Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 10 Aug, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

India Defies a Venture Capital Slowdown

In honor of our new “Look Forward” report on India, this week’s Daily Updates will cover different aspects of the Indian economy.

In mid-2022, a red-hot venture capital market abruptly turned ice cold. While venture funds struggled to raise capital and many venture-backed companies had to settle for down rounds, India became the fourth-most popular location for startups and venture funding worldwide. Defying the global slowdown, India increased its share of venture funding to 4.2%, behind the US (41%), mainland China (18%) and the UK (6%), according to S&P Global Market Intelligence. The sudden interest in Indian startups owes a great deal to favorable demographics, startup-friendly government policies and an explosion of scrappy new businesses in every industry from financial technology to electric vehicles. Sampath Sharma Nariyanuri of S&P Global Market Intelligence and Shankar Krishnamurthy of S&P Global examined the fast-growing Indian startup scene in their article “Startups Riding Digital Infrastructure Could Transform Indian Economy.”

All venture capital firms are looking for investments with significant runways to expansion. Achieving 100x valuations on their investments requires the perception of limitless possible growth. India offers this potential, with a population of 1.4 billion people and an economy well on its way to becoming the third largest in the world by 2030.

In a country with a growing working age population and increasing personal wealth, fintech is an especially attractive investment opportunity. Fintech firms in India attracted $9.7 billion in investment in 2021 and 2022, leading all other sectors. India is still largely unbanked, and fintech firms are becoming the de facto distribution platform to sell loans, wealth management products and credit cards to consumers.

Fintech firms are among the beneficiaries of government programs that seek to benefit startups. The Indian government has sponsored API infrastructures that ease consent-based sharing of financial data and help underbanked individuals and small businesses access credit. Fintech, e-commerce and marketplace apps have integrated the Account Aggregator network and the Open Credit Enablement Network to execute lending workflows online. Another state-sponsored initiative is the Open Network for Digital Commerce, which allows customers of one e-commerce app to purchase goods from vendors listed on other participating apps. This encourages startups to differentiate on customer service and convenience, rather than creating closed-loop networks driven by noncompete agreements.

Sectors such as ag-tech, electric vehicles, automation and clean technology are seen as high-growth areas for Indian startups. Investors are also eyeing space technology, artificial intelligence, drones and robotics. With an estimated 92,000 startups, according to the Department for Promotion of Industry and Internal Trade as of Feb. 28, 2023, India is a target-rich environment for international venture capital firms tired of competing in the oversubscribed US and Chinese markets. While it is likely the global funding crunch will affect later-stage Indian startups, there are an abundance of smaller firms with lower capital needs that will probably continue to attract funding.

