institute, showed that President Lopez Obrador’s MORENA party will likely not win the two-thirds majority needed to make amendments to the constitution and alter policies and institutions. “Mexico's negative attitude towards private investment comes at a time when other countries in the region like Argentina, Brazil, Colombia, and Guyana, are opening their arms to foreign capital to develop their reserves. Natural resources are the same everywhere. Investors do not care where the money goes, as long as there are returns,” S&P Global Platts senior oil writer Sheky Espejo said in a commentary earlier this year. “Mexico has plenty of resources: the geology is not in question. It is the business environment that is broken, and that will take years to fix.” Today is Monday, June 14, 2021, and here is today’s essential intelligence.

'Meme Stocks' Fall as Regulation Looms; Big Tech Stocks Unfazed by G-7 Proposal

Fears of increased regulatory oversight in the "meme stock" space led to some big drops for the week ended June 10. In prepared remarks at the Piper Sandler Global Exchange and Fintech Conference, U.S. Securities and Exchange Commission Chair Gary Gensler on June 9 said the Commission's current rulebook was created for a trading environment that no longer reflects today's markets.

—Read the full article from S&P Global Market Intelligence

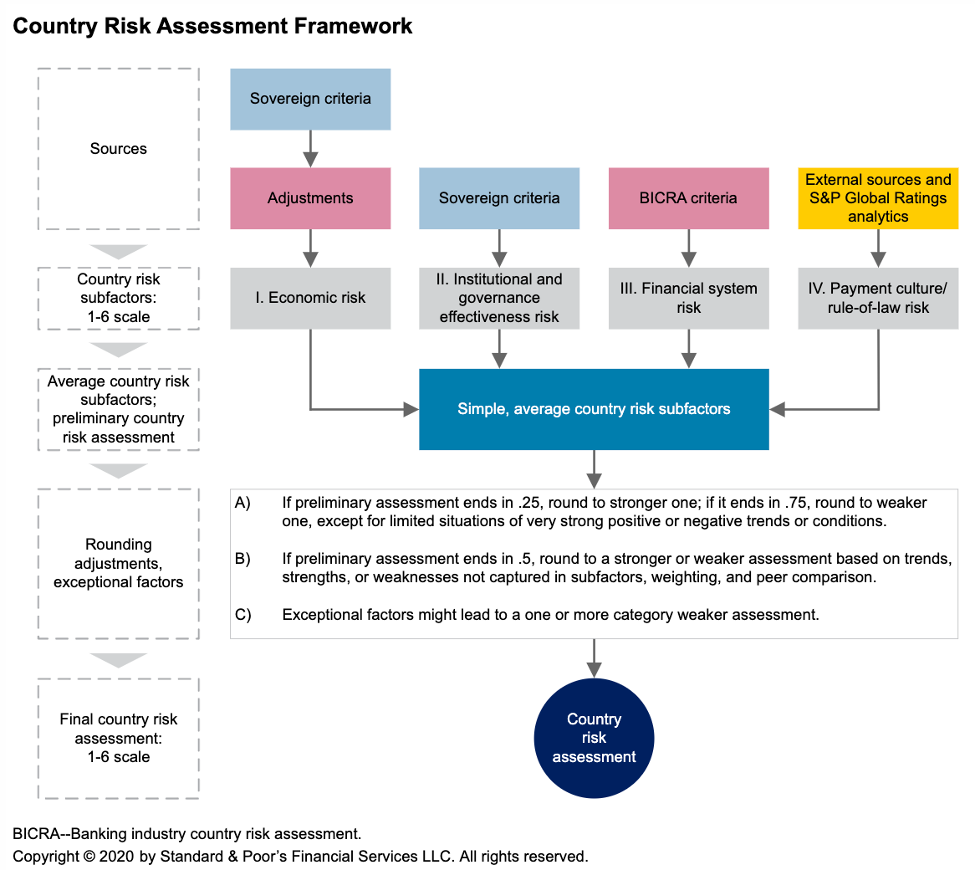

Country Risk Assessments Update: June 2021

This article presents updates to S&P Global Ratings' country risk assessments. S&P Global Ratings defines "country risk" as the broad range of economic, institutional, financial market, and legal risks that arise from doing business with or in a specific country and can affect a nonsovereign entity's credit quality.

—Read the full report from S&P Global Ratings

Listen: Fixed Income in 15 – Episode 19

On this edition of Fixed Income in 15, Joe Cass is joined by Sir Danny Alexander, Vice President and Corporate Secretary at the Asian Infrastructure Investment Bank and Susan Gray, our Global Head of Sustainable Finance Business and Innovation. Topics included the evolution of sustainable finance in infrastructure and platforms issuers are using to ensure their ESG strategy is being heard. There was also some off-topic discussion on politics, with Danny talking about his time as the Chief Secretary to the Treasury in the UK and Susan describing her experiences as a policy advisor in the Australian government.

—Listen and subscribe to Fixed Income in 15, a podcast from S&P Global Ratings

North America Is Catching Up on Battery Recycling Infrastructure - Li-Cycle CEO

Ballooning demand for electric vehicles is driving a recent surge in lithium-ion battery manufacturing. The trend is prompting demand for battery recycling infrastructure to minimize waste and feed secondary materials back into the supply chain. S&P Global Market Intelligence spoke with Li-Cycle CEO and President Ajay Kochhar about the company's approach to reintroducing recycled battery metals to the economy.

