Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 11, 2023

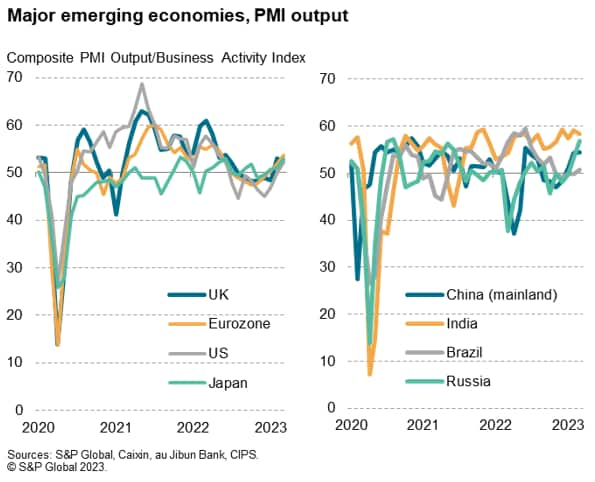

Global business activity accelerated further in March, reaching a nine-month high, according to the S&P Global PMI surveys based on data provided by over 30,000 companies. While India once again recorded the fastest expansion, all other major economies bar the UK and Australia, reported improved performances.

The data therefore helps to further allay worries of imminent recessions in the world's leading economies. However, concerns persist about the sustainability of the upturn. In particular, an ongoing decline in demand for goods leaves the global economic recovery largely dependent on reviving service sector activity, notably among consumers and financial services, which itself looks susceptible to weakness in coming months given recent monetary policy tightening by the major central banks of the US and Europe

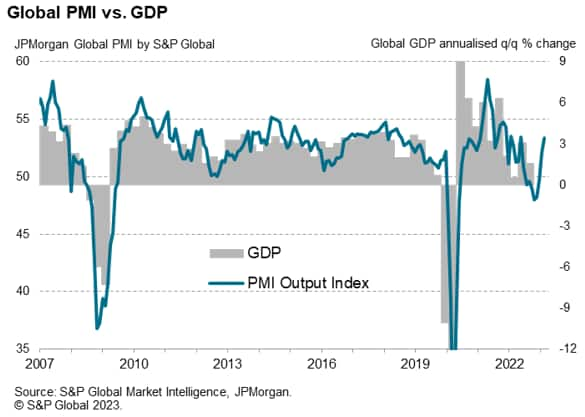

A fourth successive monthly rise in the global PMI's headline output index took the pace of growth to its highest for nine months in March. At 53.4, up from 52.1 in February, the Global PMI - compiled by S&P Global across over 40 economies and sponsored by JPMorgan -has now signalled two months of accelerating economic growth after a six month period of contraction up to January.

The latest reading is broadly indicative of worldwide GDP rising at a quarterly annualized rate of approximately 3.0%, helping to further allay worries of the global economy being in recession.

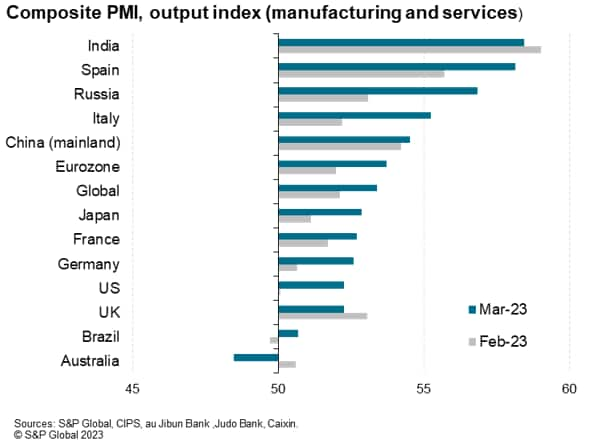

Looking at the world's largest economies, India once again reported the fastest expansion and is continuing to enjoy its strongest growth spell for over a decade.

Spain, and to a lesser degree Italy, also reported well-above average growth in March, with buoyant service sector activity accompanied by solid manufacturing performances in both cases.

Russia also saw notably strong and accelerating growth as domestic firms compensated for a further steep downturn in trade flows arising from sanctions.

Growth in mainland China likewise accelerated, rising to a nine month high on the back of resurgent service sector activity following the recent easing of COVID-19 containment measures.

