Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 26 Sep, 2020

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

As we mark the one-year anniversary of the initial inclusion of China A-shares in S&P DJI’s global benchmarks, it seems an opportune time to provide an update on key developments relating to A-share inclusion and to examine the impact that A-shares have had on the composition and performance of the S&P Emerging BMI over the past year.

Understanding the A-Share Inclusion Process, and What to Expect Next

Effective Sept. 23, 2019, eligible China A-shares accessible via Hong Kong-Shanghai Stock Connect or Hong Kong-Shenzhen Stock Connect were added to S&P DJI’s global benchmarks at a 25% reduced inclusion factor—meaning each company was represented at one-quarter of its float market cap weight.

Following a consultation with market participants earlier this year, S&P DJI announced that A-shares listed on the ChiNext Board of the Shenzhen Stock Exchange that are also accessible via Stock Connect would be eligible for the S&P Global BMI and other benchmark indices as of the September 2020 reconstitution. These additional ChiNext-listed securities represented an additional 1.0% weight added to the S&P Emerging BMI at the September 2020 reconstitution.

While we are not currently proposing an increase in the 25% partial inclusion factor nor any additional changes to eligibility requirements, S&P DJI’s 2020 Country Classification Consultation provides an overview of recent steps taken by Chinese authorities to improve accessibility to A-shares, as well as key remaining challenges cited by institutional investors. These challenges include relatively low foreign ownership limits, daily trading limits on Stock Connect facilities, and a lack of full alignment between trading days of Stock Connect and the underlying Chinese exchanges. The consultation invites feedback as to whether S&P DJI should consider proposing any changes to its treatment of A-shares and what additional steps need to be taken in order to consider increasing the inclusion factor or expanding eligibility beyond securities accessible via Stock Connect.

A-Shares Enhanced Emerging Market Returns since Inclusion while Contributing to Lower Volatility

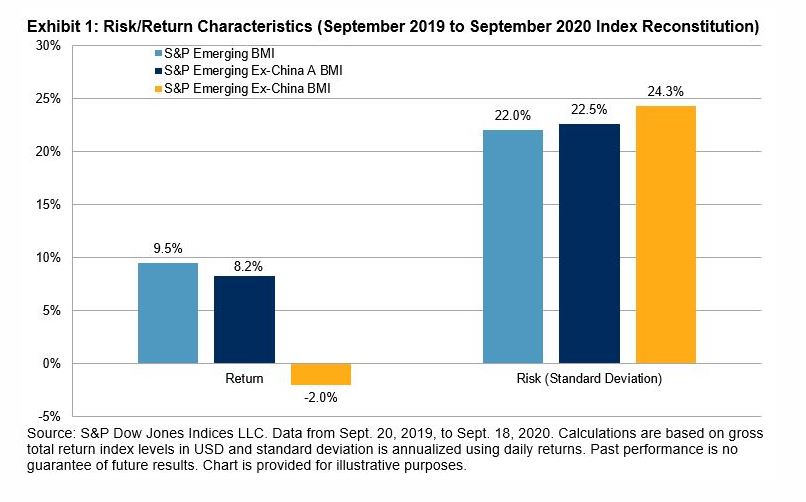

Despite their reputation as a volatile and risky segment of the global equity market, the presence of A-shares in emerging market indices improved performance and reduced risk over the past year. As illustrated in Exhibit 1, the S&P Emerging BMI outperformed the S&P Emerging Ex-China A BMI (which excludes all China A-shares) over the past year while also exhibiting slightly lower volatility.

More broadly, Chinese equities were the main positive contributor to emerging market returns over this period, pushing the S&P Emerging BMI to a 9.5% gain. While the index would have gained a lesser 8.2% over this period excluding A-shares, removing China entirely would have led to a decline of 2.0%, with meaningfully higher volatility.

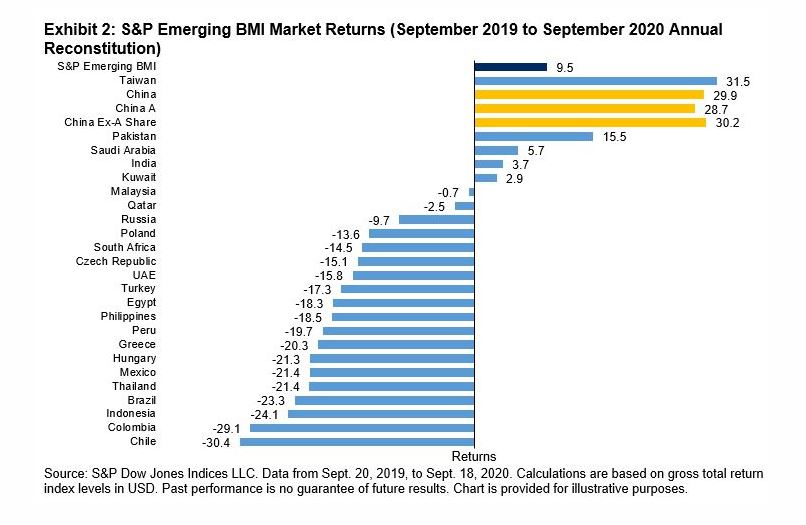

Drilling deeper, Exhibit 2 illustrates the high dispersion in emerging market returns and the notable outperformance of China relative to other emerging markets over the past 12 months. In fact, Taiwan was the only market to outperform China, and just 6 of the 25 markets posted positive returns.

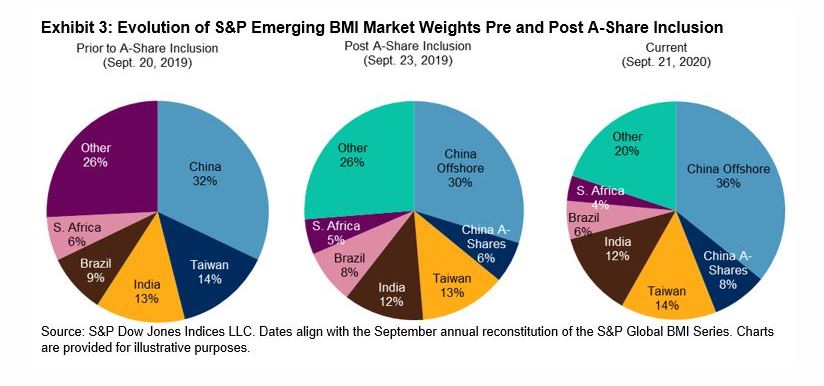

China’s weight in the S&P Emerging BMI increased markedly over the past 12 months, driven both by its relatively strong performance and the addition of A-shares to the benchmark. Prior to the inclusion of A-shares, China was already the largest market by a wide margin, representing 32% of the S&P Emerging BMI. The initial partial inclusion of A-shares boosted its weight to 36% following the September 2019 index reconstitution. As of the September 2020 reconstitution, China represents approximately 44% of the benchmark, with A-shares representing an 8% weight.

While the future path for A-share inclusion remains uncertain, it will likely be dependent on further market accessibility enhancements. Despite A-shares being only partially represented in global equity benchmarks, one thing is certain: China’s size makes it the dominant driver of the emerging market equity landscape.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Content Type

Language