Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Dec 23, 2024

By Ines Nastali

With the number of vessels being sanctioned by global authorities[3] reaching, 1,000, sanctioned ships are subject to growing scrutiny.

More than 500 vessels have been globally sanctioned since the Russia-Ukraine conflict started in 2022, S&P Global Market Intelligence data shows. In October 2024, Panama’s President José Raúl Mulino issued an executive decree that enables the Panama Ship Registry to cancel any vessel that is sanctioned.[4] The major flag state issued the decree to counter complaints that the process to deregister ships has taken several months in the past. Currently, 30 sanctioned ships are registered with the Panama flag, with six of them being investigated for deregistering.

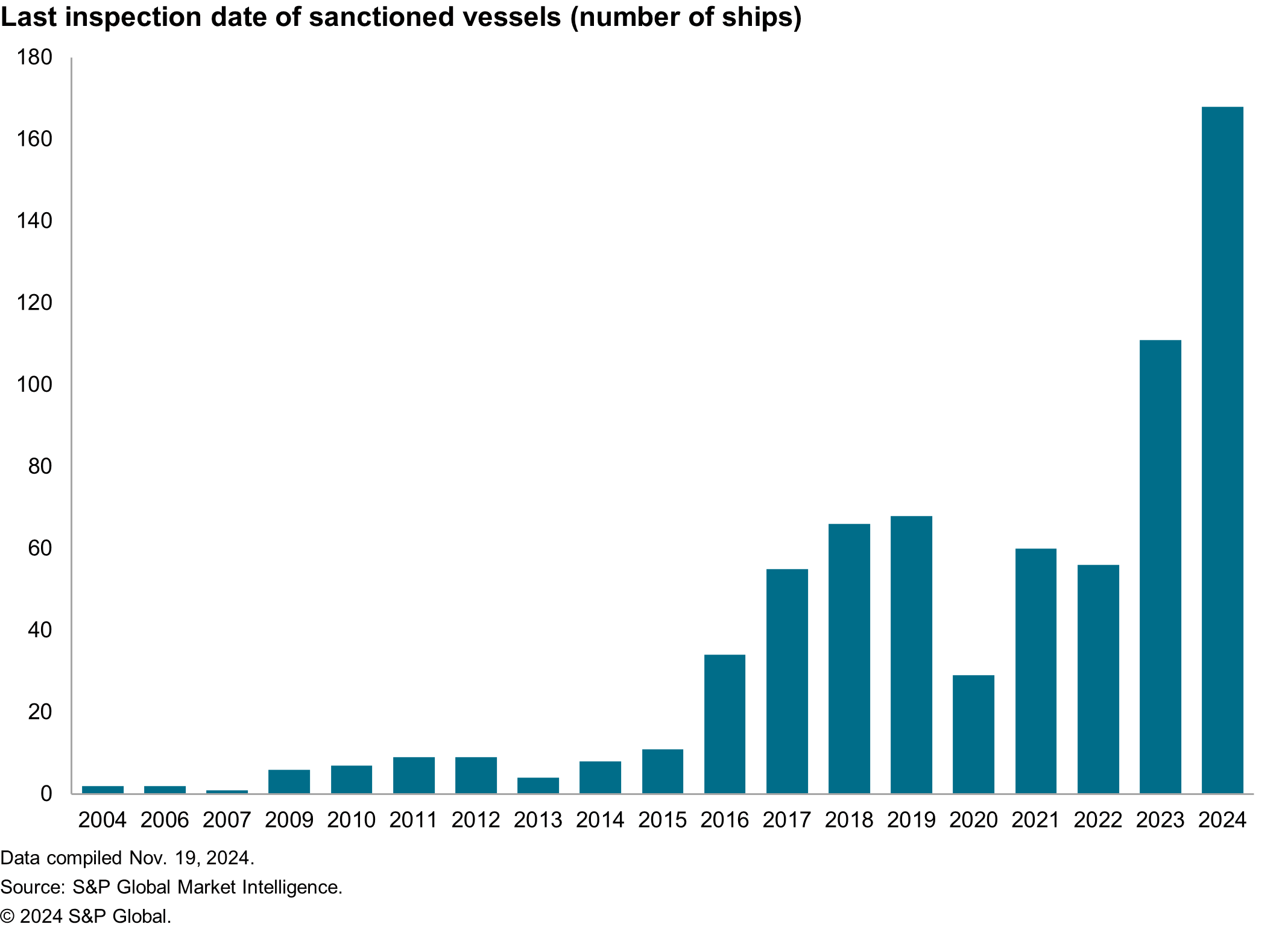

In addition, ship inspection provider RightShip Pty. Ltd. has announced a change in its vessel inspection age trigger in response to evolving market conditions and continuing safety risks in the dry bulk and general cargo sectors, which could impact aging sanctioned vessels. This change will be implemented in a two-phased approach beginning March 31, 2025. Currently, annual inspections begin when a vessel reaches 14 years of age. The change will reduce that starting age to 12 years in 2025, and then further to 10 in 2026.

“This change reflects RightShip’s continued commitment to improving safety standards, reducing incidents, and promoting sustainable maritime operations, and builds on consistent customer feedback calling for vessel inspections to identify risks and propose mitigation actions,” RightShip stated when issuing the updated guidance in October 2024.[5]

