Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 13 Sep, 2023

The Public Utilities Commission of Ohio, the North Carolina Utilities Commission, the Idaho Public Utilities Commission, the Public Service Commission of Utah and the Wyoming Public Service Commission will get to weigh in on Dominion Energy Inc.'s plans to sell its gas distribution utilities to Calgary, Alberta-based Enbridge Inc.

Dominion's remaining businesses, if the transaction is signed off on by regulators, will include regulated electric utilities serving about 3.5 million customers in Virginia, North Carolina and South Carolina.

➤ In recent years, Dominion has sold regulated gas transmission and storage assets, and in September 2022, it sold its West Virginia gas utility to an infrastructure fund.

➤ The Enbridge deal follows a strategic business review Dominion launched in November 2022, and Dominion plans to provide updates during an investor event expected to be held during the fourth quarter.

➤ Broadly speaking, US utilities are focused on strengthening their balance sheets as they navigate economic uncertainty. Since late 2022, multiple utilities have initiated internal strategic reviews and begun the process of divesting assets or selling minority interests in projects to raise cash and to facilitate capital reallocation.

➤ Regulators in the jurisdictions pertinent to the Enbridge-Dominion transaction have generally allowed proposed deals to proceed in recent years. Although the Idaho commission took issue in 2019 with a deal that had called for a Canadian entity to acquire Avista Corp., the concerns stemmed from potential foreign government ownership of an Idaho jurisdictional electric utility. These issues are not present with the instant transaction.

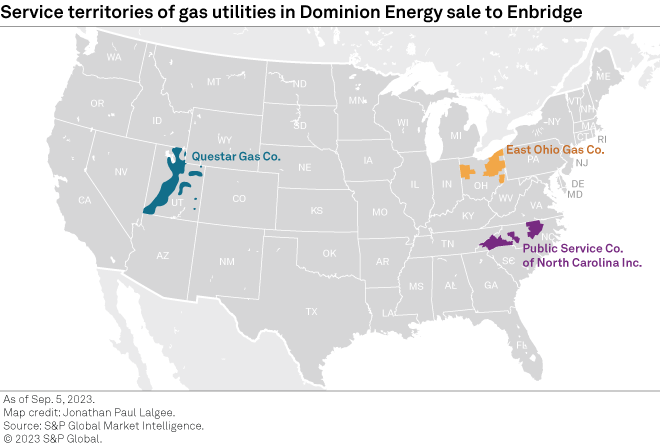

The transaction, announced Sept. 5, calls for Dominion to sell its The East Ohio Gas Co., Public Service Co. of North Carolina Inc. and Questar Gas Co. utilities to Enbridge for $9.4 billion in cash plus the assumption of $4.6 billion of debt. Enbridge will also acquire Wexpro Co., which develops and produces gas reserves, from Dominion.

The sales are part of Dominion's ongoing strategic review launched in late 2022, which thus far has not appeared to appeal to the company's shareholders; the Dominion shares have lagged the S&P 500 Utilities throughout much of 2023, and the stock has fallen to consecutive 52-week lows since the deal was announced.

The proposed deal comports with a recent trend of smaller US utility transactions, in contrast to the utility "megadeals" of decades past. These utility holding companies aim to simplify their business profile, strengthen their balance sheets and reduce strategy risk. Proceeds of sales are intended to finance capital expenditure programs, reduce and refinance debt obligations, and mitigate equity financing needs.

The companies said they expect the deal to close in 2024, subject to the receipt of several regulatory approvals. The expiration or termination of the waiting period under the Hart-Scott-Rodino Act is also a requirement. The Federal Communications Commission must also weigh in regarding the proposed transaction.

Overview of affected utilities

East Ohio Gas

East Ohio Gas serves roughly 1.2 million customers. The company's most recent base rate proceeding, Case 07-0829-GA-AIR, was decided in 2018, when the Public Utilities Commission of Ohio (PUC) authorized a $40.5 million rate increase premised upon an 8.49% return on a $1.405 billion rate base. A 10.38% return on equity (ROE) and a capital structure that includes a 51.34% common equity component were apparently relied upon in a settlement that was adopted in that case. This return is being used in the pipeline infrastructure replacement mechanism that was authorized in that proceeding.

