Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 28 Nov, 2023

Highlights

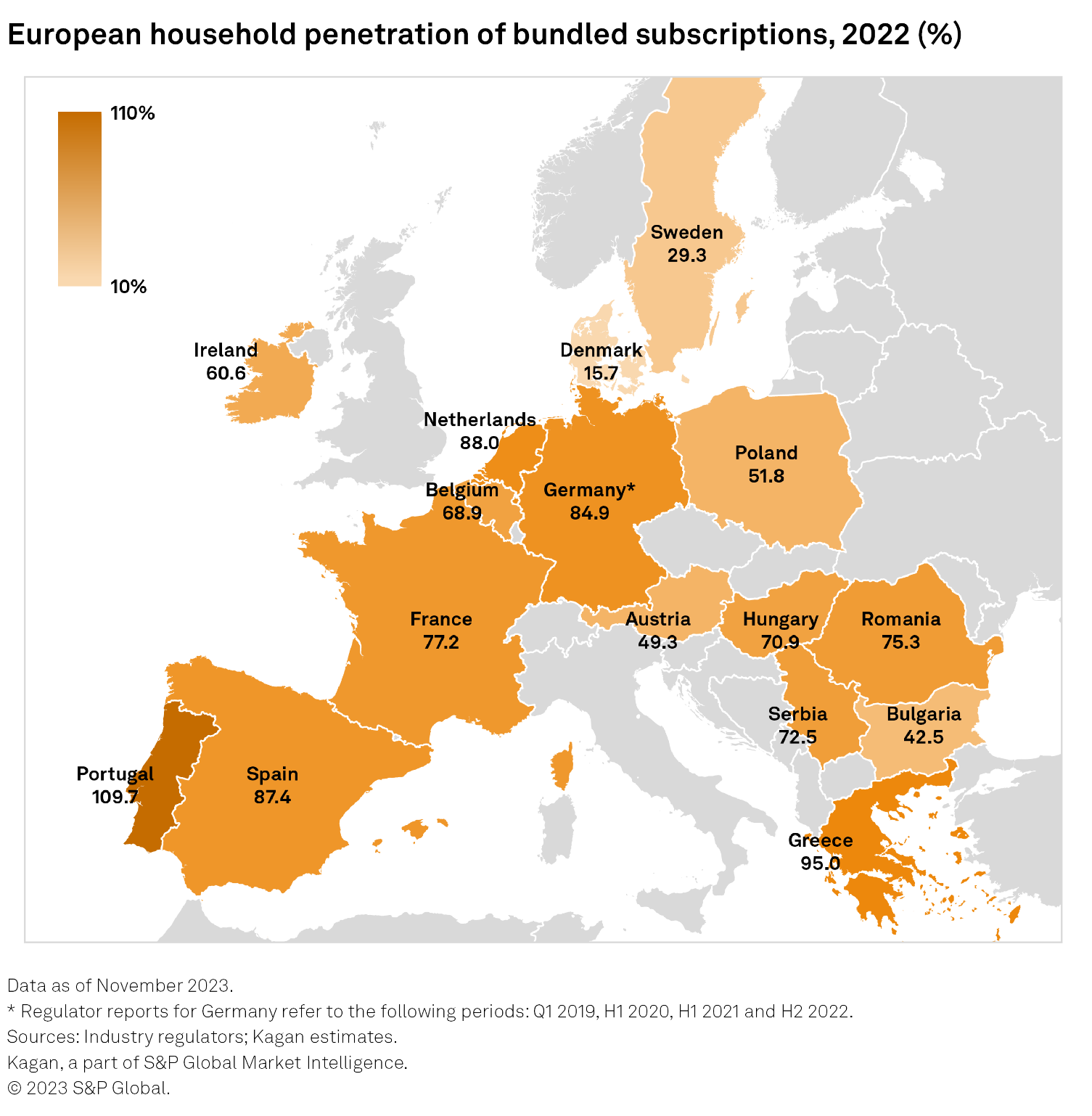

Double-play packages are the most popular bundles in nine European markets. Only in Portugal are quad-play bundles the most popular at 53.6% of market share.

In eight markets, fixed-mobile convergent bundles already represent more than 40% of total bundles.

Broadband is the most popular bundled service, being present in over 90% of bundles in most markets where breakdowns are reported.

Of the 17 European markets with regulator-reported data on bundled telecommunications services, 14 saw an increase in multiplay subscription take-up rates since our previous report, which looked at data up to 2019. In many of these markets, growth has been driven by convergent fixed-mobile bundles, often offsetting a decline in adoption of legacy fixed-line services such as fixed telephony and multichannel pay TV. This mirrors operator strategies, which in recent years have sought to merge fixed and mobile operations and focus on connectivity, turning to partnerships with OTT streaming providers to replace costly pay TV services.

Portugal saw the highest household penetration of bundled subscriptions in 2022. The market, which has long been dominated by converged operators NOS, Altice Portugal and Vodafone Portugal, was the only one to register a majority of quad-play bundles. Cable operator NOS has consistently reported Western Europe's highest triple- and quad-play rates, reaching 94.4% in the third quarter of 2023.

