Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 6 Feb, 2023

By Carl Lehmann

Highlights

Enterprises that engage in total automation can create new forms of competitive advantage by transforming their IT infrastructure and applications into data-gathering assets able to create a constant state of awareness of their digital businesses.

Several tools and technologies have come to market in recent years to facilitate automation of a variety of business and IT processes and workforce activities.

The technologies and vendors in these markets continue to converge.

Introduction

This two-part report updates our 2022 research agenda for total automation. Our research for 2023 will continue to focus on how digital automation platforms (DAPs) and robotic process automation (RPA) technology are assimilating and integrating with next-generation process discovery technologies (PDTs) and hybrid integration platforms (HIPs) and the implications thereof. Collectively, these technologies continue to converge to create innovative ways for enterprises to examine and improve the execution and performance of their digital business operations, and facilitate an emerging strategic managerial discipline we refer to as "total automation."

In Part 1, we define and call out the need for total automation and discuss how various technology markets continue to coalesce and evolve through development and M&A activity into future intelligent automation platforms. Part 2 will highlight the core capabilities of these technologies, call out how these technologies are likely to influence current technology markets (and create new ones) and identify the notable vendors we will study as part of our research on total automation.

The Take

Digitally driven enterprises are investing in intelligent process-discovery and automation technologies to enable greater levels of collaboration and productivity, and to empower workforces with resources to work smarter together to reveal hidden opportunities for improvements and imagine new ways of conducting business. They seek a total approach to enterprise automation that goes beyond mere process automation and software robots to bring together business and IT leaders, developers, and process stakeholders to think more strategically, holistically and creatively about how the entirety of their digital business operations can be improved and differentiated from rivals, and how their people can be empowered to collaborate to create and invent new products, services and better ways to serve customers. Enterprises that engage in total automation can create new forms of competitive advantage by transforming their IT infrastructure and applications into data-gathering assets able to create a constant state of awareness of their digital businesses, as well as to take action with new abilities to reactively, proactively and even autonomously respond to change, risk and opportunity intelligently.

Total automation defined

Our study of the total-automation market in 2022 revealed a greater emphasis by enterprises to empower their workforces with analytics, productivity and collaboration tools, helping them to think more creatively about how they can improve digital business operations. It has led us to revise its definition.

Total Automation is a disciplined and holistic managerial approach to the entire process automation strategy of an enterprise. It is data driven and focuses on the continuous improvement of execution efficiency and outcomes, as well as greater levels of automated and autonomous business and IT operations, and empowers the workforce to collaborate, create and invent with tools that augment their skills and help them work smarter and faster, together, with less effort.

Total automation is enabled by a combination of process- and task-discovery technologies, business and robotic process automation platforms, and hybrid integration platforms — all orchestrated as a unified intelligent automation platform. Total automation creates a constant state of execution and performance awareness to quickly sense and effectively respond — reactively, predictively and even autonomously — to sudden change, risk and customer opportunity, and to achieve superior business outcomes.

The need for total automation

Automation has been at the heart of many enterprise digital transformation strategies for a number of years. Yet many organizations still rely on manual effort that stretches already-thin skilled resources. Indeed, the work gets done, but inefficiently, and fails to capture knowledge about how processes actually execute so they can be improved to make digital businesses more competitive.

We continuously seek more information about how enterprises view their approach to digital transformation. In a recent Voice of the Enterprise survey, we asked 500 business and IT decision-makers to prioritize their digital transformation initiatives. In it, we defined "digital transformation" as the investment in new digital technologies and processes to not only more effectively engage customers, partners and employees, but also to cut costs.

