Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 Oct, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

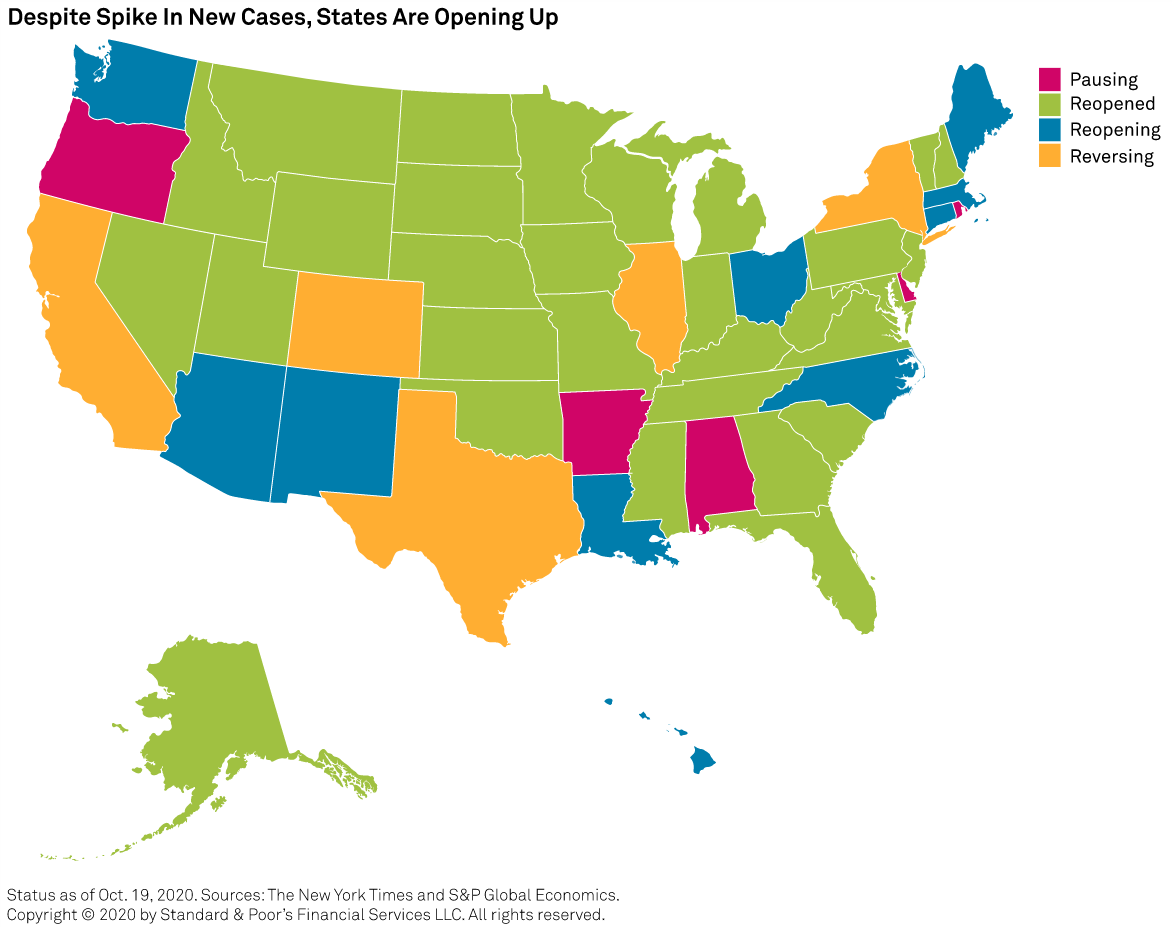

The number of Americans hospitalized due to COVID-19 is surging across the country to the highest total seen since August. The seven-day average of new daily cases of coronavirus reached a record 68,767 on Oct. 25, according to Johns Hopkins University data. Yesterday, U.S. equities suffered their biggest losses since last month, with the benchmark S&P 500 index down 1.9% for its worst day since Sept. 23 and the Dow Jones Industrial Average tumbling 2.3% for its worst day since Sept. 3. The likelihood that an economic stimulus package will be agreed upon prior to Nov. 3 has weakened as House Leader Nancy Pelosi (D-California) and Treasury Secretary Steve Mnuchin remain embroiled in tense negotiations.

