Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 07, 2023

By Jingyi Pan

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

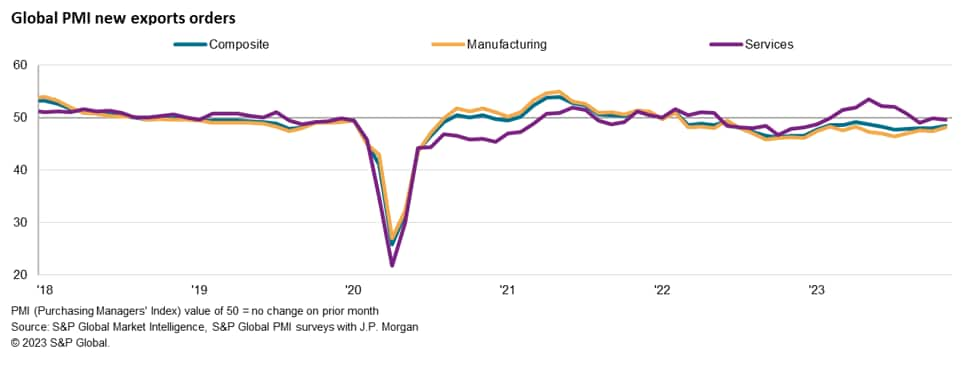

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a further deterioration in global trade in November, extending the sequence of decline to 21 months. There was some good news, however, in that the seasonally adjusted PMI New Export Orders Index rose from 48.0 in October to 48.5, which corresponded to only a moderate decline in trade conditions and the slowest pace of contraction since May.

The latest rise in the composite PMI New Export Orders Index, albeit in sub-50.0 territory, was supported by a slower decline in goods trade. This is while the downturn in services exchange sharpened, though remaining mild overall, meaning November was the third successive month in which both sectors recorded lower export business in tandem.

Manufacturing new export orders shrank for the twenty-first straight month in November, representing the worst prolonged spell for exports since the global financial crisis. Despite the rate of contraction being the slowest pace since April, it remained marked by historical standards. By broad sector, the downturn in export demand picked up speed within the intermediate goods segment (inputs shipped to other firms). Investment and consumer goods trade declined at slower rates, however, the latter recording the smallest fall in the current seven-month sequence.

More detailed sub-sector data again reflected the broad-based nature of the latest downturn in goods trade into the end of the year. The steepest decline in goods exports was seen in the paper & timber products sector, followed by metals & mining and construction materials. Observing the manufacturing sector's Future Output Index, the only sentiment-based PMI sub-index, business confidence remained below-average in the latest survey period despite rising from October, indicating subdued views about goods output and trade flows in the coming 12 months.

While services trade deteriorated only fractionally, the rate of decline accelerated slightly from October to represent a stark contrast from earlier in the year, when services trade boomed with the easing of pandemic restriction around the globe. Anecdotal evidence reflected that service sector conditions continued to be dampened by high borrowing costs and the increase cost of living. By detailed sector, most service sectors saw export business remain in a downturn, led by the real estate sector. Pockets of growth can nevertheless be found across sectors including commercial & professional services, insurance and healthcare services.

By broad region, both developed and emerging markets recorded lower trade activity for a fifth successive month in November. A slower pace of decline in export orders in developed markets contrasted with a quicker fall among emerging markets, though the former continued to record the sharper rate of decline in export orders between the two. Falling goods exports remained the key driver for subdued trade performance in both developed and emerging markets. That said, developed markets goods export orders fell at the slowest rate since June 2022 to indicate an alleviation in conditions.

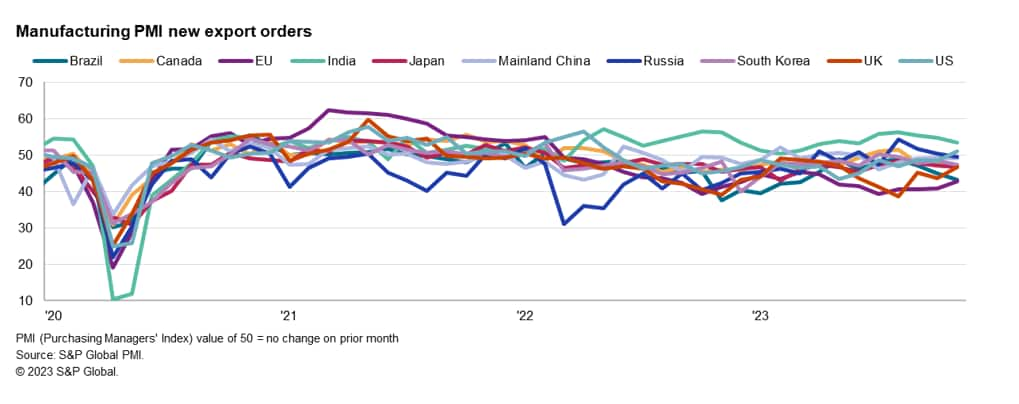

Measured across both goods and services, trade across the majority of the top 10 economies continued to deteriorate in November, though of varying degrees. The downturn in export orders was led by Brazil, with the EU following closely behind. The EU stayed the worst performer among developed markets as new export orders fell for a twenty-first straight month and at a rate faster than the rolling 12-month average. This was despite the pace of contraction easing for a second straight month. European manufacturing trade continued to fare worse when compared with services and was especially sharp across Austria, Germany and France.

Besides the EU, trade conditions in Japan and UK also worsened. New export orders notably fell for a third successive month in Japan, driven by faster declines in the goods producing sector, though a second monthly fall in services export business was also observed. The Global Electronics PMI outlined sustained demand contraction for electronics, a key export component for Japan. In contrast, the UK saw the shallowest fall in export orders since July 2022, with easing downturns in goods trade and improvements for services new business supporting the change.

Export orders meanwhile returned to growth in the US, buoyed by expansions in both the manufacturing and service sectors. Anecdotal evidence from the PMI survey suggested that incoming new business from export partners in North America and Europe supported the latest rise in services activity.

Focusing on emerging markets, India was again the best performer with exports expanding for a fifteenth successive month in November. The rate of growth eased to the slowest since June, but remained solid. This was attributed to softer increases in both manufacturing and service new export business. In contrast to the worldwide trend, India's manufacturing sector outperformed services pertaining to trade, thanks to new export orders emanating from around the world, including Africa, Asia, Europe and the US.

Russia followed next, where trade conditions remained almost unchanged in November. Marked improvements in the service sector in Russia helped offset a slowdown in manufacturing trade. Mainland China also saw muted changes, with a mild decline in export business again noted in November. While services new business rose for a third successive month in mainland China, it was the key manufacturing sector that dampened overall export conditions.

Finally, Brazil remained the worst performer among the four largest emerging economies, suffering the most pronounced decline in export orders of all major economies in November. Services new business notably fell at the sharpest pace outside of the pandemic period, while the fall in manufacturing export orders was also marked.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location