This change is timely: On average, sanctioned ships are significantly older than the average merchant vessels. While merchant vessels are generally around 13 years old, the average age of sanctioned vessels is 21 years old, S&P Global Market Intelligence data shows — a difference that can lead to issues around vessel safety in terms of operation, crew, and incidents as these sanctioned vessels typically avoid being inspected.

Fewer than 200 sanctioned vessels have been inspected in 2024 according to S&P Global Market Intelligence Ships in Service data. Moreover, analysis shows about one-fifth of sanctioned vessels have not been seen by any of the major port state control authorities this year.

Since 2021, 118 maritime incidents involving sanctioned vessels have been recorded on Market Intelligence’s Maritime Intelligence Risk Suite (MIRS). The majority of these incidents involved collisions and hull and machinery issues; they also range from pollution, piracy, and crew injury and fatalities to security and legal disputes, such as illegal ship-to-ship transfers.

This translates to a tenth of the sanctioned fleet having been involved in recorded incidents, compared with one-third of the general merchant fleet. Most vessel journeys take place on the open sea, which is hard to monitor according to MIRS data analysis. Some 80% of sanctioned ships regularly switch off their automatic identification system (AIS) broadcasts, in what the industry refers to as dark activity. This makes potential incidents harder to track. However, having access to historical ship tracking and reconstructing vessel journeys leading up to an incident through AIS can help to make shipping operations safer.

