Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 12 Sep, 2020

By Mona Naqvi

The S&P Global Carbon Efficient Index Series is designed to reduce carbon exposure while maintaining similar levels of risk/return to the benchmark. Most notably, the index series incentivizes behavioral change among companies by uniquely encouraging two things:

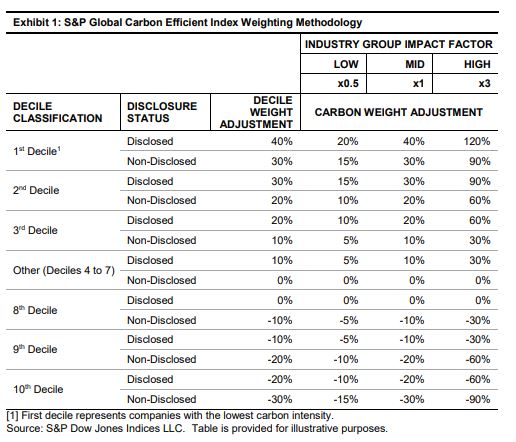

The latter is achieved by assessing the carbon performance of companies (based on GHG emissions data from Trucost), sorting them into deciles within GICS® industry groups, and reweighting accordingly. However, since some industries are inherently more GHG emitting than others, our methodology considers the spread of possible emissions within an industry group and increases or decreases company weights by either a greater or lesser extent, depending on how much a company can feasibly improve given current available technologies.

For example, a highly carbon-efficient Energy company in the top decile of the broad-ranging Energy industry is likely to be far ahead of its peers and, thus, deserves a significant weight increase of 120%. Conversely, a Media company in the top decile of the smaller-ranging Media industry only receives a small weight increase of 20%, as it is only slightly ahead of its peers. Vice versa, a high-emitting Energy company in the bottom decile would get a weight reduction of 90% versus just 15% for a Media company in the same position (see Exhibit 1). As such, companies are incentivized to both disclose and decarbonize to boost their overall standing—to the extent that they are able to.

The S&P Global Carbon Efficient Index Series is designed to measure financial markets worldwide and offers market participants the opportunity to reduce their exposure to carbon risk. The methodology is also sector neutral, amounting to a carbon reduction of 20%-60% relative to the underlying benchmarks, with low tracking errors and comparable returns, thereby demonstrating that there need not be an inherent trade-off between investment performance and decarbonization. In theory, the carbon performance of the S&P Global Efficient Carbon Index Series should further improve over the long term, as companies adapt their behavior and as the indices continue to grow in popularity among market participants. Indeed, our initial results to date suggest that they are already heading in that direction.

Content Type

Segment

Language