Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 19 Jun, 2023

Highlights

The cost of building and operating a fiber network has significantly increased in the past year, putting a strain on the attractiveness and profit margins of new network build-outs.

Beyond the cost of borrowing, cost per home connected has also gone up in line with rising prices for resources due to jumps in inflation rates across Western Europe.

Securing new investors and renewing loans has become a significant challenge for new network operators as the cost of borrowing rises and investors are more cautious.

At the FTTH Council Conference in Madrid in 2023, operators and investors focused on their new reality of the high number of small alternative networks rolling out fiber as investors become more selective and funding costs grow. The pressing challenge in 2023 is the ability to secure investors and renew loans as the cost of borrowing rises and investors, now with more experience and knowledge, more carefully evaluate rollout plans.

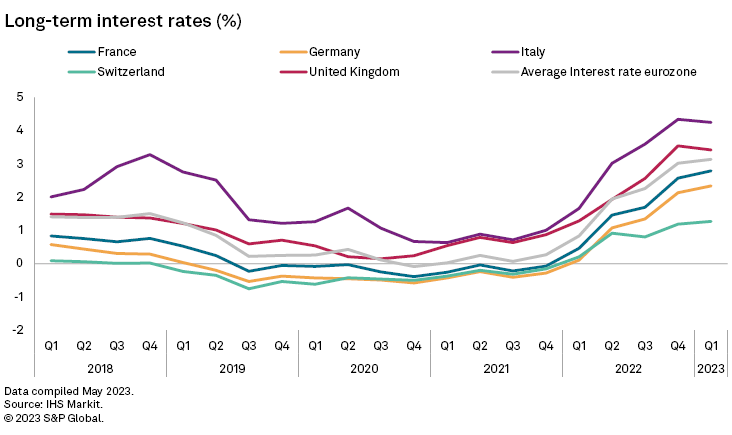

The current economic conditions in Western Europe have generated a more cautious environment. Investors and banks remain wary of rising interest rates, inflationary pressures, economic downturns, and the increasing costs of and competition for resources. As Greg Widroe, managing director at investment bank and financial services provider Houlihan Lokey Inc. said, "In the last 18 months, there is a fear of losing money rather than fear of missing out," which is what dominated the industry in the past. In that period, interest rates across Western European markets have risen dramatically, making access to liquidity a larger challenge.

From 2018 to March 2022, interest rates across Europe largely remained below 2.0% but have since risen rapidly. In the UK, for example, interest rates went from 0.54% in the first quarter of 2021 to 3.42% in the same quarter in 2023. The average eurozone interest rate, which stood below 1.0% until 2021, has now reached 3.14%. Between July 2019 and July 2021, interest rates were below zero in most European markets including Germany and France.

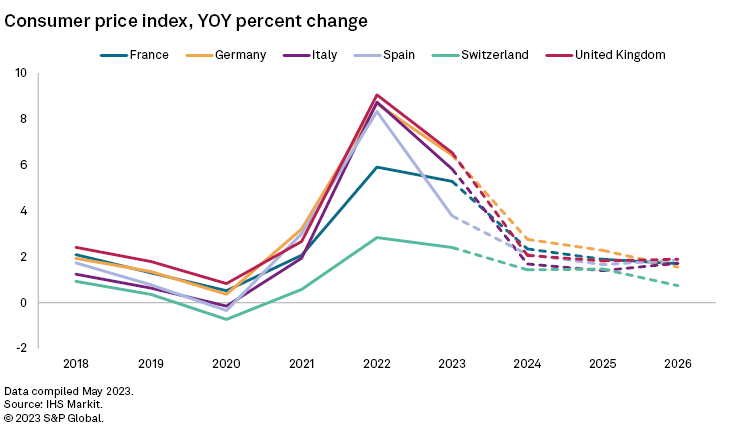

In the meantime, the cost of labor and materials have also increased, straining build-out budgets. Inflation rates across Europe, which stagnated below 3% for the past 10 years, more than doubled in 2022. In major markets dominated by fiber build-outs, such as Germany and the UK, inflation jumped to 8.67% and 9.05%, respectively, in 2022.

