Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 21, 2023

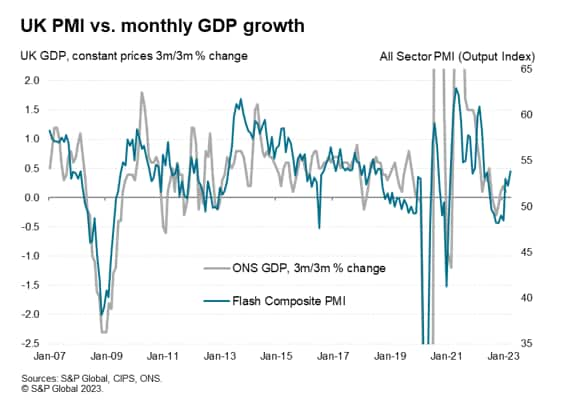

Flash PMI surveys indicated an acceleration of economic growth to the fastest for a year in April, building on a modest return to growth signalled in the first quarter of the year.

Growth is lopsided, however, with surging demand for services contrasting with an ongoing downturn in demand for goods. Even within the service sector, growth is dependent on consumers switching spending from goods to services and a revival of financial services activity, both of which are areas susceptible to the impact of higher interest rates and the ongoing cost of living squeeze. Business services and manufacturing are clearly struggling. However, for now the key takeaway is that the economy as a whole is not only showing encouraging resilience but has gained growth momentum heading into the second quarter, the latest PMI reading broadly indicative of GDP rising at a robust quarterly rate of 0.4%.

Inflationary pressures have meanwhile continued to cool in manufacturing, but price pressures have picked up in services following the resurgence of demand.

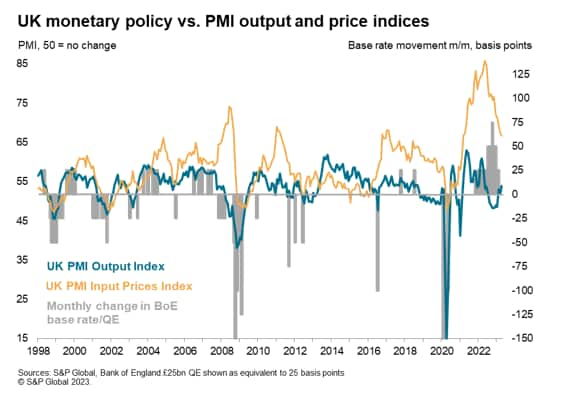

This combination of faster growth and elevated price pressures put a twelfth rate hike by the Bank of England an increasingly done deal when it next meets on 11th May, and will add to speculation that further hikes may be needed.

UK business activity growth accelerated sharply at the start of the second quarter, according to the flash PMI survey data compiled by S&P Global and sponsored by CIPS. The survey's headline output gauge, the composite PMI, rose from 52.2 in March to 53.9 in April according to the provisional data, signalling the fastest rate of expansion for a year and a third successive month of growth.

The latest reading is consistent with GDP rising at a quarterly rate of just under 0.4%, building on a 0.2% expansion signalled in the first quarter. The recent data therefore point to an encouraging economic upturn so far this year after recording one of the steepest downturns since the global financial crisis in the latter months of 2022, if pandemic lockdowns are excluded.

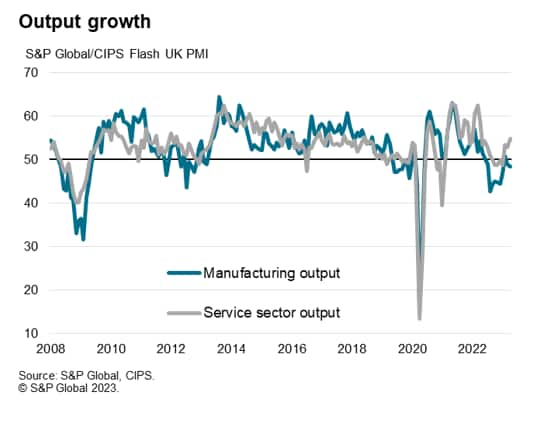

Service sector drives upturn

As seen in March, April's upturn was driven entirely by the service sector, where output rose for a third straight month and at the steepest rate since April of last year. Manufacturing output, in contrast, contracted for the ninth time in the past ten months, the rate of decline accelerating to the fastest for three months.