Today is Friday, August 11, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

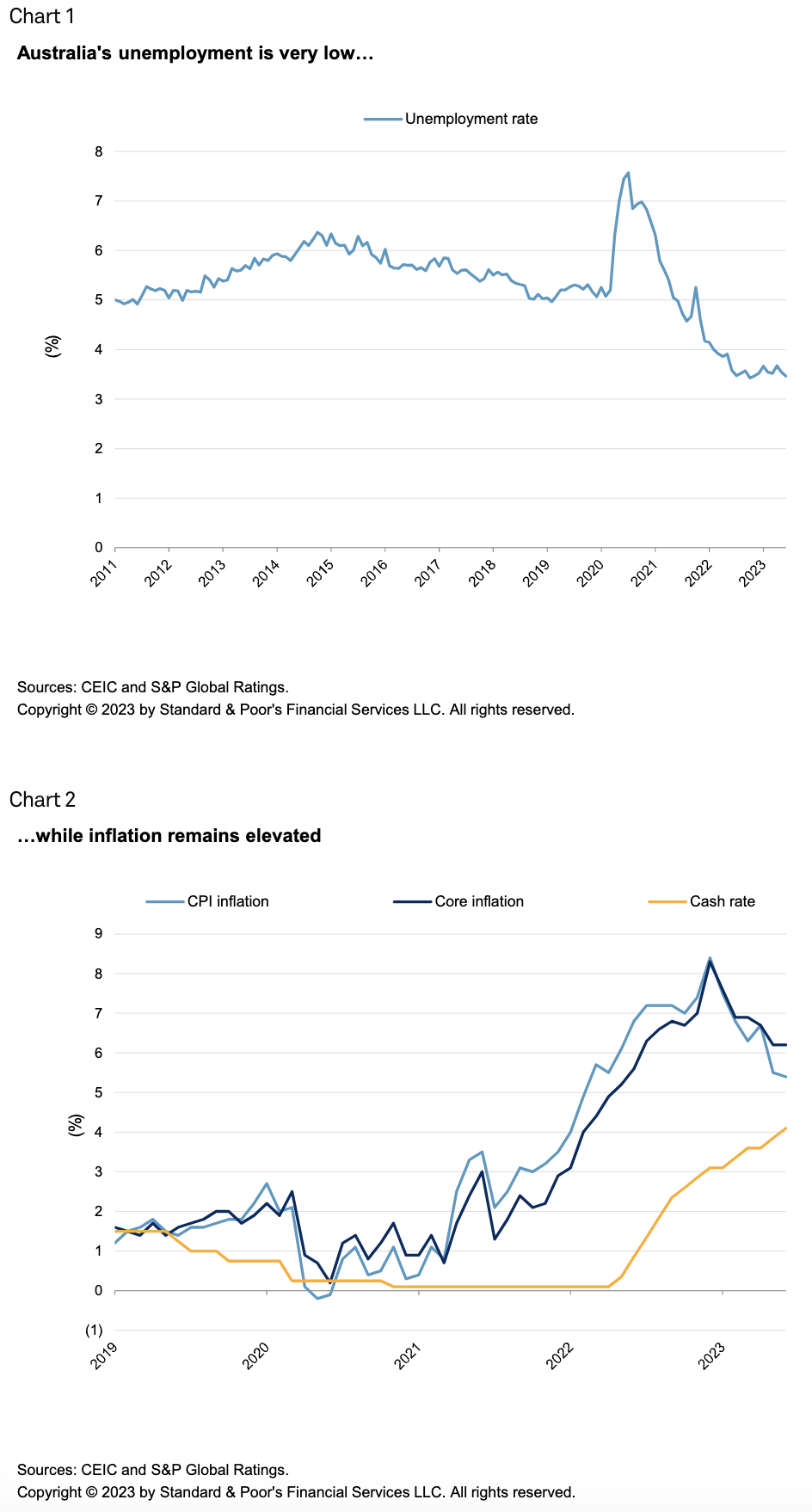

Australia: A Soft Landing Is Possible, Not Certain

The Australian economy has held up, despite slowing global trade and higher interest rates to rein in inflation. The quarter-on-quarter GDP expansion has slowed from an average of 0.7% in 2022 to 0.2% in the first quarter of 2023. But the fact that growth has remained positive speaks to the domestic resilience.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

Bank M&A 2023 Deal Tracker: 2 Largest Deals of the Year Announced in July

Despite credit quality data showing gradual deterioration, US credit unions are shifting more of their asset mix into loans.Two of the eight US bank M&A deals announced in July were the biggest deal announcements of the year and significantly boosted the total value of US bank M&A in 2023. Year-to-date aggregate deal value soared to $2.15 billion for all 51 deals announced through July, with the two deals accounting for 70% of total deal value.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

Listen: European Oil Markets After the Russian Embargo (Part 1)

Trade disruptions. Refinery adjustments. New arbitrage flows. These are some of the consequences Europe faced as the continent had to wean itself off Russian crude following the embargo, which came into effect in December 2022. Russia has since managed to find new customers in Asia, but military attacks on oil infrastructure in the Black Sea could jeopardize such a strategy.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

IRA at 1: Speed of Mining Investments Surprises Experts

Automakers and miners have responded with gusto to the incentives built into the Inflation Reduction Act since it was passed a year ago, investing in the US battery supply chain with a speed that surprised observers of these typically cautious industries.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

