Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 20 Jun, 2020

By Koel Ghosh

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

The year 2020 has brought about many unexpected turns of events. The COVID-19 pandemic, which will be marked in history as one of the most-acute pandemics that the world has had to experience, is one.

Another area that has seen a transformation in the financial investing space is the realization and acceptance of passive investing. The recent growth trends globally and in India are marking new trajectories. The global growth story in passive products has been strong and broadening, with new innovations and themes. India has played catch-up, with the exponential growth in assets in the past few years revealing the potential for the passive space in the region.

As of March 2020, global assets in passive products passed USD 5 trillion, with over 7,000 passive products. The U.S., with a market share of 68%, USD 3.6 trillion in assets, and over 2,000 products, is followed by Europe and Japan with 16% and 6.5% of market share, respectively. The global asset mix is skewed toward equities, leading with a 70% share in assets at USD 3 trillion, followed by fixed income with a 21% share at USD 1 trillion.

For India, though the numbers are far more modest, the growth has been encouraging, with the total assets under management in passive products at USD 24 billion and 86 passive products. Five years ago, the scenario in India included a mere USD 2 billion in assets and 57 products. A decade back had far less, with USD 1 billion and 26 products in the market. Hence, the progress made by the country has been remarkable, especially in the backdrop of a faster-paced active investing market. Two years ago, the exchange-traded fund market constituted 2.2% of the mutual fund industry, while in December 2019, it stood at 7.5%.[1]

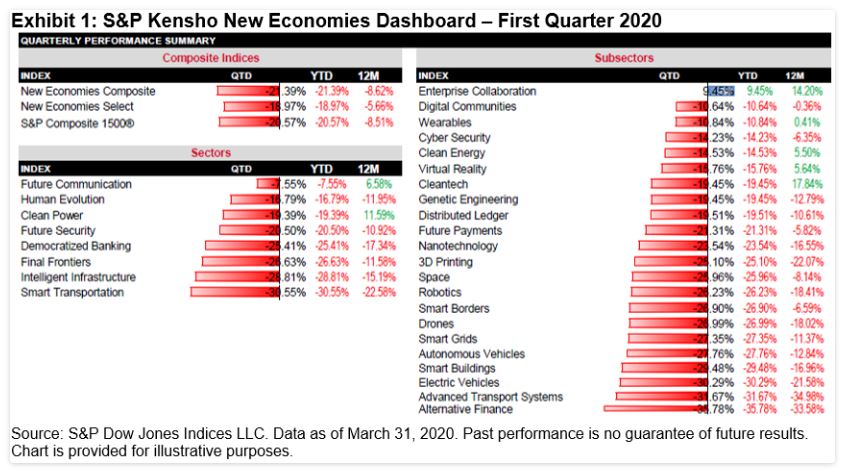

Global themes in passive products have progressed from plain vanilla asset classes, geographies, segments, and market benchmarks to factors that could be single or multi-factor, thematic-like infrastructure or corporate clusters, sustainability (a popular and fast-growing segment), and so on. Furthermore, advanced concepts are being explored via indices, such as new economies. For example, the S&P Kensho New Economies Indices are a family of indices tracking the industries and innovations of the Fourth Industrial Revolution.

Rapid developments in artificial intelligence and robotics, coupled with exponential processing power and ubiquitous connectivity, are driving structural changes in the global economy, disrupting existing industries and forging new ones. The S&P Kensho New Economies Composite Index is designed to measure the performance of companies involved in the New Economies 21st Century Sectors, including a dynamically adjusted list of companies drawn from all of the S&P Kensho New Economy subsector indices. The S&P Kensho New Economies Select Index measures a subset of the five best-performing subsector indices.

These new innovative indices are breaking grounds in investment themes and products that offer further variety to portfolio strategies.

[1] Source: https://etfgi.com. March 2020.

Content Type

Theme

Language