Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 22, 2021

By Ken Wattret

IHS Markit recently updated its growth forecasts. Our forecast for 2021 annual growth in the eurozone was edged up, to 3.8%, reflecting the smaller than initially expected q/q decline in GDP in Q4 2020 (revised to -0.6%) but also a slight offset from the minor downward adjustment to our q/q estimate for Q1 2021 (to -1.0%).

Downward adjustment to external forecasts

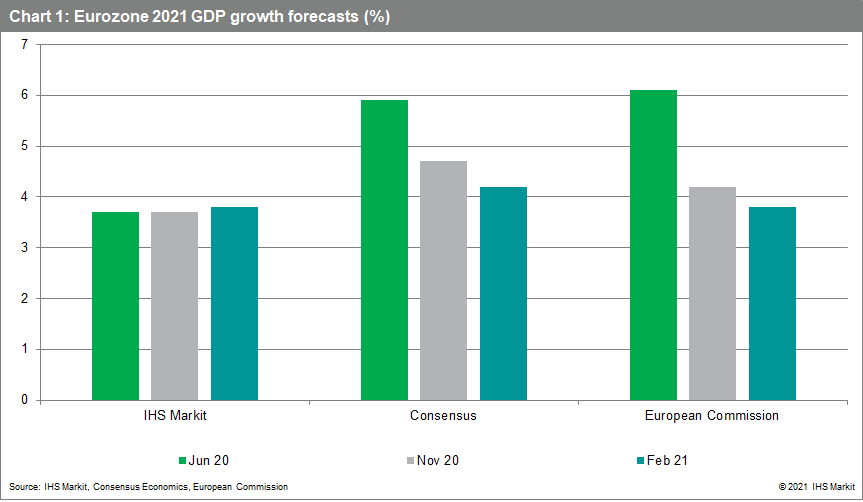

Chart 1 highlights a striking divergence of forecasters' eurozone growth expectations for 2021. While IHS Markit's forecast has remained relatively steady, and sub-4%, market consensus expectations and those of official institutions (in this case the European Commission) were way too optimistic initially but have fallen back markedly since. Back in mid-2020, the consensus and the Commission's 2021 forecasts were both in excess of 6%.

IHS Markit's current forecast of 3.8% remains below the current market consensus expectation (of 4.4%, based on February's Consensus Economics). Following the European Commission's latest downgrade in February's "winter" update, its forecast now matches IHS Markit's estimate.

Beware of annual growth rates

In such volatile times, annual estimates are a sub-optimal guide to growth trajectories. As in 2020, the quarterly path of GDP changes this year will be exceptionally bumpy due primarily to the effects of COVID-19 containment measures and their subsequent reversal.

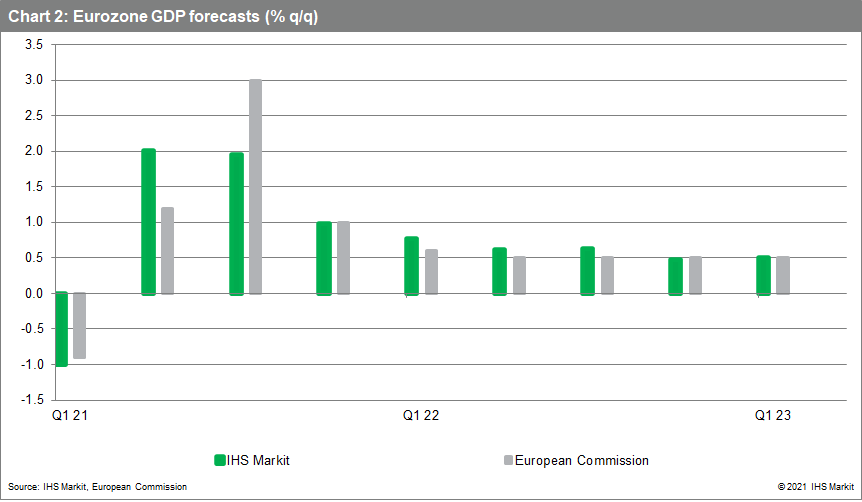

Q1's GDP figures, which will be available from late April, will confirm a second post-COVID-19 recession in the eurozone, albeit much less severe than the first. But from Q2 onwards, we continue to expect a compensating growth spurt, as COVID-19 restrictions ease due to vaccination roll-outs and seasonal influences.

As in Q3 2020, we expect private consumption to lead the pick-up, rebounding strongly following significant COVID-19 disruption in the prior two quarters, with household savings rates declining following unprecedented increases in the first half of 2020.

How soon for the rebound?

While annual growth estimates for 2021 are now the same, IHS Markit's quarterly path for eurozone GDP growth is different in one notable respect from the European Commission's latest estimates. We expect the rebound to begin in Q2 and to continue during Q3, whereas the Commission expects the rebound to be concentrated in the latter quarter only, reflecting different assumptions about the speed of the unwind of COVID-19 restrictions.

