Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 24 Jun, 2021

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

As advanced economies enjoy the bounties of economic rebounds and the beginnings of a return to a new normal, developing economies are enduring a rockier road to recovery

Despite stronger-than-expected GDP growth in the first quarter of this year, propelled by domestic demand and the performance of the service sector, many emerging economies have confronted new waves of coronavirus infections that have led to renewed lockdowns and may ultimately constrict activity, according to S&P Global Ratings. Companies across these emerging markets may face elevated credit risks. To assist, the International Monetary Fund is planning to increase Special Drawing Rights by $650 billion this year to boost the reserve adequacy of struggling emerging market economies. Bolstering vaccine rollouts in such nations will be critical to stabilizing growth.

“Progress in vaccination is key in maintaining the economic recovery’s momentum. In order to prevent ‘on-and-off’ lockdown measures and return to operating at full capacity, a wider vaccination rollout is necessary across most EMs,” S&P Global Ratings said in its monthly report on emerging market economies. “Fully vaccinating roughly 70% of the populations will likely take at least until 2022 in most EMs amid the current vaccination pace. This leaves most EMs’ economic recovery highly vulnerable to setbacks if the pandemic worsens and leads to renewed lockdowns.”

Few emerging markets will suffer slower growth than sub-Saharan Africa due to conditions brought on by the COVID-19 pandemic. By the end of 2024, the economies of Ethiopia, Ghana, Kenya, Nigeria, and South Africa combined will be 6.6% smaller than the pre-pandemic long-run trend-based estimate, according to S&P Global Ratings. On average, these economies are projected to expand 2.7% this year and 3.1% in 2022.

“The pace of [this] rebound is nowhere enough to bring the economies back to their pre-pandemic GDP trajectories,” S&P Global Economies said in a recent report on the sub-Saharan African recovery.

Slow growth in emerging markets could impact the global economy overall, even as decarbonization action intensifies. The International Energy Agency anticipates that, without private finance for energy transitions, emerging and developing economies will account for the majority of increasing greenhouse-gas emissions in coming decades.

"We all talk about the race to net-zero," IEA executive director Fatih Birol said June 21 during a webcast with academic researchers organized by the Brookings Institution think tank, according to S&P Global Platts. “In my view, the race is not between the countries, but against time. We have to acknowledge some countries start the race in front of others … Unless all countries cross the finish line, nobody wins the race."

Today is Thursday, June 24, 2021, and here is today’s essential intelligence.

Global Actions on Corporations, Sovereigns, International Public Finance, and Project Finance to Date In 2021