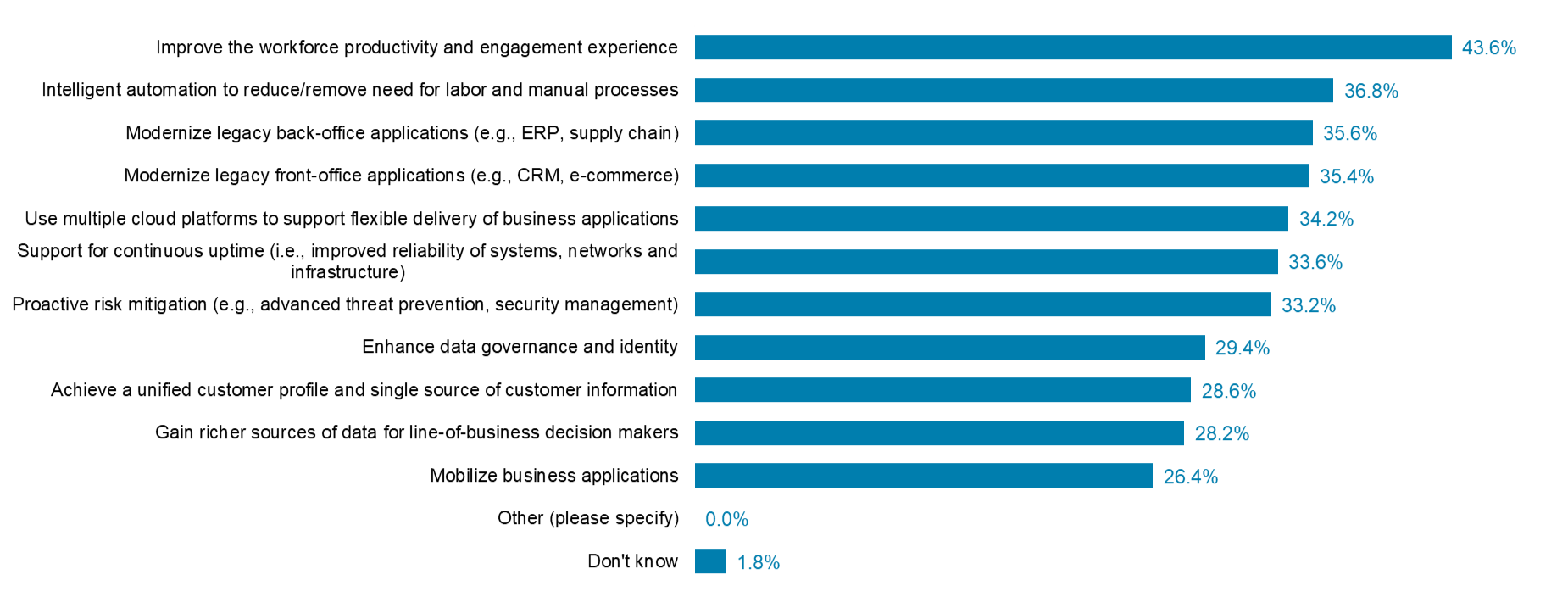

Figure 1 reveals that improving workforce productivity and engagement experience (selected by 43.6% of respondents), and intelligent automation to reduce the need for labor and manual processes (36.8%) are top priorities. These are closely followed by the need to modernize legacy back-office (35.6%) and front-office (35.4%) applications and to make use of multiple cloud platforms for flexible delivery of business applications (34.2%).

Figure 1: Transformational Priorities

Source: 451 Research's Voice of the Enterprise: Workforce Productivity & Collaboration, Technology Ecosystems 2022

Q. In your opinion, what are the main IT-led priorities in digital transformation? Select all that apply.

Base: All respondents (n=500)

These findings reveal that enterprises seek to improve the quality and level of their workforce productivity and process automation efficiency, and emphasize the need to modernize IT infrastructure and applications. On the latter, we have learned that many enterprises seek the benefits enabled through various cloud platforms. Moreover, they seek to transform their infrastructure and applications, whereby they become data-gathering assets to enable greater levels of enterprise performance intelligence, which will be discussed in Part 2.

Market convergence

Several tools and technologies have come to market in recent years to facilitate automation of a variety of business and IT processes and workforce activities. DAPs automate complex structured processes, decisions, and unstructured collaborations and cases. RPA technology automates repetitive manual tasks and supplements workforces with digital skills. PDT enables a visual data-driven approach to process and task analysis and automation design. HIPs bring together disparate data, applications, processes and IT ecosystems, enabling event-driven integrations to facilitate cloud-native, edge and IoT computing.

