Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

By Tom Libby

Despite similar sales volumes between Lexus, BMW and Mercedes, the customer profiles of these luxury car buyers are not as closely aligned as one might assume..

From 2015 to January 2025, BMW, Lexus and Mercedes-Benz have consistently ranked in the top four in US new luxury retail registrations. But despite similar sales volumes, the customer profiles of these luxury car buyers are not as closely aligned as one might assume.

S&P Global Mobility data on demographics, financial metrics and migration patterns reveal that while BMW and Mercedes-Benz attract similar customers, Lexus buyers differ notably from their German counterparts.

A look at the US histories of these brands helps explain the differences between luxury car buyers that favor BMW or Mercedes-Benz versus Lexus.*

Since the birth of Mercedes-Benz in the late 19th century and BMW in the early 20th century, both brands have focused on performance on and off the racetrack. BMW quickly carved out a niche with sporty, innovative designs. In 1935, it debuted with the 319, including a roadster with low-slung doors, a folding windshield and a triple-carbureted engine.

A year later, in 1936, the company introduced the 328 roadster, with cutaway doors and three carburetors. In its first race at Nürburgring that year, the 328 reached 95 mph to win. In the late 1930s, another 328 won in the two-liter class at Le Mans.

In the decades that followed, BMW continued to evolve its performance image. After World War II, it introduced the 5 Series, including a model that reached 50 mph in 11 seconds and topped out at 135 mph.

The 3 Series followed in the 1970s, resonating with US consumers and cementing BMW’s reputation for quality and performance. In 1978, BMW unveiled the M1 Supercar, designed by Lamborghini’s Giugiaro and powered by a 24-valve, 3.5 liter six-cylinder engine that generated 277hp and reached 162 mph.

Throughout its history, BMW has emphasized performance and sportiness, defined by acceleration, power, speed and styling.

Mercedes-Benz’s performance legacy reaches even further back. In 1908, a 120-hp Mercedes won the Grand Prix at Dieppe, France. That success carried into the US, where Ralph de Palma raced a Mercedes at the Indianapolis 500 and won.

Innovations soon followed: by 1920, Mercedes became the first automaker to add a supercharger to a production model. That blend of racing heritage and technical innovation culminated in the early 1950s, when the 300 SL dominated Le Mans and inspired the now-iconic SL Series.

Throughout the 1960s, Mercedes pushed boundaries—from the debut of the Type 600, riding on a 126-inch wheelbase and reaching more than 125 mph, to the 300D, the world’s first turbo-diesel production car.

Like BMW, Mercedes-Benz has long married exceptional performance and exclusive luxury.

While BMW and Mercedes-Benz built their legacies around performance, luxury and motorsports, Lexus’s history has been rooted in reliability and innovation, with a different approach to brand identity.

When Toyota introduced the Lexus brand to North America in 1989, it offered just two models: the compact ES300 and the full-size LS400. Lexus cars gained a reputation as “expensive Toyotas,” which both helped and hindered its image. While Lexus customers benefited from Toyota’s reliability, the brand lacked the emotional appeal of its German competitors.

That began to change in 1999 with the launch of the RX300, the first true luxury crossover. Though Mercedes-Benz debuted the ML-Class earlier, it was criticized for resembling a minivan, while the RX was a success from day one. The RX became the segment and brand leader, and brands have been attempting to emulate it ever since.

The RX’s appeal helped drive Lexus to the top of the luxury space for much of the early 2000s, though it also overshadowed other Lexus models.

The success of the RX to this day has heavily skewed Lexus’s mix in favor of midsize vehicles. As illustrated below, in the October 2024–January 2025 time period, two thirds of Lexus registrations were midsize vehicles, versus 37% of BMW and 31% of Mercedes-Benz registrations.