With just one week until the 2020 U.S. presidential election, uncertainty and volatility are on the rise as concerns regarding whether the winner will be known on Nov. 3 intensify.

"COVID matters more than the election," Scott DiMaggio, director of global fixed income at AllianceBernstein, told S&P Global Market Intelligence. "Even if Biden wins, he’s not waving a magic wand in December and everything gets fixed."

Incumbent President Donald Trump and Democratic nominee Joe Biden have vastly different platforms on taxes, fiscal stimulus, regulation, and immigration, but have taken similar positions on trade and infrastructure, according to an S&P Global Ratings analysis of each candidate’s plan.

The energy industry—encompassing oil, gas, and other fossil fuel generation as well as renewables—face varying risk depending on who wins the contest, considering the disparities in the candidate’s energy and climate policies. President Trump has pushed an energy independence agenda focused on fossil fuel generation, while Mr. Biden’s platform focuses on expanding green energy development. The diverging energy policies could affect companies’ credit quality if Biden is elected, as fossil fuel companies would likely rush to adapt their business to meet the more rigorous policies, according to S&P Global Ratings.

Over the last three and a half years, the current administration repealed energy regulations in a manner that created "a regulatory uncertainty that never existed in previous administrations," former Environmental Protection Agency water official Betsy Southerland told S&P Global Platts. "When you went between [Presidents Bill] Clinton and [George W.] Bush or Bush and [Barack] Obama, you would have a change in priorities, but you would not have a decision that they were literally going to roll back everything the previous administration did.”

Despite such aggressive actions, the energy transition is expected to accelerate whether President Trump serves another term or Mr. Biden wins the White House. Market participants and observers have expressed confidence that the renewables market would continue to expand regardless of the election’s outcome due to municipalities taking strong action to transition from fossil fuel dependencies.

"As we look back at the last three and a half years, the renewable energy industry has seen unprecedented growth, and it's being driven by the stakeholders," Susan Nickey, the managing director of Hannon Armstrong Sustainable Infrastructure Capital Inc., an investment firm in climate change solutions managing more than $6 billion in assets, told S&P Global Market Intelligence’s Energy Evolution podcast. “The fallback goes to the state's cities, utilities that every day are stepping up their renewable portfolio standards [and] zero carbon emission goals.”

"We're viewing [the clean energy transition] as more of a grassroots, bottom-up state level initiative," Lillian Federico, an S&P Global Market Intelligence energy research director, told S&P Global Platts. "I don't think that Trump being reelected would derail that, and I don't think Biden being elected would necessarily meaningfully accelerate that."

Investors appear to be preparing for a Biden victory—evidenced by the spread between 2-year U.S. Treasury yields and 10-year notes settling at 0.71% on Oct. 22, the highest curve seen in three years. “The main factor is undoubtedly what we like to call the 'Biden reflation trade,” ING senior rates strategist Antoine Bouvet told S&P Global Market Intelligence, explaining that “the market is pricing a greater growth and inflation prospect in the U.S. due to more pro-growth fiscal policy in case of a Democrat sweep at next month's election.”

But whomever becomes president on Jan. 20 will have his work cut out for him. “Given that the U.S. economy is mired in a weak recovery, we believe the single most important task the next president has will be to create jobs, given the unemployment rate is still high, at 7.9%—above or equal to the peak of eight of the past 11 recessions,” S&P Global Ratings’ Chief U.S. Economist Beth Ann Bovino said the report analyzing the candidate’s positions.

Today is Tuesday, October 27, 2020, and here is today’s essential intelligence.

U.S. Real-Time Data: A Cloudy Economic Outlook as COVID-19 Resurges

Since S&P Global Ratings’ last U.S. real-time data report on October 8, the data remains mixed, highlighting the growing divide between those exposed to the economic damage from COVID-19 and those more insulated from it. Ratings’ real-time economic indicators continue to show an economy that is slowly climbing out of the hole it fell into during the recession. This is in line with Ratings’ belief that after the U.S. economy took the elevator down and halfway back, the recovery has to take the stairs the rest of the way up.

