Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 11 May, 2023

In its monthly Zinc Commodity Briefing Service (CBS) reports, S&P Global Commodity Insights discusses the zinc market within the broader macroeconomic environment and provides rolling five-year supply, demand and price forecasts.

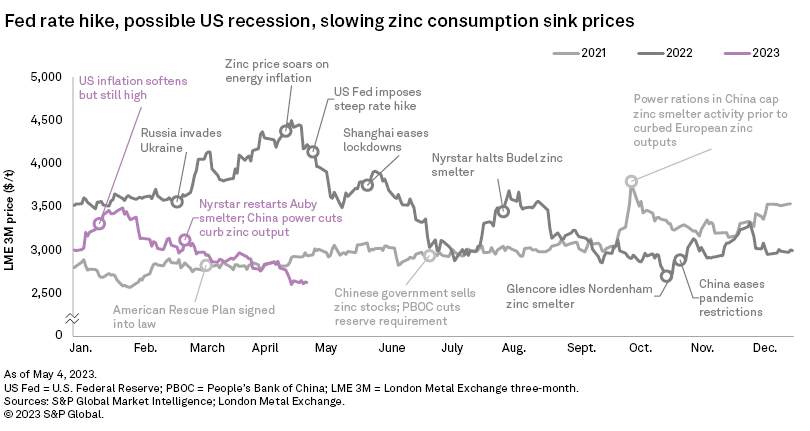

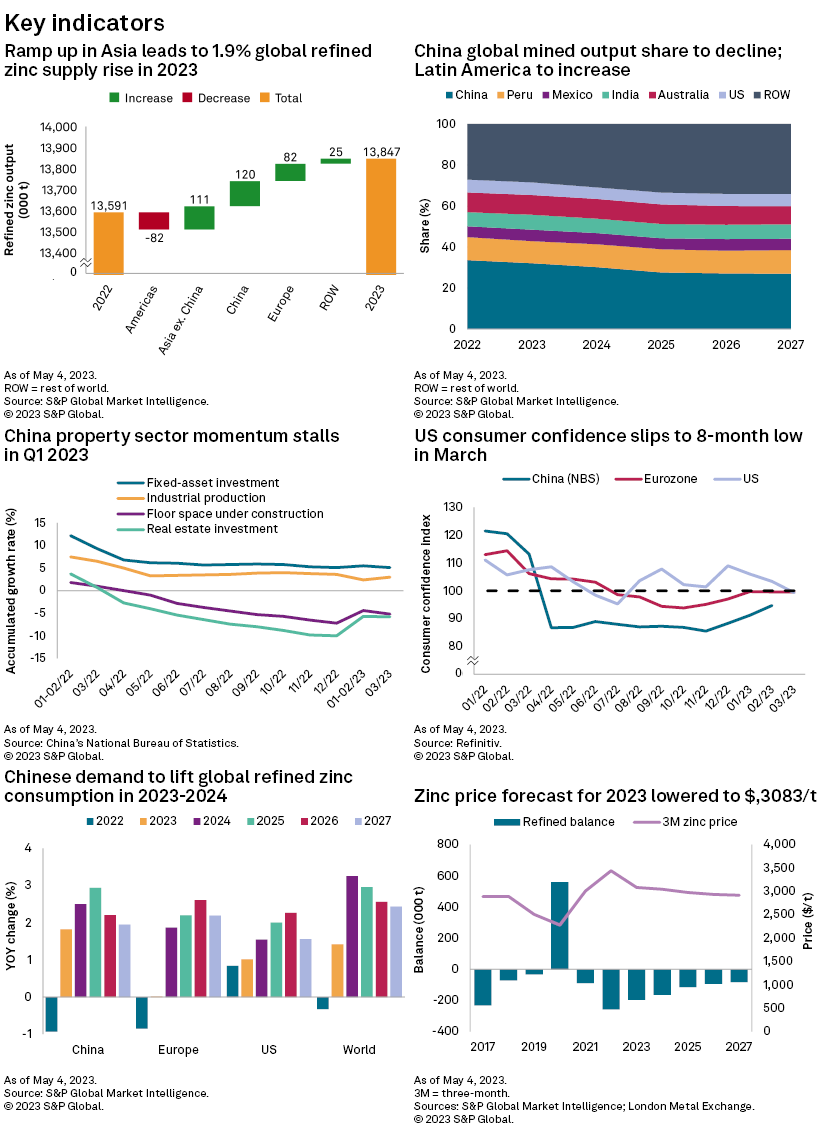

➤ The London Metal Exchange three-month (LME 3M) zinc price dropped to $2,600 per metric ton April 25 on broadening recessionary risks. The price has been moving sideways since, despite a softer US dollar.

➤ Chinese manufacturing activity failed to sustain momentum in April, with sector indexes falling into contractionary territory. While there have been improvements in zinc downstream and end usage, we expect pessimistic consumers to pressure the economic rebound. We maintain our view of a stronger second half and expect China's refined zinc consumption to grow 1.8% in 2023.

➤ With both the US and Europe still grappling with inflation and tight monetary policies, we foresee global refined zinc demand rising 1.4% in 2023. Given a low base year, we estimate 1.9% growth for global refined zinc supply as energy costs in Europe ease while power curbs in China limit zinc smelter production.

