Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 2 Apr, 2021

By Brian Bacon

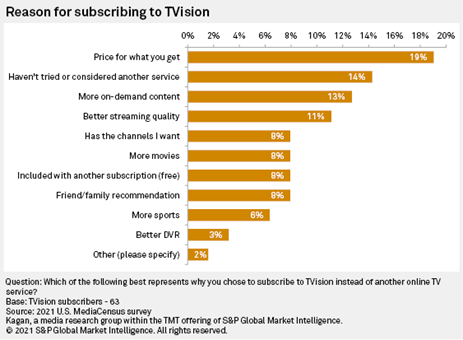

The most selected reason for subscribing to TVision instead of another virtual multichannel service was “price for what you get” at 19%, among subscribers surveyed in Kagan’s February 2021 MediaCensus online consumer survey. However, with three tiered packages at incremental price points, TVision was not a budget service like Philo, which pitted the service head-to-head with more established services. In fact, T-Mobile is partnering with Alphabet Inc.’s YouTube TV by providing a $10 per month discount, which brings YouTube TV’s regular monthly price down to $54.99 – a better deal than TVision Live Zone at $60. Another 14% of subscribers indicated they had not tried or considered another service, suggesting that TVision was able to bring in some new consumers to the virtual multichannel space.

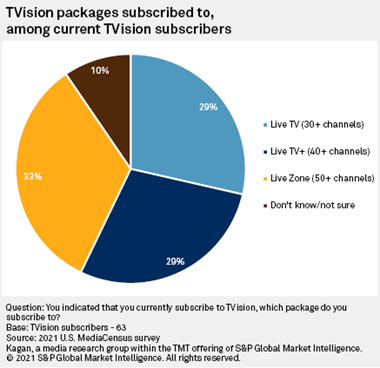

When asked which of the packages they subscribed to, 33% indicated they subscribed to the Live Zone package, which was the package with the most networks. Close behind were the Live TV and Live TV+ packages, both at 29%.

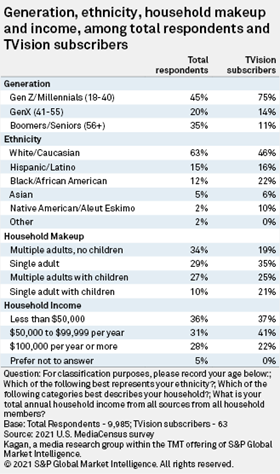

Three quarters of TVision subscribers surveyed were Gen Z/millennials (75%), a much higher share than total respondents at 45%. Black/African Americans represented a larger share of TVision subscribers compared to total respondents, at 22% and 12% respectively. TVision subscribers were more likely to be in single adult households without children at 35% and with children at 21%, compared to total respondents at 29% and 10%, respectively. Subscribers were also more likely to be in households earning $50,000 to $99,999 per year at 41%, compared to 31% of total respondents.

Data presented in this article is from the general population sample of the MediaCensus survey conducted in February 2021. This sample includes 9,985 U.S. internet adults matched by age and gender to the U.S. Census. The survey results have a margin of error of +/-0.3 ppts at the 95% confidence level. Generational segments are as follows: Gen Z: 18-23, millennials: 24-40, Gen X: 41-55, boomers/seniors: 56+. Survey data should only be used to identify general market characteristics and directional trends.

Consumer Insights is a regular feature from Kagan, a group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

Already a client?

Already a client?