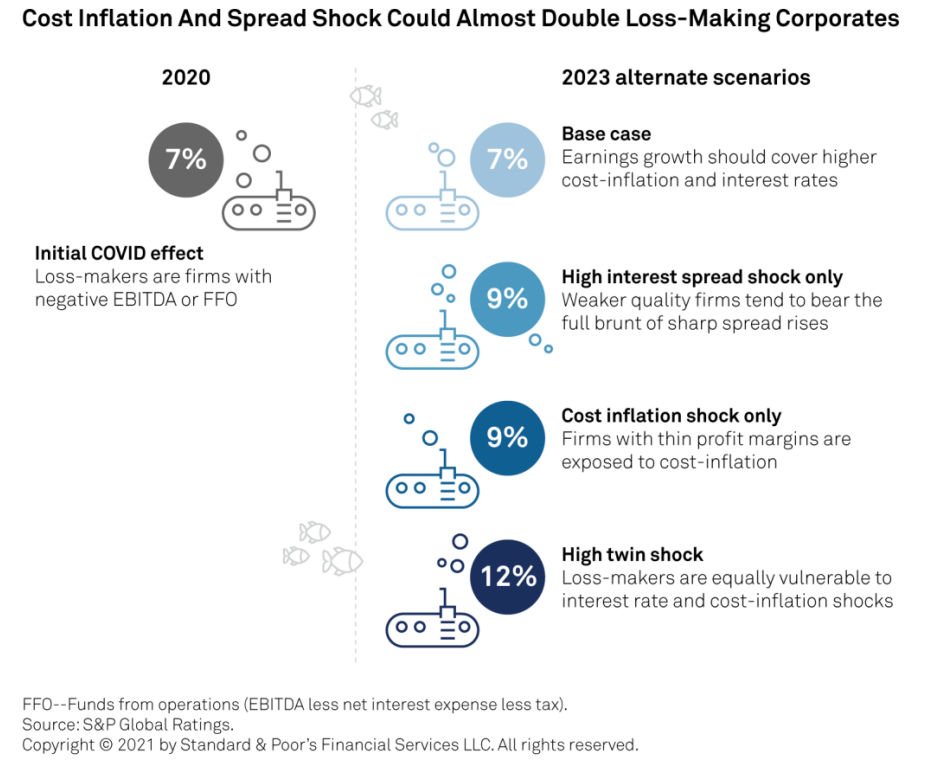

Rating actions in June 2021 have declined considerably since the highs in April 2021. So far in 2021, there have been 358 issuers that have had a negative rating action and 1,041 issuers with a positive rating actions. The largest percentage of rating actions have been due to an outlook revision to stable from positive. Much of the recovery has been due to stabilization, as over half of the issuers with positive rating actions had experienced one or more negative rating actions in 2020.

—Read the full report from S&P Global Ratings

U.S. Not-For-Profit Private College And University Fiscal 2020 Median Ratios: Metrics Start to Demonstrate Effects of the Pandemic

Enrollment pressures persist for many institutions in the private higher education sector with the exception of a small pool of higher-rated colleges and universities, indicating widening divergence within the industry.

—Read the full report from S&P Global Ratings

U.S. Not-For-Profit Health Care Sector View Revised To Stable From Negative

The revision reflects a trend of revenue recovery, ongoing balance sheet strength, and proactive management teams' focus on maintaining financial stability.

—Read the full report from S&P Global Ratings

Short Sellers Back Off Bets Against Financial Sector Stocks

As equity investors have increased their bets against healthcare stocks and electric vehicle manufacturers this year, short sellers have increasingly backed away from financial sector stocks.

—Read the full article from S&P Global Market Intelligence

Foreign Demand Supports US Government Debt Market Even As Yields Fall

A strong dollar is making Treasurys more attractive to foreign buyers — a key source of demand as the U.S. government pumps up supply to fund the response to COVID-19 — and buoying already robust international demand for the asset class even as yields fall, according to experts.

—Read the full article from S&P Global Market Intelligence

Spotlight: Oil Project Sanctioning Is Picking Up on the Back of Higher Oil Prices

The pandemic hit the oil market hard in 2020, resulting in a global capital expenditure reduction of 24% (minus 38% in North America and minus 18% internationally). Oil prices have increased significantly since Brent dropped below $18/b in April 2020, to the current level of $72/b.

—Read the full article from S&P Global Platts

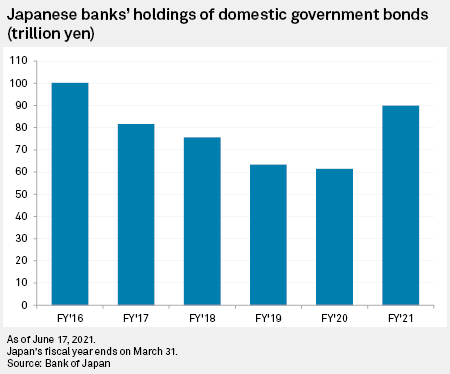

Japanese Banks Could Return to U.S. Treasurys, Shifting Away From Yen Bonds

Japanese banks are likely to pivot toward investing in U.S. Treasurys and other higher-yielding foreign assets as they seek better returns on their swelling deposits. That marks a change after local lenders in 2020 raised their holdings of near-zero-yielding domestic government bonds to the highest point in five years.

—Read the full article from S&P Global Market Intelligence

Big Tech May Seek Recusal of New FTC Chair Khan Over Objectivity Questions

Lina Khan, the new chair of the Federal Trade Commission, is known as a prominent critic of Big Tech, a reputation that could actually hinder the ability to rein in tech firms' power, industry experts say.

—Read the full article from S&P Global Market Intelligence

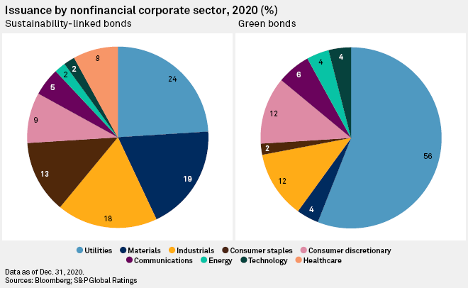

Sustainability-Linked Bonds In 'Rapid Growth' as More Firms Tap ESG Debt Market

As companies across a broad range of sectors increasingly look to access the environmental, social and governance debt market, analysts expect accelerated growth in issuance of a nascent type of bond that links the coupon to the issuer's sustainability performance.