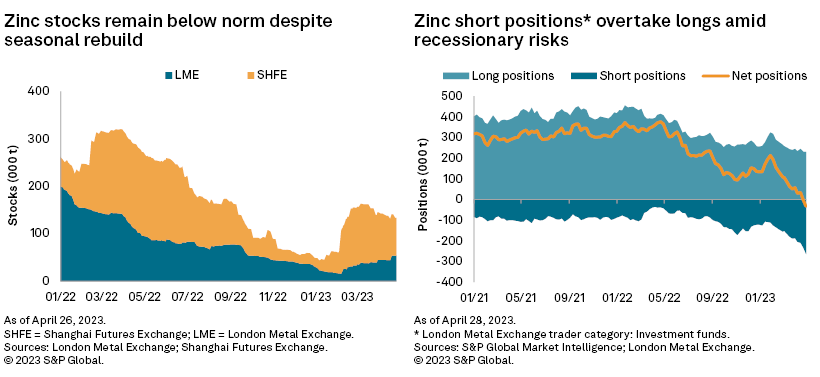

➤ Despite seasonal accumulations at the major zinc exchanges, inventories remain historically low. Investors grew bearish, however, as short positions overtook long ones at the LME in April.

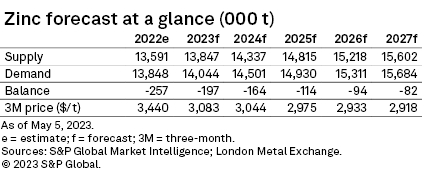

➤ The steep decrease in prices since mid-April led us to downgrade our 2023 LME 3M zinc price forecast to average $3,083/t. Given pent-up demand in China, we now expect a slightly deeper deficit of 197,000 metric tons this year.

Analyst comment

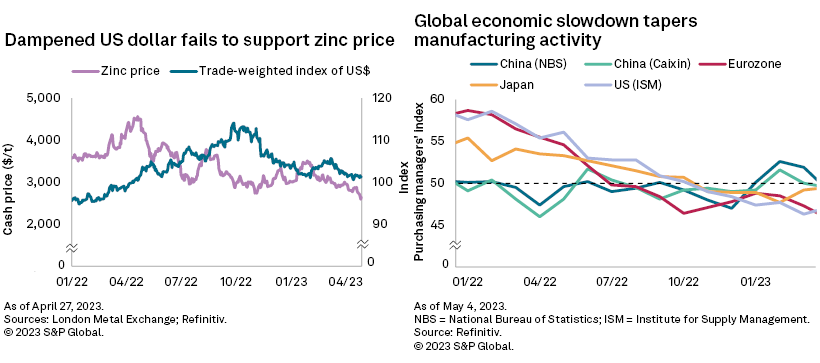

The LME 3M zinc price tumbled to $2,600/t April 25 on expectations of another interest rate hike from the US Federal Reserve despite the growing likelihood of an economic recession in the country. While the greenback's trade-weighted index moved sideways, it offered no support to the zinc price amid moderating refined demand and improving European smelter activity. Refined zinc supply remains stretched, however, given smelter disruptions in China and low inventories at major exchanges.