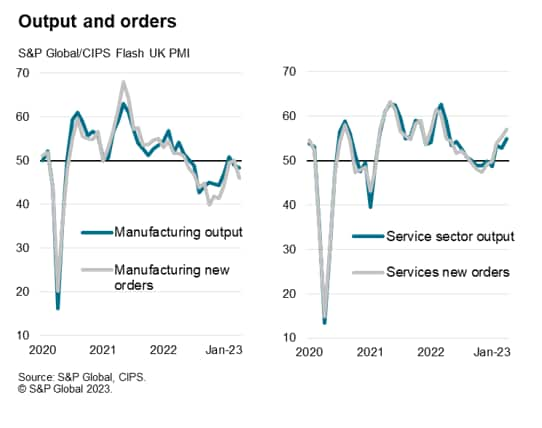

The varying output trends were fueled by divergences in demand. Demand for services, as measured by new order inflows, rose in April at the fastest rate since March 2022, accelerating sharply for a second successive month.

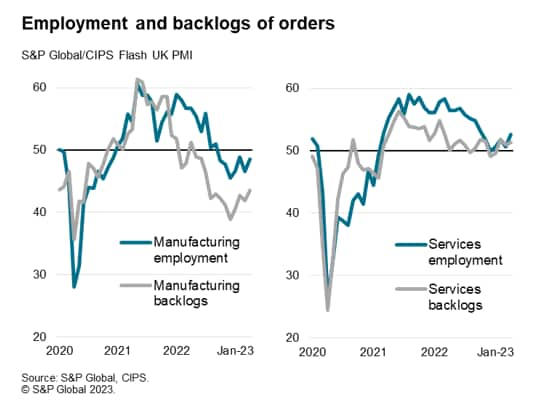

The rise in demand for services was such that, on average, service providers were unable to fulfill these new orders, resulting in a rise in backlogs of uncompleted work. This in turn encouraged more hiring in the sector, with service employment rising at the steepest rate for six months as a result. The sector nevertheless continued to report shortages of staff, in turn helping to explain the inability to fully meet new demand.

It's a very different picture in manufacturing. Inflows of new orders into factories fell at the sharpest rate for three months in April, having stabilised in March, dropping at a sharper rate than output was cut during the month. Worsening domestic demand was accompanied by an increased rate of loss of exports. Backlogs of work also fell markedly, as downward pressure on factory output was alleviated by the fulfilment of orders placed in prior months (which, in many cases, had risen during the pandemic due to component shortages).

The depletion of these backlogs, in the absence of new orders, prompted a further reduction in factory payroll numbers and adds downside risks to manufacturing production in coming months.

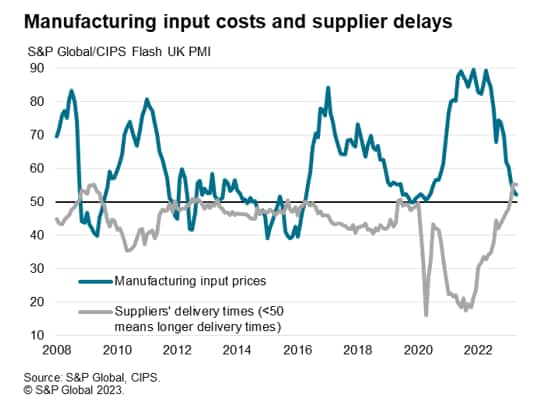

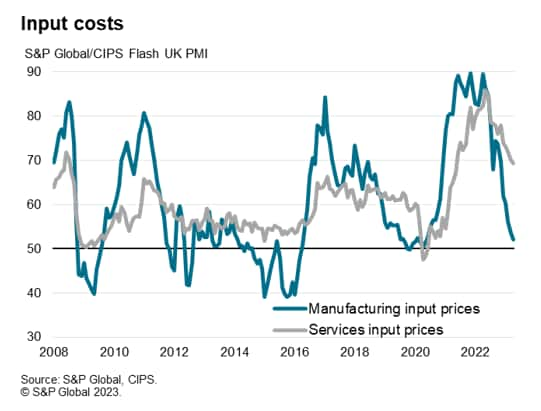

There were also strong divergences in price trends by sector. In manufacturing, the inflationary picture has been dominated by supply chains, where component shortages and supply delays during the pandemic led to sharply higher prices for a wide variety of items. This situation has now reversed, with the past two months seeing the most pronounced back-to-back improvement in supplier delivery times recorded in the survey's 30-year history. Price pressures have fallen accordingly, with manufacturing input costs rising only modestly in April, posting the smallest monthly gain since May 2020.