—Read the full report from S&P Global Ratings

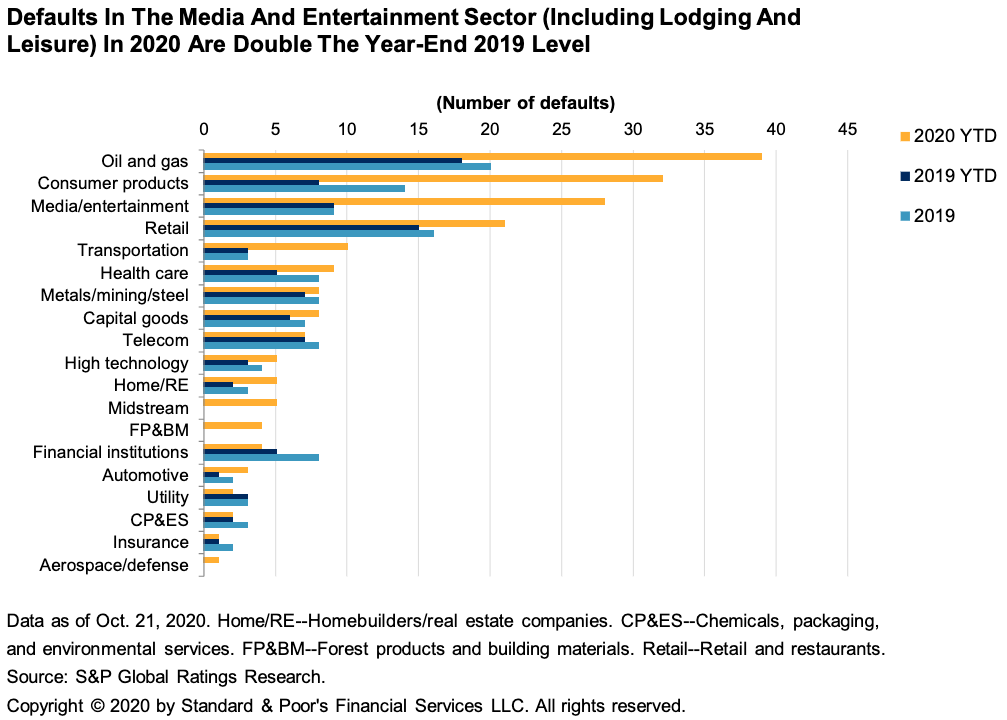

Default, Transition, and Recovery: Global Corporate Defaults Continue To Rise, To 194 So Far In 2020

The global corporate default tally has reached 194 so far in 2020, after five companies defaulted since S&P Global Ratings’ last report. Three of the defaults were distressed exchanges and two missed interest payments. Accounting for two of five defaults this week, the media and entertainment sector now has the third-highest default tally (at 28), behind oil and gas, with 39, and consumer products, with 32. Nearly 70% of defaults in the sector were from the U.S., followed by emerging markets, with five.

—Read the full report from S&P Global Ratings

BDC Quarterly Wrap Q2'20: Pandemic Weighs on Volumes, Values

The deep freeze that gripped credit markets in the second quarter depressed volumes and values of loans in the portfolios of business development companies, cutting across both syndicated and nonsyndicated structures, LCD data shows. As pandemic lockdowns arrested economic activity in the second half of March, deal flow dropped off. The slowdown in new loan transactions dominated the second quarter, ending the buoyant, borrower-friendly market conditions that ushered in 2020.

