Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 22 Sep, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

APPEC Clarifies Major Themes for Asian Oil Markets

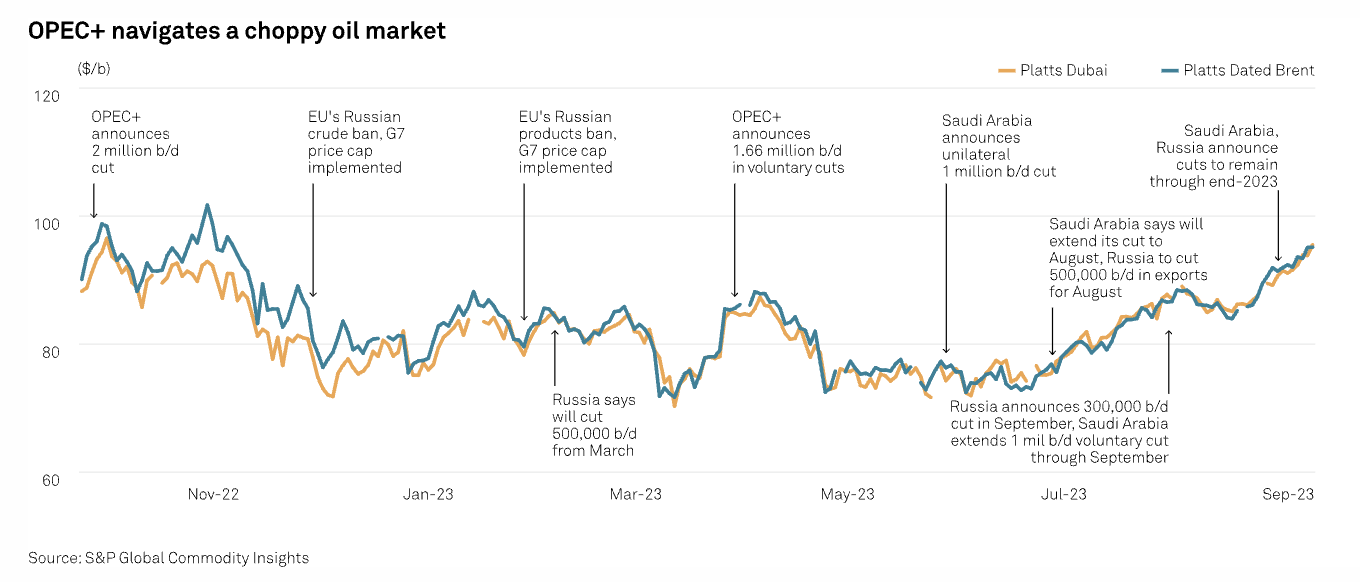

From Sept. 4–6, industry leaders, government officials and the press gathered in Singapore for S&P Global Commodity Insights’ 39th annual Asia Pacific Petroleum Conference (APPEC). Discussions at the conference focused on the issues of Asian oil demand revival, the region’s uneven demand recovery, tightening oil market fundamentals and the prospects of global recession. Geopolitics continued to be a major issue, with discussions of Russian crude and the oil price cap in the wake of Ukraine’s invasion remaining points of contention. Changing trade flows and the growth in Indian demand were also key topics. In a recent “Oil Markets” podcast from S&P Global Commodity Insights, S&P Global Platts experts discussed takeaways from the conference and their thoughts on oil markets in general.

China’s relatively tepid economic growth was on the minds of many attendees at the conference. The forecast for China's real GDP growth fell to 5.2% for 2023 from 5.5% and to 4.8% for 2024 from 5.0%. While these numbers continue to indicate economic strength, many market participants believe that India will replace China as the center of long-term oil demand growth.

"China has been supporting the global crude demand for the past 20 years, but in the coming three to five years, China's demand is going to peak and then it will start to decline," Fereidun Fesharaki, chairman of energy consultancy FGE, said during an APPEC panel on China, India and Russia. “The global market has to look at India or other countries for demand resilience.”

India and China have been active in buying Russian crude at discounted prices, driven by the oil price cap imposed by Western countries. While the available discounts under the price cap have narrowed since 2022, India and China remain buyers. India's crude oil imports from Russia are projected to constitute 35%–40% of overall imports in 2023. The growth in Chinese demand for Russian crude is smaller. Prior to Ukraine’s invasion, China imported about 1.6 million barrels per day of Russian oil. It now imports about 2.0 million b/d. This reflects a growing trend of Asian markets focusing on affordability over sustainability or energy security. Eric Van Nostrand, acting assistant secretary for economic policy of the US Treasury Department, defended the efficacy of the price cap at the conference.

"In the first half of this year, relative to last year, Kremlin's oil revenues are down 50%," Nostrand said. "At the same time, in the middle of the summer, there were very little reductions in Russian oil supply. ... We have kind of optimal supply and, at the same time, the Russian revenues were slashed."

