Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 Dec, 2023

By Hailey Ross and Jason Woleben

Several years ago, the National Association of Insurance Commissioners set out to solve a problem: a lack of consistency at the state level when it came to approving rate increase requests for long-term care insurance.

In early 2019, the National Association of Insurance Commissioners (NAIC) took action and formed an executive-level task force on long-term care insurance, of which most state regulators were members. The group adopted a multi-state actuarial framework as a guide for handling rate increase requests in April 2022, which was then "operationalized" in September 2022, according to the NAIC.

But in the present day, although the work of the multi-state actuarial team has helped improve the situation, it is clear that those efforts have not been the perfect fix that insurance companies wanted for the troubled business line. Long-term care (LTC) insurers have long struggled to get what they feel are adequate rate increases on their long-term care blocks.

"The number one thing is it's gotten states to talk to each other and get educated together on these issues, and try to form more of a common understanding than there was before," Fred Andersen, chief life actuary at the Minnesota Department of Commerce, said in an interview.

'Big success'

The idea behind the multi-state reviews was to create an additional option for insurance companies filing for long-term care rate requests, Andersen explained. Instead of insurers doing what they have always done — filing requests in 50 different states — they could have the multi-state actuarial (MSA) team perform an initial review that would lead to a recommendation for what constitutes an appropriate rate increase or decrease that then gets distributed to states.

But the stage after the distribution of the recommendation is probably the "tougher part," Andersen said, noting that each state still maintains total control over what sort of rate increase is actually approved, allowing them to reject what the MSA team has suggested. Even if states are on board with the recommendation, insurers may still have to submit filings in individual states as a formality.

Andersen, who has long been a leader in helping to develop the MSA framework, characterized the overall process as a "big success."

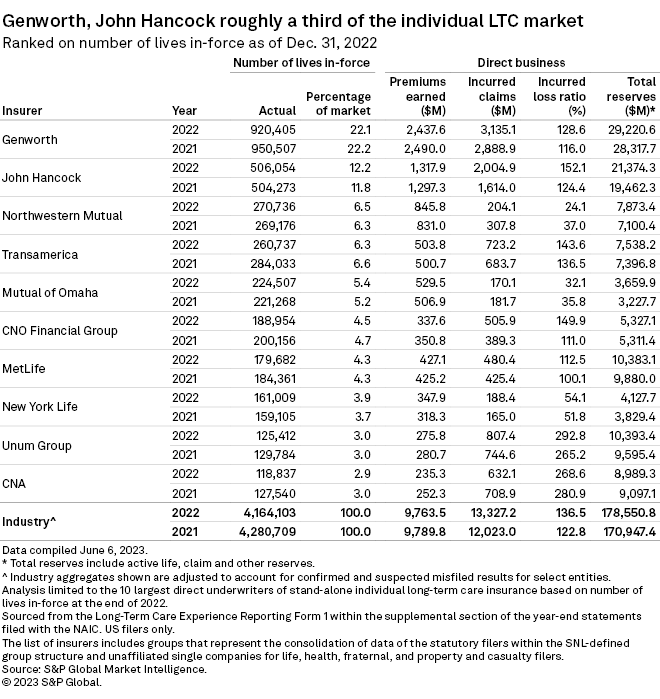

Genworth Financial Inc. is the largest provider of individual long-term care business in the US, followed by Manulife Financial Corp.'s John Hancock and The Northwestern Mutual Life Insurance Co.

Andersen reported that after states have been receiving recommendations they seem to make decisions relative to the amount of rate increase requested.

"The lower the rate increase recommendation the more participation by the states," Andersen said. "As you get higher magnitudes of recommended rate increases, states tend to have processes to kind of dig a little deeper and do their own thing."

Bad math

Genworth was heavily involved in the NAIC's process as it worked to develop a multi-state actuarial review.

Genworth CEO Tom McInerney said in an interview that he was initially "quite critical" of the MSA's methodology, which he said assumes insurers' past requests have been approved by regulators even if they were not awarded.

"To me, it's kind of crazy to just use that as a starting point," McInerney said.

McInerney said Genworth only agreed to use the methodology on one of its older policy forms because even though it was "not perfect," it was "close enough" to what they had been asking for. For now, the insurer is not interested in filing under the MSA for any of its other policy forms.

McInerney said he hopes that states that have been reluctant to grant rate increases in the past will "step up" and approve what the MSA team recommends.

As for other insurers, Genworth's CEO said companies that have not done as well with getting past premium increases are somewhat reluctant to use the MSA review process because they feel the underlying actuarial methodology is not really the correct mathematical calculation.

"We'll see how many other LTC insurers are willing to use it, and we'll see if the states that are behind will agree to the number that comes out of it," McInerney said.

Although the MSA framework is already operational, Andersen said he feels it is still "always evolving," with a key component being the actuarial approach. The NAIC said in an email that the LTC task force continues to work on "improving and refining" the MSA review process.

Overall, McInerney believes it will reduce cross-subsidization, but it will not eliminate it.

Genworth's Choice 2 and 2.1 policy forms, which represent one of their larger LTC blocks, show that cumulative rate increases widely vary between individual states.

For example, South Dakota has granted 370.5% cumulative rate increases between 2013 and 2022, while Vermont approved 22.4% cumulative rate increases during the same period. The status of pending and approved rate filings in S&P Global Market Intelligence's analysis is as of February 2023.

Multiple policyholders sued Genworth as part of a class-action suit, alleging that Genworth failed to include certain information in letters sent to Genworth Choice 2 and Choice 2.1 policyholders related to premium increases. Genworth denied allegations of wrongdoing but entered into a settlement that became final March 27, 2023.

Genworth started implementation of the settlement in the second quarter of 2023, and in a regulatory filing said it expects an "overall net favorable economic impact" to its LTC business from the case's settlement.