Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Sep, 2022

By Sean Sullivan and Susan Dlin

A substantial amount of U.S. natural gas transportation and storage infrastructure will move through the development cycle in the next five years as the nation balances energy needs with climate concerns.

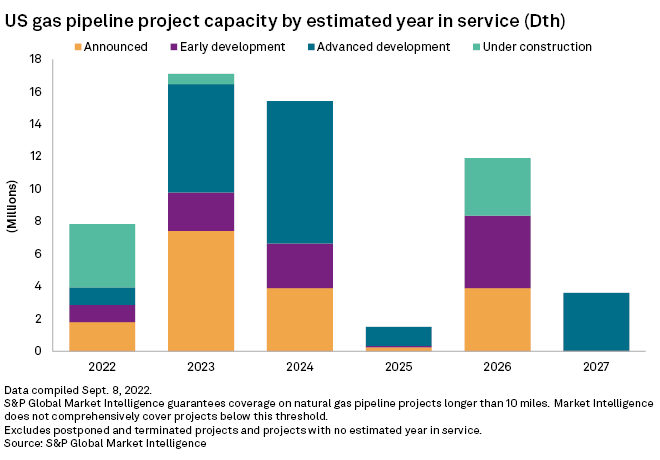

A wave of pipeline projects with a total gas transportation capacity of about 17 million Dth/d is expected to enter service in 2023, S&P Global Market Intelligence data showed. The total capacity volume of project starts is slated to drop slightly in 2024 and shrink to almost nothing in 2025. The volume is expected to pick back up in 2026 to over 12 million Dth/d with the scheduled arrival of the 2 million-Dth/d Mountain Valley Pipeline LLC mainline project and others.

Smoky crystal ball

Unpredictable regulatory and legal paths for pipelines, especially greenfield construction projects that strike out on a new right of way, make due dates difficult to forecast. In one example, the 304-mile Mountain Valley pipeline, already largely in place but facing lawsuits and permitting challenges, could arrive before a federally authorized deadline extension to October 2026. Or it could get knocked off course by its challenges.

The data, which included U.S. interstate and intrastate pipeline projects over 10 miles in length, was consistent with the development schedules for a variety of projects that are generally smaller in size than five years ago and the often optimistic in-service estimates that accompany project announcements. The proposed Alaska Gas Pipeline, an 800-mile piece of an Alaska liquefied natural gas export project, is due in 2027 with a capacity of over 3.6 million Dth/d, but the state is having trouble finding a sponsor, and some observers doubt that the whole project will make it off the drawing board.

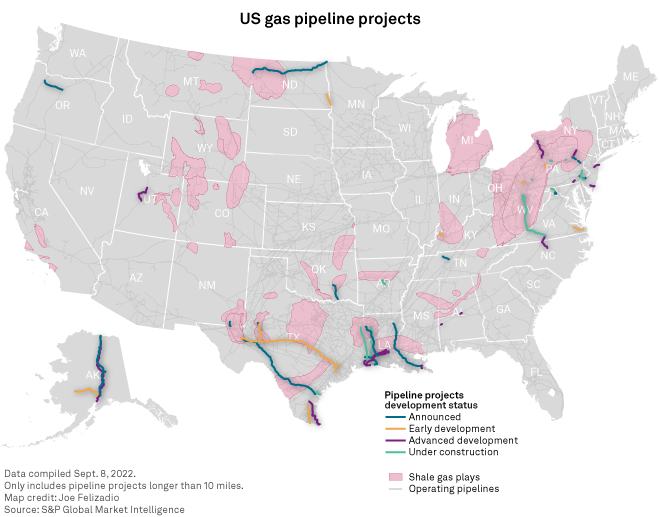

Pipeline developers have faced a tough permitting environment as the U.S. and market nations have put a priority on fighting climate change. Pipeline companies have focused on expansions of their existing systems because obtaining permits for expansions is easier than for new projects.

|

* Download natural gas development project data. * Use our Pipeline Summary page to find pipeline flow data and indexes of customers. |

The war in Ukraine has propelled an energy crisis in Europe, tied in part to curtailments of Russian pipeline gas. The situation has bolstered the case for U.S. gas in the White House and among European governments. U.S. pipeline companies with systems that support LNG export terminals, which are largely based on the Gulf Coast, have seized the opportunity to serve this source of demand.

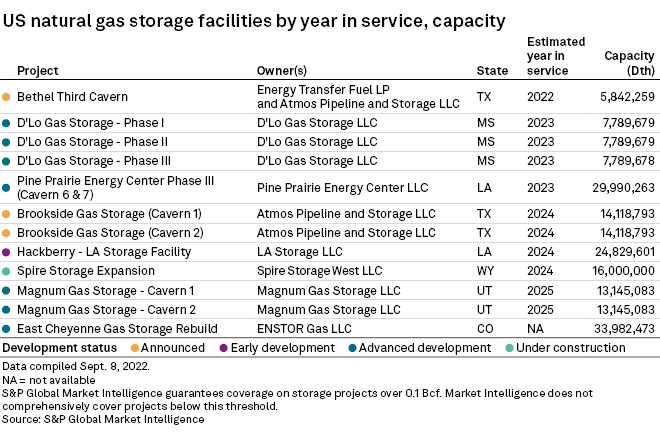

Gas storage fields

Natural gas storage projects that support the pipeline grid are also in development. One, the Bethel Third Cavern project by Energy Transfer Fuel LP and Atmos Pipeline and Storage LLC with a gas storage capacity of 5.8 million Dth, is estimated to enter service in 2022.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.