Despite the discounts available on Russian oil, Asian and Persian Gulf refineries continue to depend on Middle Eastern crude. Regardless of overall production cuts, producers from OPEC and its allies have made an effort to ensure that Asian buyers receive their necessary volumes. Approximately 95% of Japan's total crude imports during the first seven months of 2023 were sourced from the Middle East. But the continued OPEC+ production cuts and their impact on prices were points of discussion at APPEC.

“The biggest issue on people’s minds in oil is this battle around value or volume as far as producers are concerned in the crude oil market,” S&P Global Commodity Insights’ Dave Ernsberger said. “It was a constant refrain around how long Saudi Arabia will continue to restrain production on its own and when will the price be ‘high enough.’”

Today is Friday, September 22, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

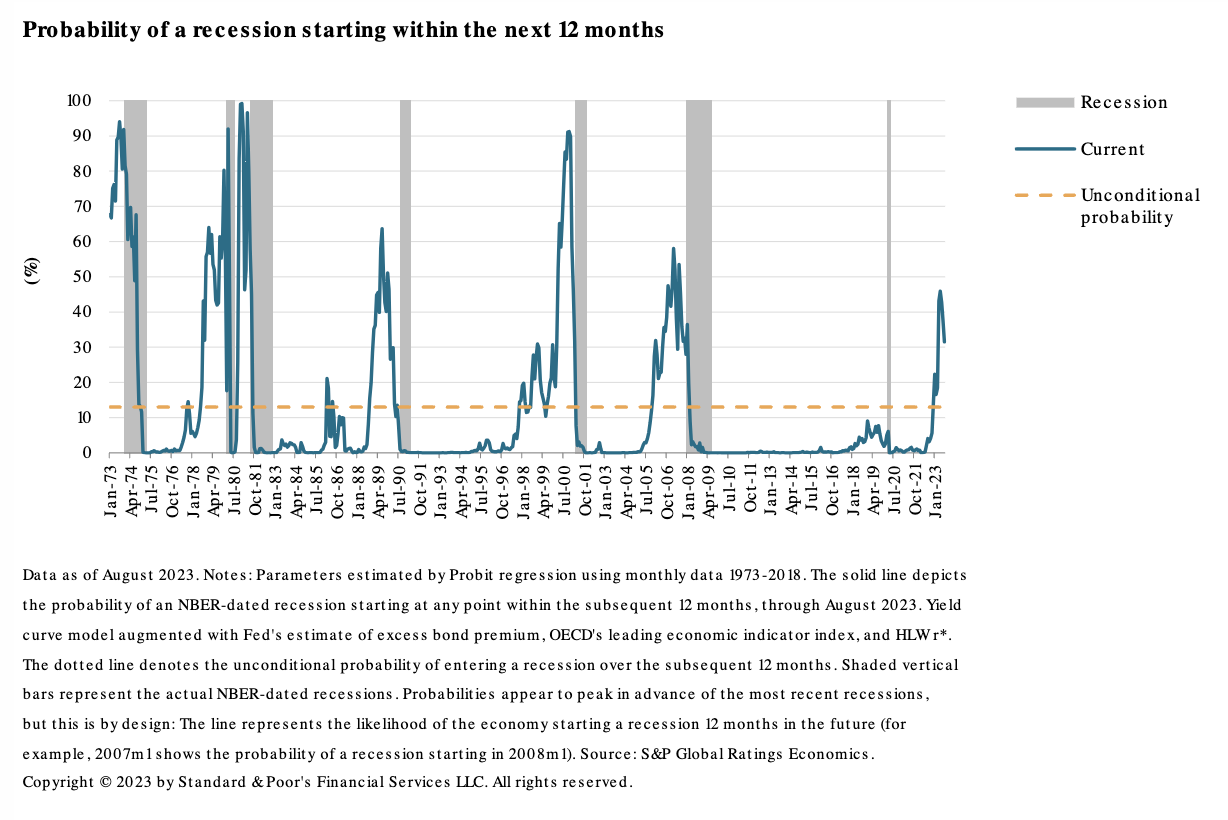

Economic Research: US Business Cycle Barometer: Recession Risk Still Elevated Amid Uncertain Growth Prospects

The probability of a recession starting within the next 12 months has moderated since the beginning of the year but remains elevated at 30%-35%. Data from the key coincident indicators shows the current expansion is in its late cycle, indicating that any further short-run cyclical boost to growth is limited by the economy's underlying growth potential. The principal leading indicators give mixed signals for near-term growth prospects, and the current expansion is likely to enter a period of slower-than-trend growth in the coming quarters.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Banking As A Service Still Boosts Banks' Deposits But Has Its Risks

In general, banking as a service (BaaS) seems an ideal partnership. Financial technology companies have proven their ability to innovate and create modern, user-friendly interfaces, with the rapid deposit growth of direct-to-consumer neobanks attesting to this. The banks they partner with have things fintechs often lack, including the back-end architecture for account management, Federal Deposit Insurance Corp. insurance and deep regulatory knowledge.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Saudi Oil Policy Based Purely On Supply And Demand: Crown Prince