—Read the full article from S&P Global Market Intelligence

Feature: IEA's Net-Zero Roadmap Is Unrealistic, Lacks Localized Approach - Chinese Experts

China's energy experts expressed concerns over the International Energy Agency's net-zero emissions pathway citing the lack of a differentiated approach between developed and developing countries as well as unrealistic milestones to phase out fossil fuels. They said the IEA's ambitious milestones were arduous given China's continued energy demand growth, coal-dominant electricity system, and yet-to-be-reinforced market mechanisms for electricity and carbon pricing, and suggested a localized approach.

—Read the full article from S&P Global Platts

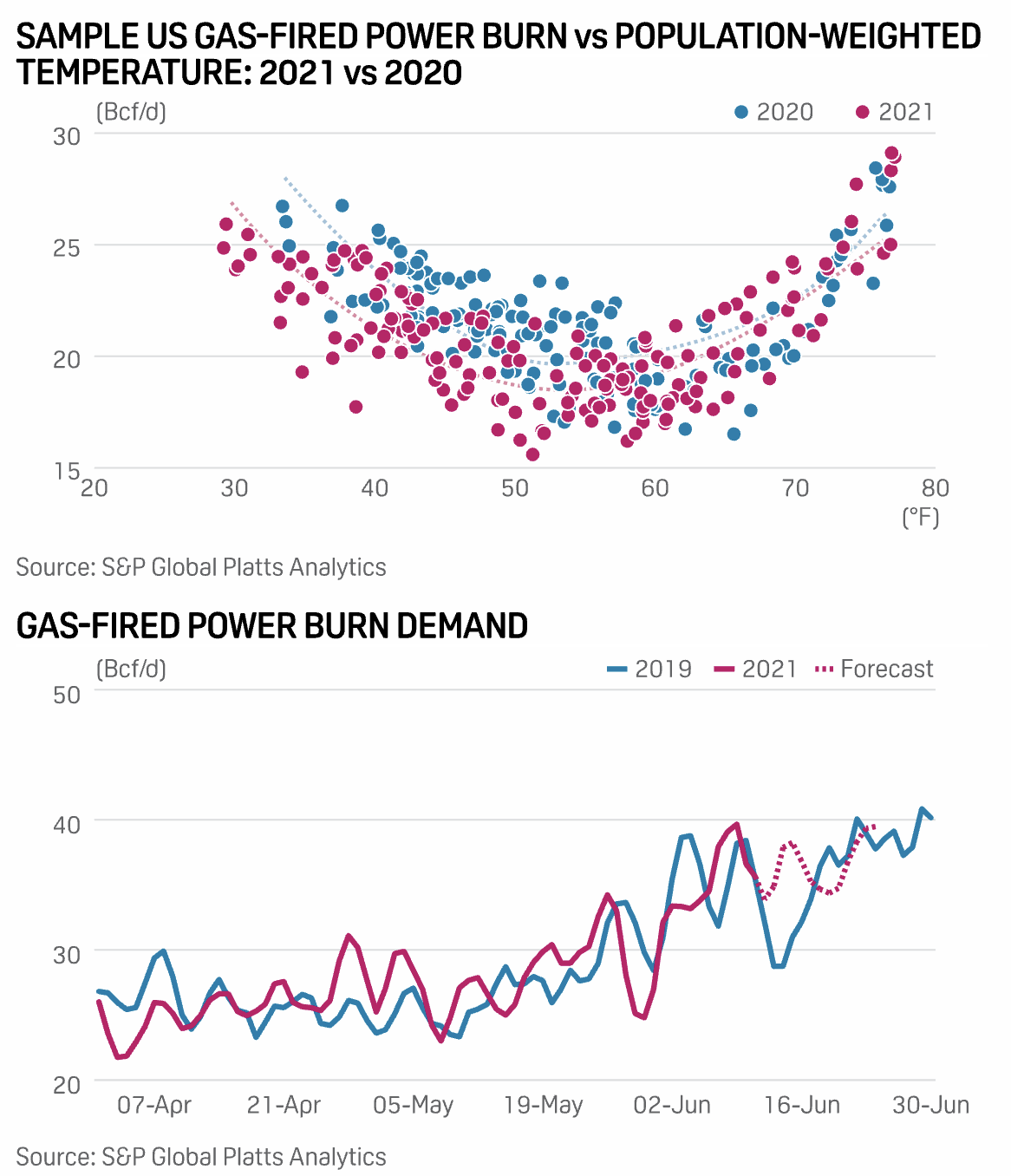

Hot Weather, Lower Wind Output Lift Gas Generation; Prices Remain A Risk

Toasty early-summer weather and falling wind generation have lifted US gas-fired power burn to seasonal highs this month, but rising gas prices threaten to put a damper on the rally. On June 9, total demand from generators topped 39.6 Bcf/d, marking a record high for demand in any late-spring period prior to the June 20 official start to summer, S&P Global Platts Analytics data shows.

—Read the full article from S&P Global Platts

IEA Urges OPEC+ to 'Open the Taps' as Global Demand Seen Rising 3.1 Mil B/D In 2022

Global oil demand is set to rise by 3.1 million b/d in 2022, returning to pre-pandemic levels by the fourth quarter, the International Energy Agency said June 11, warning that a "chasm" could open between supply and demand in the second half of this year if OPEC+ nations do not respond.

—Read the full article from S&P Global Platts

Closures, Conversions to Partially Offset New Refining Capacity: IEA

Announced refinery closures or conversions to biorefineries will partially offset new capacity coming online in this year and in 2022, the International Energy Agency said in its latest monthly report.

—Read the full article from S&P Global Platts

FEATURE: European ETBE to Find Support From E10 Gasoline Uptake

The European ETBE market will find support from the upcoming E10 fuel uptake in Sweden and the UK as the availability of feedstock ethanol is expected to tighten, according to sources.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Language