Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Jul, 2022

By Neil Barbour

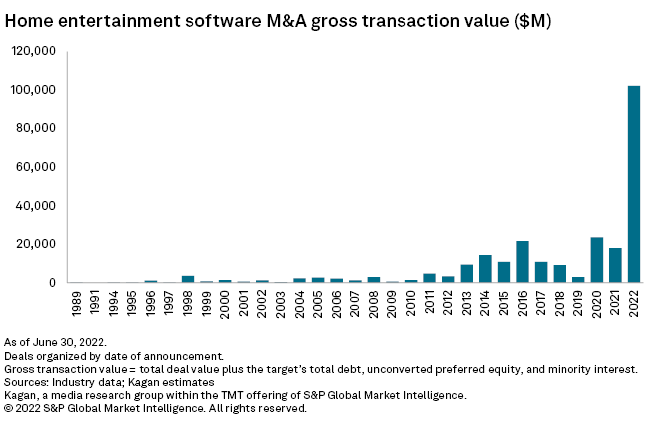

Two billion-dollar deals in June pushed the year's total gross transaction value for announced M&A in the video game space to $102.21 billion, further padding its position as the top year on record for M&A.

Our analysis categorizes deals by their date of announcement, and all announced deals are included regardless of their status. We have included any deal S&P Capital IQ categorizes as home entertainment software, which includes some assets connected to tutoring, gambling or other elements involving interactive entertainment that may not be expressly considered video games. That said, the historic comparison is consistent and composed largely of video game assets.

S&P Capital IQ's gross transaction value is calculated by taking the total deal value plus the target's total debt, unconverted preferred equity and minority interest.

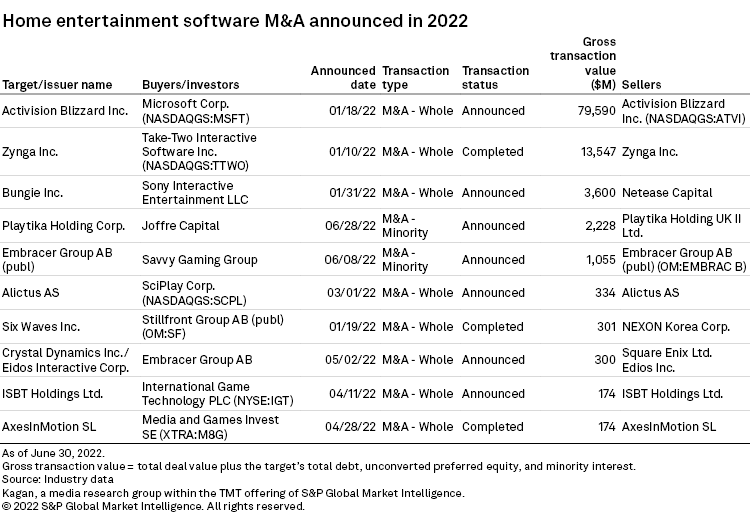

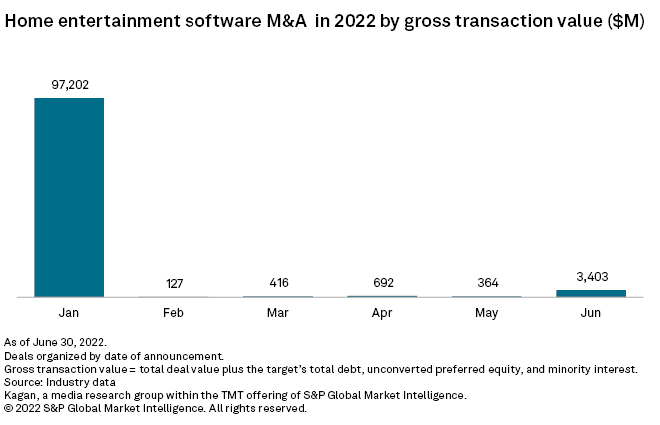

On June 28, Joffre Capital announced it would take a 25.73% stake in mobile publisher Playtika Holding Corp. for a gross transaction value of $2.23 billion. Playtika's core business is in casino-themed games, but the developer has pushed into other casual genres in recent years, such as hidden-object games.

Savvy Gaming Group, an arm of Saudi Arabia's ministry of finance, announced on June 8 that it would take an 8.10% stake in Embracer Group AB (publ) for $1.06 billion. The deal follows Embracer's $300 million bid for Tomb Raider developer Crystal Dynamics/Eidos Interactive announced in May. Embracer Group focuses on big-budget console and PC games but has exposure to mobile as well. Notable franchises under the Embracer umbrella include Borderlands and Saints Row.

The Playtika and Embracer deals stand out because they involve acquirers from outside of the tech or gaming industry. Investment and buyout funds are taking note of the estimated $195 billion in revenue the video game content segment racked up in 2021.

The overall rush of M&A in 2022 reflects the industry's status as a revenue powerhouse as well as one of emerging growth opportunities. Cloud gaming has the potential to grow console-style gaming's user base while in-game purchases will play a major role in metaverse development.

June is the second-largest month for M&A so far in 2022, but it pales in comparison to the blockbuster deals announced in January.

On Jan. 18, Microsoft said it would acquire Activision Blizzard Inc. in a deal valued at $79.60 billion. Microsoft specifically cited its metaverse ambitions in the deal announcement. Microsoft is also trying to stand up a cloud gaming division with high-profile content, and the acquisition would give it some of the biggest franchises in gaming, such as Call of Duty and World of Warcraft. The Microsoft deal is the largest-ever announced in home entertainment software.

On Jan. 10, Take-Two Interactive Software Inc. announced it would acquire Zynga in a deal valued at $13.55 billion. The deal was largely a way for the console-focused publisher to increase its exposure to mobile gaming, which accounted for 60% of all gaming content revenue in 2021. The deal closed May 23.

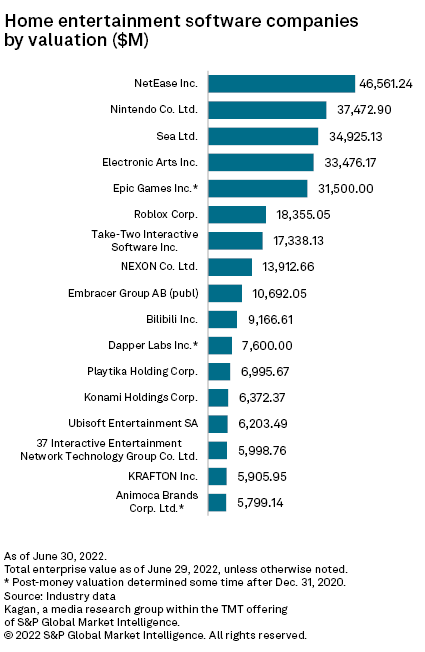

The top 15 companies by valuation categorized by S&P Global Capital IQ Pro in the home entertainment software industry as of June 30 are listed below. This list excludes Activision Blizzard, even though the Microsoft deal has yet to close, but we have retained companies for which a minority stake deal is pending.

This list represents many of the potential headline-grabbing M&A opportunities available in the video game space, but we make no claims as to the likelihood of any deal.

It is unlikely that any of these deals would rise to the level of Activision Blizzard in terms of valuation at this time, but there are companies with similar portfolios of content, such as Electronic Arts Inc. and Take Two.

Other companies represent more targeted exposure to metaverse or proto-metaverse development, such as Roblox Corp., Rec Room Inc. and Niantic Inc.

Technology is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.