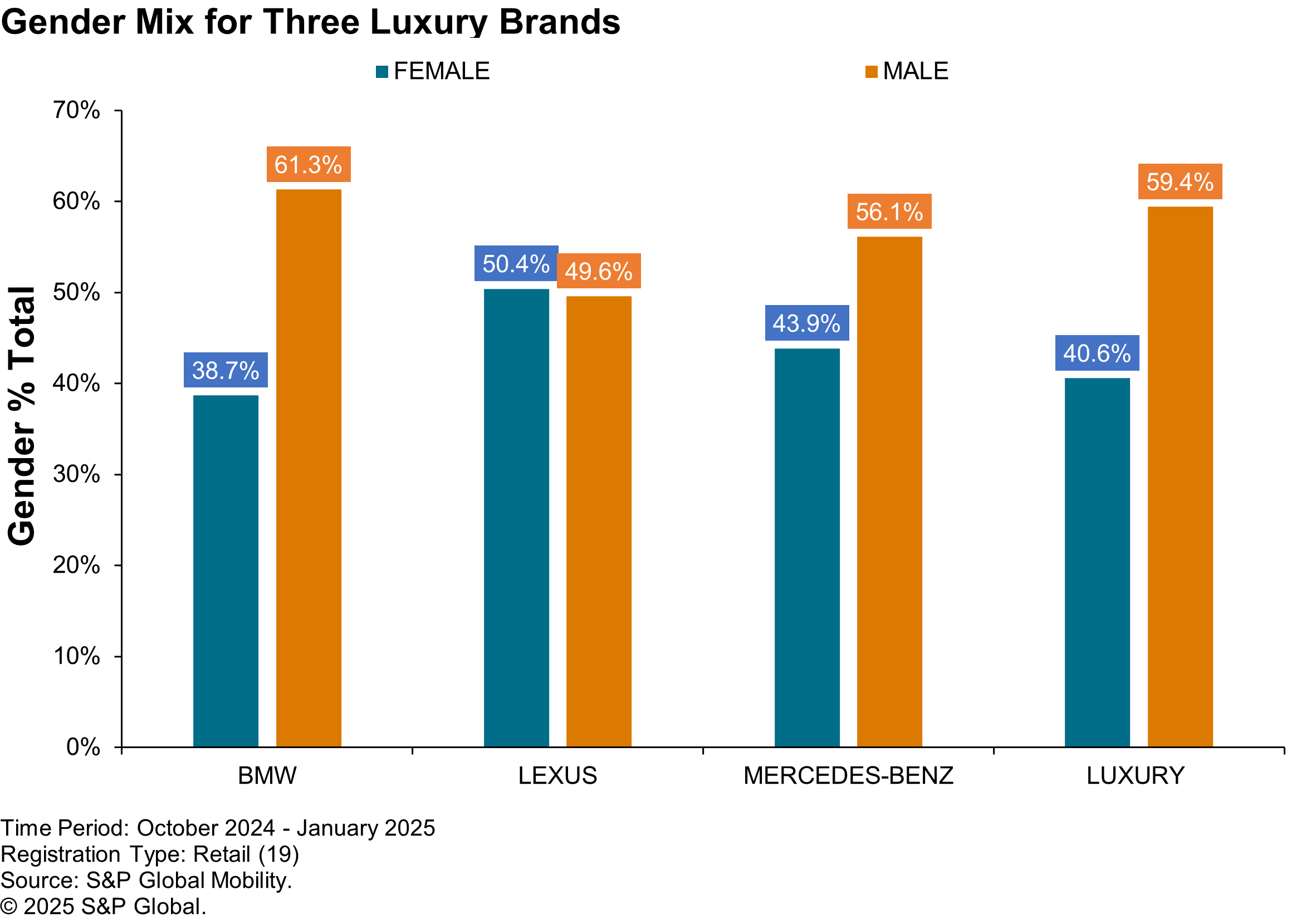

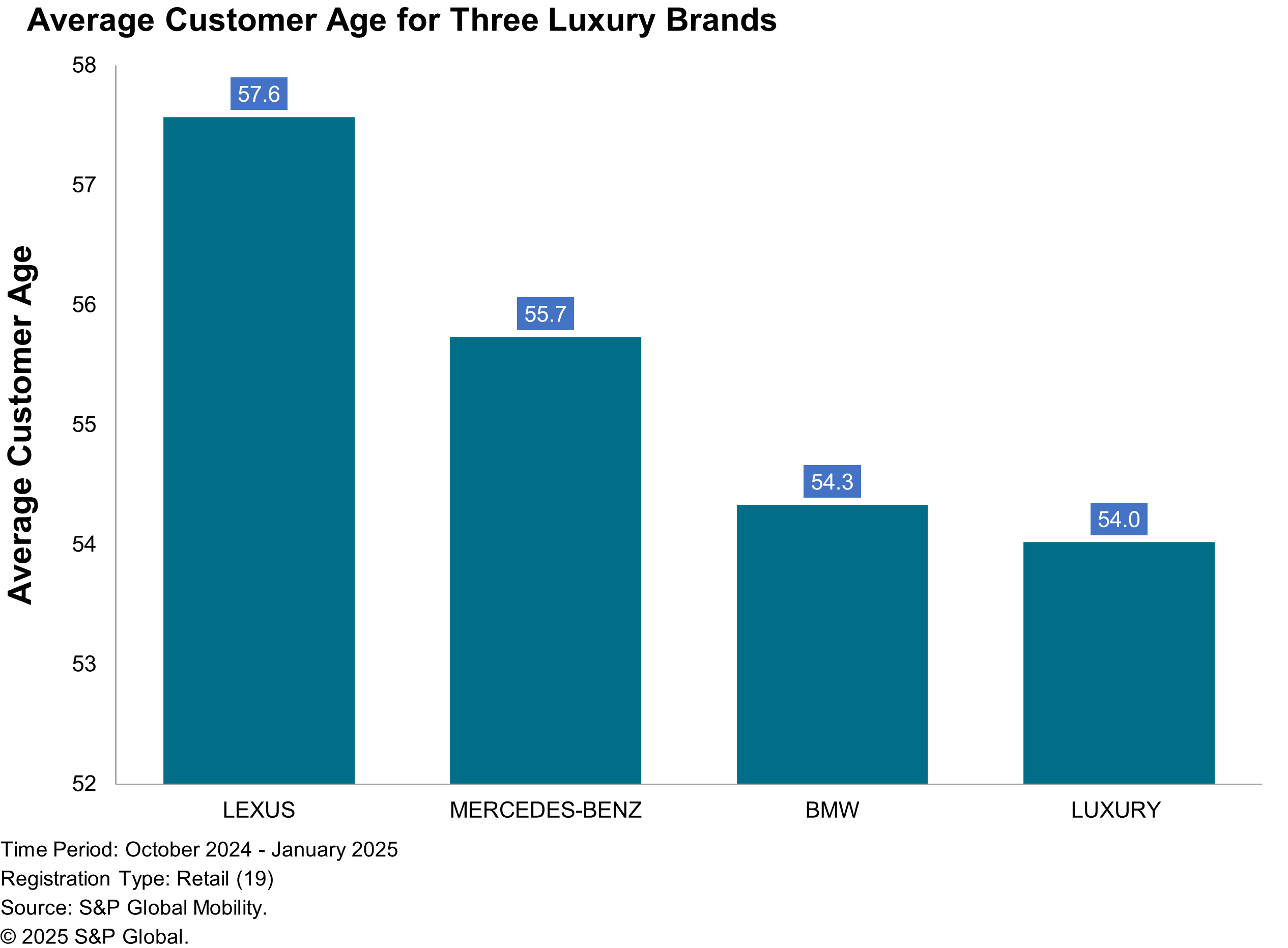

The histories of these three brands have shaped the differing customer profiles for the German automakers versus Lexus. Compared to their German counterparts, Lexus customers are typically older, more likely to be women and have lower household incomes, as illustrated in the three charts below.

Lexus’s higher female mix is driven by its strong reliance on the RX, a crossover that appeals more to women than traditional body-on-frame SUVs. The lower average age of the German brands’ buyers reflects the automakers’ emphasis on performance, sportiness and racing, traits traditionally favored by younger consumers.

Lexus buyers’ lower household income is a result of its focus on the midsize market with the RX, while the German brands have established a presence across the full luxury spectrum from compact to full-size models.