Manufacturing activity in China contracted in April, with the National Bureau of Statistics and Caixin purchasing managers' indexes (PMI) settling at 49.2 and 49.5, respectively. Accumulated growth rates for floor space under construction and real estate investment stalled in March, while industrial production and fixed-asset investment rose. End-use output has shown improvements, with production for domestic vehicles and white goods up year over year in March. The downstream sector had mixed performances, with galvanizing enterprises increasing zinc utilization rates while die-cast operations remained muted. Refined zinc imports to China gained momentum month over month in March but remained weak year over year. We foresee a slow but steady infrastructure boom and gradual property sector revamp for the rest of the year. We nevertheless expect muted consumer spending and weaker export orders to keep the country's economic rebound at bay. We, therefore, upgraded China's refined zinc demand to rise 1.8% to 7.1 million metric tons in 2023, followed by 2.5% growth in 2024.

Macroeconomic headwinds in the US continue to erode consumer confidence. The US Institute for Supply Management PMI remained in contractionary territory in April despite rising to 47.1 from 46.3. Several other indicators, such as industrial production, construction spending and automotive production, inched higher year over year in March but at a slower pace. The Eurozone's manufacturing performance also continues to lag, with the IHS Markit PMI dropping to 45.8 in April from 47.3 in March. Recent data, however, shows improvements in new passenger car registrations, construction activity and industrial production. Refined zinc inflows to the EU and the US have remained robust since the start of the year despite sticky inflation and successive interest-rate hikes from their central banks.

Taking these factors into account in our forecast, we expect global refined zinc demand to increase 1.4% to 14.0 MMt in 2023. Given that we expect major economies to gain economic momentum toward year-end, we anticipate demand in 2024 to rise 3.3%. Looking at global refined zinc output, we expect a 1.9% rise to 13.8 MMt in 2023, as power shortages in China limit production while easing energy costs in Europe support zinc smelter production. We expect new capacity to arrive from Boliden AB's Odda expansion in Norway, which will help refined zinc supply grow 3.5% in 2024.

Despite seasonal accumulations at the major zinc exchanges, the market remains tight as inventories remain historically low. Due to recessionary risks and demand concerns, however, short positions at the LME have finally overtaken longs since declining steeply in January. With falling LME and firming Shanghai Futures Exchange prices, China retains its net importer status despite weaker inflows and outflows.

We maintain our global mined zinc supply growth forecast of 2.6% to 13.4 MMt in 2023, as reserves depletion in China offsets incremental additions from ramp-ups in Latin America and Europe. We expect global mined supply growth will rise to 2.8% in 2024. In the background, a brewing mega-deal between two of the largest mining companies, Glencore PLC and Teck Resources Ltd., could significantly boost Glencore's copper and zinc portfolio in the Americas. Among Glencore's possible takeovers is Teck's wholly owned Red Dog mine in Alaska, the world's largest-producing zinc mine. The asset is expected to produce 565,000 metric tons of zinc in concentrate in 2023.

Outlook

Given the recent retreat in prices, we have downgraded our 2023 LME 3M zinc price forecast to average $3,083/t, along with a milder deficit of 197,000 metric tons. We expect the price to average $2,854/t in the June quarter but to strengthen in the second half as peak consumption season arrives.

We forecast an average price of $2,968/t across 2024–27, accompanied by narrowing deficits as we expect demand to peak in 2024–25 amid an improving refined zinc supply response.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Campaigns