Saudi Arabia's oil policy is based purely on supply and demand, Crown Prince Mohammed bin Salman said Sept. 20, in an interview broadcast on Fox News. "We just watch supply, demand. If there is a shortage of supply, our role in OPEC+ is to fill the shortage. If there is oversupply our role is to measure that for stability of the market," he said, when asked about OPEC+ supply cuts benefiting Russia. Saudi Arabia has faced criticism for sticking to its cooperation with Russia and introducing major cuts, at a time when Western countries have imposed wide-ranging sanctions in response to Russia's invasion of Ukraine. Production cuts have boosted prices, helping Russia to deal with sanctions, spiraling war costs and discounts on its crude.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: On The Ground At Climate Week NYC: The Challenge Of Scope 3 Emissions

This week the ESG Insider podcast is on the ground at Climate Week NYC for a special series of interviews from the sidelines of The Nest Climate Campus. In this episode, hosts Lindsey Hall and Esther Whieldon sit down with Matt Helgeson. Matt is Head of Sustainability for Siemens USA, the US arm of the German conglomerate Siemens AG, a technology company focused on industry, infrastructure, transport and healthcare. Matt talks about what he’s hearing from Climate Week NYC so far and the challenges presented by Scope 3 greenhouse gas emissions, which s the emissions that occur up and down a company's supply chain as well as when a customer uses the company’s products. He also shares his perspective on what needs to happen to make Climate Week NYC a success.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

Listen: How High Can It Go? Crude Market Tightness Sparks Oil Price Surge

The OPEC+ production cuts continue to impact both crude oil and refined products. Dated Brent has reached a 10-month high. Prices in the diesel market are also rising amid supply constraints. Meanwhile, the latest report from the IEA has warned investors of strong demand in Q4. In this episode of the Platts Oil Markets podcast, London-based oil news reporter Robert Perkins and oil price reporters Sam Angell and Sasha Foss join Francesco Di Salvo to discuss the current bullish sentiment supporting prices as market participants react to the latest developments in the oil markets.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

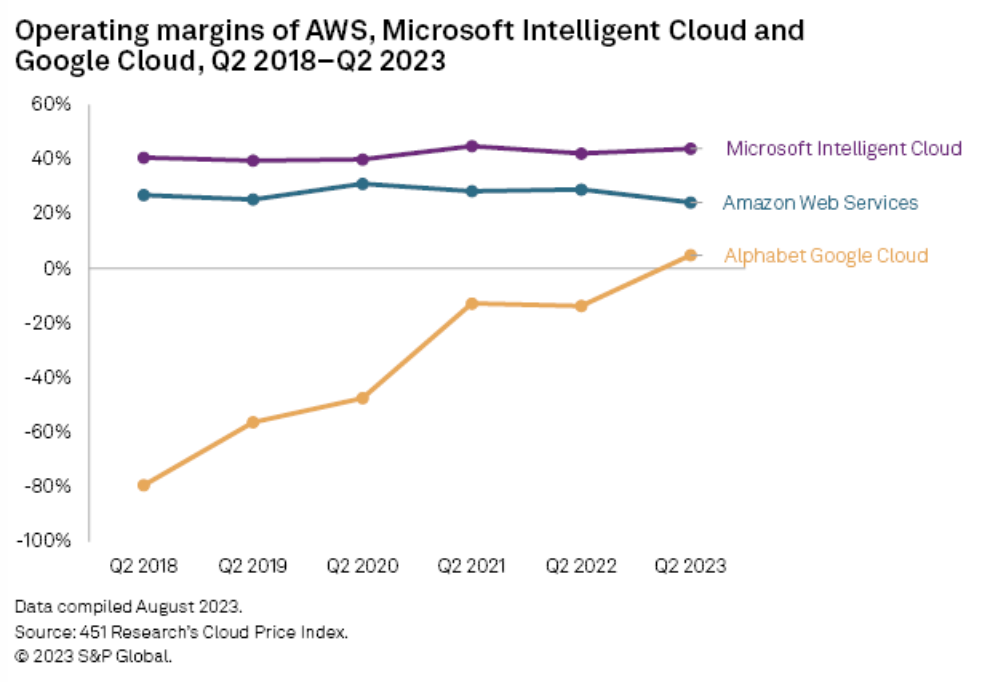

AWS, Azure And Google Ready To Spend On AI Infrastructure

Financial results for the second quarter show hyperscaler parent companies Amazon.com Inc., Microsoft Corp. and Alphabet Inc. navigating the pervasive market opportunity brought by the generative AI frenzy. All three are forging synergistic partnerships with AI startups to secure access to intellectual property and provide compute capacity — presumably at a discount — for model training and tuning. Meanwhile, Google LLC is reasserting its claim to AI leadership as the operating margin of its Google Cloud unit has moved into positive territory.

—Read the article from S&P Global Market Intelligence