Although below average growth was recorded in Japan, France, Germany and the US, in all cases the rate of expansion accelerated compared to February, in each case driven by reviving service sector activity.

Growth meanwhile slowed in the UK, though remained in positive territory for a second month running thanks to a solid expansion of activity in the service sector.

Brazil reported rising output for the first time in five months, as a recovery in service sector activity helped offset a steepening manufacturing decline.

That left Australia as the only major economy (for which composite PMI data are available) in decline.

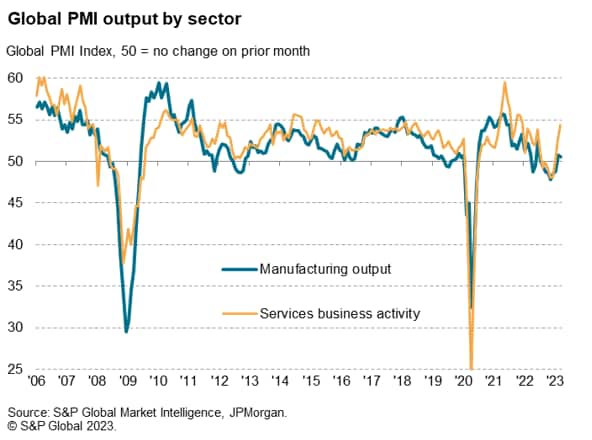

A common thread running through the majority of the national PMI surveys was the extent to which growth was driven in March by the service sector, which has accounted for much of the improvements in economic performance since the downturns seen late last year.

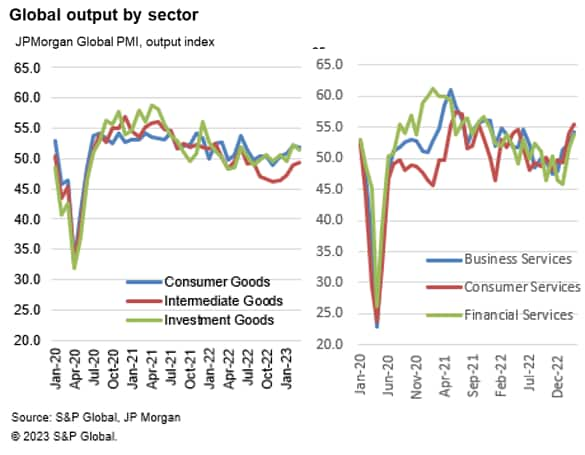

Measured overall, service sector growth accelerated globally in March to the fastest since December 2021. By contrast, manufacturing output barely rose for a second month running, the rate of growth slipping slightly compared to February - albeit still representing an improvement on the downturn seen in the prior six months.

Barring two months during the pandemic lockdowns - May and October 2021, the latest outperformance of the service sector relative to manufacturing is the widest recorded since 2009.

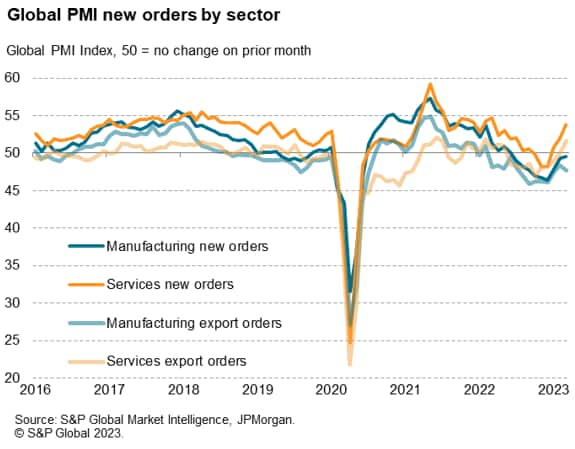

There was an even greater sector divergence in terms of new order inflows, where the gap between services and manufacturing grew for the fourth month running. While manufacturing new orders fell for a ninth successive month in March, dragged down by an accelerating slump in global goods exports, service sector new business inflows grew at the steepest rate for a year, with exports registering the largest monthly gain since February 2022.

