Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 11 Apr, 2023

By Sarah Cottle

Today is Tuesday, April 11, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

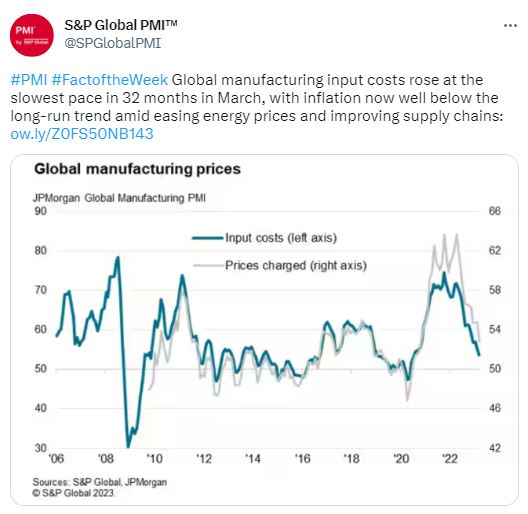

In this edition of Insight Weekly, we take a close look at the global labor market. Employment growth in the manufacturing sector around the world nearly stalled in March after reaching an eight-month high in February, according to the latest Purchasing Managers' Index survey data compiled by S&P Global and JPMorgan. The sluggish payroll expansion reflected an increasing trend among companies towards cost reduction that fueled job losses. In the eurozone, labor shortages remain high, particularly in the services sector. Tight labor market conditions may hinder progress in reducing inflation and threaten economic growth, according to S&P Global Market Intelligence economists.

The median ratio of operating expenses to total revenue for US investment-grade-rated companies climbed to 85% in the fourth quarter of 2022, up from 83.6% in the third quarter of 2022, according to Market Intelligence data. The ratio rose to a 10-quarter high as operating expenses, such as rent and payroll, increased 5.3% in the quarter to $2.791 trillion.

A robust drop in private equity and venture capital funds launched in the year to April 3, among other factors, caused the underallocation of global pension funds to private equity in the first quarter of 2023, an indicator of the challenging investment environment. Across 365 global pension funds, the median target allocation was $280 million and the median actual allocation was $276 million, according to Market Intelligence and Preqin.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @SPGlobalPMI on Twitter

Anticipate the Unknown

The difference between

risk and opportunity

is perspective.

Clear vision – even in the face of uncertainty – guides confident credit and risk decisions. Unlock the possibility inside market volatility with the right data, models and insights.

Essential Intelligence from S&P Global can help you assess your risks, reduce uncertainty, and make decisions with confidence. When you have the tools to do more than simply manage risk, there’s no opportunity you can’t seize.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Waqas Azeem

Theme