—Read the full article from S&P Global Market Intelligence

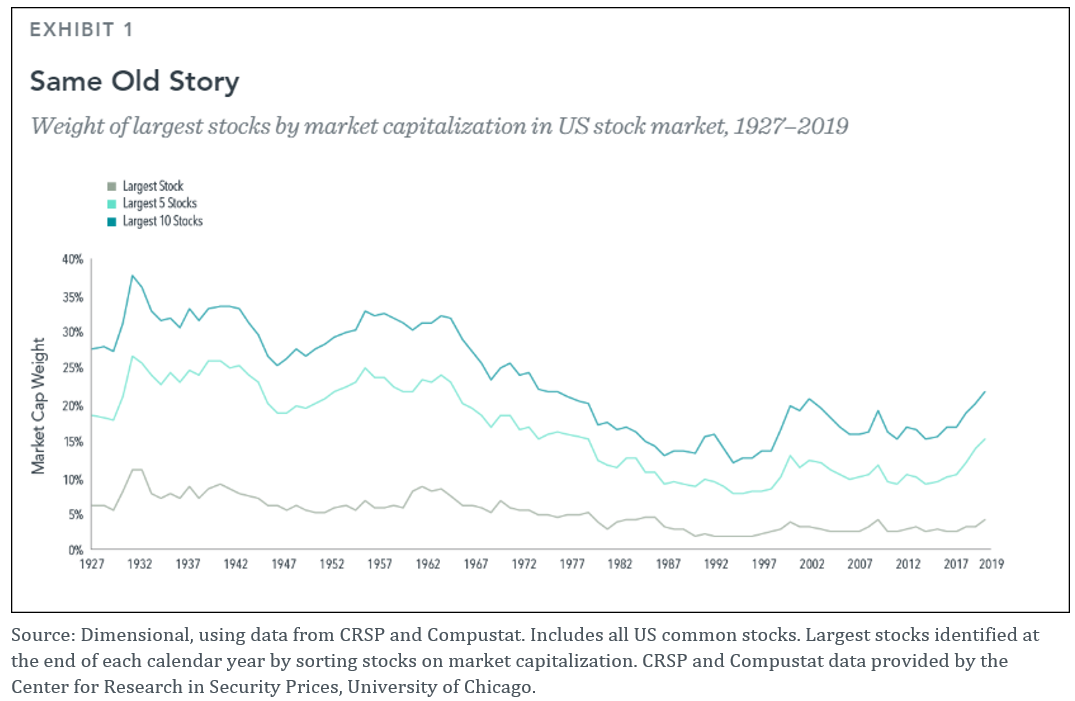

Large and In Charge? Giant Firms Atop Market is Nothing New.

While the types of businesses most prominent in the market vary through time, the fact that a small subset of companies’ stocks account for an outsized portion of the stock market is not new. Moreover, research suggests these stocks’ best performance might be in the rearview mirror. The takeaway is that relying on well-established investing principles such as broad diversification helps ensure investors have exposure to a vast array of companies and sectors, potentially providing a more reliable approach to achieving their investment goals.

—Read the full article from S&P Dow Jones Indices

A Supply Drop and Demand Pickup Pushed Soybeans to a Three-Year High

Only a few months ago, it seemed that global soybean supplies were more than ample, and in the case of the U.S., a semi-permanent soybean mountain had been built in the wake of damaged demand from its top customer, China. Fast forward to late October 2020, and the S&P GSCI Soybeans is up 29% since the low in March of this year, making a new high last week driven by abrupt supply cuts and the rapid return of export demand.

