Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 22 May, 2020

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

The COVID-19 pandemic has shaken financial markets and led many market participants to take a closer look at their investments. While emotionally and psychologically challenging, these selloffs can create opportunities to enhance long-term portfolio objectives. In this environment, advisors can demonstrate their value by helping clients invest in strategies they find meaningful and motivating.

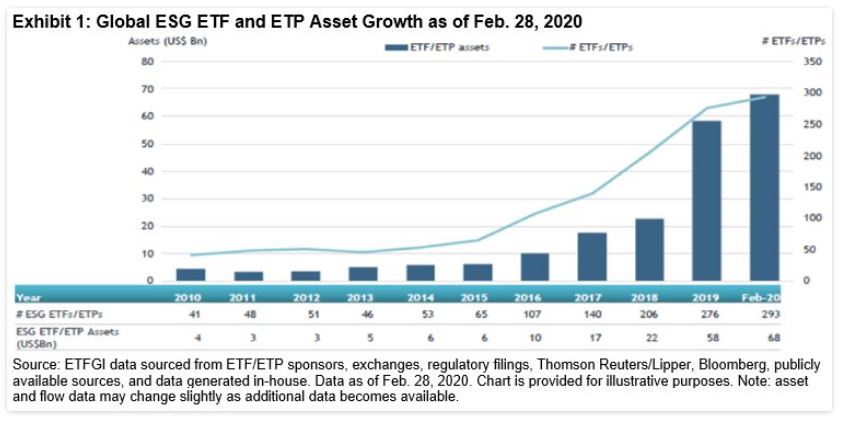

Investors are reimagining the future state of investing in the aftermath of the pandemic, and record flows into environmental, social, and governance (ESG) ETFs undoubtedly reflect that mindset (see Exhibit 1). Assets in ESG ETFs and ETPs listed globally increased by 4.93% at the end of February 2020, to a new record of USD 67.99 billion.[1]

The recent surge of ESG ETF asset growth raises the question of who is investing in ESG-focused funds.

For years, ESG adoption has focused on millennials and their influence on sustainable investing. What has been consistently ignored, however, is that investors from all generations want to learn more about ESG investing and how best to put their values into action. Surprising to some, this includes the baby boomer generation. Let us not forget that many millennials inherited their core values from their baby boomer parents, whose activism and strong voices led to the establishment of the first sustainable funds in the 1970s. A recent report found that “baby boomers are more likely than millennials and Gen Xers to say that the reason they want to participate in ESG investing is to encourage companies to be good corporate citizens,”[2] which is an inspiring perspective, especially in the current environment.

It is increasingly evident that all generations wish to educate themselves on how to make ESG investment decisions and how to best align their investment objectives with their values. However, an additional objective shared by baby boomers, Gen Xers, and millennials alike is that aligning investments with their values not come at the cost of investment performance.

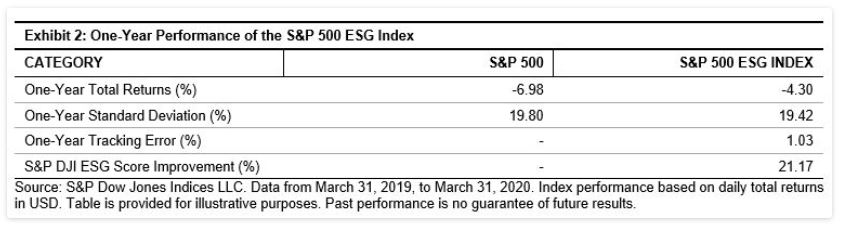

The S&P 500® ESG Index helps dispel the myth that a trade-off must exist between ESG principles and performance. Rather than detract from performance, ESG data can enhance visibility into financially material metrics that have not always been captured by traditional regulatory filings and standard financial analysis. In the past year, the S&P 500 ESG Index has delivered on its mandate to provide a sustainable alternative to the iconic S&P 500, with similar risk and return, but with an additional lens into the constituents’ ESG principles (see Exhibit 2). While the recent outperformance is a welcomed result, it is important to note that the S&P 500 ESG Index does not aim to outperform its S&P 500 benchmark. It does, however, aim to achieve a considerable improvement in overall ESG performance by retaining companies with notable positive impacts such as an increase in female representation across management positions, a reduction in greenhouse gas emissions, and effective promotion of a risk culture.[3]

While indices like the S&P 500 ESG Index have continued to push the often marginalized conversation around sustainable investing into the mainstream, there remains boundless opportunity for financial professionals to educate all their clients on the reality of ESG investing. Advisors taking a proactive approach by initiating the ESG conversation are likely to be surprised by the openness of clients of all ages to engage around the topic in the current environment and beyond.

[1] ETFGI reports ESG ETFs and ETPs listed globally gathered USD 7.54 billion in net inflows during Feb. 28, 2020. https://etfgi.com/news/press-releases/2020/03/etfgi-reports-environmental-social-and-governance-esg-etfs-and-etps

[2] Allianz Global Investors, Socially Responsible Investing and ESG: It’s Not just a Millennial Trend. August 2019. https://www.allianzlife.com/about/newsroom/2019-press-releases/socially-responsible-investing-and-esg

[3] For more information on the S&P 500 ESG Index, visit www.spdji.com.

Content Type

Location

Language