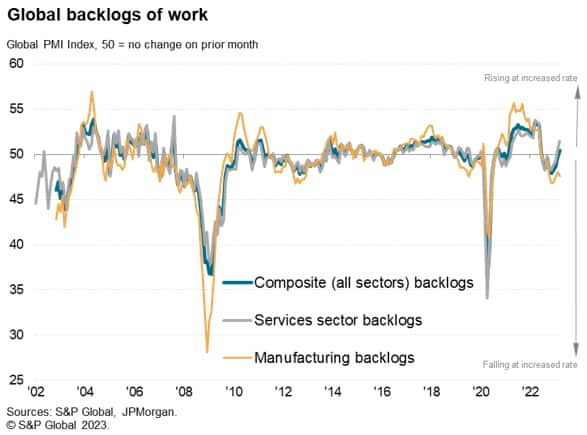

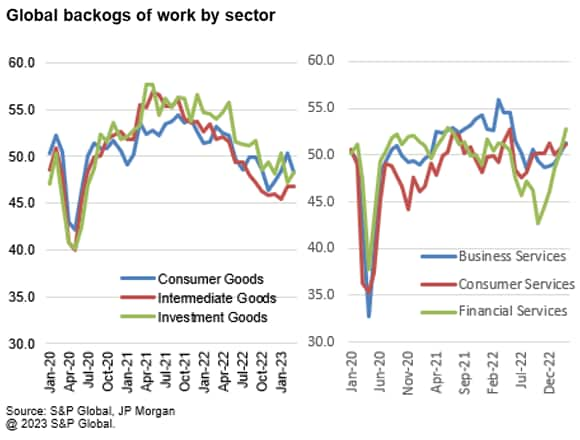

Perhaps one of the most worrying divergences was seen in terms of backlogs of work. The amount of orders that companies have either not yet started work on, or have yet to complete, typically provides a key metric on future output levels.

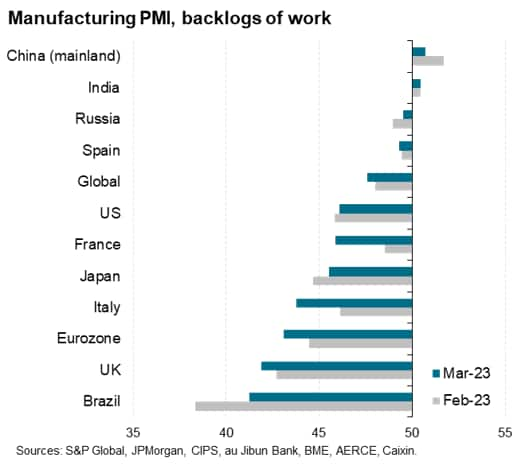

While manufacturing had seen an especially steep build up in backlogs of work at the height of the pandemic, linked to an inability to fulfill orders due to supply constraints, manufacturing backlogs have now fallen globally for nine straight months, with the rate of decline remaining among the steepest seen over the past 15 years in March. The erosion of these order backlogs, combined with a further fall in new orders, suggest factory output will weaken in coming months absent a revival of new demand.

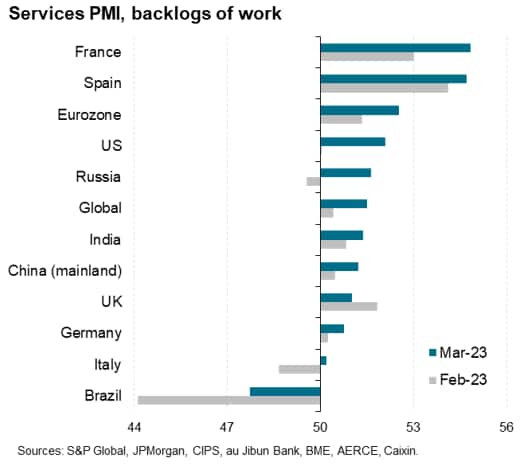

In contrast, service sector backlogs rose in March, up for a second month after seven months of decline, growing at the steepest rate since last May. This build-up of uncompleted work suggests that the service sector will continue to expand output in April, providing a key pillar of growth in the month ahead at a time of likely further pressure on the manufacturing sector.

Geographically, the rise in service sector backlogs has been most pronounced in France and Spain, followed by the US. This has been in part linked to rising travel and tourism business, as well as a reviving financial service activity (which saw a steep decline in activity last year). This does, however, raise questions about the sustainability of these key areas of support to global growth, given the further tightening of monetary policy amid an ongoing cost of living squeeze and elevated banking sector concerns.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location