Looking at flag states and vessel types

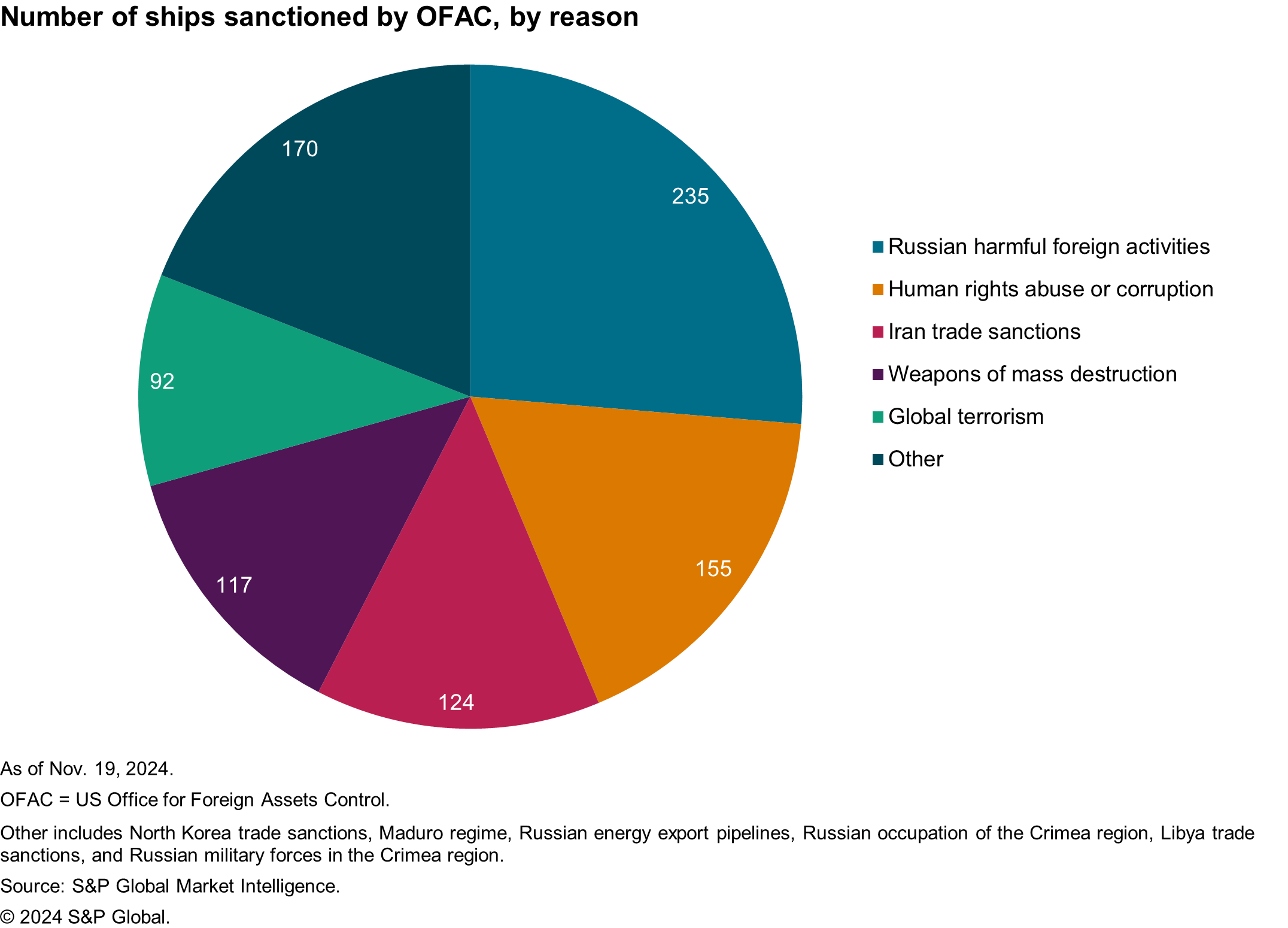

To date, 924 vessels have been sanctioned by the US Office for Foreign Assets Control (OFAC) in relation to Russian harmful activities, Iran and North Korea trade sanctions, or human rights abuses. Other sanctions authorities include the UK, the UN, the EU, and Switzerland.

Around one-third of globally sanctioned ships are tankers, followed by general cargo and fishing vessels. But a variety of vessel types are affected by sanctions, from tugs to roll-on/roll-off (ro/ro) vessels, or ferries. Of the globally sanctioned fleet, over 220 are registered in Russia, 200 in Iran, and more than 150 in China. This top three is followed by ship registrations in North Korea, Barbados, Guyana (via fraudulent registrations), and Panama, which each have 30-60 sanctioned ships affiliated with their flags. Panama’s planned executive decree to investigate registrations is therefore very pertinent and other flag states are advised to follow suit.

Countering flag state misuse

The International Maritime Organization (IMO) has contracted S&P Global Market Intelligence to run the IMO ship numbering scheme for both vessels and companies. In addition, Market Intelligence conducts the yearly IMO Tonnage Assessment that determines membership fees to the IMO.

This year’s tonnage assessment showed that a number of flag states have grown proportionally more than others. While the average growth of flag states in terms of vessels is 11%, some far outstripped that. For instance, the Cook Islands grew by 40% in terms of vessels, with a gross tonnage (GT) growth of 230%; Tanzania by 130%, with a GT growth of close to 100%; and São Tomé and Príncipe by 385%, with a GT growth of 50,000%.