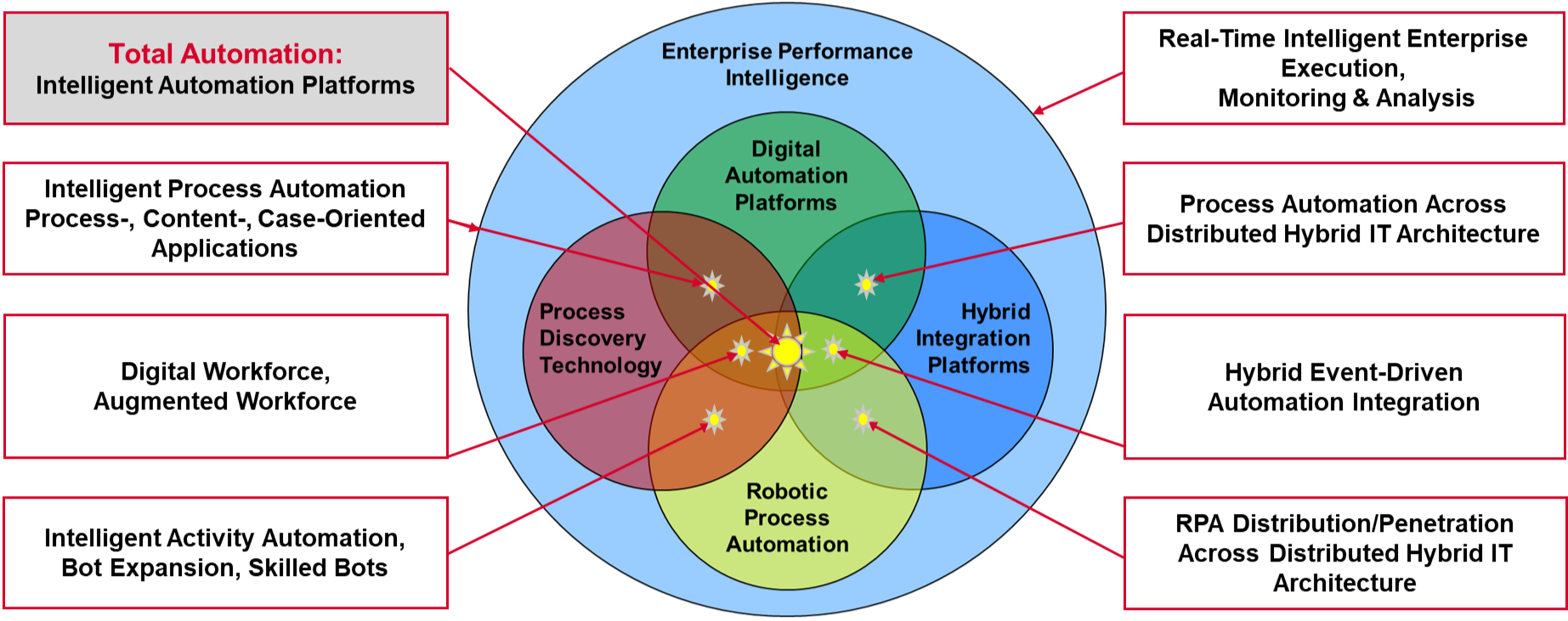

Vendors in each market now coexist, driven by enterprise customers to interoperate as more homogeneous systems. This will likely continue to trigger waves of R&D and M&A activity. The technologies and vendors in these markets continue to converge. Figure 2 illustrates how they overlap and interoperate to form new capabilities and technology markets.

Figure 2: Essential Technologies for Total Automaton and the Emerging Markets They Create

Source: 451 Research

The deployment and integration of these technologies continues at a steady pace within enterprises as part of their ongoing modernization efforts and strategic initiatives to create new competitive advantages. As this happens, enterprises will have enabled their own unique intelligent automation platforms that can continuously enable new competitive advantages through intelligent process automations, and through a greater number of autonomous operations that can free scarce workforce resources and skills to concentrate on value-added activities.

Moreover, the technology to compose such intelligent automation platforms can, in effect, "instrument" IT infrastructure and applications, equipping them with means to capture, in real time, the event and telemetry data needed to monitor and control the performance and outcomes of digital business operations, thereby creating the emerging enterprise performance intelligence market. EPI enables real-time (or near-real-time) sensing/monitoring and analysis of measurement and performance data, and is capable of proactively responding to the change, risk and opportunity that can occur during the execution of digital business operations that may affect enterprise performance.

Notable M&A activity in 2022

Observation of the M&A activity in 2022, noted below, demonstrates how these markets are converging and reveals how vendors from other IT pedigrees have an equal appetite for consuming and consolidating the essential technologies needed for total automation.

Figure 3: Pedigree Legend

|

BI — business intelligence, analytics |

HIP — hybrid integration platform |

|

CRM — customer relationship management |

IDP — intelligent document processing |

|

DAP — digital automation platform |

iPaaS — integration platform as a service |

|

ECM — enterprise content management |

LCAD — low-code application development |

|

EDA — event-driven architecture/automation |

NLP — natural language processing |

|

ERP — enterprise resource planning |

PAP — preconfigured automated processes |

|

PDT — process discovery technology |

RPA — robotic process automation |

|

SI — systems integrator |

ITOps — IT operations management |

Source: 451 Research

Figure 4: Notable M&A Activity in the Total Automaton Market, 2022

|

Acquirer |

Target |

Date |

Rational (Capabilities Added to Acquirer from Target) |

|

Neostella SI |

Work-Relay DAP |

September |

Provides software to automate the coordination, management, and optimization of time-sensitive, repetitive and complex processes. Adds automation technology to Neostella's SI practices. |

|

Kofax ECM, DAP |

Ephesoft IDP |

August |

Provides intelligent document capture and data classification platform that automates scanning processes; captures data from mobile devices, email, paper docs; assists in identifying document types; and extracts meaningful data to feed back-office applications. Strengthens Kofax's position in the IDP market. |