Thereafter, eurozone q/q growth rates in both forecasts are expected to moderate to a much more gradual pace of around 0.5% q/q, through into 2022. As base effects will be very favourable for y/y rates of change in eurozone GDP from Q2 this year onwards, we think it more likely than not that the annual growth rate in 2022 will actually exceed that in 2021 despite the much lower trajectory of growth rates. This is another example of why annual rates of change should be treated with caution.

Divergence of GDP "crossovers"

We expect the "crossover" in eurozone GDP (that is, the quarter in which it will surpass its pre-COVID-19 level) in Q3 2022, much later than 2021's forecast "crossovers" in the US and Canada, in part due to the next slug of large-scale US fiscal stimulus.

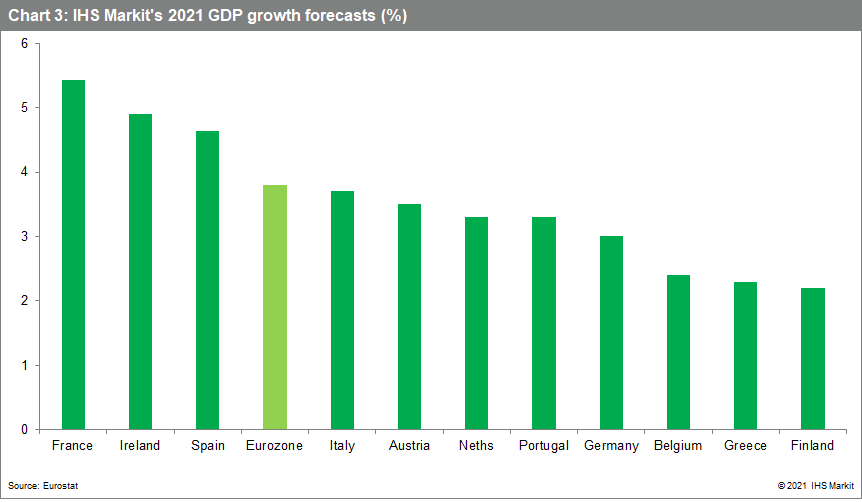

GDP "crossovers" will also vary considerably across the eurozone's member states, in line with divergent growth forecasts, including for 2021. These variations in performance reflecting a range of factors, including the relative magnitude of 2020's GDP declines, recent divergence of COVID-19 trends, related restrictions and approaches to containment, differences in exposure to the most and least affected sectors of activity, plus variations in vaccination roll-outs and policy support.

Long story short, the more manufacturing-driven, less indebted "northern" economies will experience their GDP "crossovers" much earlier (think Germany) than the consumer services-sensitive, more indebted "southern" economies (think Greece).

But again, this may not necessarily be reflected in annual growth forecasts for 2021, as Chart 3 illustrates. Those that suffered comparatively smaller declines in 2020, like Germany, will have less scope to rebound this year.

Look through data volatility

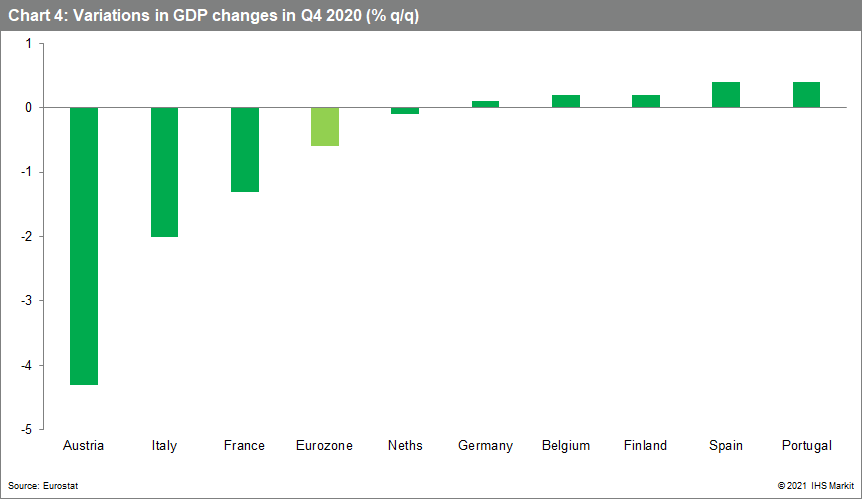

"Noise" in economic indicators across member states and sectors will continue to make interpretation of data challenging going forward. The initial estimates of GDP in Q4 2020 are a case in point.

Of the eleven largest economies of the eurozone, Austria fared worst (-4.3% q/q) and Spain and Portugal outperformed (both +0.4% q/q). But these data points are in no way indicative of their relative performances during the COVID-19 shock.

The latest retail sales data, for December last year, offer another example of exceptionally "noisy" data. While Germany saw a near-10% m/m collapse in sales volumes, France experienced a 20%-plus m/m rebound. Differences in the timing of COVID-19 restrictions in the eurozone's two largest member states contributed to this unprecedented divergence. More than ever before, individual data points need to be set in the wider economic context.

Posted 22 February 2021 by Ken Wattret, Vice-President, Global Economics, S&P Global Market Intelligence