Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Oct, 2020

Highlights

Good corporate managers strike a balance between profitability and growth. Companies that grow assets too quickly underperform, while low-to-moderate asset growth companies outperform.

Large M&A deals negatively affect fundamentals and returns, often for years following an acquisition. Stock deals severely underperform.

Strategies that return cash to shareholders are rewarded by investors, while over-reliance on the capital markets is punished.

The onset of the COVID-19 pandemic wreaked havoc on many commercial markets, leaving corporations to reassess strategies and priorities. In times of uncertainty, business leaders and investors are well served to remember management practices that have created value and withstood the test of time. This report highlights four types of executive policy that drive value creation: profitability vs. growth decisions, mergers & acquisitions policy, return of cash to shareholders, and insider stock ownership. In it, we demonstrate empirically those practices that increase corporate value over time, thereby rewarding shareholders, employees, and other stakeholders. These practices also form a scorecard by which stakeholders can evaluate whether or not management is undertaking actions likely to increase corporate prosperity. Research findings include:

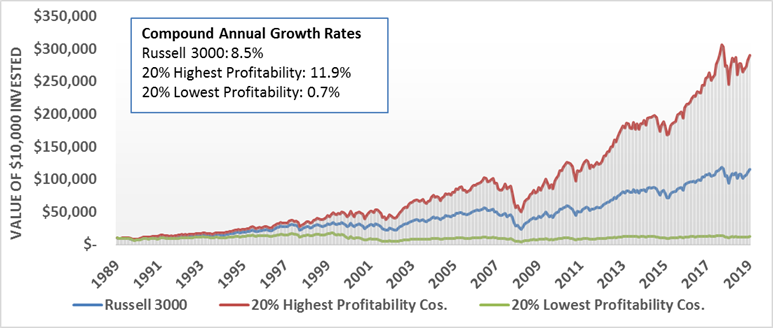

Figure 1. Value of $10,000 Invested Over Time by Gross Profit to Assets Ratio, Russell 3000, 1990-2019 (Excludes Financials)

Source: S&P Global Market Intelligence Quantamental Research. All returns and indices are unmanaged, statistical composites and their returns do not include payment of any sales charges or fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. Past performance is not a guarantee of future results. Data as of 6/1/2020

Products & Offerings