Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 15 Jun, 2022

By Keith Nissen

Introduction

Survey results show that in Europe, the introduction of cheaper ad-supported subscription video-on-demand service tiers by Netflix Inc. and Walt Disney Co.'s Disney+ may be more useful in promoting SVOD stacking than in attracting new SVOD adopters.

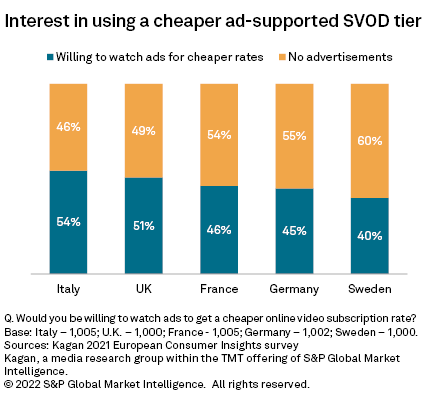

* Kagan's 2021 European Consumer Insights survey results showed that between 40% and 54% of European consumers expressed interest in using a cheaper, ad-supported SVOD service tier.

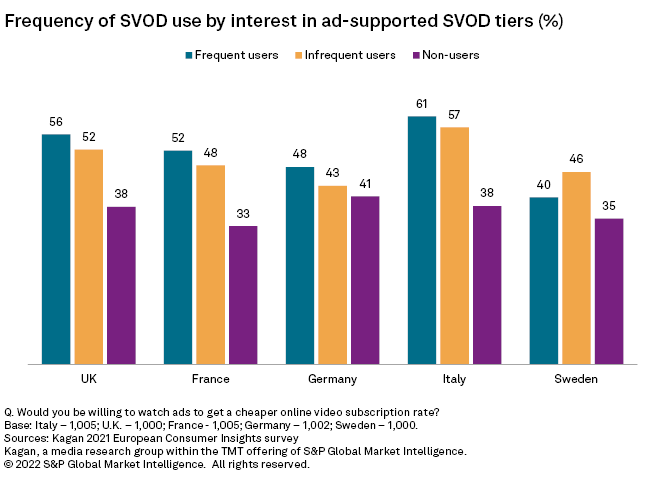

* Typically, those watching SVOD content at least once per week (frequent users) have much more interest in using ad-supported SVOD service tiers than non-SVOD users.

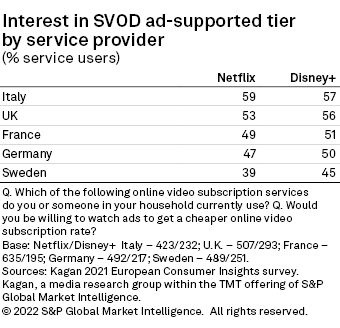

* Across all five surveyed European markets, there was strong interest among current Netflix and Disney+ users for using a cheaper, ad-supported SVOD service tier.

Recently, both Netflix and Disney announced plans to introduce advertisement-supported service tiers that come with a cheaper subscription rate. Neither company has released details of their respective new ad-supported tiers, such as the lower subscription rate or the timed introduction of the new service tiers across geographical regions. As part of the Kagan year-end 2021 European Consumer Insights survey, consumers were asked if they would be willing to watch ads to get a cheaper online video subscription rate. Overall, the survey found that there was strong consumer interest for advertising-supported SVOD tiers (from any service provider), ranging from 54% of internet adults in Italy to 46% in France and 40% in Sweden.

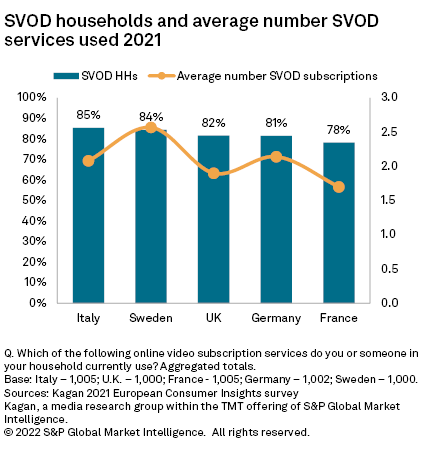

Both Netflix and Disney+ make huge investments in proprietary video content, which helps explain why the companies have been reluctant to offer cheaper subscription options. Part of the reason behind their willingness to launch an ad-supported service tier in 2022 may be due to competition and market maturity. The survey data shows that in each of the five surveyed European markets, approximately eight out of 10 internet households use at least one SVOD service, with the average number of SVOD services used ranging from only 1.7 in France to 2.6 in Sweden.

Most concerning to European online video service providers is that between 40% and 50% of surveyed internet adults indicated they will only add a new SVOD subscription if another subscription is dropped. As a result, SVOD service providers cannot count on consumers subscribing to an increased number of SVOD services, also known as SVOD stacking, to fuel future subscriber growth. Both Netflix and Disney+ may be looking to a cheaper, ad-supported service tier as a means of attracting and retaining cost-conscious subscribers, supplemented by a stream of advertising revenue.

