Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 31 Mar, 2021

By Anu Ganti

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

We’ve previously argued that most managers should prefer above-average correlation, because the incremental volatility a manager accepts to pursue an active strategy will be lower when correlations are high. In addition, active managers should prefer above-average dispersion, because stock selection skill is worth more when dispersion is high. Both correlation and dispersion rose in 2020. Despite these relatively auspicious conditions, most active managers still failed to outperform. Why?

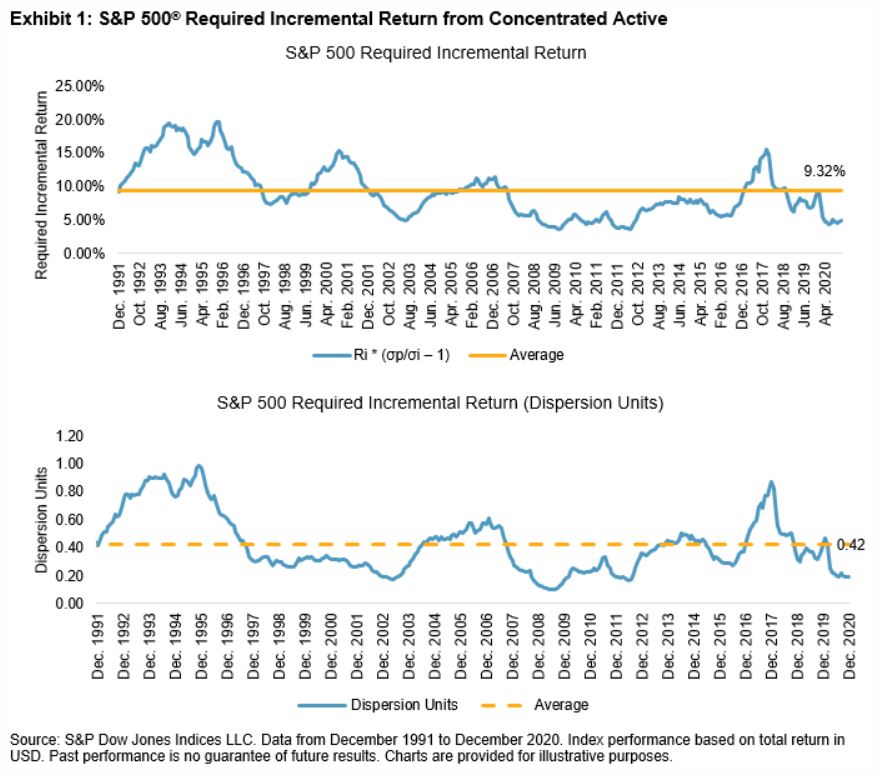

The top half of Exhibit 1 illustrates how the required incremental return for large-cap active managers declined in 2020, as correlations rose. In order to understand how difficult it is to earn the incremental return, we can divide the required incremental return by dispersion, as shown in the bottom half of Exhibit 1. The decline in required incremental return below its long-run average suggests that conditions in 2020 were more favorable (or less unfavorable) than usual for active managers.

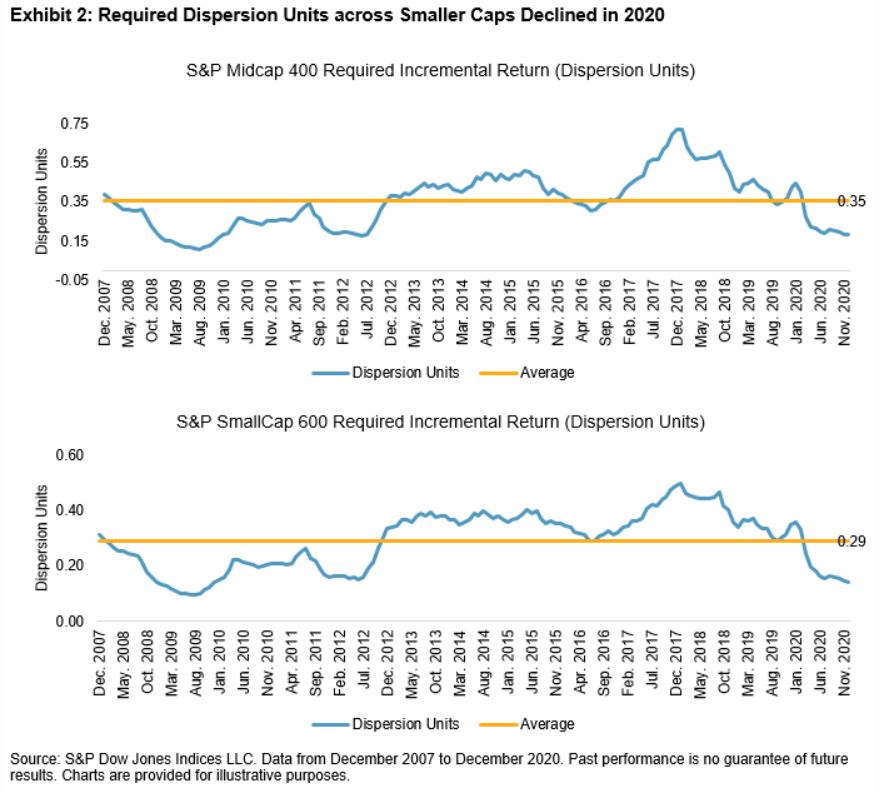

We see similar results in Exhibit 2 for smaller-cap active managers, as the required dispersion units for the S&P MidCap 400® and S&P SmallCap 600® declined below their historical average as well, signaling a relatively easier environment for active management.

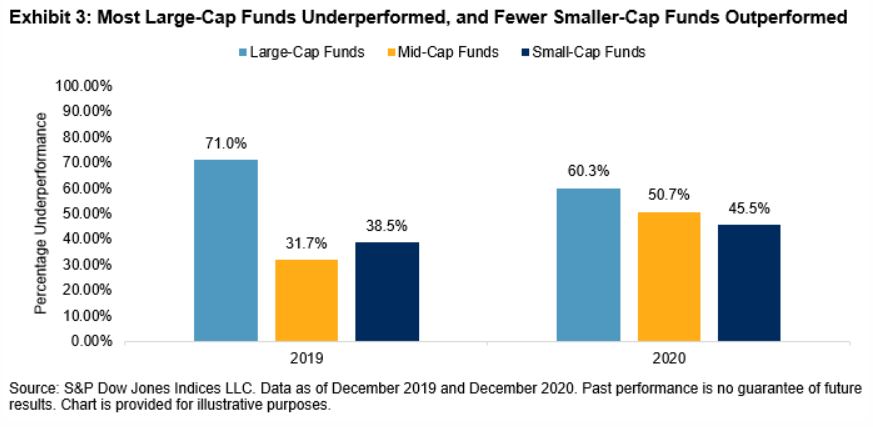

However, our U.S. SPIVA results in Exhibit 3 show that most large-cap funds still underperformed in 2020, although by a bit less compared to their 2019 results. Most smaller-cap funds outperformed, but surprisingly they had done even better in 2019, when conditions for active were more challenging.

Most active managers did not take advantage of 2020’s relatively more favorable environment for stock selection. Higher dispersion, or lower required dispersion units, only help active managers if they have genuine stock selection skill. For other managers, high dispersion might mean larger performance shortfalls. The misalignment between the promising prospects for active management in 2020 and their subsequent performance remind us that true skill is rare and larger active opportunities do not automatically translate into actual outperformance.

The posts on this blog are opinions, not advice. Please read our Disclaimers.