Although the overall rate of service sector input cost inflation also eased, down to the lowest for 23 months and cooling further from the peak seen last May, unlike manufacturing it saw the rate of inflation continue to run sharply higher than any time in the decade leading up to the pandemic. Elevated service sector cost growth was blamed on higher staff costs as well as higher raw material prices, especially for food (by far the steepest rise was seen in hotels, restaurants and catering).

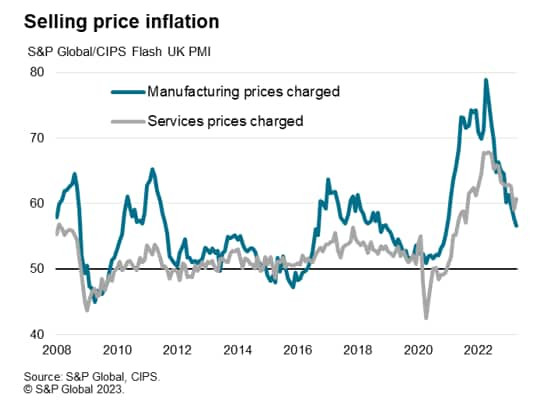

A divergence was also evident for prices charged for goods and services. Whereas the rate of inflation for goods leaving the factory gate slowed in April to the lowest since December 2020, service sector selling price inflation accelerated from March's 19-month low, remaining higher than at any time in the survey history prior to the pandemic, which extends back to 1996.

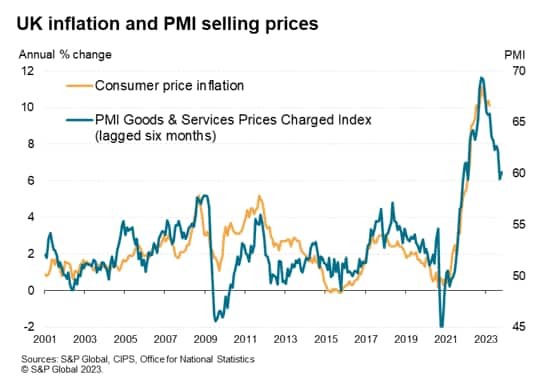

The upturn in selling price inflation for services was sufficient to outweigh the easing of manufacturing prices, resulting in an overall slight acceleration of total selling price inflation in April. Thus, although overall selling price inflation has cooled sharply from the peak seen in April of last year, consistent with consumer price inflation (CPI) moderating from the 10.1% rate seen in March in the coming months, the survey data point to inflation running stubbornly elevated relative to the Bank of England's 2% target in the near-term.

With inflation continuing to run in double digits, the stronger economic growth picture and renewed upturn in selling price inflation from the April flash PMI puts a twelfth rate hike increasingly look like a done deal when the Bank of England's policymakers meet on 11th May. Furthermore, although the Bank's main policy rate now sits at 4.25%, its highest for 15 years, with inflation still in double digits and wage growth accelerating again according to the latest official data, more hikes may be in the pipeline after May if the pace of economic growth continues to surprise to the upside.

The PMI data come on the heels of official GDP data which showed the economy as a whole flatlined in February, subdued by public sector strikes. However, the detail of the official GDP data also reveal how the private sector has fared better so far this year than the slump seen in the fourth quarter of 2022, led by the service sector and corroborating recent PMI findings. Underlying economic growth is, in essence, stronger than the headline official data suggest.

A reliance on services nonetheless remains a concern in terms of the sustainability of the upturn. Looking into the detail of the services economy in April, the flash PMI showed growth continuing to be led by a revival of financial series activity, which had seen an especially steep downturn late last year amid the tightening of financial conditions following the autumn mini-budget. Spending on consumer services, notably hotels and restaurants, also rose sharply, though April saw inflows of orders into this sector slip for the first time in six months to hint at some easing of this tailwind to the economy. Growth of business services and transportation meanwhile remained subdued, with demand conditions weakening during the month.

Both business services and manufacturing therefore look to have had a poor month in April, leaving the economy largely dependent on consumer spending on services - growth of demand for which now appears to be waning - and financial services, which look prone to a renewed set back if financial conditions tighten again as markets start to price in more central bank rate hikes.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location