A straight-fixed-variable rate design for residential customers that effectively accomplishes the effects of revenue decoupling, without the need for after-the-fact revenue adjustments, is in place for East Ohio Gas.

The company intends to initiate its next rate case in October.

Public Service Co. of North Carolina

Public Service Co. of North Carolina serves about 600,000 customers. The company's most recent base rate case, Docket G-5 Sub 632, was decided in early 2022, when the North Carolina Utilities Commission (NCUC) adopted a settlement that provided for a $29.5 million rate increase based on a 9.60% return on equity (51.60% of capital) and a 7.07% return on a $1.702 billion rate base.

In that proceeding, Public Service Co. of North Carolina was allowed to continue to use its integrity management tracker. The company was also permitted to engage a consultant to advise it regarding the further development of hydrogen research, the costs of which are to be reevaluated in its next rate case. A detailed annual report is to be filed.

Questar Gas

Questar Gas serves approximately 1.2 million customers in Idaho, Utah and Wyoming. The company's most recent base rate proceeding in Utah, Docket 22-057-03, was decided in December 2022, when the Utah Public Service Commission (PSC) authorized a $47.8 million rate hike based on a 9.60% return on equity (51.00% of capital) and a 6.86% return on a $2.56 billion rate base.

Questar Gas, which does business in Wyoming as Dominion Energy Wyoming, is currently seeking PSC approval of a $2.1 million base rate hike in Docket 30010-215-GR-23. The proposed increase is based on a 10.30% return on equity (51.56% of capital) and a 7.28% return on a $71.1 million rate base. The state's consumer advocate recently submitted testimony recommending the commission authorize a $1.5 million rate hike based on a 9.40% return on equity (51.56% of capital) and a 6.82% overall return on a rate base valued at $71.1 million.

The company's most recent Wyoming-jurisdictional rate case decision was issued in 2020 when the PSC approved a settlement authorizing a $1.5 million rate increase reflecting a 9.35% return on equity (55.00% of capital) and a 7.11% return on a $60.5 million rate base.

Merger review standards

Ohio

Legislation enacted in 1999 granted the Ohio PUC authority to review mergers of gas utilities or holding companies.

By law, merging entities must demonstrate that the acquisition will promote the public convenience and result in the provision of adequate service at a reasonable rate. In practice, the Ohio PUC has not exercised this authority where there was no change in control of the utility located in Ohio.

The Ohio PUC is required to issue a decision regarding a proposed deal that it reviews within 30 days of the request, or within 20 days of the conclusion of a hearing, if one is held. State law defines "control" in a utility acquisition as the ability to own, vote or hold proxies representing 20% or more of the total number of voting securities of the entity to be acquired.

Merger activity has been rather limited in Ohio in recent years. As required by the 1999 law, NiSource Inc. submitted a filing regarding its then-pending acquisition of the Columbia Energy Group, then the parent of Columbia Gas of Ohio Inc. In 2000, the Ohio PUC indicated that, in light of certain commitments negotiated by the staff, the PUC was satisfied that the merger would not adversely affect Ohio's interests. The merger was completed in 2000.

In 2000, the Ohio PUC approved Vectren Corp.'s purchase, through subsidiary Vectren Energy Delivery of Ohio Inc., of AES Corp. subsidiary The Dayton Power and Light Co.'s gas distribution assets. The commission approved the purchase without a hearing, and the sale closed in 2000. Vectren and CenterPoint Energy Inc. subsequently merged in 2019.

Several electric utility transactions have been approved by the Ohio PUC over the past 20 years without onerous conditions being imposed.

RRA accords Ohio energy utility regulation an Average/3 ranking.

North Carolina

In approving a merger or combination affecting a public utility, the NCUC must determine whether a proposed merger is justified by "the public convenience and necessity," which the commission has interpreted to mean that a determination that rates and service will not be adversely affected by the transaction.

In addition, the NCUC has concluded that for the public convenience and necessity standard to be met, expected benefits must be at least equal to known and expected costs so that customers are not negatively impacted. Other factors to be considered by the NCUC include, but are not limited to, maintenance of, or improvement in, service quality, the extent to which costs can be lowered and rates can be maintained or reduced, and the continuation of effective state regulation.