—Read the full article from S&P Global Market Intelligence

Reskilling Workforces, Developing Hydrogen and CCS Vital to Energy Transition: Enel CEO

The transition to a zero-carbon economy will hinge on governments successfully facilitating the shift of large sections of their workforces to new sectors, as well as a rapid acceleration of technology in renewable hydrogen and carbon capture and storage, Italian utility Enel's CEO Francesco Starace said June 23.

—Read the full article from S&P Global Platts

UK Stands by Offshore Oil, Gas Licensing Despite Rising Tensions Over Net-Zero Targets

The UK will still consider offering new offshore oil and gas licenses in the future, energy minister Anne-Marie Trevelyan said June 23, despite rising pressure on the country to ban new exploration in the wake of a landmark report on global carbon emissions by the International Energy Agency.

—Read the full article from S&P Global Platts

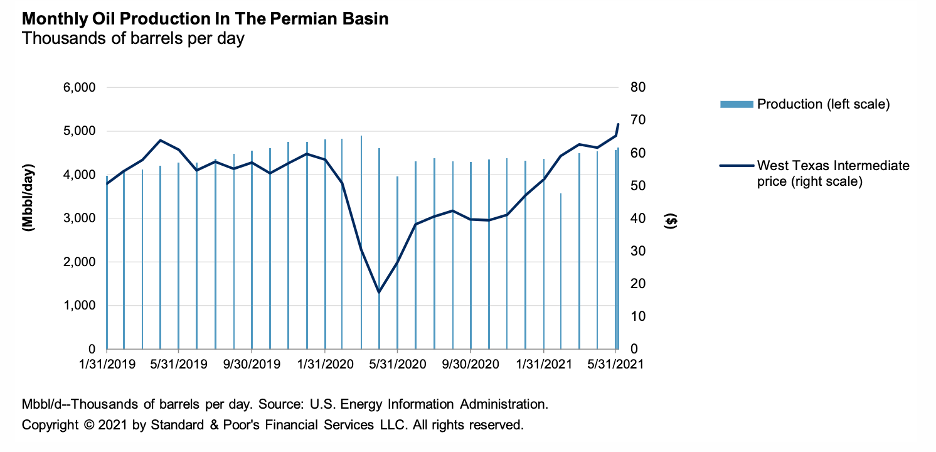

Credit Quality Improves for Permian G&Ps as Volumes Bounce Back

After a challenging environment in the Permian Basin for gathering and processing (G&P) companies in 2020, the outlook has dramatically improved. West Texas Intermediate (WTI) crude oil was approximately $60 per barrel (bbl) at the beginning of 2020 and collapsed with the onset of the COVID-19 pandemic. WTI hovered at about $20/bbl for much of March and April 2020, and gradually climbed to $70/bbl as of June 17, 2021.

—Read the full report from S&P Global Ratings

Most U.S. Upstream Execs Expect Global Oil Supply Gap by 2025: Dallas Fed Survey

Underinvestment and a focus on the energy transition will create a global oil supply shortage in two to four years, according to three-quarters of U.S. oil and natural gas executives surveyed by the Federal Reserve Bank of Dallas in June.

—Read the full article from S&P Global Platts

ANALYSIS: U.S. Gasoline Stocks See Unexpected Draw Amid Strong Demand, Weaker Imports

U.S. gasoline inventories saw an unexpected decline in the week ended June 18 as implied demand tested pandemic-highs and imports plunged, U.S. Energy Information Administration data showed June 23.

—Read the full article from S&P Global Platts

INTERVIEW: Iraq to Boost Exports of New Basrah Medium Crude Grade

Iraq expects to export higher volumes of its relatively new and increasingly popular Basrah Medium crude, as its production quota rises under the OPEC+ supply accord, the deputy director of the country's state marketer told S&P Global Platts.

—Read the full article from S&P Global Platts

China 'Needs A Future Coal Industry, Not A Future Without Coal'

China's strategy to achieve net zero will require large-scale deployment of carbon capture, usage and storage (CCUS) to remove CO2 from coal-fired power generation and from hydrogen production, energy experts said at June 22 forum.

—Read the full article from S&P Global Platts

Interview: Saudi Arabia to Auction Mining Licenses In 2022 to Woo Foreign Investors

Saudi Arabia plans to auction two major mining licenses in 2022 as the world's biggest oil exporter seeks foreign investments into a sector that has $1.3 trillion in untapped potential reserve value, the vice minister for mining affairs told S&P Global Platts on June 16.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language