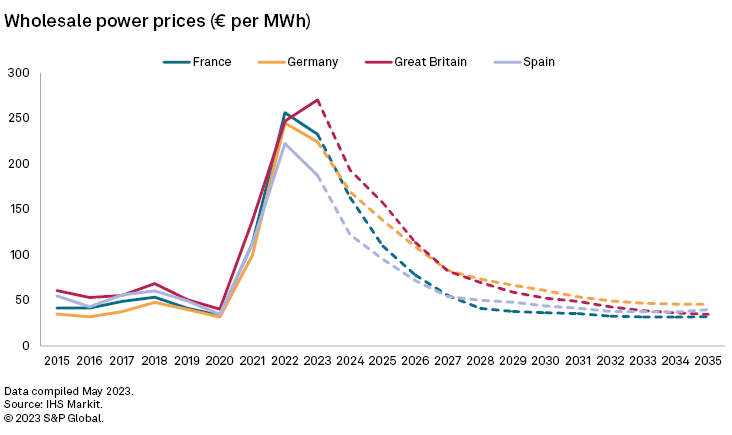

Beyond the rising cost of building a network, the cost of operating one has also risen due to the increase in electricity prices. According to a report by ADTRAN Europe Ltd., wholesale electricity prices are eight times higher than two years ago due to the war in Ukraine. Operators such as Deutsche Telekom AG and Telia Company AB have been pushed to lower their energy consumption to ensure their networks' profitability and thus look at the cost of the equipment they deploy and the associated energy consumption.

Adtran's solution was to develop compact optical line terminals (OLTs) that can maximize usage, whereas historically, operators launched expandable systems that started with one or two line cards and were gradually built as take-up increased. Systems with low penetration continue to consume electricity without being optimized. A compact OLT brings the highest density per subscriber available while simultaneously offering the lowest energy consumption per consumer. In a research study Adtran conducted for an Italian operator, the company compared the annual energy cost of traditional chassis modules currently deployed to their system across 10 years and found that a compact OLT can deliver about €21 million in cost reductions and thousands of tons in carbon emissions savings for a rollout that would cover 80% of the Italian market.

Investing in fiber infrastructure is no longer a novelty, and with higher costs, investors have become more selective. As a result, they have now raised the bar in terms of who they choose to invest in and are seeking sustainable business models. Target homes passed is no longer the key performance indicator they look at, but one of many. The size of the network planned, the topography in the target area, local regulations and required licenses, the potential of additional competition, and expected take-up rates — all help estimate the cost per home passed and evaluate the potential profit margins and viability of a project.

Many projects that launched in 2022 focus on Europe's rural areas that remain underserved, while urban areas, in many cases, are overbuilt. Rural areas are more costly to build, and in nascent but fast-developing fiber markets such as Germany, the cost of a rural connection can go up to €2,000 per home compared to €60 per home in Spain, where homes are more clustered. As a result, investors and networks seek to maximize profit and create a sustainable company.

Competing with incumbents Deutsche Telekom and Openreach Ltd. has proven challenging, as they can lower wholesale prices, unlike smaller operators, keeping ISPs from changing networks. Thus, smaller operators such as Fibrus Ltd. in the UK and Deutsche Glasfaser Holding GmbH in Germany sell directly to consumers and do not operate as wholesalers only. They have focused on building marketing departments to push consumers to switch and target areas where they can ensure demand. As Fibrus Co-founder and Chair Conal Henry said during the UK panel, "While infrastructure funds are not interested in investing in a marketing department, you are not going to get the revenue to deliver the return unless you get retail margins."

Global Multichannel is a service of Kagan, a part of S&P Global Market Intelligence.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Research

Blog