Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 29 Jun, 2022

Highlights

Netflix Inc. and Walt Disney Co. are looking at offering ad-supported plans in Europe in an attempt to minimize churn and diversify their source of revenue.

The addition of advertising to an already established subscription model will reduce average revenue per user.

Successful implementation of hybrid revenue models will compensate OTT video providers for the loss of revenue from current subscribers downsizing to a lower-priced plan.

After a decade of rapid growth fueled by the worldwide expansion of subscription-based over-the-top video services, a saturated video entertainment landscape, coupled with a worsening macroeconomic environment, has put many OTT video providers under pressure. They are quickly responding to these volatile conditions by diversifying their revenue streams and combining subscriptions with advertising.

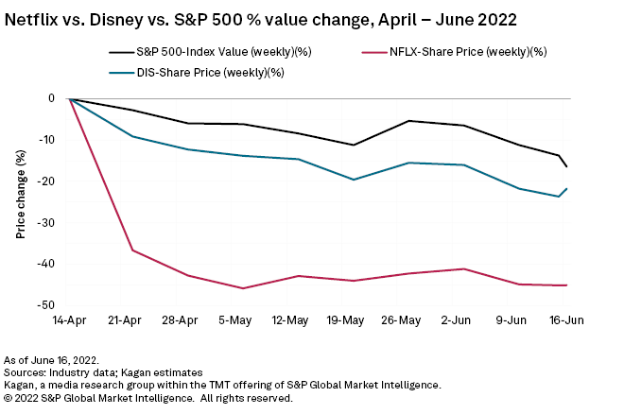

In fact, Netflix Inc. and Disney recently announced their intention to begin offering ad-supported alternative options to subscribers that wish to downscale. Netflix's disappointing first-quarter 2022 results saw the streamer post a decrease of 0.3 million in net subscriptions following the closure of its service in Russia and as it faces stagnation challenges in Central and Eastern Europe (CEE). This had an impact on its share price, which has lost over 45% of its value since the day of the announcement. Disney, Netflix's major rival in the global streaming scene, was also down by over 22% in the same period. We attribute this to macroeconomic factors such as feared upcoming recession, inflationary pressure, an expected rise in interest rates by the Federal Reserve, and finally, the loss of the special jurisdiction status in the state of Florida. For comparison, the S&P 500 index was down by 16.42%.

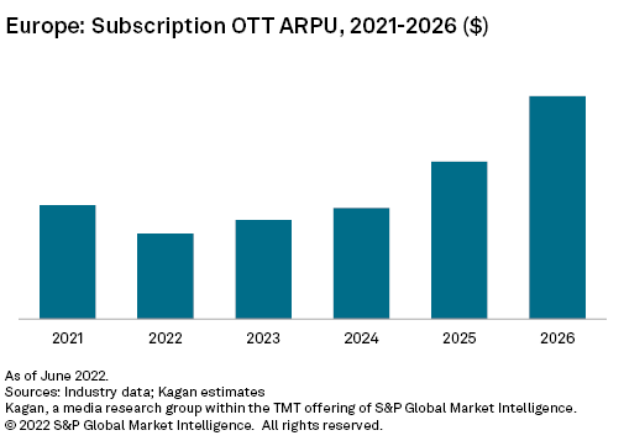

Our model indicates a slight downward pressure in expected ARPUs across the European continent between 2022 and 2024 compared to the past year. This is mainly due to the combination of streaming fatigue and the expected introduction of lower-priced plans by two of the top three players, Netflix and Disney. Inflationary pressure and rising programming costs should eventually push prices back during the 2025-2026 period.

There are several factors that need to be taken into consideration before adopting such strategy due to the risks involved. First, both players will need to decide on the pricing of their ad-supported plans. Taking the U.K. as an example, we expect Disney to price its ad-supported plan anywhere between £4.50 and £5.50, with Netflix matching the cost of its Basic plan at £6.99. Secondly, the higher the usage, the bigger the ad revenues for the service. Our survey showed that, in general, frequent users are more accepting of advertising than infrequent ones, possibly because they subscribe to multiple services and are looking for a way to cut down on their monthly bills.

Blog

Blog