|

UiPath RPA |

Re:infer NLP |

August |

Provides AI- and NLP-based conversational data intelligence, analysis, monitoring, and automation management SaaS and related APIs. Software provides features for data storage, encryption, automation, model development, real-time monitoring, analytics and integration. Strengthens UiPath's position in the IDP market. |

|

SAP ERP, DAP, HIP |

Askdata ERP, DAP |

July |

Provides AI- and NLP-based data intelligence and analysis SaaS and on-premise software. Software enables automated insight, searching data, data personalization and data collaboration. Strengthens SAP's capabilities to provide NLP-based search and data-driven decisions. |

|

Kofax ECM, DAP |

Tungsten PAP |

June |

Provides AI-based invoicing and accounts payable automation SaaS. Software provides features for onboarding of suppliers, PO exchange, invoice processing, e-invoicing, compliance, payment processing, analytics, reporting, procurement, workflow and supply chain finance management. Strengthens Kofax's position in the PAP market. |

|

Pega DAP |

Everflow PDT |

May |

Provides AI-based process-mining capabilities. Mixes process-mining and machine-learning techniques with big data and a streamlined user experience to analyze and improve business and technical processes. Strengthens Pega's Process AI offering. |

|

Salesforce CRM |

Troops EDA |

May |

Provides AI-enabled Slack-focused automation and revenue communications SaaS. Software provides features for real-time updates, coaching, actions, insight, collaboration, sales velocity, forecasting, visibility, alerts, reporting and workflow. Strengthens Salesforces CRM and Slack offerings. |

|

Celonis PDT |

Process Analytics Factory PDT |

March |

Provides AI-enabled business process mining and execution management SaaS and consulting services. Enables users to visualize and analyze business process data from in-place enterprise software, data ingestion, planning and execution, daily management, and action flows. Strengthens Celonis' critical path detection efficiency. |

|

SS&C DAP, LCAD |

Blue Prism RPA |

March |

Provides RPA software. Enables users to automate repetitive manual activities including manual data entry and processing work. Will be integrated into SS&C's Chorus DAP/LCAD offering. |

|

Microsoft DAP, iPaaS |

Minit PDT |

March |

Provides AI-based data-driven business process mining SaaS, automates the discovery, root-cause analysis, auditing, simulation and monitoring of business process management. Will be added to Microsoft's Power Automate offerings. |

|

PagerDuty ITOps |

Catalytic DAP |

March |

Provides low-/no-code workflow and business process automation to the PagerDuty digital operations platform. |

|

Redwood Software DAP |

Advanced Systems Concepts DAP |

February |

Provides business and IT process automation. Adds ASCI's ActiveBatch (a central automation hub for scheduling and monitoring business-critical systems) and JSCAPE (managed file transfer) products to Redwood's workload automation technology. |

|

Software AG DAP, HIP |

StreamSets HIP |

February |

Provides data integration and related DevOps performance management SaaS. Includes open-source capabilities and enables data management across hybrid and multicloud architectures. Strengthens Software AG's integration capabilities. |

|

Nintex DAP |

Kryon RPA, PDT |

February |

Provides PDT that enables enterprises to quickly identify and automate the processes that are best suited for RPA. Strengthens Nintex's position in the RPA and PDT markets. |

|

Newgen DAP |

Number Theory Software BI |

January |

Provides AI-based enterprise data science SaaS and related APIs and SDKs for businesses in the telecom, banking, insurance, and logistics and warehousing sectors. Provides features to prepare, visualize, train, deploy and monitor, automate, and collaborate data. Strengthens Newgen's low-code NewgenONE DAP/LCAD with AI/ML modeling and data analytics capabilities. |

|

SAP ERP, DAP |

Taulia PAP |

January |

Provides AI-based supply chain management invoicing and discount optimization SaaS. Software provides features for dynamic discounting, invoice automation, supplier management, cash forecasting, inventory management and early payment. Strengthens SAP's capabilities in the PAP market. |

|

Jitterbit iPaaS |

PrimeApps DAP |

January |

Provides low-code application development iPaaS capabilities. Enables companies to create and deploy business applications and build online databases. Helps position Jitterbit in the DAP/LCAD markets. |

|

iGrafx DAP |

Logpickr PDT |

January |

Provides features for process mining, creating flowcharts, process maps and diagrams. Strengthens iGrafx's process analysis capabilities. |

To be continued in Part 2

Part 2 will discuss capabilities of the various technologies that will drive the evolution of future intelligent automation platforms, as well as the existing and new technology markets these technologies are likely to influence, and will identify the notable vendors we will study as part of our research on a total automation approach to intelligent enterprise execution.