Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Sep, 2017 | 15:45

By Dan Lowrey

Highlights

A look at premiums paid in recent utility M&A transactions and valuation trends across the sector.

The following post was written by research groups within our Energy offering, including Regulatory Research Associates, or RRA. For further information on the full reports, please request a call.

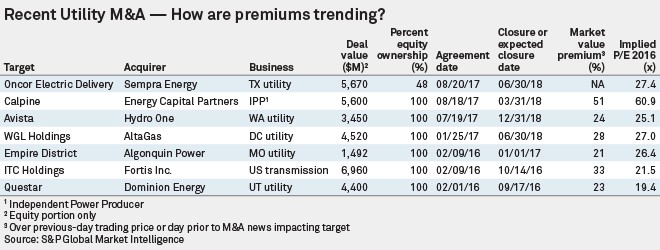

The healthy stream of proposed mergers and acquisitions in the U.S. utility sector since 2016 reflects attractive takeover premiums and implied 2016 P/E multiples generally in the 20x-30x range. The average market value premium announced or paid in six major deals since 2016 was 26% (see chart below). But premiums have fallen from those paid in 2015, likely due in part to reduced macroeconomic forecasts.

Three major transactions announced since mid-July 2017 suggest that concerns over tax reform eliminating the deductibility of interest expense on merger debt may be fading. Congressional GOP leaders indicate that they hope to finish major tax reform this year, but the fate of interest deductibility and lower corporate tax rates is far from settled. Given the capital-intensive nature of utilities and their need for borrowing, interest deductibility can have a significant impact on their financial statements and use of debt for M&A.

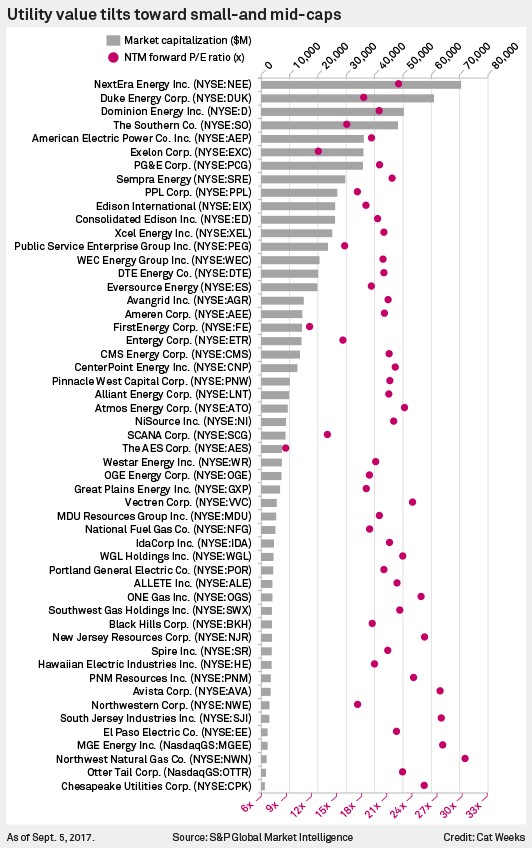

Small and mid-cap utilities, particularly gas utilities serving smaller markets, remain most likely takeover targets in our view. Gas LDCs have been particularly attractive to Canadian buyers due to their healthy rate base growth potential and higher authorized ROEs. Of the 53 utility holding companies in the RRA coverage universe, the seven with the highest P/E ratio at September 5 control gas utilities or both gas and electric utilities (see chart in full report).

Rising publicly traded market valuations and a rising U.S. interest rate environment could cool M&A activity beyond asset-specific transactions, but robust capital spending plans and rate base growth expectations at some utilities could prove too attractive to pass up. The latest takeover speculation involves Indiana-based gas and electric utility holding company Vectren Corp., which reportedly hired a financial adviser to explore a potential sale.

Sector consolidation is likely to continue in the intermediate term with interest rates still near historical lows, yet on the rise. The wild card may be the future of tax reform. A cut in corporate tax rates would benefit merchant power producers but those cost savings would likely be passed through to customers during rate making proceedings by regulated utilities. But a proposed elimination of the interest deductibility of debt could have a chilling effect on new utility sector M&A as debt has historically been a large component of total deal value.

Large utility holding companies looking to sustain above average earnings growth may be drawn to more robust CapEx plans and above-average rate base growth expectations of smaller gas LDCs. This could especially hold true for those companies facing regulatory or other setbacks with major projects or finding difficulty achieving authorized ROEs in regulated jurisdictions.

For our coverage on the issue check out the full report: Valuation premiums for smaller gas utilities suggest takeout speculation