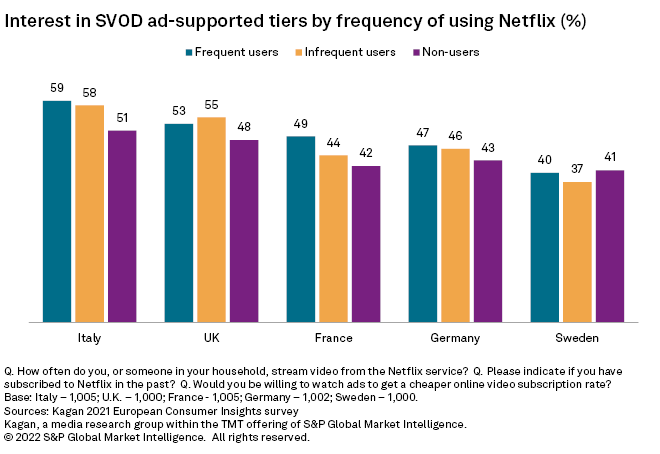

The survey found that, with the exception of Sweden, those watching SVOD content at least once per week, also known as frequent users, were slightly more likely to have interest in ad-supported SVOD service tiers than infrequent SVOD viewers. Only about one-third of non-SVOD users in each of the surveyed markets expressed interest in adopting SVOD through an ad-supported SVOD service tier.

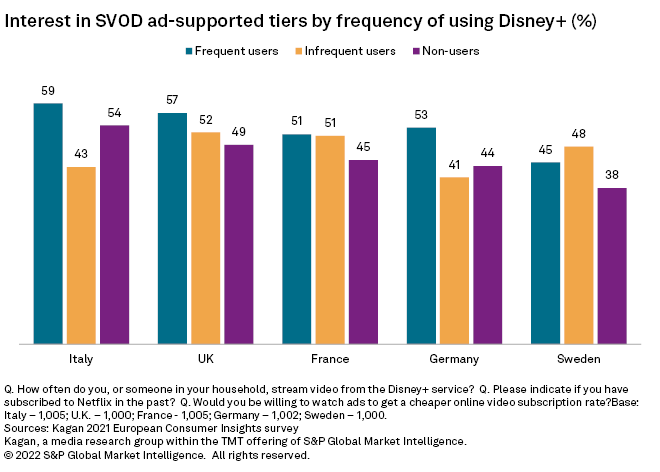

More specifically, the survey data shows there is strong interest for ad-supported SVOD tiers among current European Netflix and Disney+ users. In Italy, where approximately nine in 10 households (88%) still receive free-to-air TV programming, 59% of current Netflix users and 57% of Disney+ users cited interest in using a cheaper, ad-supported SVOD service tier. Conversely, in Sweden, where 60% of internet households have a multichannel TV service subscription, only 39% of current Netflix and 45% of Disney+ reported interest in using a cheaper, ad-supported SVOD service tier. Note that respondents were asked about their general interest in ad-supported SVOD service tiers, not specifically about interest in using future Netflix or Disney+ offerings.

Among Netflix users, interest in ad-supported SVOD service tiers is high, regardless of how often the service is accessed. For example, the survey found that in the U.K., 53% of frequent Netflix viewers (those accessing the service at least once per week) expressed interest in using ad-supported SVOD service tiers, compared to 55% of infrequent Netflix users. Approximately half (48%) of those not currently using Netflix also express interest in ad-supported SVOD service tiers. A substantial portion of these non-users are previous Netflix subscribers. Results similar to that of the U.K. were found in the other four surveyed European markets.

The survey data for Disney+ users mirrors that of Netflix, where 57% of frequent users and 52% of infrequent users in the U.K. reported being interested in using an ad-supported SVOD service tier. Once again, a substantial portion of those not subscribing to Disney+ also expressed interest. However, unlike Netflix, the majority of those not using Disney+ have never been subscribers.

Based on the survey results, it is very possible that a substantial portion of current Netflix and Disney+ users in Europe will opt for a cheaper, ad-supported service tier when introduced. In addition, the data suggests that a cheaper, ad-supported service tier will attract new subscribers, especially previous subscribers, where cost was a major barrier to adoption or long-term use. The data also infers that ad-supported SVOD service tiers will probably be much less effective in convincing non-SVOD users to adopt online subscription video.

The 2021 Kagan European Consumer Insights surveys were conducted during December 2021 with approximately 1,000 internet adults per country in the U.K., France, Germany, Italy, Sweden and Poland. Each survey has a margin of error of +/-3 ppts at the 95% confidence level. Percentages are rounded up to the nearest whole number. Survey data should only be used to identify general market characteristics and directional trends.

Consumer Insights is a regular feature from Kagan, a group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.