Meanwhile, in Greece, which has the second-highest household penetration of bundles, the majority of these are dual-play fixed-voice and fixed-broadband bundles, at 46.3% of total bundles, although these have been losing share over the years to convergent triple-play bundles adding mobile services, with a 39.9% share in 2022. Traditional fixed-only triple-play bundles with pay TV make up only 7.6% of the bundle market. Bundles including pay TV remain low in the market as local content continues to remain popular and price sensitivity deters consumers from taking up the additional service.

Nordic markets Sweden and Denmark saw the lowest bundle adoption in 2022. In Sweden, this is partly due to a change in methodology by regulator PTS, which as of 2019 only considers bundles with discounted prices. France's bundle penetration is likely higher than 77.2% of households, as regulator ARCEP only reports the number of pay TV access bundled with broadband, excluding non-TV combinations.

Denmark saw the largest drop in bundle adoption of the 17 markets analyzed, from 28.3% of total households in 2019 to 15.7% in 2022, with the number of subscriptions declining by an average annual rate of 17.3%. This is in line with the country's cord-cutting trend, as Denmark saw the fastest multichannel subscriber loss of all 17 markets in the same period, at an estimated CAGR of negative 5.0%.

Along with Denmark and Ireland, the UK was also among the markets to see a drop in bundle adoption. In 2022, regulator Ofcom reported that 83% of residential fixed-line customers subscribed to bundled services, down from 88% in 2021.

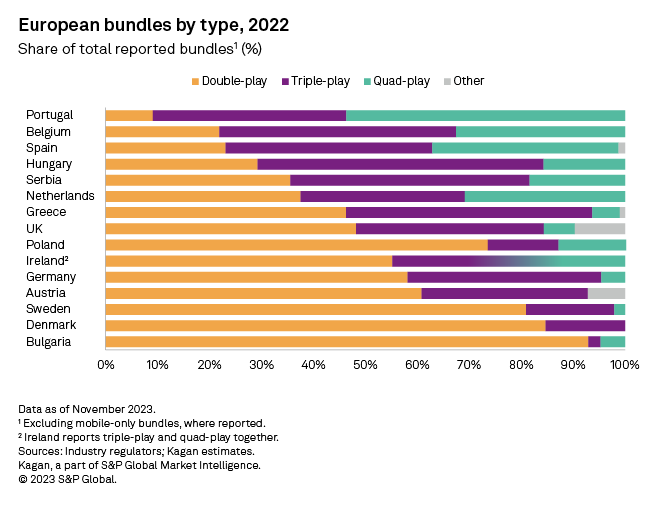

Of the 15 markets that report bundle breakdowns, double-play packages are the most popular bundles in nine European markets. In Bulgaria, double-play bundles represent 92.9% of total reported bundles (excluding mobile-only bundles), followed by Denmark with 84.7% and Sweden with 80.9%. Only in Portugal are quad-play bundles the most popular, with a 53.6% market share.

The makeup of these bundles varies significantly in each market. Broadband and fixed voice is the most popular dual-play bundle in Austria, Germany, Greece, Spain and the UK, while broadband and pay TV is most common in Belgium, France (includes triple- and quad-play), the Netherlands, Poland, Hungary, and Bulgaria. In Sweden, mobile and fixed broadband is already the most popular dual-play bundle.

If we were to include mobile-only voice and broadband bundles, as reported by regulators in Bulgaria, Poland and Sweden, those would be the most popular in the first two markets, at 83.4% in Bulgaria and 45.2% in Poland, whereas in Sweden mobile-only bundles represent 5.7% of total reported bundles.

The traditional fixed-only triple-play bundle is most common in Belgium, Germany, Hungary, and Poland, but has already been overtaken by convergent options in Greece, the Netherlands, Spain and Sweden. Take-up of all-encompassing quad-play bundles, initially seen as the ultimate expression of the fully convergent telco, has remained limited, with eight out of 12 markets reporting less than 20% of bundles being quad-play in 2022.

Among the 11 markets for which there is data on bundles including both fixed and mobile services, all but one (Denmark) showed growth in the adoption of convergent subscriptions. In eight markets, fixed-mobile convergent bundles already represent more than 40% of total bundles.

Fixed-mobile convergence has driven European operators' M&A strategies across the region in recent years, with multiple mergers between mobile carriers and cable operators. Most recently, Vodafone Group's Vodafone UK announced a planned merger with CK Hutchison's Three, although it is uncertain that the deal will receive regulatory approval.

Broadband is the most popular bundled service, being present in over 90% of bundles in most markets where breakdowns are reported, including Belgium, Denmark, Greece, Hungary, the Netherlands and Sweden (Austria, France, Germany and Spain only report broadband bundles). Poland is the exception, where pay TV is present in 83% of bundles (excluding mobile only), being frequently paired with mobile services, while fixed broadband is present in 65.5% of bundles.

Take-up of legacy services such as pay TV and fixed voice is less consistent. In markets with mature cable platforms, such as Belgium, Denmark, the Netherlands, Poland and Hungary, multichannel TV services are present in over 80% of bundles, whereas in Sweden, where fiber ISPs have grown significantly in recent years, TV is only present in 56.7% of bundles. Fixed voice remains strong in telco-dominated Greece and Spain, where TV is the least popular bundled service.

Global Multichannel is a regular feature from Kagan, a part of S&P Global Market Intelligence.

Research

Research