—Read the full article from S&P Dow Jones Indices

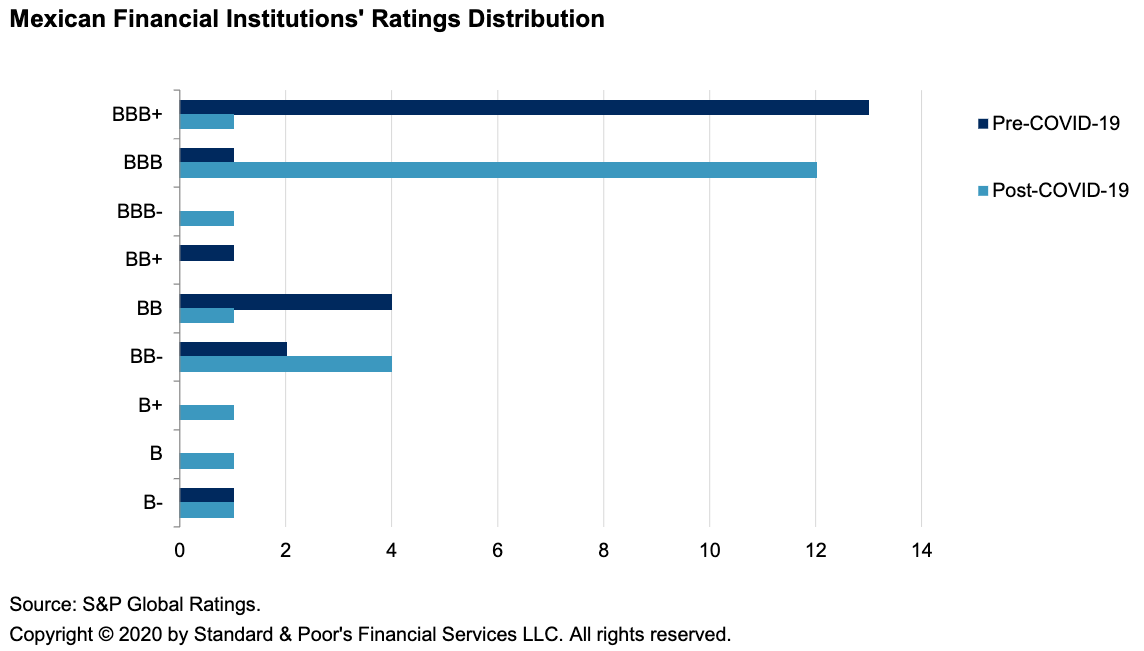

Mexican Banks Brace for Widening Credit Losses

The Mexican banking system has been one of the hardest hit in the world during 2020, in terms of negative rating actions. This is because of COVID-19 and the collapse in oil prices, along with an economy that slowed in 2019. These factors have increased economic risk for the financial sector, prompting S&P Global Ratings to revise its BICRA on Mexico to a weaker category and downgrade domestic financial institutions, as well.

—Read the full report from S&P Global Ratings

India's Nonbank Lenders get Liquidity Boost, Though Some Challenges Remain

India's nonbanking financial companies, once a major strain on the nation's financial system, may have put the worst behind them as enhanced liquidity, regulatory measures and resilient asset quality puts many of them in a stronger position than they were at the start of the year, analysts say. Several months into the coronavirus pandemic that upended India's economy, the country's nonbanking financial company, or NBFC, sector is faring surprisingly well, a turnaround that seemed unlikely at the start of 2020.

—Read the full article from S&P Global Market Intelligence

UK Aims to Shape Global Fintech Regulation as it Bridges EU Divorce – Experts

The U.K.'s fintech bridges initiative, a series of bilateral agreements with five APAC countries designed to help young companies enter new markets, could strengthen the country's hand in shaping global fintech regulation after the Brexit transition period ends, according to industry observers. Britain currently has fintech bridges with Hong Kong, Singapore, China, South Korea and Australia, in addition to various fintech co-operation agreements with the U.S., Canada, China, Hong Kong, Japan and South Korea.

—Read the full article from S&P Global Market Intelligence

Banks Raise Concern over Insider Threats as Pandemic Takes Toll on Mental Health

Prolonged remote working and the pandemic's potential impact on mental health have led banks and cybersecurity experts to warn of a growing challenge around insider threats, and it could be a costly affair for those organizations that fall victim to this form of cyberattack. As the pandemic sent staff home across the globe earlier in the year, it created the perfect environment for cybercriminals. But while banks and financial firms rushed to gear themselves up against growing external threats, they may have to look within their organization to address the next big cyber risk.

—Read the full article from S&P Global Market Intelligence

Listen: Street Talk Episode 70 - Banks' Liquidity Conundrum Could Fuel M&A Activity

As deposits have flooded into the system and loan growth has been hard to come by, many banks find themselves drenched with excess liquidity. The dynamic has put considerable pressure on net interest margins but might not prove short-term in nature like many banks hope, according to Greg Hertrich, head of U.S. depository strategies at Nomura Securities. In the episode, Hertrich said those earnings pressures could remain in place for many banks, prompting them to consolidate branches — particularly in light of increased digital adoption — and pursue M&A activity.