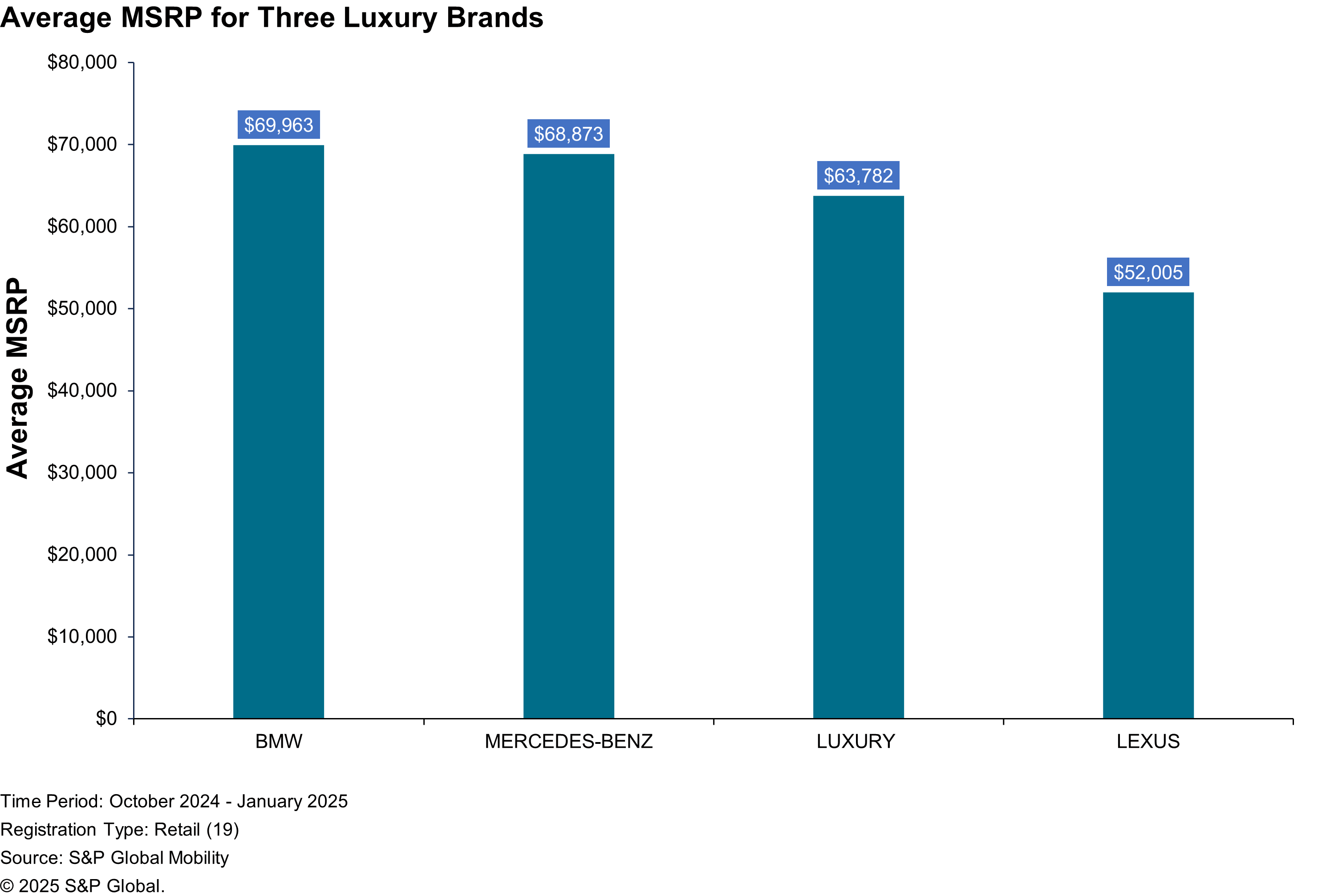

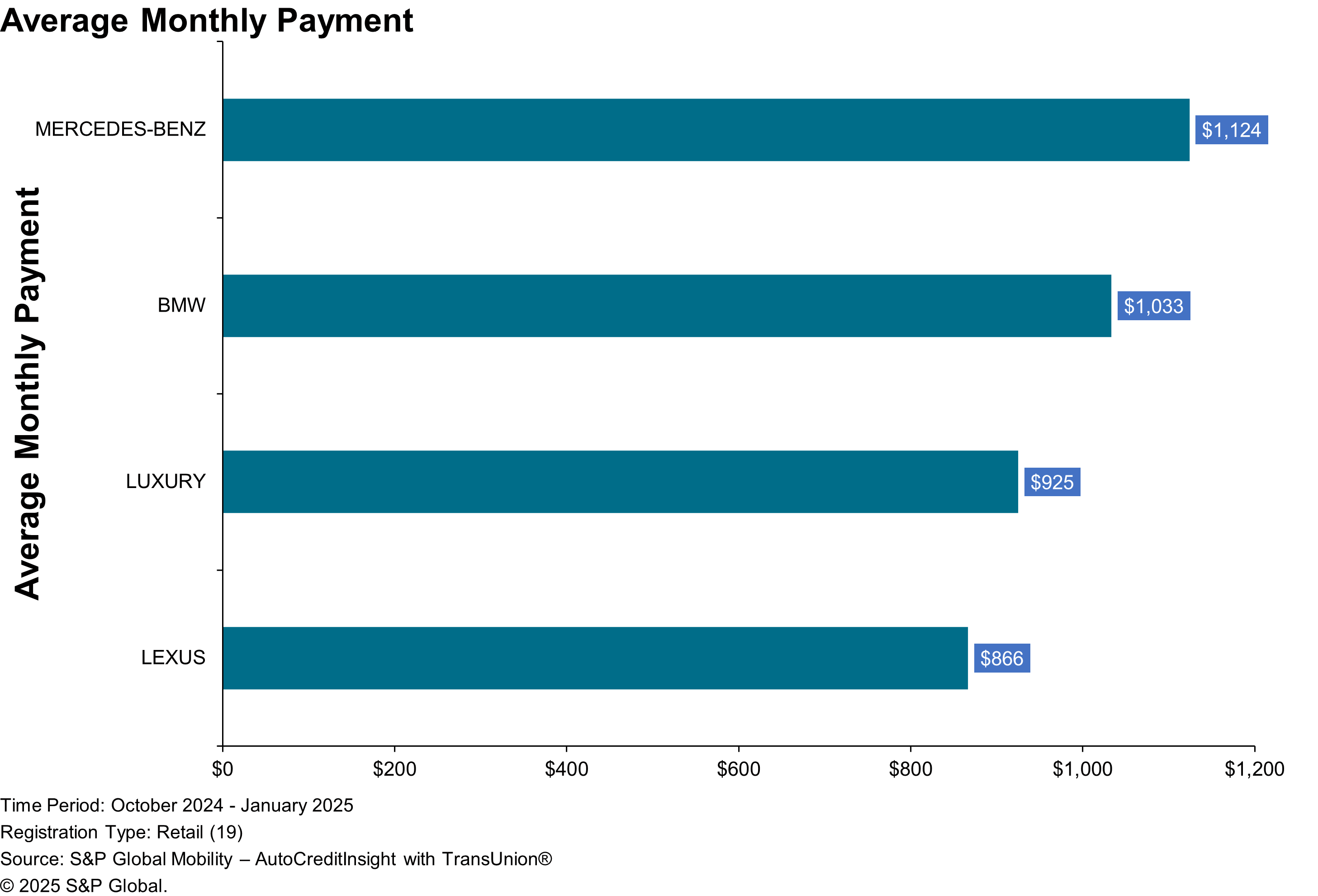

Transaction data, including average MSRP and average monthly payment, further differentiates Lexus buyers from their German counterparts. As shown below, the average Lexus MSRP for the October 2024–January 2025 time period was more than $16,000 below that of either BMW or Mercedes-Benz. Additionally, the average Lexus monthly payment of $866 is more than $140 and $240 less than those of BMW and Mercedes-Benz, respectively.

Migration patterns into and out of the three luxury brands align with their histories and portfolios. As the charts below show, Lexus attracts more mainstream households than its German competitors and sees a higher rate of owners returning to mainstream brands. These results reflect Lexus’s stronger position in the mid-luxury segment, weaker presence at the higher end and close ties to Toyota.

Although BMW, Mercedes-Benz and Lexus frequently appear side by side in sales rankings, their customer bases differ significantly—differences that reflect each brand’s history and product lineup. These distinctions offer a compelling window into automotive consumer trends, highlighting how brand identity, performance legacy, and product strategy shape buyer demographics in today’s competitive luxury vehicle landscape.

S&P Global Mobility offers a web-based US loyalty analytics tool that tracks all vehicle purchases per household during the past ten years. The tool allows you to quickly assess owner loyalty and defection regarding all new vehicle purchases by geography, vehicle traits, financing and demographics over time.

*Source for historical facts about BMW and Mercedes-Benz: Standard Catalog of Imported Cars, 1946-2002, Iola, Wisconsin, Krause Publications, 2002, pp. 134 – 5, 523 – 525.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.