This means that certain flag state authorities are being chosen by registered owners involved in dark activity, on the assumption that there will be less scrutiny when registering a vessel with such a flag state. According to the IMO, “Fraudulent registration of ships prevents lawful registries from exercising effective jurisdiction and control over vessels at sea, deprives lawful registries from obtaining legitimate revenue while unjustly enriching fraudulent actors and exacts unjustified reputational harms on States when vessels engage in illicit activities under the cloak of a fraudulent registration. Furthermore, fraudulently registered ships may not be in compliance with safety and environmental protection standards, endangering the vessels' crew and posing an increased threat of damage to the marine environment.”[6] One of those flag states is Barbados. The Barbados Maritime Ship Registry is based in London and continues to have UK-sanctioned vessels under its flag. In total, just over 70 tankers have been sanctioned by the UK Foreign, Commonwealth & Development Office since the Russian war with Ukraine started. Out of those, 33 vessels — close to 50% — are registered with the Barbados flag.

Scrutiny into insurance cover needed

The issue around the lack of visibility of these ships also becomes clear when looking at their protection and indemnity (P&I) insurance clubs. S&P Global Market Intelligence has been unable to confirm insurance cover for more than 800 of these 1,000 vessels in a recent internal audit. With unclear insurance cover, these old vessels pose a threat to safe shipping operations in case of an incident.

On Dec. 5, Ingosstrakh Insurance Co. — one of Russia’s biggest insurers that was also sanctioned by the UK in June 2024 and consequently by OFAC in January 2025 — issued a statement on marine insurance, asserting that “as a Russian private entity [it] is not obliged to comply with sanctions regimes enacted for the companies incorporated in the EU, the USA or the UK” but that it nevertheless “remains steadfastly committed to international maritime safety standards” as well stating that it “does not insure any sanctioned vessels”, and, during 2022–24, has “canceled or denied coverage to over 100 vessels,” without providing a reason for such.[7] Ingosstrakh told S&P Global Market Intelligence in January 2025 that “Under the ‘Sanction Exclusion Clause’, Ingosstrakh does not provide coverage to clients involved in certain ‘uninsurable activities’. Requests for specific data on individual tankers are unnecessary, as any policy with Ingosstrakh is automatically terminated if the insured vessel becomes subject to sanctions. This is explicitly stated in our policy terms.” Ships in Service data showed that before their policy was deemed canceled by Ingosstrakh, 58 out of the 478 sanctioned tankers had been insured by Ingosstrakh, with 34 of those being flagged in Barbados.

Consequently, to enhance the safety of shipping operations for both crews and the environment, it is imperative that flag states, P&I clubs, and other authorities exercise vigilance. This proactive approach is essential to prevent unnecessary harm to the environment and to safeguard the lives of crew members.

[1] Sanctions issued by the US Office for Foreign Assets Control (OFAC) in relation to Russian harmful activities, Iran and North Korea trade sanctions, or human rights abuses. Other sanction authorities include the UK Foreign, Commonwealth & Development Office, the UN, the EU, and Switzerland.

[2] https://www.imo.org/en/OurWork/Legal/Pages/Registration-of-ships-and-fraudulent-registration-matters.aspx

[3] Sanctions issued by the US Office for Foreign Assets Control (OFAC) in relation to Russian harmful activities, Iran and North Korea trade sanctions, or human rights abuses. Other sanction authorities include the UK Foreign, Commonwealth & Development Office, the UN, the EU, as well as and Switzerland.

[4] https://www.gacetaoficial.gob.pa/pdfTemp/30143_B/GacetaNo_30143b_20241018.pdf

[5] https://rightship.com/insights/rightship-updates-age-trigger-vessel-inspections-boost-maritime-safety

[6] https://www.imo.org/en/OurWork/Legal/Pages/Registration-of-ships-and-fraudulent-registration-matters.aspx

[7] https://cdn.ingos.ru/docs/Ingosstrakh-Compliance-Statement.pdf