Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 15, 2021

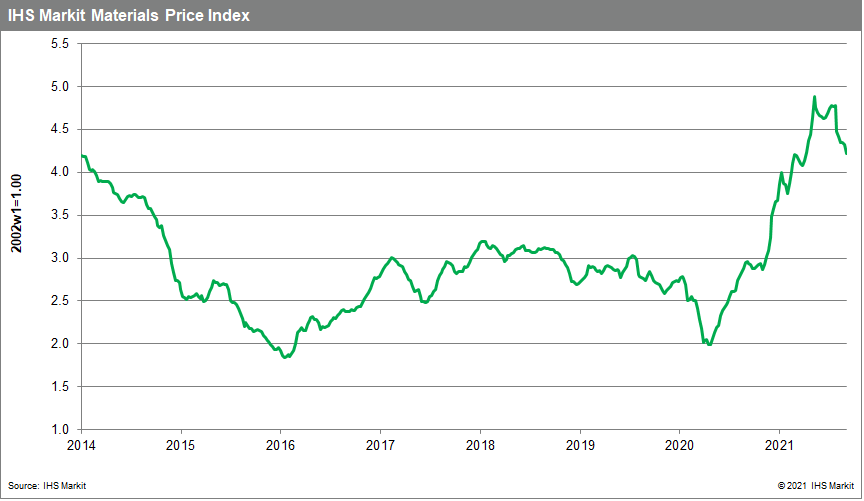

Our Materials Price Index (MPI) fell 2.4% last week, the sixth consecutive weekly drop. The retreat was not widespread, with only five of the MPI's ten sub-components declining. With last week's drop, the MPI is now down 11.5% since the end of July.

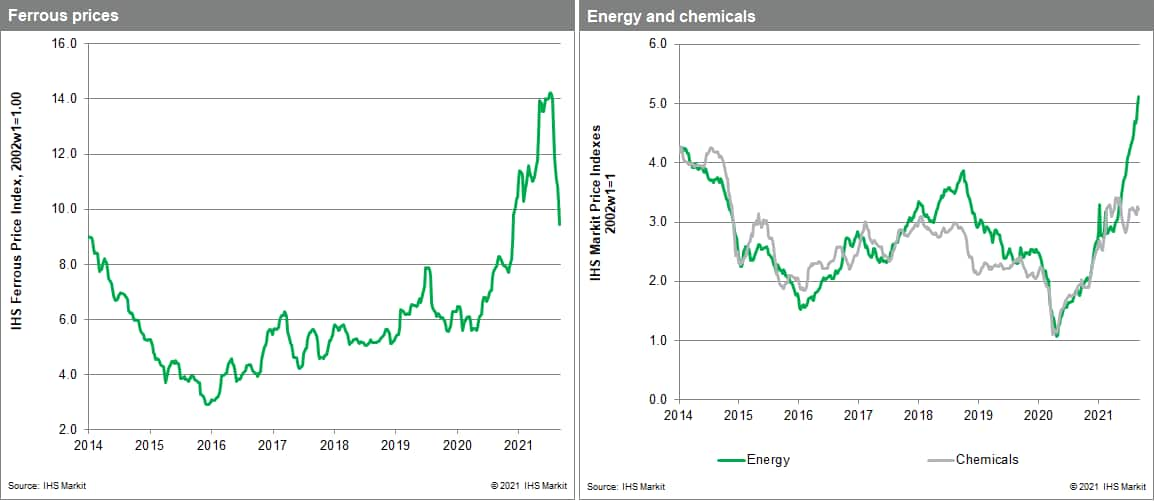

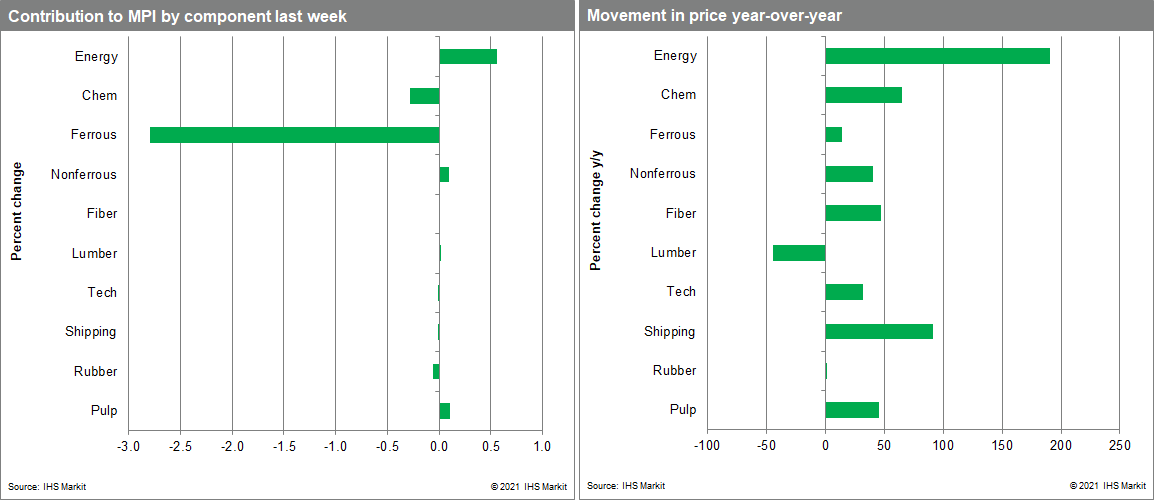

Steel making raw materials were again the main contributor to the MPI's decline last week. Our ferrous sub-index was down 7.7% as both iron ore and scrap steel prices fell. Iron ore prices dropped to $135 a tonne, the lowest since November 2020, after peaking at $219 in July. Scrap prices declined for a tenth consecutive week. Prices have fallen from $518 a tonne in late May to $444 a tonne in early September. Worries over uncertain future Chinese consumption continue to weigh on steel markets. On the other side of price moves were energy, with our energy sub-index rising 3.2% last week. Coal and crude oil prices were little changed but natural gas prices jumped again. The UK spot landed prices of liquefied natural gas (LNG) climbed to $19/MMBtu last week, the highest ever recorded. The Japan spot landed price for LNG reached $20/MMBtu and is nearing the record set during the deep freeze in early January this year. A severe winter left inventories depleted in both Europe and Asia and the scramble to build up stocks for the 2021-2022 winter season is likely to support elevated prices into next year. Aluminum was another category showing rising prices, with an increase of nearly 4% last week. The coup in Guinea has heightened concern over near-term bauxite supply, the raw material used to produce aluminum.

Although the MPI declined again last week, the change was once more driven by demand-side softness rather than an improvement in the supply-side of markets. Looking ahead, we continue to believe that as supply disruptions and bottlenecks ease, more favorable balances in markets will not only end price increases but lead to price declines. However, since July the drop in the MPI has been dominated by concerns over demand. This was certainly the case with falling iron ore prices last week. Moreover, we have seen little of improvement on the supply-side of markets, highlighted by the increase in natural gas prices, where inventories are low and disruptions continue. The good news is that there has been a change in commodity markets. However, cost pressures will remain until we see an improvement in vendor performance, something that has yet to occur.

Posted 15 September 2021 by Thomas McCartin, Senior Economist, Pricing & Purchasing, S&P Global Market Intelligence