Under the law, a public utility is defined "to include all persons affiliated through stock ownership with a public utility doing business in this state as parent corporation or subsidiary corporation to the extent the commission finds that such affiliation has an effect on the rates or service of such public utility."

The most recent merger approved by the NCUC was the Dominion and SCANA Corp. deal, which was completed in 2019. Bill credits, a two-year base rate case filing moratorium and certain other conditions were required.

In 2016, the NCUC adopted a settlement approving Duke Energy Corp.'s acquisition of Piedmont Natural Gas Co. Inc. Bill credits were among the conditions imposed upon the companies by the commission in its review of that transaction.

RRA accords North Carolina energy utility regulation an Above Average/3 ranking.

Idaho

Pursuant to state code, the Idaho Public Utilities Commission does not have authority over the sale of gas utilities at the holding company level, but may potentially review Enbridge's acquisition of Dominion's Idaho gas utility operations.

In its 2016 acquisition of Utah-based Questar Corp. — a deal that attracted Dominion's interest due to Questar's extensive gas pipeline assets — Questar and Dominion said they would provide the commission with information about the proposed deal.

MDU Resources Group Inc.'s 2008 acquisition of Intermountain Gas Co. was not subject to Idaho PUC approval but the companies, in conjunction with the commission staff, agreed to several ring-fencing safeguards, including that: Intermountain Gas would not make loans to MDU Resources or its respective subsidiaries; Intermountain Gas would maintain its own accounting documentation and financial books and records; MDU Resources and Intermountain Gas would provide the PUC access to all books and records; Intermountain Gas would not make any dividend distribution that would reduce its equity ratio to below 35% without PUC approval through 2018; and Intermountain Gas would notify the Idaho PUC staff regarding affiliate transactions.

The Idaho PUC has contracted with the Utah PSC for rate oversight of Questar Gas' operations in a small area of southeastern Idaho. When necessary, Questar Gas seeks base rate increases to recover increased operating costs and a "fair" return on rate base investments.

Questar Gas in Idaho does not presently face direct competition from other distributors of gas for residential and commercial customers in its service territories, as state regulations in Idaho (as well as Utah and Wyoming) do not allow customers to choose their gas utility provider.

Of note, the Idaho PUC in 2019 rejected Toronto-based Hydro One Ltd.'s planned acquisition of Avista Corp. Of chief concern was the Ontario government's potential control of Hydro One and a post-acquisition Avista.

RRA accords Idaho energy utility regulation an Average/2 ranking.

Utah

The Enbridge/Dominion deal requires Utah PSC review and approval. In its review, the PSC will examine the proposed deal for net positive benefits and must find it in the public interest prior to approval. There is no statutory time frame in which the PSC is required to issue a decision regarding a merger or acquisition application.

The PSC approved Dominion's acquisition of Questar Corp. in 2016 following a settlement between the companies and the Utah Division of Public Utilities. Among the many provisions of the settlement, Questar Gas was required to withdraw a then-pending rate case and was prohibited from filing for a rate increase until mid-2019.

RRA accords Utah energy utility regulation an Average/2 ranking.

Wyoming

State law says the Wyoming PSC "shall not approve any proposed reorganization if the commission finds ... that the reorganization will adversely affect the utility's ability to serve the public." The law defines a reorganization to mean any transaction which results in a change in the majority ownership interest or control of a public utility, or the majority ownership interest or control of any entity which owns a majority interest in or controls a public utility.

The commission requires several provisions to be included in an application, such as the utility's financial condition, the effect of the proposed transaction on the ability of the utility to provide service and on any other utility. There is no statutory timeframe within which the PSC is required to render a decision regarding a proposed merger.

Dominion's 2016 acquisition of Questar Corp. was the most recent major utility purchase in the state. The Wyoming PSC was the last state regulatory body to approve the purchase after it adopted a settlement filed by the companies and the Wyoming Office of Consumer Advocate. The settlement addressed all pertinent issues with respect to the acquisition, such as cost recovery provisions, a rate case moratorium until the beginning of 2020, community benefits, recognition of various Wexpro agreements and more. The transaction closed the same year.

RRA accords Wyoming energy utility regulation an Average/2 ranking.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, visit the S&P Capital IQ Pro Energy Research Library.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.