—Listen and subscribe to Street Talk, a podcast from S&P Global Market Intelligence

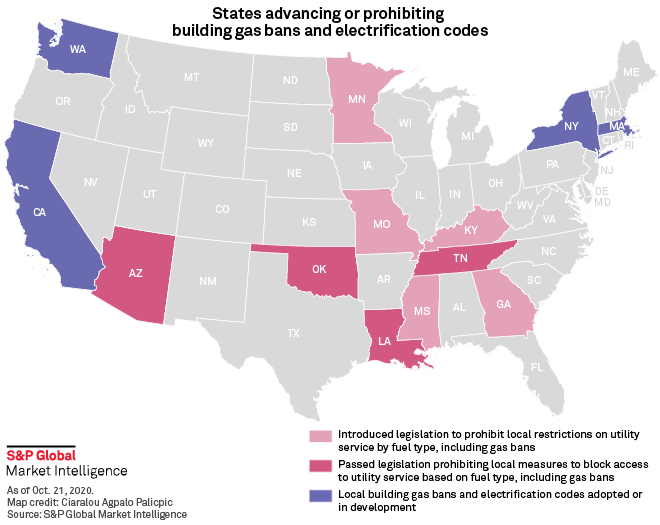

Building Electrification Could get Support Under Biden Presidency

Building electrification backers could get a powerful ally if Democratic candidate Biden prevails in the presidential election on November 3. Biden's $2 trillion climate-oriented infrastructure plan includes a goal of halving the U.S. building sector's carbon footprint by 2035. It also calls for establishing building performance standards throughout the country; reforming building energy codes; and financing state, city and tribal efforts to adopt stronger codes.

—Read the full article from S&P Global Market Intelligence

Duke CEO says Environmental Justice Key to Clean Energy Transformation

Duke CEO says environmental justice is key to clean energy transformation. In an interview with S&P Global Market Intelligence after the event, the company's CEO, president and chair, Lynn Good, provided more details on what those metrics and principles might involve. She also defended the company's decision to build more natural gas generation despite having a net-zero emissions target.

—Read the full article from S&P Global Market Intelligence

Podcast: How COVID-19 is Forcing Big Changes for Parents, Family Caregivers

"It's going to be a disaster." That's what Natasha Lamb, managing partner at sustainable investment firm Arjuna Capital LLC, said when asked how the pandemic will impact women in the workforce. In this special episode of ESG Insider, an S&P Global podcast about environmental, social and governance issues, S&P Global Market Intelligence explores how corporate America is responding to COVID-19 with new policies for employees caring for children and elderly relatives. S&P Global partnered with AARP to research how leave policies are evolving in the U.S. private sector and the potential impact on women in the workforce.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Market Intelligence

Watch: Market Movers Asia Oct 26-30: China's Five-Year Plan, SIEW 2020 in Focus

The highlights in Asia on S&P Global Platts Market Movers, with India Desk Editor Aastha Agnihotri: Eyes on China's five-year plan and how it could shape the commodities markets; Japan aluminum premiums surge; thermal coal producers focus on Chinese power utility seaborne tenders; and SIEW 2020 tackles strategies for a low-carbon energy future.

—Watch and share this video from S&P Global Platts

Total Plans to Maintain, Not Shrink, Future Oil Output Despite Tougher Outlook: CEO

French oil group Total has no plans to shrink its oil production volumes in the coming years but hopes to maintain its current output levels while prioritizing lower-cost, shorter-cycle upstream projects, its chief executive officer Patrick Pouyanne said October 26. "We don't want to decline oil on the production side, we'll continue," Pouyanne told an industry event on October 26. "It's a bit difficult to grow when you are selective but maintaining our oil production is part of a strategy...When we have opportunities to grow we'll do it...we are proud to be an oil producer."

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language