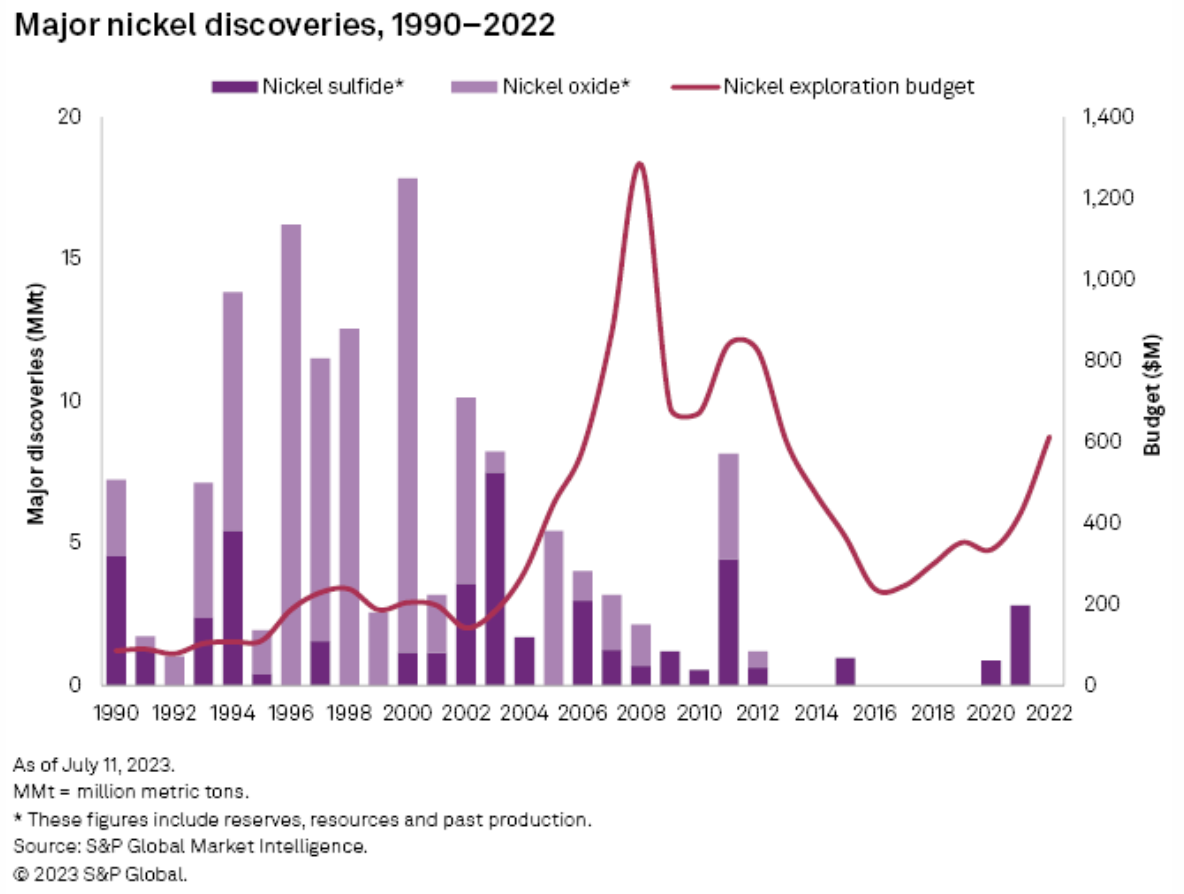

Major Nickel Discoveries Remain Scarce Amid Looming Supply Deficits

S&P Global Commodity Insights has identified 82 major nickel discoveries made from 1990 to 2022, containing 147 million metric tons of nickel in oxide and sulfide deposits. Only four were discovered in the past decade and account for just 3% of the total nickel discovered — far from the prolific years of the 1990s when almost two-thirds of the nickel discoveries were made.

