Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 28 May, 2020

By Anu Ganti

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

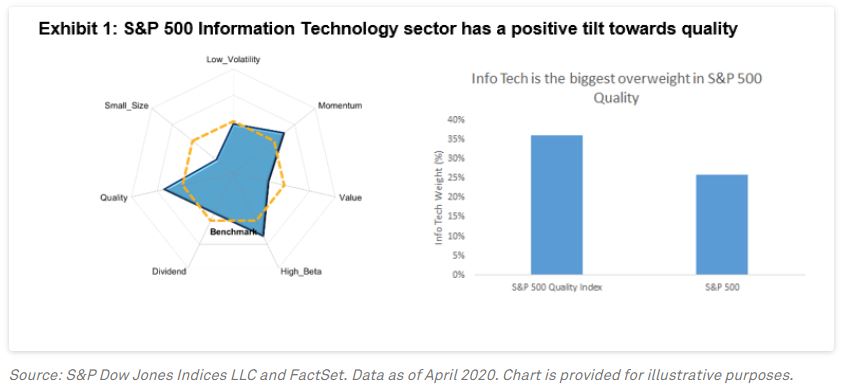

Sectors and factors are different ways of viewing the world, but they are not mutually exclusive. We find an example of such a close, symbiotic relationship between the technology sector and the quality factor. Exhibit 1 shows that the S&P 500 Information Technology index has a strong tilt towards quality, while the biggest overweight in the S&P 500 Quality Index is towards information technology.

Both technology and quality have outperformed during both calendar 2020 and the 12 months ending April 30. This raises an obvious question: Has technology done well because of its exposure to quality, or has quality done well because of its exposure to technology?

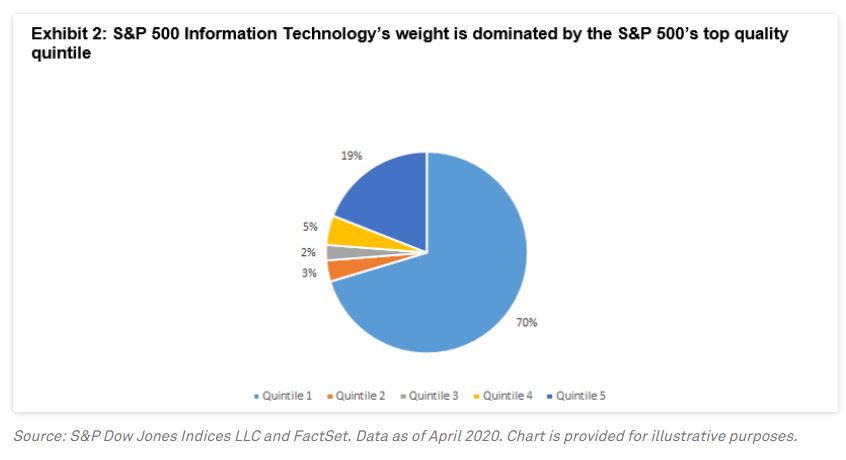

We begin our inquiries by calculating quality scores for all the constituents of the S&P 500, based on the following metrics: return on equity, financial leverage and accruals ratio. We then rank the constituents by their quality score, and slice the S&P 500 into quality quintiles. Finally, we analyze how much of S&P 500 Info Tech’s weight is in each of these quintiles.

Exhibit 2 illustrates that an astonishing 70% of S&P 500 Info Tech’s weight is in the top quality quintile.

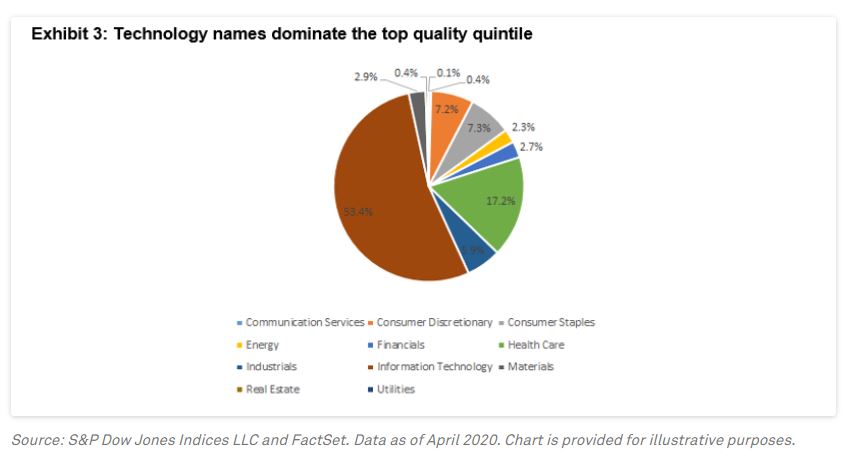

Quality is clearly important to the technology sector, but how important is technology to the quality factor? To answer, we turn the tables and look at technology’s weight in the S&P 500’s top quality quintile.

We observe in Exhibit 3 that 53% of the capitalization of the top quality quintile in the S&P 500 is in technology, dominating the other sectors. But an even greater share – 70% – of large-cap technology comes from the top quality quintile. Therefore, we can conclude that quality’s influence on technology is greater than technology’s influence on quality.

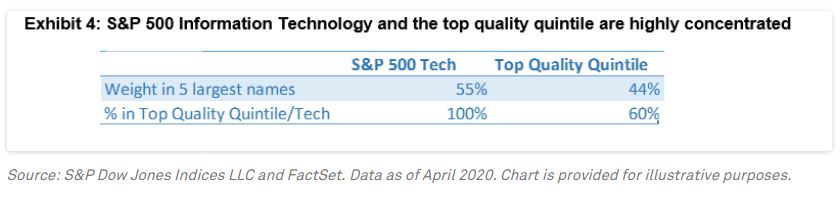

Both S&P 500 Info Tech and the top quality quintile of the S&P 500 are highly concentrated, as we see in Exhibit 4. While the five largest names in Info Tech are all in the top quality quintile, only three out of the five largest names in the top quality quintile are in Technology, further confirming our conclusion that quality’s influence on technology outweighs technology’s influence on quality.

While we cannot fully disentangle the overlap between the technology sector and the quality factor, the data argue that quality has greater significance to technology than the other way around. Understanding both perspectives is not only helpful, but also important to recognizing the intertwined relationship between sectors and factors.

Content Type

Location

Language