—Read and explore more from S&P Global Market Intelligence

Access more insights on energy and commodities >

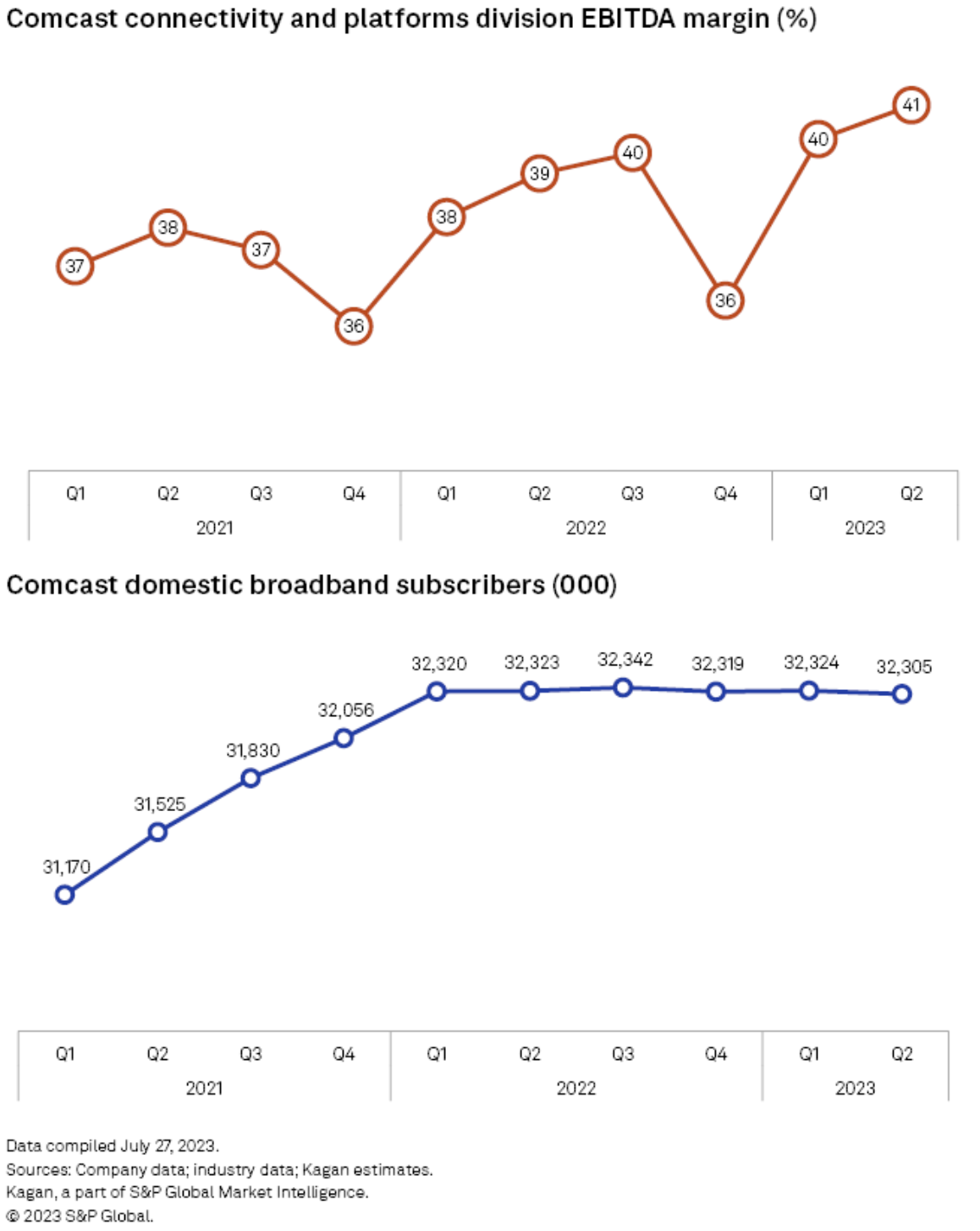

Media Quick Take: Comcast Q2 2023

Comcast Corp. consolidated revenue was up 1.7% to $30.51 billion in the second quarter, with EBITDA up 4.2% to a record high of $10.24 billion. Consolidated EBITDA margin hit a high of 34% in the quarter despite softness in the media, traditional multichannel video and advertising segments.

—Read the full article from S&P Global Market Intelligence

Content Type

Language